How Fortinet’s New Climb Channel Partnership (FTNT) Could Reshape Its Long‑Term Growth Story

- On 1 December 2025, Climb Channel Solutions announced a new partnership with Fortinet, adding Fortinet’s enterprise-grade cybersecurity products to its curated reseller-focused distribution portfolio.

- This alliance broadens access to Fortinet’s security platform through Climb’s specialized channel support and marketing services, potentially reinforcing Fortinet’s position within value-added reseller ecosystems.

- We’ll now examine how this expanded reseller distribution access through Climb could influence Fortinet’s investment narrative and long-term growth drivers.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Fortinet Investment Narrative Recap

To own Fortinet, I think you need to believe its integrated security platform can keep winning share as threats and network complexity rise, while the hardware firewall refresh cycle remains the key near term driver and risk. The Climb Channel Solutions partnership looks incrementally positive for Fortinet’s reach into value added resellers, but it does not materially change the near term dependence on firewall upgrades or the execution risk around higher infrastructure and sales investments.

This new Climb alliance fits beside Fortinet’s recent Secure AI Data Center launch and AI focused FortiGate 3800G firewall, both aimed at keeping its platform relevant as workloads and security spending shift toward AI centric data centers. Together, these moves could support the pivot toward higher margin, recurring services and cloud security, which is an important counterbalance to concerns about what happens once the current firewall refresh cycle rolls over.

Yet beneath this expanding channel reach, investors still need to weigh how exposed Fortinet remains to the eventual slowdown in the current firewall refresh cycle and...

Read the full narrative on Fortinet (it's free!)

Fortinet's narrative projects $9.2 billion revenue and $2.4 billion earnings by 2028.

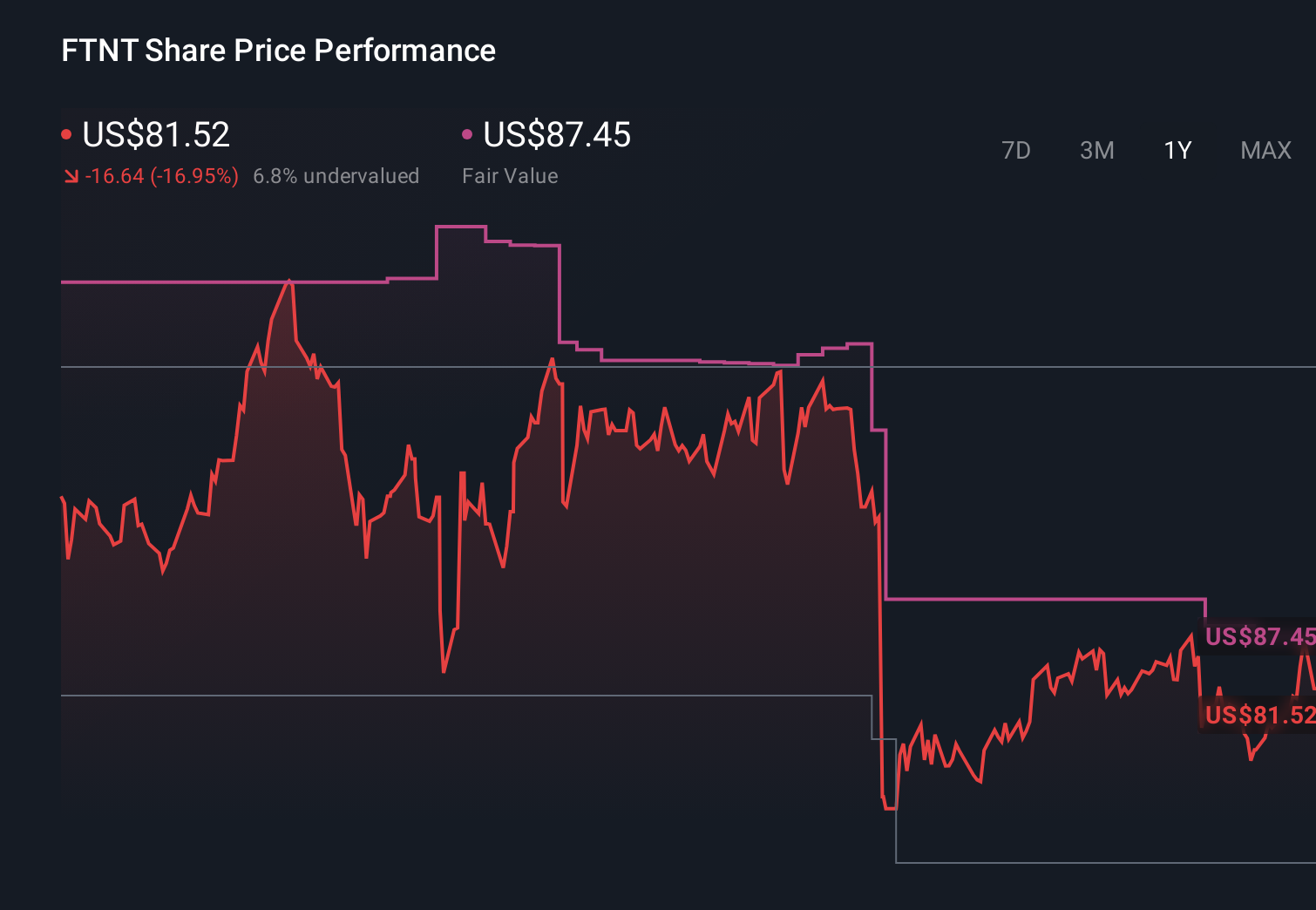

Uncover how Fortinet's forecasts yield a $87.45 fair value, a 5% upside to its current price.

Exploring Other Perspectives

Twenty six fair value estimates from the Simply Wall St Community span roughly US$82 to US$110 per share, underlining how far apart individual views can be. When you set those against Fortinet’s reliance on a time limited firewall refresh cycle, it becomes especially important to compare multiple scenarios for how its newer cloud and SASE offerings might shape longer term performance.

Explore 26 other fair value estimates on Fortinet - why the stock might be worth just $82.39!

Build Your Own Fortinet Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fortinet research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Fortinet research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fortinet's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com