Aoxin Q & M Dental Group Leads These 3 Asian Penny Stocks

As Asian markets navigate a complex landscape of economic shifts and investor sentiment, the focus on smaller, potentially high-growth companies remains strong. The term "penny stocks" may seem outdated, but these investments still hold appeal for those seeking affordability and growth potential in emerging firms. In this article, we will explore several penny stocks that stand out for their financial strength and potential to offer unique investment opportunities amidst current market conditions.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| JBM (Healthcare) (SEHK:2161) | HK$2.71 | HK$2.21B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.48 | HK$915.41M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.56 | HK$2.12B | ✅ 4 ⚠️ 1 View Analysis > |

| Perfect Medical Health Management (SEHK:1830) | HK$1.41 | HK$1.77B | ✅ 2 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.00 | SGD405.29M | ✅ 4 ⚠️ 1 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.103 | SGD53.92M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.37 | SGD13.26B | ✅ 5 ⚠️ 1 View Analysis > |

| F & J Prince Holdings (PSE:FJP) | ₱2.20 | ₱841.12M | ✅ 2 ⚠️ 3 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$1.00 | NZ$142.34M | ✅ 2 ⚠️ 5 View Analysis > |

| Scott Technology (NZSE:SCT) | NZ$3.02 | NZ$258.17M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 959 stocks from our Asian Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Aoxin Q & M Dental Group (Catalist:1D4)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Aoxin Q & M Dental Group Limited is an investment holding company offering private dental healthcare services in the People's Republic of China, with a market cap of SGD38.88 million.

Operations: The company's revenue is primarily derived from Primary Healthcare (CN¥152.63 million), Laboratory Services (CN¥35.26 million), and the Distribution of Dental Equipment and Supplies (CN¥54.57 million).

Market Cap: SGD38.88M

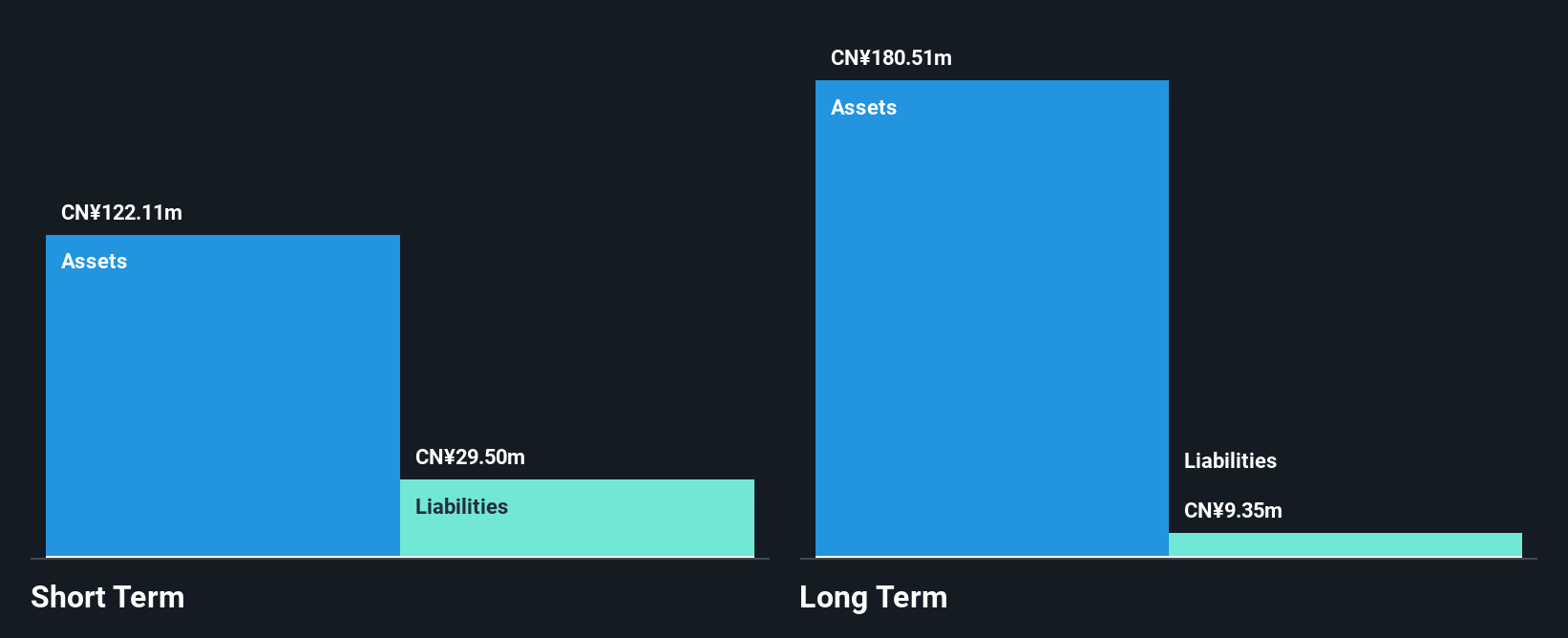

Aoxin Q & M Dental Group, with a market cap of SGD38.88 million, derives revenue from primary healthcare (CN¥152.63M), laboratory services (CN¥35.26M), and dental equipment distribution (CN¥54.57M). Despite being unprofitable, it remains debt-free and has a cash runway exceeding three years due to positive free cash flow growth of 47.9% annually. Recent executive changes include appointing four Deputy CEOs to manage operations and assist in expansion strategies, alongside a reconstituted board with the addition of Mr. Chong Eng Wee as an Independent Director, aiming to strengthen governance amidst high share price volatility and significant insider selling.

- Click to explore a detailed breakdown of our findings in Aoxin Q & M Dental Group's financial health report.

- Understand Aoxin Q & M Dental Group's track record by examining our performance history report.

Lion Rock Group (SEHK:1127)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Lion Rock Group Limited, an investment holding company with a market cap of HK$1.09 billion, offers printing services to international book publishers and various publishing conglomerates.

Operations: The company generates revenue primarily from its printing segment, which accounts for HK$1.77 billion, and its publishing segment, contributing HK$875.57 million.

Market Cap: HK$1.09B

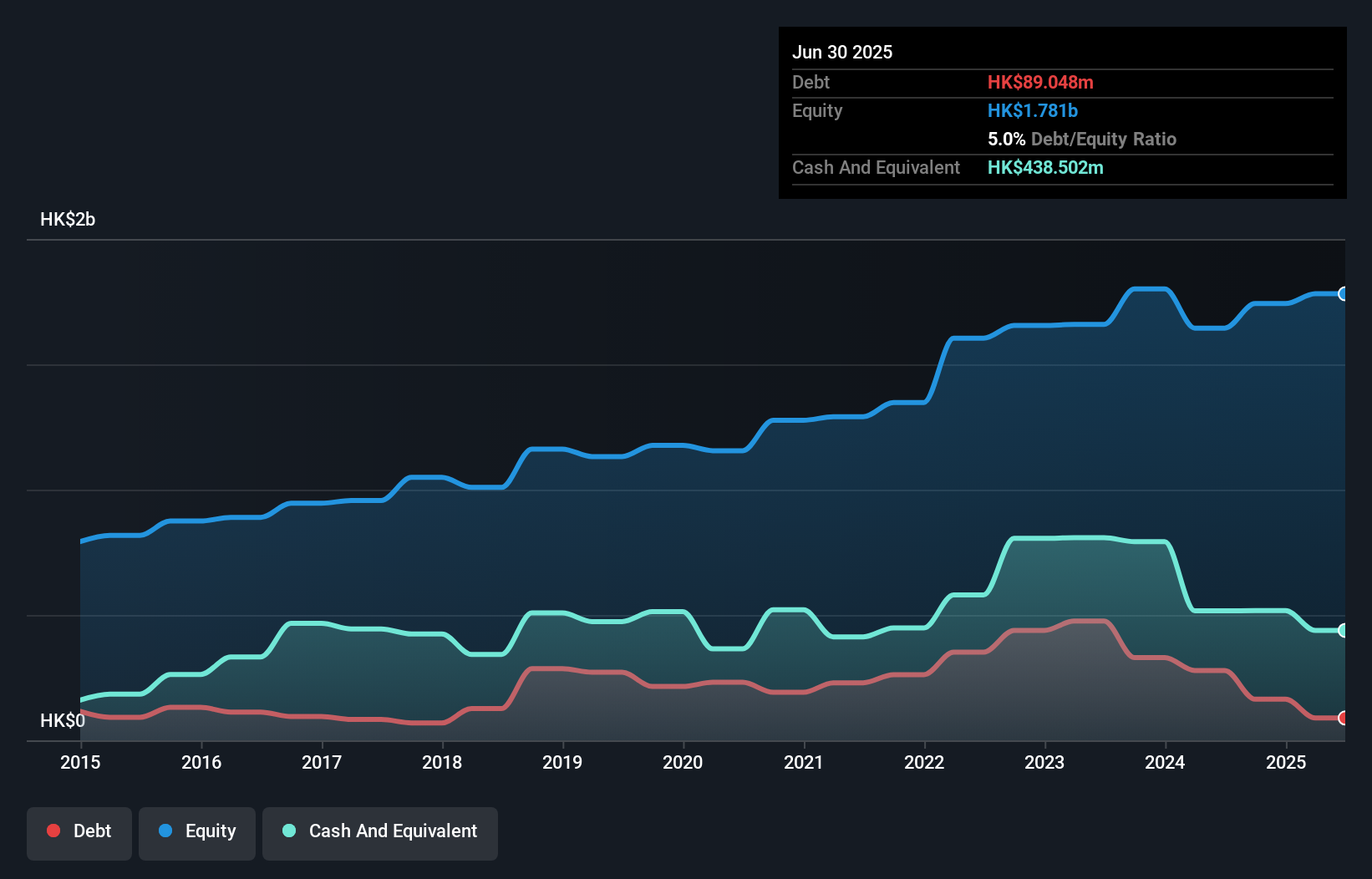

Lion Rock Group, with a market cap of HK$1.09 billion, is trading significantly below its estimated fair value and has demonstrated consistent earnings growth over the past five years. The company maintains a strong financial position with more cash than total debt and well-covered interest payments by EBIT. While its return on equity is considered low, Lion Rock's short-term assets comfortably cover both short- and long-term liabilities. Recent board changes include the appointment of Ms. Ng Cheuk Hei as an independent non-executive director to enhance governance, following Mr. Chu Chun Wan's transition to a non-executive role.

- Take a closer look at Lion Rock Group's potential here in our financial health report.

- Learn about Lion Rock Group's historical performance here.

Addvalue Technologies (SGX:A31)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Addvalue Technologies Ltd is an investment holding company that offers satellite-based communication and digital broadband products and solutions across Europe, the Middle East, Africa, North America, and the Asia Pacific, with a market cap of SGD167.70 million.

Operations: The company generates revenue of $18.58 million from its communications equipment segment.

Market Cap: SGD167.7M

Addvalue Technologies Ltd, with a market cap of SGD167.70 million, has shown robust earnings growth, reporting a net income of US$1.98 million for the half-year ended September 2025. The company secured new orders worth US$3.6 million for its Space Connectivity business, boosting its order book to US$17.5 million and potentially impacting future financial results positively. Despite high volatility in share price and significant insider selling recently, Addvalue's financial health is supported by more cash than total debt and well-covered interest payments by EBIT. Recent board reconstitutions aim to strengthen governance and strategic direction.

- Jump into the full analysis health report here for a deeper understanding of Addvalue Technologies.

- Assess Addvalue Technologies' previous results with our detailed historical performance reports.

Next Steps

- Click here to access our complete index of 959 Asian Penny Stocks.

- Want To Explore Some Alternatives? AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com