Asian Growth Stocks With High Insider Confidence

As global markets navigate a complex landscape of economic indicators, Asian stocks have shown resilience, particularly in sectors like technology and artificial intelligence. In this environment, growth companies with high insider ownership can signal strong internal confidence and potential alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| UTI (KOSDAQ:A179900) | 25.2% | 120.7% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Oscotec (KOSDAQ:A039200) | 12.7% | 118.4% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 37.2% |

| Fulin Precision (SZSE:300432) | 11.6% | 55.2% |

We'll examine a selection from our screener results.

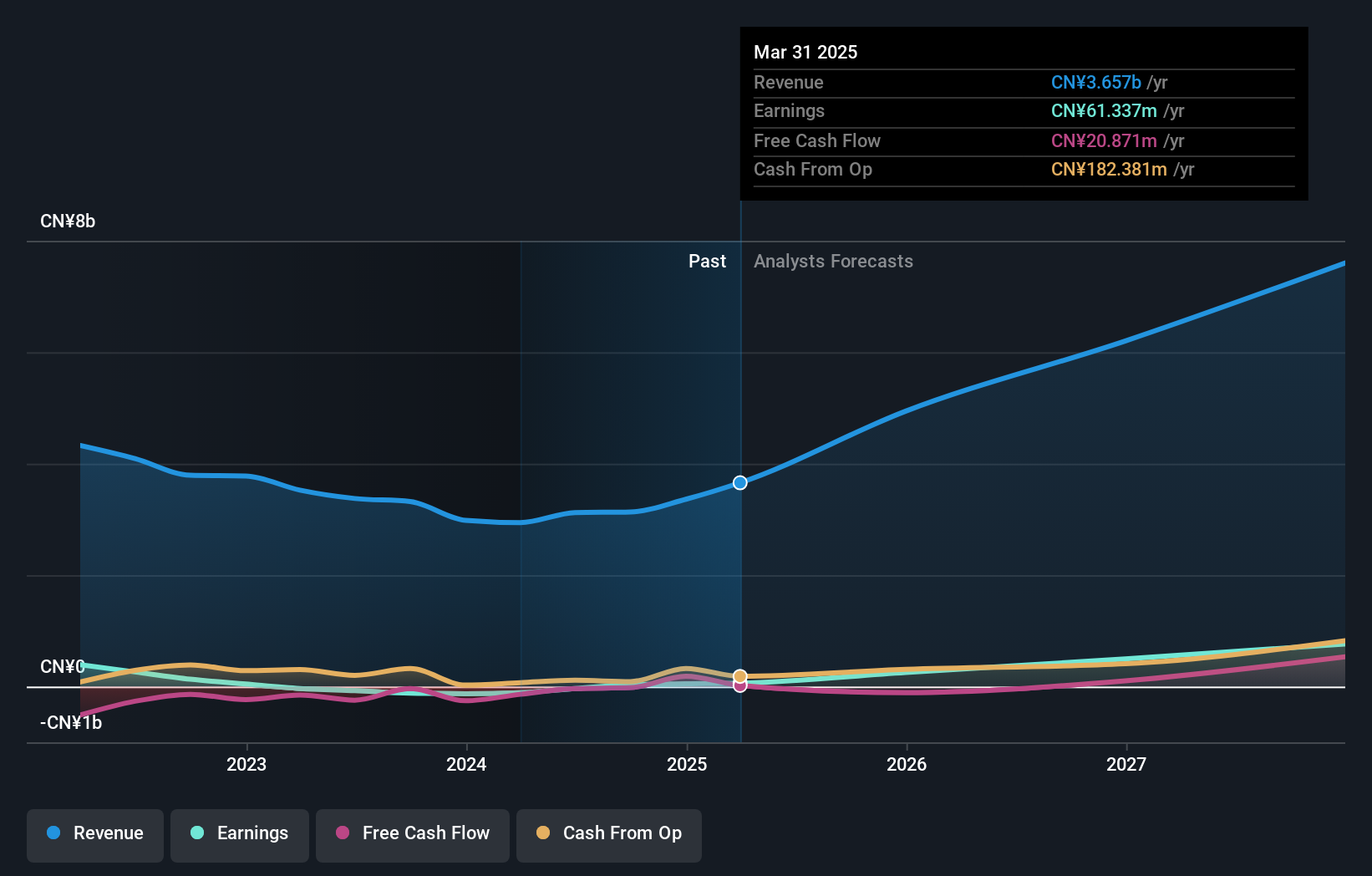

Nanya New Material TechnologyLtd (SHSE:688519)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Nanya New Material Technology Co., Ltd specializes in the manufacturing, design, development, and sale of composite materials with a market cap of CN¥16.14 billion.

Operations: The company generates revenue through the production and sale of composite materials.

Insider Ownership: 20.2%

Nanya New Material Technology Ltd. demonstrates strong growth potential with earnings forecasted to grow significantly at 63.7% annually, outpacing the CN market. Revenue is also expected to increase by 22.8% per year, surpassing market averages. Despite recent share price volatility, the company trades below its estimated fair value and reported substantial revenue growth for the nine months ending September 2025, with sales reaching CNY 3.66 billion and net income rising to CNY 158.1 million from CNY 56.3 million a year ago.

- Delve into the full analysis future growth report here for a deeper understanding of Nanya New Material TechnologyLtd.

- Insights from our recent valuation report point to the potential overvaluation of Nanya New Material TechnologyLtd shares in the market.

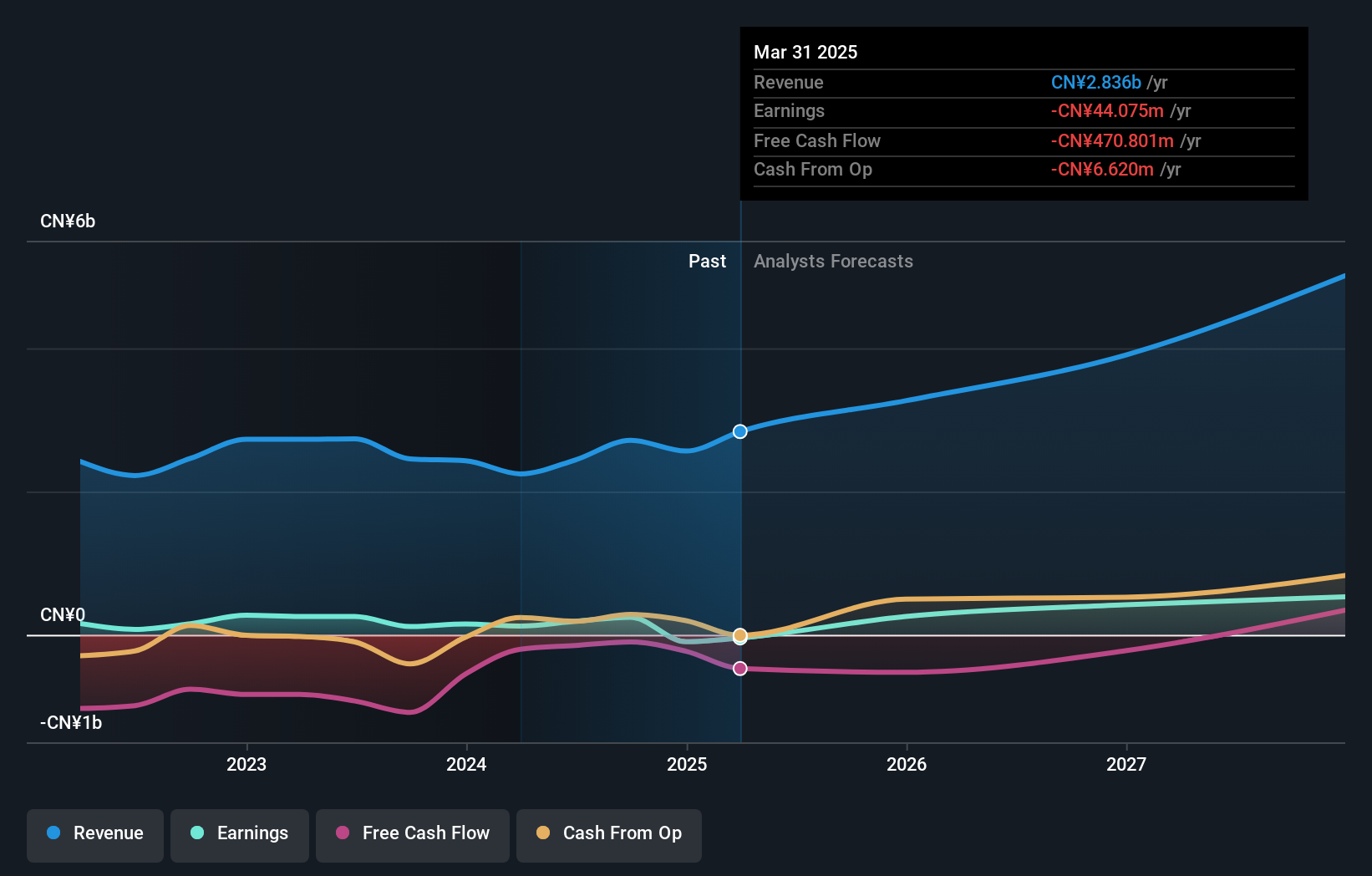

Wuhan Jingce Electronic GroupLtd (SZSE:300567)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wuhan Jingce Electronic Group Co., Ltd specializes in the research, development, production, and sale of display, semiconductor, and new energy equipment with a market cap of CN¥20.36 billion.

Operations: The company generates revenue primarily from its Electron Product segment, amounting to CN¥3.01 billion.

Insider Ownership: 36.5%

Wuhan Jingce Electronic Group Ltd. is poised for significant growth, with revenue expected to increase by 22.3% annually, outpacing the broader CN market. The company reported sales of CNY 2.27 billion for the first nine months of 2025, up from CNY 1.83 billion a year earlier, and net income rose to CNY 100.09 million from CNY 82.24 million. Despite low forecasted return on equity and debt concerns, it trades below its estimated fair value.

- Take a closer look at Wuhan Jingce Electronic GroupLtd's potential here in our earnings growth report.

- Our valuation report unveils the possibility Wuhan Jingce Electronic GroupLtd's shares may be trading at a discount.

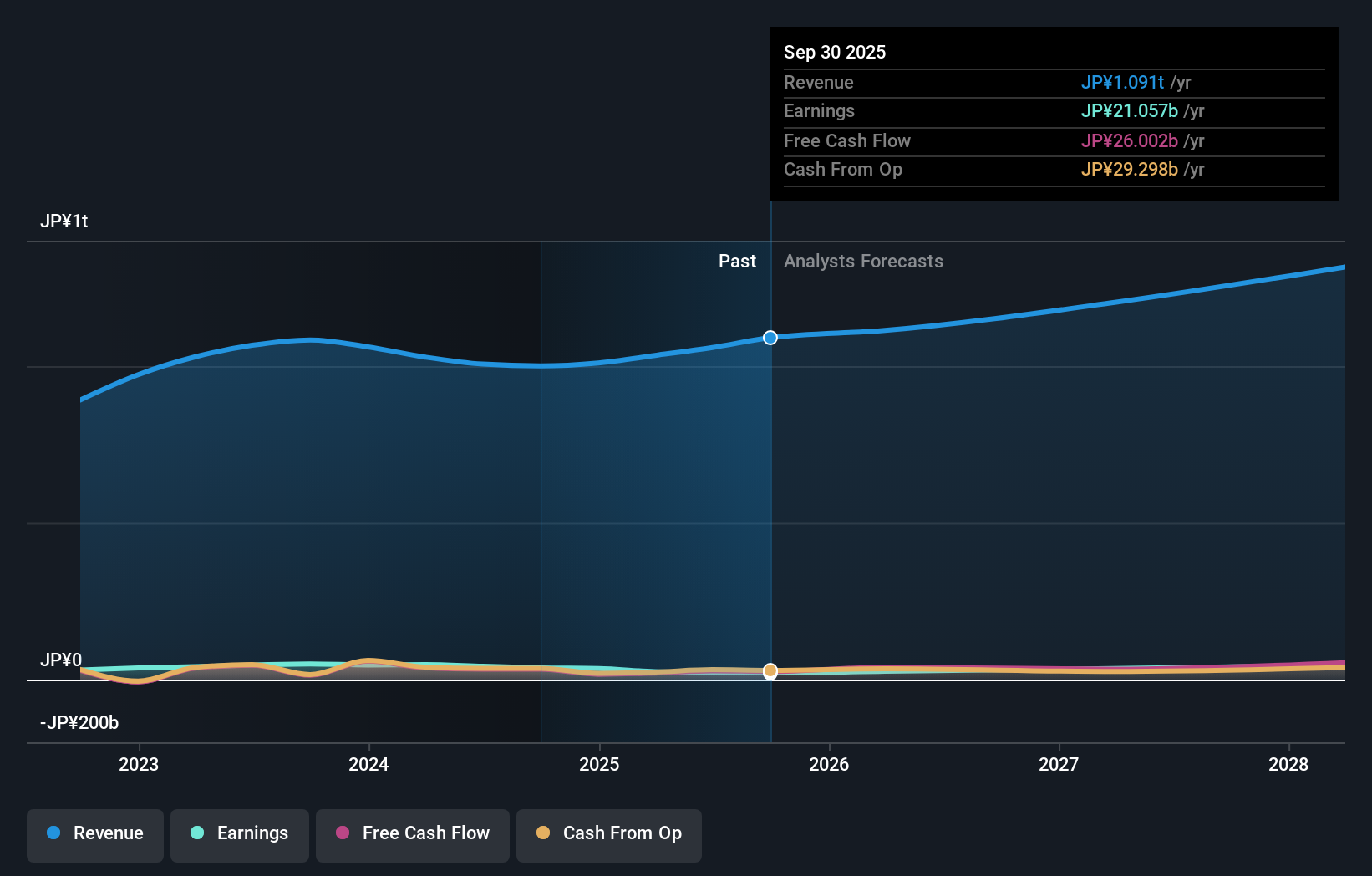

Macnica Holdings (TSE:3132)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Macnica Holdings, Inc. is involved in the import, sale, and export of electronic components in Japan with a market cap of ¥433.73 billion.

Operations: Macnica Holdings generates revenue through the import, sale, and export of electronic components in Japan.

Insider Ownership: 13.5%

Macnica Holdings is positioned for significant growth, with earnings projected to increase 30% annually, surpassing the JP market's 8.3%. Despite a low forecasted return on equity of 13%, it trades at 63.8% below its estimated fair value. Recent events include maintaining a stable dividend and strategic mergers among subsidiaries. However, profit margins have declined from last year’s figures, indicating potential challenges in operational efficiency amidst robust revenue growth expectations of 7.8% per year.

- Unlock comprehensive insights into our analysis of Macnica Holdings stock in this growth report.

- Insights from our recent valuation report point to the potential undervaluation of Macnica Holdings shares in the market.

Turning Ideas Into Actions

- Delve into our full catalog of 639 Fast Growing Asian Companies With High Insider Ownership here.

- Seeking Other Investments? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com