Regency Centers (REG): Has the 6% Share Price Dip Opened a Valuation Opportunity?

Regency Centers (REG) has quietly slipped about 6 % this year, even as its grocery anchored shopping centers keep delivering steady revenue and earnings growth. That disconnect is exactly what makes the stock interesting now.

See our latest analysis for Regency Centers.

Despite the recent slide, including a 30 day share price return of about minus 3 percent and a year to date share price return of roughly minus 6 percent, longer term total shareholder return near 73 percent over five years suggests momentum has cooled rather than disappeared.

If this kind of steady compounder appeals to you, it might also be worth scanning fast growing stocks with high insider ownership as a way to spot the next wave of potential outperformers.

With modest top line growth, faster rising profits and analysts still seeing double digit upside to fair value, investors face a familiar dilemma: is Regency genuinely undervalued here, or is the market already pricing in its future growth?

Most Popular Narrative: 15.3% Undervalued

Compared with Regency Centers' last close at $67.79, the most followed narrative points to a fair value above $80, suggesting a meaningful valuation gap that hinges on steady but improving profitability.

Regency's proactive capital deployment in high barrier to entry suburban markets (e.g., recent South Orange County acquisition and robust development or redevelopment pipeline) allows the company to capture higher rents, drive NOI growth, and grow NAV. Future earnings leverage may come from incremental projects as supply remains constrained. Strong balance sheet management (low leverage, ample liquidity, investment grade credit rating) and competitive advantages from its UPREIT structure provide Regency with flexibility to capitalize on attractive, accretive acquisitions and distressed opportunities, which could lead to scale driven EPS growth.

Curious how modest revenue growth can still justify a richer future earnings multiple and higher margins. Want to see the exact profit roadmap behind that call.

Result: Fair Value of $80.05 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, any pickup in tenant distress or setbacks on development projects could quickly pressure margins and challenge the optimistic earnings and valuation roadmap.

Find out about the key risks to this Regency Centers narrative.

Another Angle on Valuation

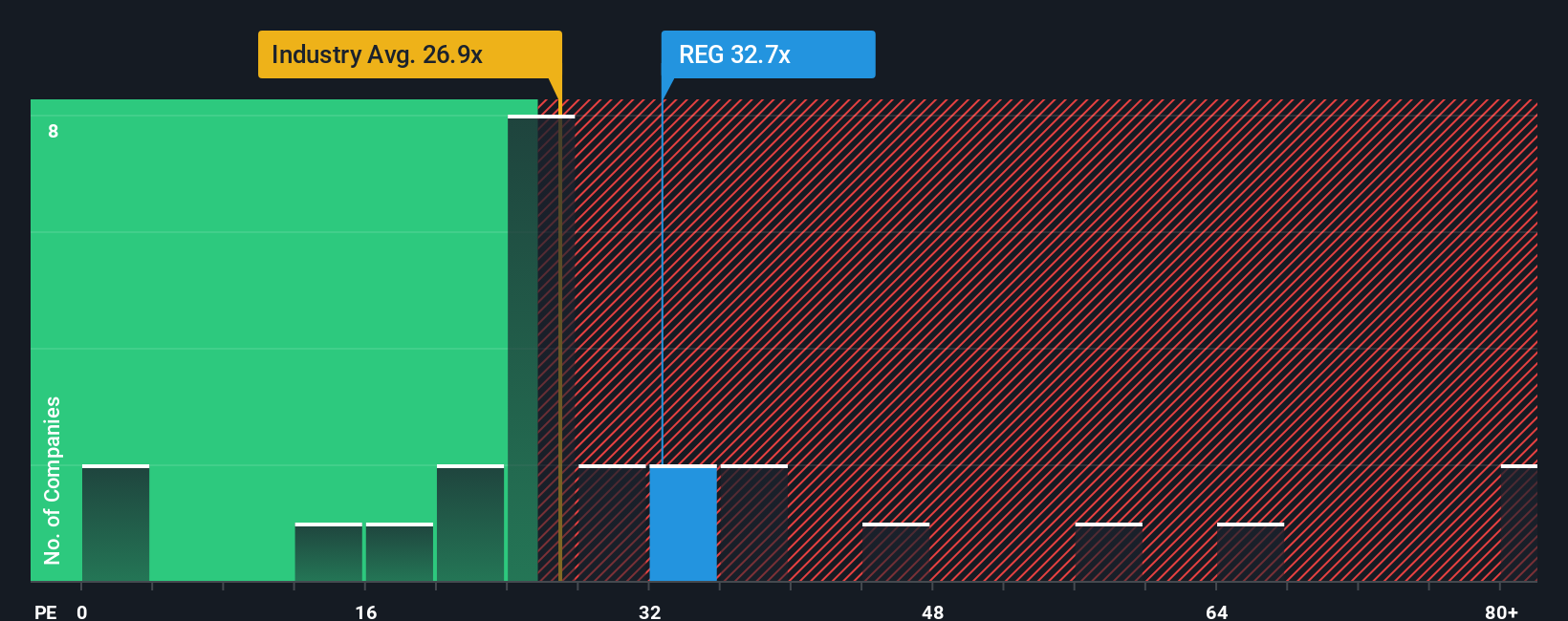

On earnings, the picture looks less forgiving. Regency trades at about 31.1 times earnings, richer than both the US Retail REITs average of 26.4 times and peer average of 28 times, though still below a fair ratio of 32.9 times. Is this a quality premium or valuation risk building?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Regency Centers Narrative

If you are not fully convinced by this view, or prefer digging into the numbers yourself, you can build a fresh narrative in just a few minutes: Do it your way.

A great starting point for your Regency Centers research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you want to keep an edge beyond Regency, put the Simply Wall Street Screener to work now and avoid missing tomorrow's strongest opportunities.

- Capture potential multi baggers early by targeting these 3588 penny stocks with strong financials that already show real financial strength instead of just hype.

- Position your portfolio for structural growth by focusing on these 30 healthcare AI stocks reshaping diagnostics, treatment pathways, and medical workflows.

- Lock in more reliable income streams by zeroing in on these 15 dividend stocks with yields > 3% that can support and grow payouts above inflation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com