ArcBest (ARCB): Valuation Check After Expanded Credit Facility Boosts Financial Flexibility

ArcBest (ARCB) just refreshed its core revolving credit facility, extending its life to 2030 while boosting letter of credit capacity. This move quietly expands the company’s financial flexibility for the next phase of growth.

See our latest analysis for ArcBest.

The refreshed credit facility lands while the stock is trying to stabilize, with a recent 1 month share price return of 5.32 percent but a weak year to date share price return of 24.05 percent decline and a 1 year total shareholder return of 36.89 percent decline. Investors are watching to see if better balance sheet flexibility can eventually translate into a stronger long term total shareholder return trend.

If this kind of financial reset has you thinking beyond a single name, it could be a good moment to explore fast growing stocks with high insider ownership for other potential standout ideas.

With earnings still growing, a modest discount to analyst targets and a deeper credit backstop, is ArcBest trading below its true value or are markets already baking in every ounce of its future growth?

Most Popular Narrative Narrative: 13.8% Undervalued

With ArcBest’s fair value pegged around 13.8 percent above the last close, the dominant narrative frames today’s price as a freight cycle entry point.

Broad deployment of AI driven optimization tools such as real time route and dock management systems are driving measurable productivity gains and cost savings, which are expected to translate into improved net margins and operational earnings as automation and technology adoption intensify across the industry.

Want to see what kind of revenue runway, margin reset and future earnings multiple are baked into that upside case? The narrative lays out the full playbook.

Result: Fair Value of $81 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent freight softness and elevated labor costs could pressure margins and challenge the view that today’s price marks an attractive cycle entry point.

Find out about the key risks to this ArcBest narrative.

Another Lens On Value

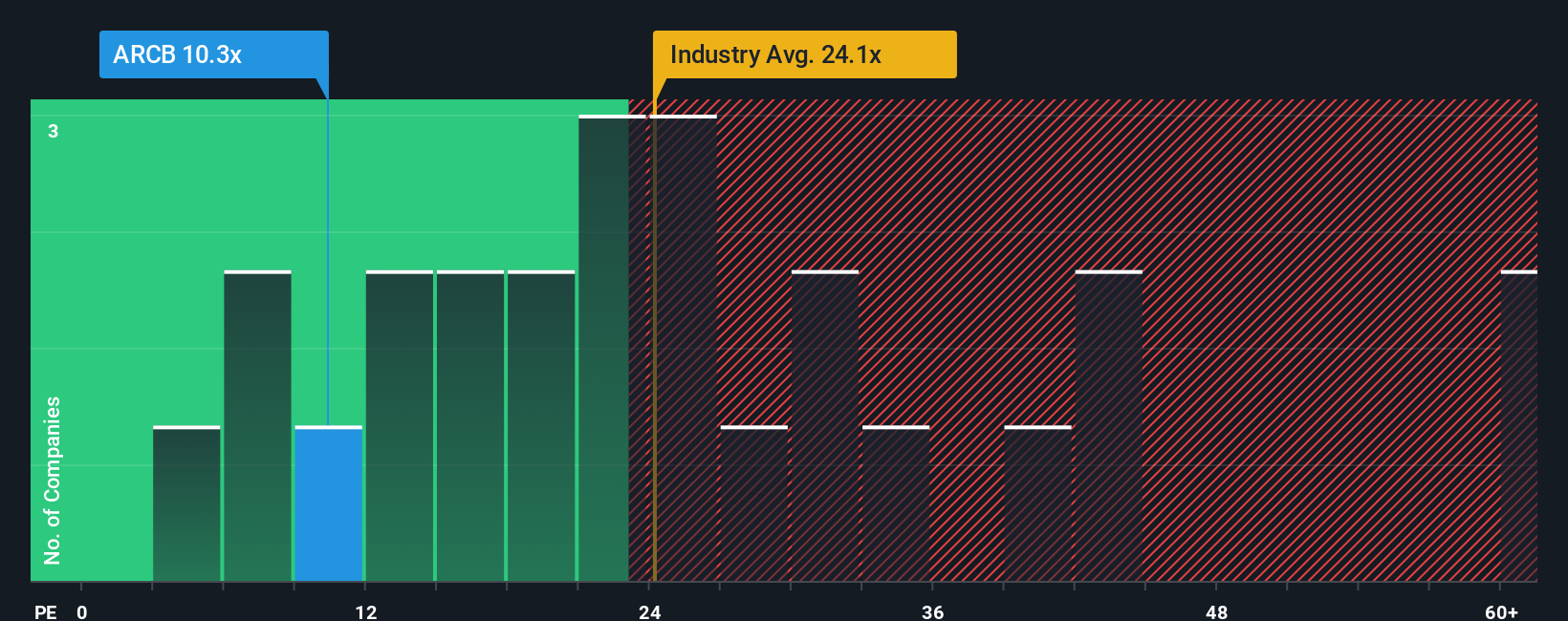

Step away from the fair value estimate and the earnings multiple tells a different story. ArcBest trades at 16.2 times earnings, which looks cheap versus transportation peers at 31.1 times, yet expensive against a fair ratio of 12.5 times. This hints at both potential upside and downside. Which way will sentiment swing next?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ArcBest Narrative

If you see the story differently or want to dig into the numbers yourself, you can shape a custom view in under three minutes: Do it your way.

A great starting point for your ArcBest research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop at a single opportunity when entire themes are moving. Use the Simply Wall Street Screener to uncover focused ideas that match your strategy.

- Capture powerful secular shifts by targeting innovators across automation, digital platforms and smart infrastructure with these 899 undervalued stocks based on cash flows that still trade at attractive prices.

- Ride the next wave of intelligent software and data infrastructure by zeroing in on companies leading breakthroughs in automation and smart tools through these 27 AI penny stocks.

- Focus on companies that reward shareholders consistently by using these 15 dividend stocks with yields > 3% to anchor your portfolio with income.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com