Exploring 3 Undiscovered Gems in Asia with Strong Potential

As global markets navigate a landscape marked by cautious optimism and mixed economic signals, Asia presents intriguing opportunities for investors seeking growth beyond the well-trodden paths. In this environment, identifying stocks with robust fundamentals and innovative business models can be key to uncovering potential gems that might thrive despite broader market uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Jetwell Computer | 34.75% | 16.24% | 27.51% | ★★★★★★ |

| Sinopower Semiconductor | NA | 0.10% | -10.24% | ★★★★★★ |

| Shindaeyang Paper | 10.96% | 0.53% | -8.77% | ★★★★★★ |

| VICOM | NA | 6.95% | 4.06% | ★★★★★★ |

| Central Forest Group | NA | 5.20% | 24.71% | ★★★★★★ |

| AzureWave Technologies | 11.00% | -1.30% | 12.72% | ★★★★★★ |

| OpenWork | NA | 30.11% | 29.99% | ★★★★★★ |

| MNtech | 69.81% | 10.24% | -13.03% | ★★★★★☆ |

| TSTE | 37.68% | 4.91% | -5.78% | ★★★★★☆ |

| Marusan Securities | 3.64% | 0.57% | 3.44% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Matrix Design (SZSE:301365)

Simply Wall St Value Rating: ★★★★★★

Overview: Matrix Design Co., Ltd. operates in the space design and soft furnishing sectors in China, with a market capitalization of CN¥5.05 billion.

Operations: Matrix Design generates revenue primarily from its space design and soft furnishing businesses in China. The company has a market capitalization of CN¥5.05 billion.

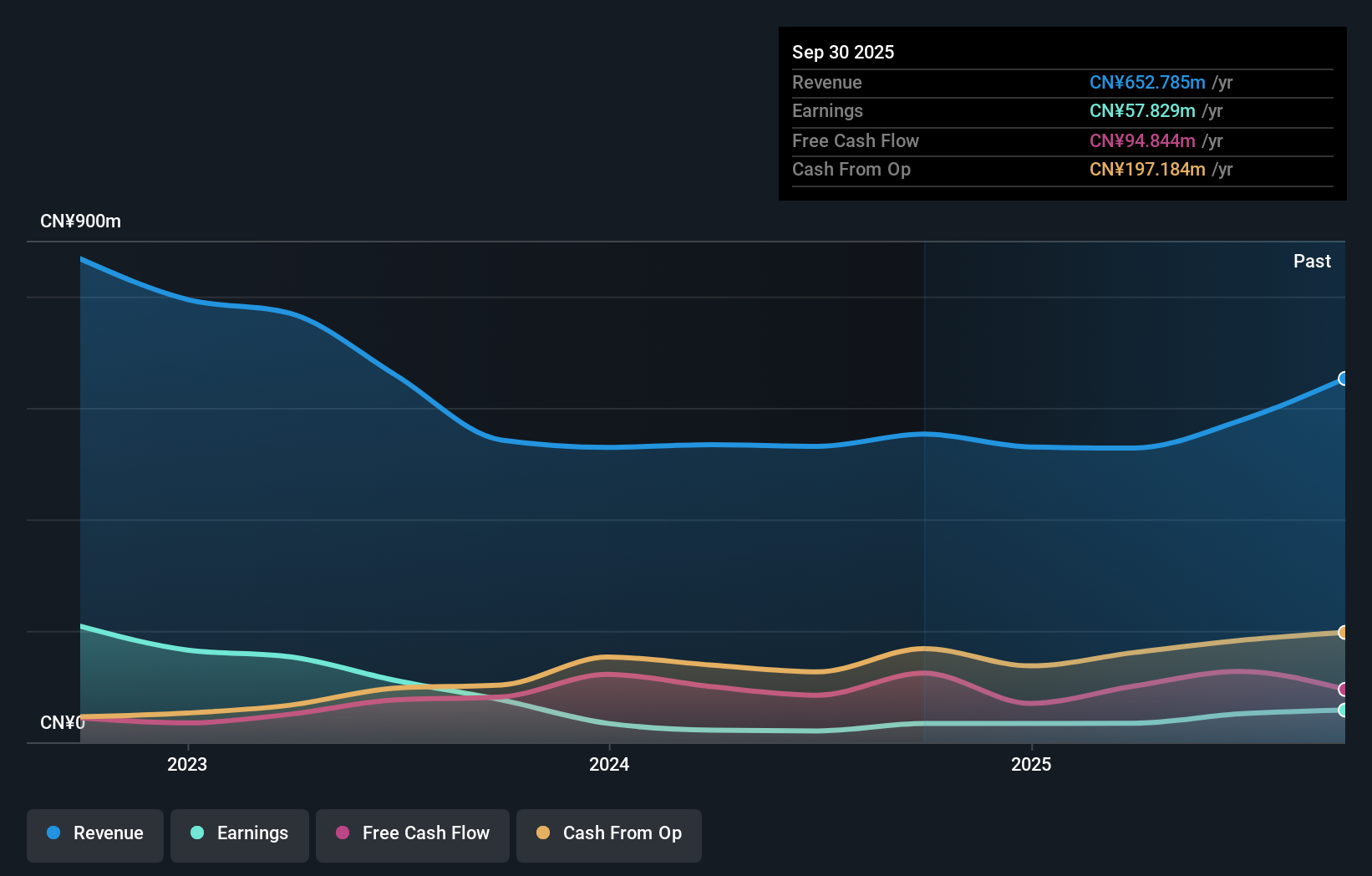

Matrix Design, a small player in the market, has shown impressive growth with earnings surging by 71% over the past year, outpacing the Consumer Services industry's 12%. The company reported sales of CNY 505.61 million for nine months ending September 2025, up from CNY 382.7 million last year. Net income also rose to CNY 68.84 million from CNY 44.71 million previously. With no debt on its books and high-quality earnings, Matrix Design seems well-positioned despite recent share price volatility and a historical decline of earnings by an average of 47% annually over five years.

- Navigate through the intricacies of Matrix Design with our comprehensive health report here.

Gain insights into Matrix Design's historical performance by reviewing our past performance report.

ADATA Technology (TPEX:3260)

Simply Wall St Value Rating: ★★★★☆☆

Overview: ADATA Technology Co., Ltd. is a global manufacturer and seller of memory products, with a market capitalization of NT$59.31 billion.

Operations: The company generates revenue primarily from its E-commerce Division, contributing NT$47.05 billion, while the Biotech Department adds NT$46.29 million.

ADATA Technology, a nimble player in the tech space, has shown impressive numbers with recent earnings growth of 11.6%, outpacing the semiconductor industry average of 2.4%. Trading at a hefty discount of 75.7% below its estimated fair value, it stands as an attractive proposition for those looking for undervalued opportunities. The company's net income surged to TWD 1,760 million in Q3 2025 from TWD 590 million a year earlier, reflecting robust financial health and high-quality earnings. However, its net debt to equity ratio remains high at 108.1%, indicating potential leverage concerns despite strong EBIT coverage of interest payments at nearly eight times.

- Click here to discover the nuances of ADATA Technology with our detailed analytical health report.

Explore historical data to track ADATA Technology's performance over time in our Past section.

Ichia Technologies (TWSE:2402)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ichia Technologies, Inc. operates in the manufacturing, processing, and trading of components and materials for various sectors including electronics and communications across the United States, Europe, and Asia with a market capitalization of NT$18.76 billion.

Operations: Ichia Technologies generates revenue primarily from the production and sales of soft boards and buttons, amounting to NT$10.64 billion. The company's financial performance is influenced by its cost structure and market dynamics across diverse regions.

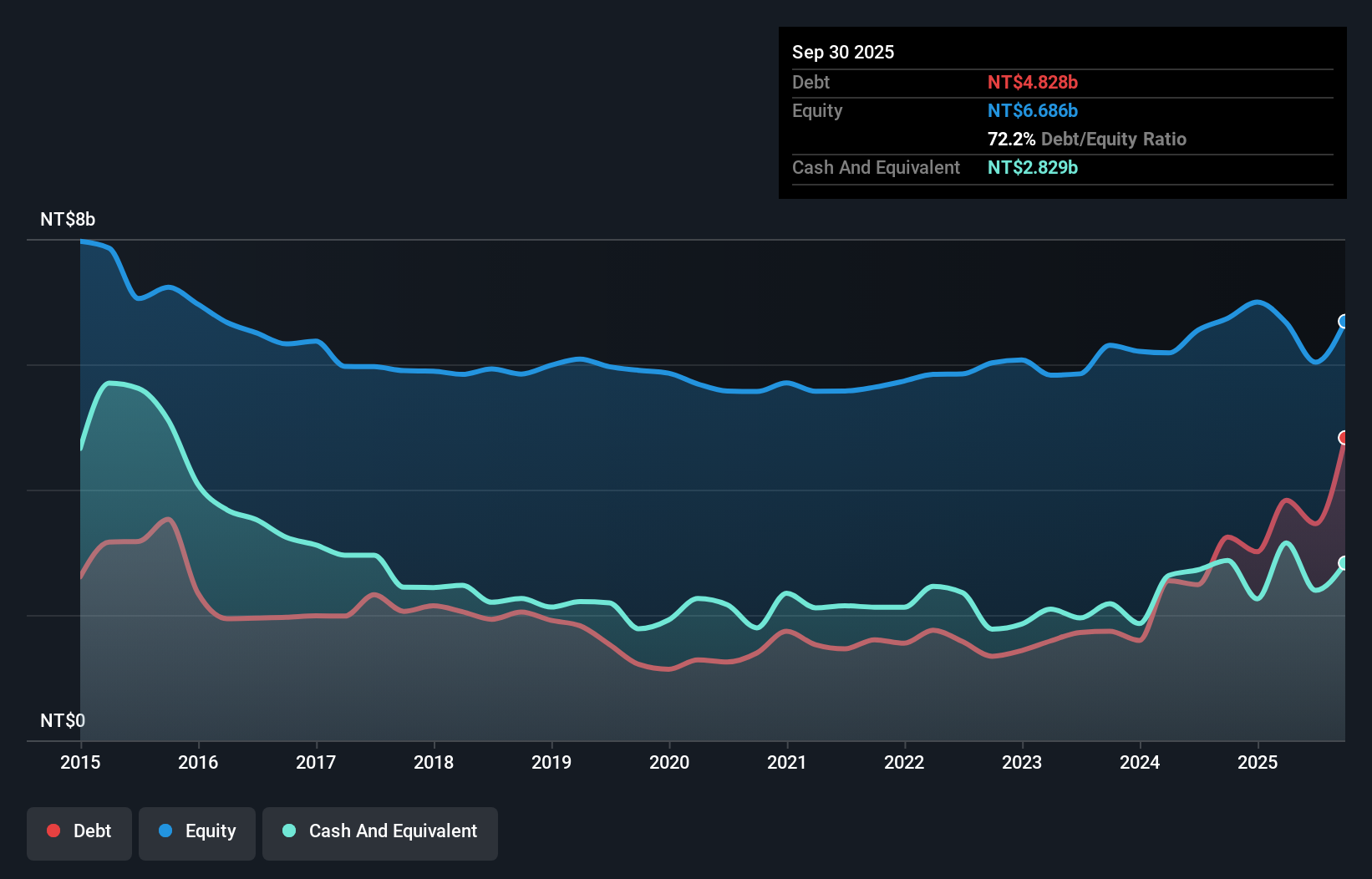

Ichia Technologies, a relatively small player in the electronics sector, has shown impressive earnings growth of 21.5% over the past year, outpacing the industry average of 6.6%. Despite having high-quality past earnings and a satisfactory net debt to equity ratio of 29.9%, its share price has been highly volatile recently. The company's interest payments are well covered by EBIT at 40.2 times coverage, indicating financial stability despite a rising debt to equity ratio from 25% to 72.2% over five years. Recent results show sales increasing to TWD 2,885 million for Q3 but with net income dropping slightly compared to last year’s figures.

Turning Ideas Into Actions

- Navigate through the entire inventory of 2491 Asian Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com