Will Lundin Gold’s (TSX:LUG) Aggressive 2026 Outlook and Record Exploration Spend Shift Its Narrative?

- Lundin Gold recently released its 2026 and multi-year outlook, targeting 475,000–525,000 ounces of gold production from its Fruta del Norte mine in Ecuador, alongside US$75–US$90 million of sustaining capital and plans to evaluate expanding mine and mill capacity beyond 5,500 tonnes per day.

- The company also launched its largest-ever US$85 million exploration program, with 133,000 meters of drilling aimed at extending mine life and unlocking new growth options beyond its current production profile.

- Next, we’ll examine how the planned mill expansion and multi-year outlook could reshape Lundin Gold’s existing investment narrative and risk profile.

Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

Lundin Gold Investment Narrative Recap

To be a shareholder in Lundin Gold, you need to believe in the long term cash generation from Fruta del Norte and the company’s ability to keep costs under control while extending mine life. The new 2026 and multi year outlook largely reinforces that view, with higher future production tied to potential mill expansion and an intensified exploration push, though the key short term catalyst remains how quickly Lundin can convert this guidance into firm investment decisions and updated reserve life, while the biggest risk is still...

For me, the most relevant recent announcement alongside this guidance is the launch of the US$85 million exploration campaign, which includes 133,000 meters of drilling across Fruta del Norte and surrounding targets. This program sits at the heart of Lundin’s current catalyst mix, because it directly supports the case for extending mine life and potentially filling any production gaps that might emerge over time, especially if mill throughput increases faster than new reserves are defined.

But while Lundin’s exploration success could be a powerful driver, investors should also be aware that...

Read the full narrative on Lundin Gold (it's free!)

Lundin Gold's narrative projects $1.4 billion revenue and $758.8 million earnings by 2028.

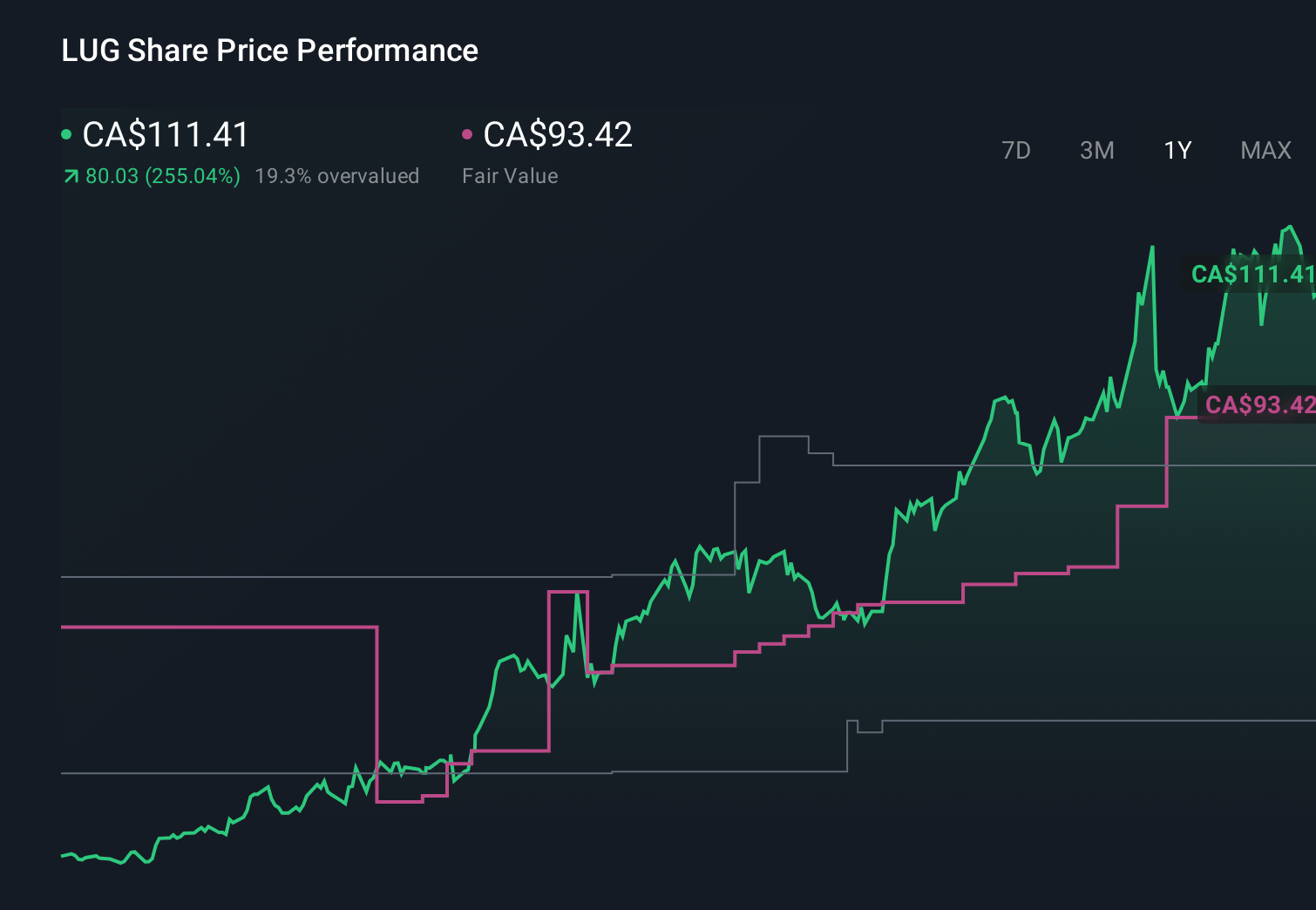

Uncover how Lundin Gold's forecasts yield a CA$93.42 fair value, a 13% downside to its current price.

Exploring Other Perspectives

Nine members of the Simply Wall St Community currently see Lundin Gold’s fair value between CA$34.66 and CA$96.33, highlighting very different expectations for the stock. When you weigh those views against the company’s aggressive US$85,000,000 exploration and mill expansion plans, it underlines how important it is to compare several scenarios for future production and cash flows before deciding how Lundin Gold fits into your portfolio.

Explore 9 other fair value estimates on Lundin Gold - why the stock might be worth as much as CA$96.33!

Build Your Own Lundin Gold Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lundin Gold research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Lundin Gold research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lundin Gold's overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com