Why Investors Shouldn't Be Surprised By InTiCa Systems SE's (ETR:IS7) 69% Share Price Surge

InTiCa Systems SE (ETR:IS7) shareholders would be excited to see that the share price has had a great month, posting a 69% gain and recovering from prior weakness. Taking a wider view, although not as strong as the last month, the full year gain of 13% is also fairly reasonable.

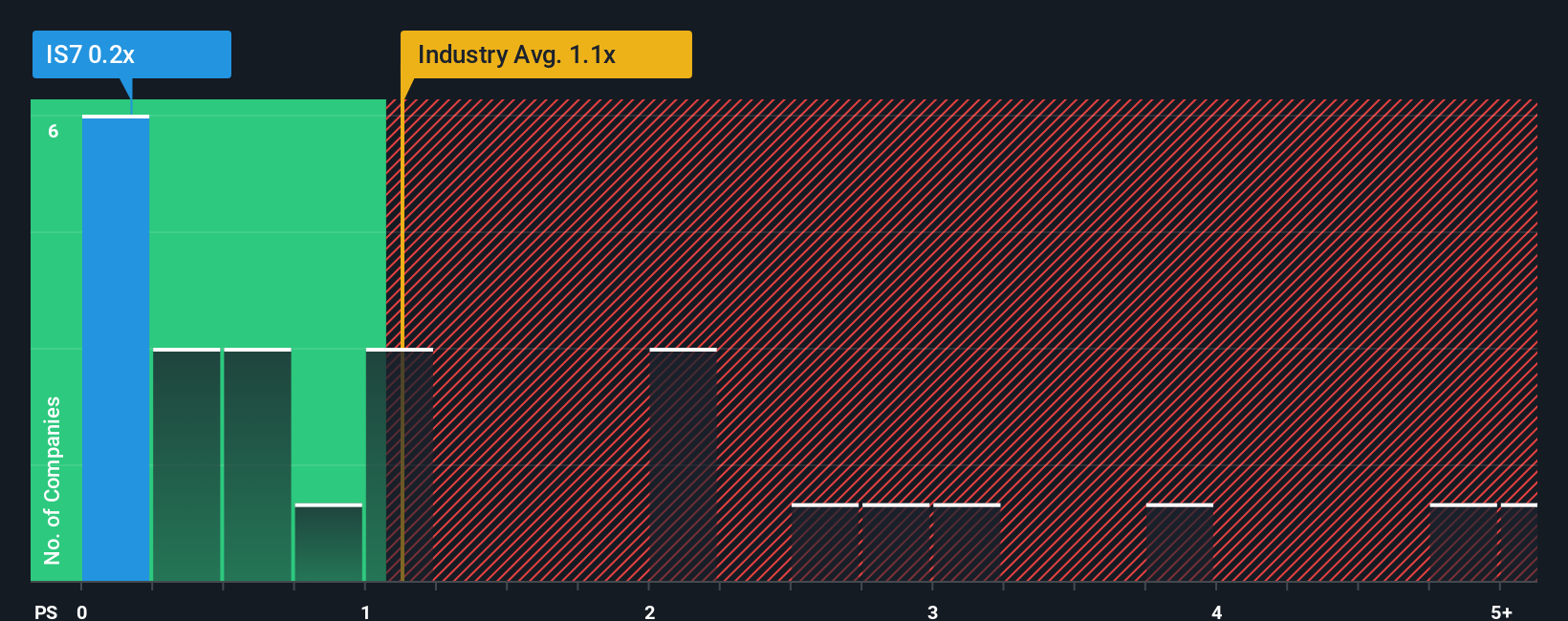

In spite of the firm bounce in price, it's still not a stretch to say that InTiCa Systems' price-to-sales (or "P/S") ratio of 0.2x right now seems quite "middle-of-the-road" compared to the Electronic industry in Germany, where the median P/S ratio is around 0.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for InTiCa Systems

What Does InTiCa Systems' P/S Mean For Shareholders?

InTiCa Systems hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on InTiCa Systems will help you uncover what's on the horizon.How Is InTiCa Systems' Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like InTiCa Systems' to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 12%. The last three years don't look nice either as the company has shrunk revenue by 28% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 5.2% each year during the coming three years according to the one analyst following the company. Meanwhile, the rest of the industry is forecast to expand by 7.1% per year, which is not materially different.

With this information, we can see why InTiCa Systems is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Key Takeaway

Its shares have lifted substantially and now InTiCa Systems' P/S is back within range of the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've seen that InTiCa Systems maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. Unless these conditions change, they will continue to support the share price at these levels.

We don't want to rain on the parade too much, but we did also find 2 warning signs for InTiCa Systems (1 is a bit unpleasant!) that you need to be mindful of.

If you're unsure about the strength of InTiCa Systems' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.