Nvidia (NVDA): Reopened China AI Chip Sales Prompt Fresh Look at Premium Valuation and Growth Expectations

Nvidia (NVDA) just got a key door reopened, with Washington clearing its H200 AI chips for approved Chinese customers in exchange for a 25% revenue cut, after direct talks between President Trump and CEO Jensen Huang.

See our latest analysis for NVIDIA.

The policy shift comes as NVIDIA’s 33.7% year to date share price return contrasts with a recent 7.1% one month pullback, while a huge five year total shareholder return above 1,300% shows long term momentum is still firmly intact.

If this kind of AI driven story has your attention, it might be worth seeing which other names are breaking out in high growth tech and AI stocks before the next leg of the cycle takes hold.

With the China door partly reopened and Wall Street still calling for upside, is Nvidia’s premium valuation actually lagging its earnings power, or are investors already paying up for every dollar of future AI growth?

Most Popular Narrative Narrative: 21.3% Undervalued

Restinglion’s fair value estimate of $235 sits well above NVIDIA’s last close at $184.97, framing the stock as mispriced against its earnings engine.

While its monumental past illustrates a historic run that may never be recreated, the company stands in a position to continue historic growth; although this growth may not meet standards set in the past 5 years, the company will still maintain a chokehold on the high tech ai market for these 3 reasons:

Want to see how this narrative blends slowing growth with outsized margins and a rich future earnings multiple, yet still lands on upside potential? The assumptions behind that call might surprise you.

Result: Fair Value of $235 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slowing revenue growth assumptions and potential competition eroding Nvidia’s AI dominance could quickly turn perceived undervaluation into a justified premium.

Find out about the key risks to this NVIDIA narrative.

Another Take on Value

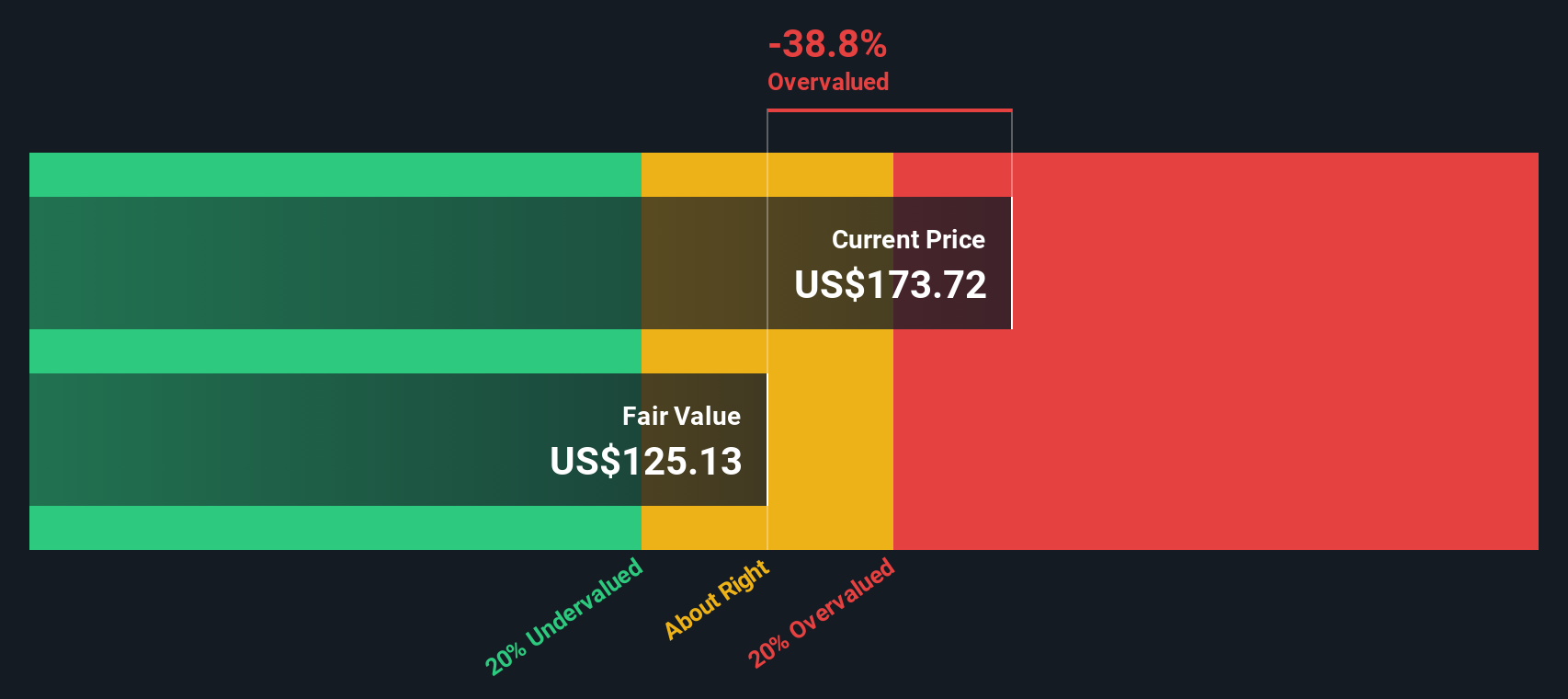

Our DCF model presents a more conservative view and places fair value for NVIDIA closer to $164.47 per share. This is below the current price of $184.97 per share and suggests the stock may be overvalued. This raises the question of whether growth expectations are already stretched despite the generally positive narrative.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out NVIDIA for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 900 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own NVIDIA Narrative

If this view does not fully resonate, or you would rather examine the numbers yourself, you can craft a personalized take in minutes using Do it your way.

A great starting point for your NVIDIA research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investing angles?

Before the market’s next big shift leaves you watching from the sidelines, put Simply Wall Street’s Screener to work and uncover fresh, data driven opportunities today.

- Capture early momentum in smaller names by targeting these 3588 penny stocks with strong financials that already back their stories with real financial strength.

- Ride the structural wave of automation by zeroing in on these 30 healthcare AI stocks at the crossroads of medicine and machine intelligence.

- Explore reliable cash flow potential by focusing on these 15 dividend stocks with yields > 3% that combine income today with room for long term growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com