European Dividend Stocks To Consider In December 2025

As the European market experiences mixed returns with a slight uptick in the STOXX Europe 600 Index amid hopes for interest rate cuts, investors are keenly observing inflation trends and economic growth revisions across the region. In this dynamic environment, dividend stocks can offer stability and income potential, making them a compelling consideration for those looking to navigate these uncertain times.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.28% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.61% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.11% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.84% | ★★★★★★ |

| freenet (XTRA:FNTN) | 6.60% | ★★★★★☆ |

| Evolution (OM:EVO) | 4.78% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.22% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.46% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.42% | ★★★★★★ |

| Banca Popolare di Sondrio (BIT:BPSO) | 5.23% | ★★★★★☆ |

Click here to see the full list of 206 stocks from our Top European Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Infotel (ENXTPA:INF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Infotel SA designs, develops, markets, and maintains software solutions focused on security, performance, and management across France, Europe, and the United States with a market cap of €297.16 million.

Operations: Infotel SA generates revenue through its Services segment, which accounts for €277.56 million, and its Software segment, contributing €14.62 million.

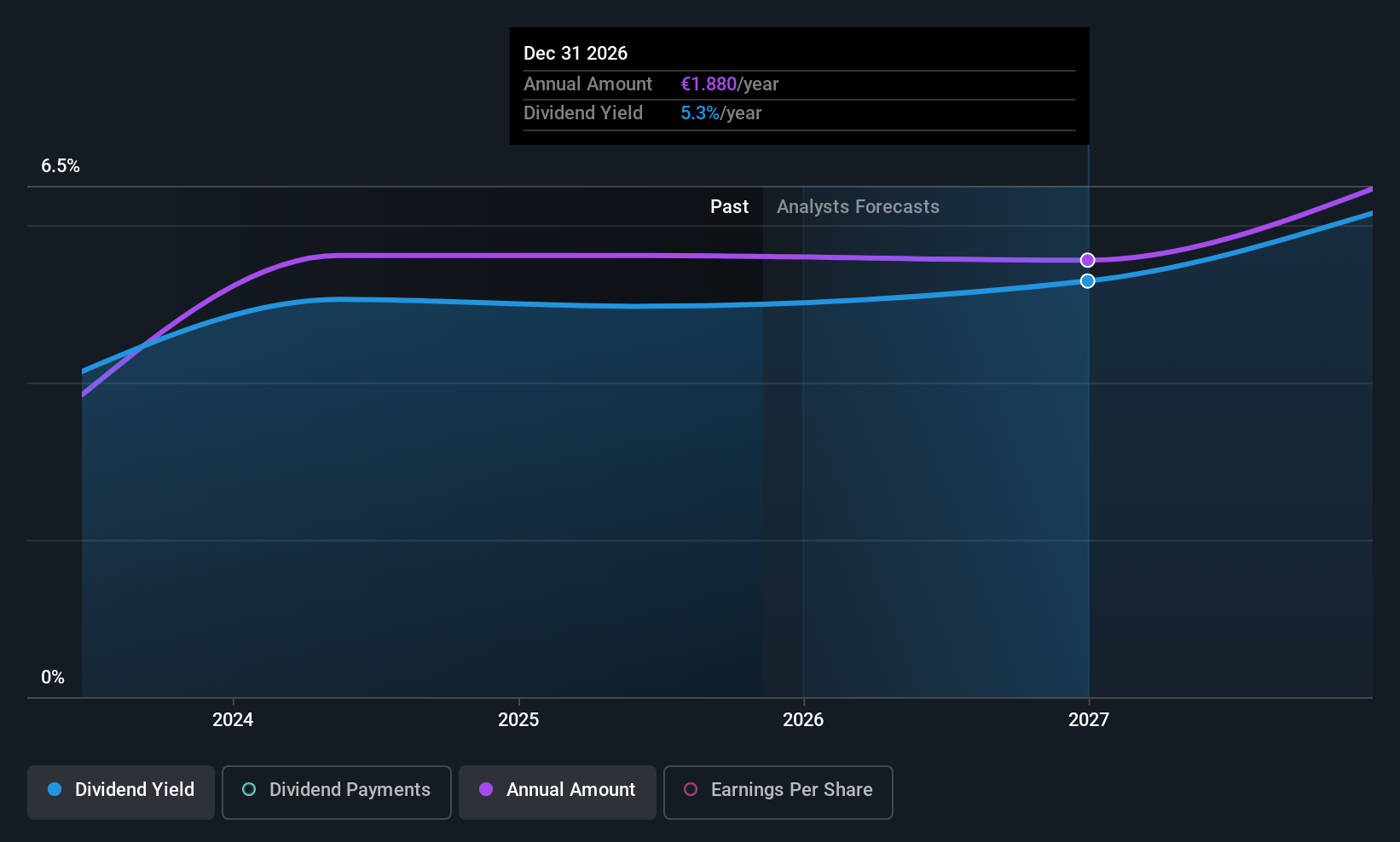

Dividend Yield: 4.7%

Infotel's dividend payments are well covered by cash flows with a cash payout ratio of 43.9%, although the overall payout ratio is higher at 89.8%. Despite a history of volatility, dividends have grown over the past decade. However, its current yield of 4.69% lags behind France's top dividend payers. Recent financial results show stable revenue but decreased net income, affecting profitability and potentially impacting future payouts amidst ongoing buybacks and index inclusions in CAC Small and All-Tradable Indexes.

- Unlock comprehensive insights into our analysis of Infotel stock in this dividend report.

- Upon reviewing our latest valuation report, Infotel's share price might be too optimistic.

CFM Indosuez Wealth Management (ENXTPA:MLCFM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CFM Indosuez Wealth Management SA, along with its subsidiaries, provides banking and financial solutions both in Monaco and internationally, with a market cap of €744.90 million.

Operations: CFM Indosuez Wealth Management SA generates revenue primarily from its Wealth Management segment, which amounted to €196.43 million.

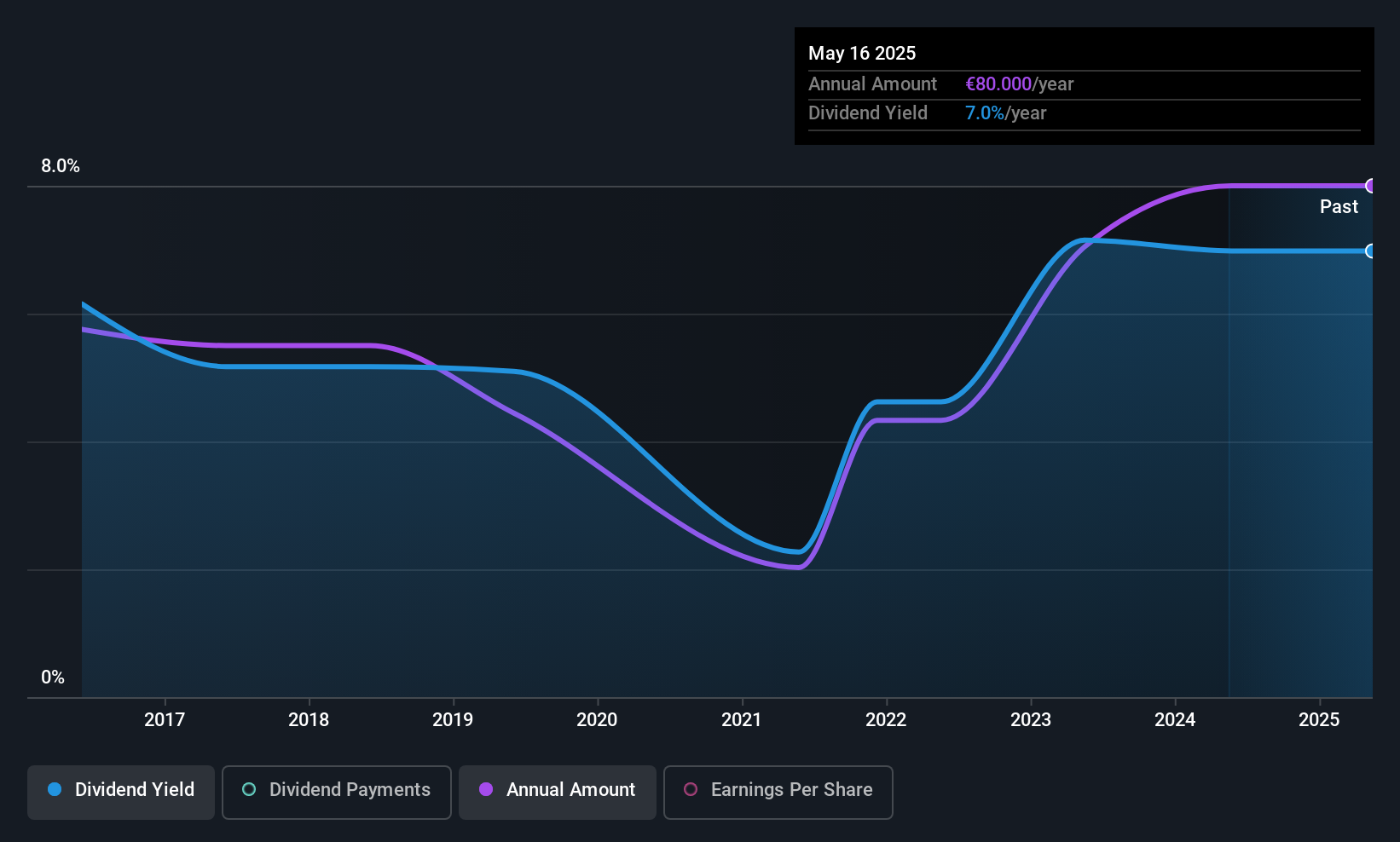

Dividend Yield: 6%

CFM Indosuez Wealth Management's dividend yield of 6% ranks in the top 25% of French dividend payers, although payments have been volatile over the past decade. The payout ratio is reasonable at 73.6%, indicating coverage by earnings, yet historical unreliability raises concerns about sustainability. Despite an attractive price-to-earnings ratio of 12.6x compared to the market average, a low allowance for bad loans at 48% could pose risks to financial stability and future dividends.

- Click here to discover the nuances of CFM Indosuez Wealth Management with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that CFM Indosuez Wealth Management is trading beyond its estimated value.

Daimler Truck Holding (XTRA:DTG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Daimler Truck Holding AG manufactures and sells light, medium, and heavy-duty trucks and buses across Europe, North America, Asia, Latin America, and other international markets with a market cap of €28.31 billion.

Operations: Daimler Truck Holding AG generates revenue through its Trucks North America segment (€20.47 billion), Mercedes-Benz Trucks (€18.35 billion), Trucks Asia (€6.09 billion), Daimler Buses (€5.79 billion), and Financial Services (€3.49 billion).

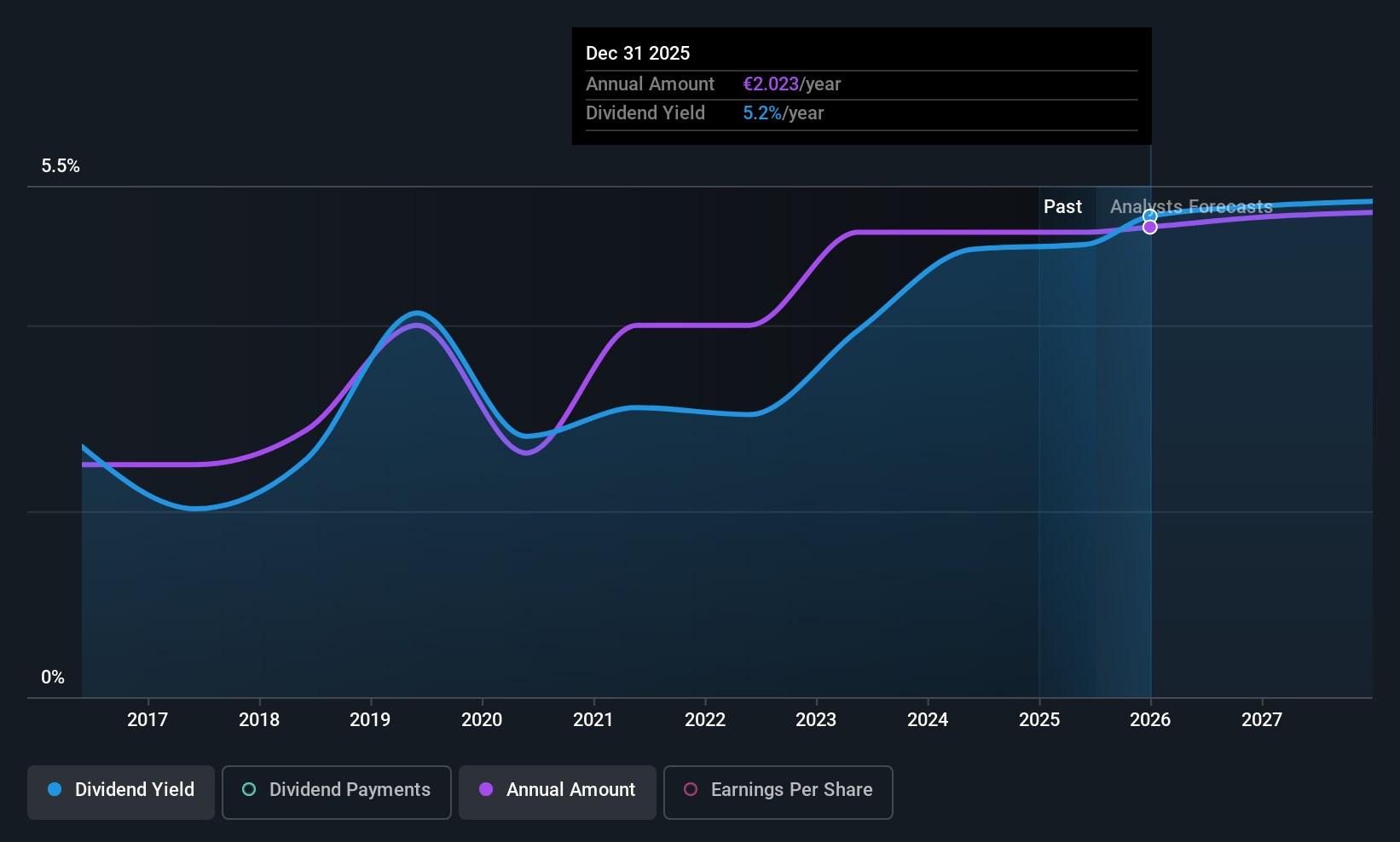

Dividend Yield: 5.1%

Daimler Truck Holding's dividend yield of 5.15% ranks in the top 25% of German dividend payers, with payments covered by both earnings and cash flows, as indicated by payout ratios of 66.2% and 57.1%, respectively. However, dividends have only been paid for three years, raising questions about long-term stability. Recent guidance suggests challenges in profitability due to tariff costs and an unfavorable sales mix, despite expected growth in Mercedes-Benz Trucks' unit sales for Q4 2025.

- Click to explore a detailed breakdown of our findings in Daimler Truck Holding's dividend report.

- The valuation report we've compiled suggests that Daimler Truck Holding's current price could be quite moderate.

Next Steps

- Click here to access our complete index of 206 Top European Dividend Stocks.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com