Bourrelier Group And 2 Other Promising Small Caps In Europe

Amidst a backdrop of mixed returns in major European stock indexes, the pan-European STOXX Europe 600 Index ended slightly higher, buoyed by hopes of interest rate cuts in the U.S. and UK. As eurozone inflation ticks up and GDP revisions show modest growth, small-cap stocks like Bourrelier Group are gaining attention for their potential to capitalize on these evolving economic conditions. Identifying promising small-cap stocks often involves looking for companies with strong fundamentals that can navigate and benefit from broader market dynamics such as these.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| Evergent Investments | 3.63% | 11.51% | 22.05% | ★★★★★☆ |

| KABE Group AB (publ.) | 3.82% | 3.46% | 5.42% | ★★★★★☆ |

| Inmocemento | 28.68% | 4.15% | 33.84% | ★★★★★☆ |

| Inversiones Doalca SOCIMI | 13.10% | 6.72% | 3.11% | ★★★★★☆ |

| Dn Agrar Group | NA | 29.02% | 36.03% | ★★★★★☆ |

| ABG Sundal Collier Holding | 35.58% | -7.59% | -18.30% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| Alantra Partners | 11.36% | -6.39% | -33.69% | ★★★★☆☆ |

| MCH Group | 126.04% | 19.05% | 60.90% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Bourrelier Group (ENXTPA:ALBOU)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Bourrelier Group SA operates do-it-yourself (DIY) stores in France, Belgium, and the Netherlands with a market capitalization of approximately €278.04 million.

Operations: The primary revenue stream for Bourrelier Group comes from its Distribution segment, generating €246.94 million, followed by Industry and Investments contributing €39.47 million and €5.72 million respectively. The Hotel Business adds another €8.01 million to the total revenue mix.

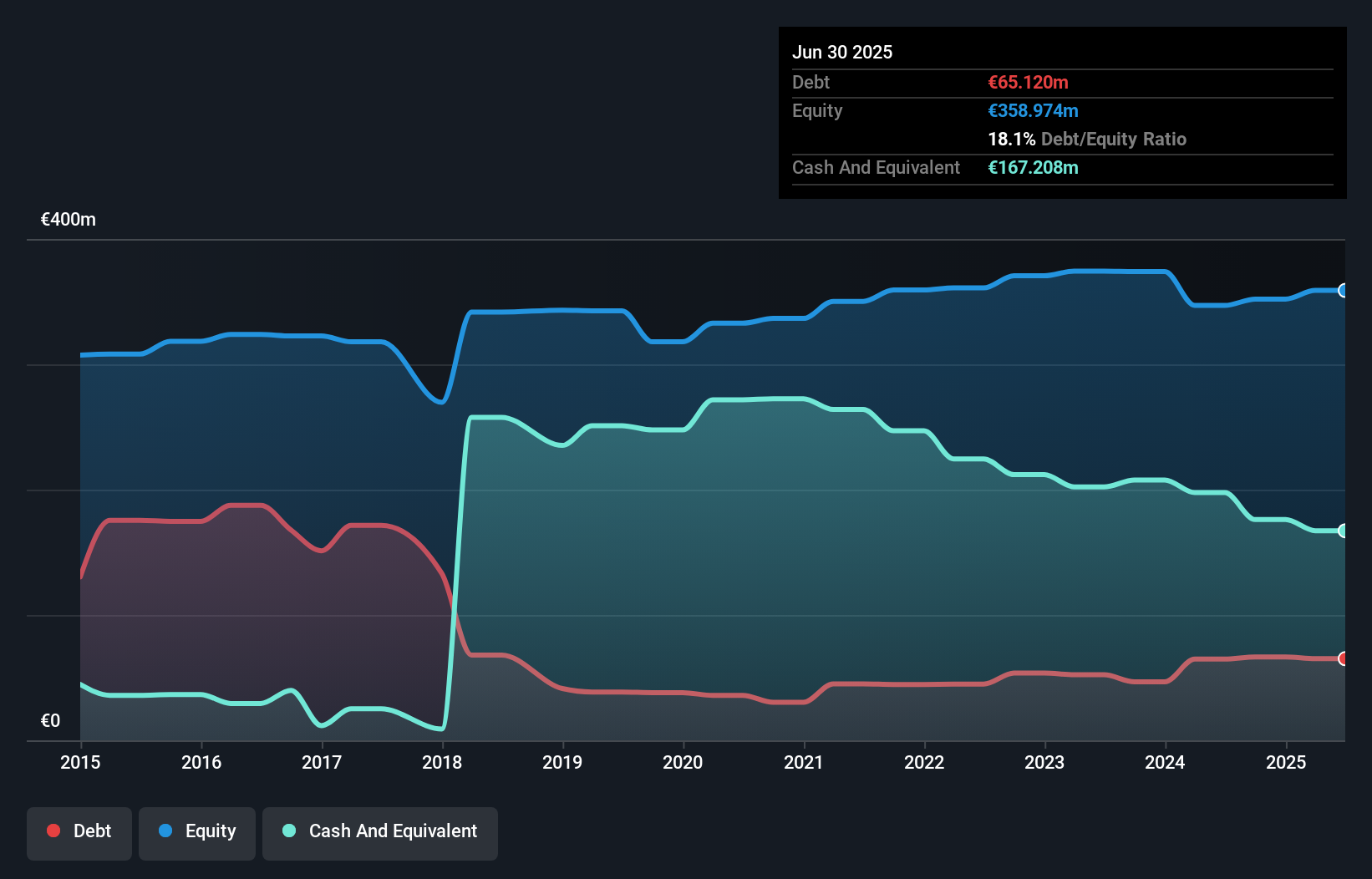

Bourrelier Group, a small player in the market, has shown remarkable earnings growth of 229.4% over the past year, outpacing its industry peers. Despite a large one-off loss of €5.9M impacting recent results, net income for the half-year ending June 2025 rose to €6.85M from €1M previously. Trading at 48.9% below its estimated fair value suggests potential undervaluation, yet its debt-to-equity ratio increased from 10.8% to 18.1% over five years raises some cautionary flags about leverage management and interest coverage remains thin with only 1.4x EBIT coverage on debt obligations.

Rusta (OM:RUSTA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Rusta AB (publ) operates as a retailer offering home decoration, consumables, seasonal products, leisure items, and DIY products across Sweden, Norway, Finland, and Germany with a market cap of SEK12.11 billion.

Operations: Rusta generates revenue primarily from its operations in Sweden, Norway, and other markets, with Sweden contributing SEK 6.99 billion and Norway SEK 2.56 billion. The company's financial performance is influenced by its diverse product offerings across multiple countries.

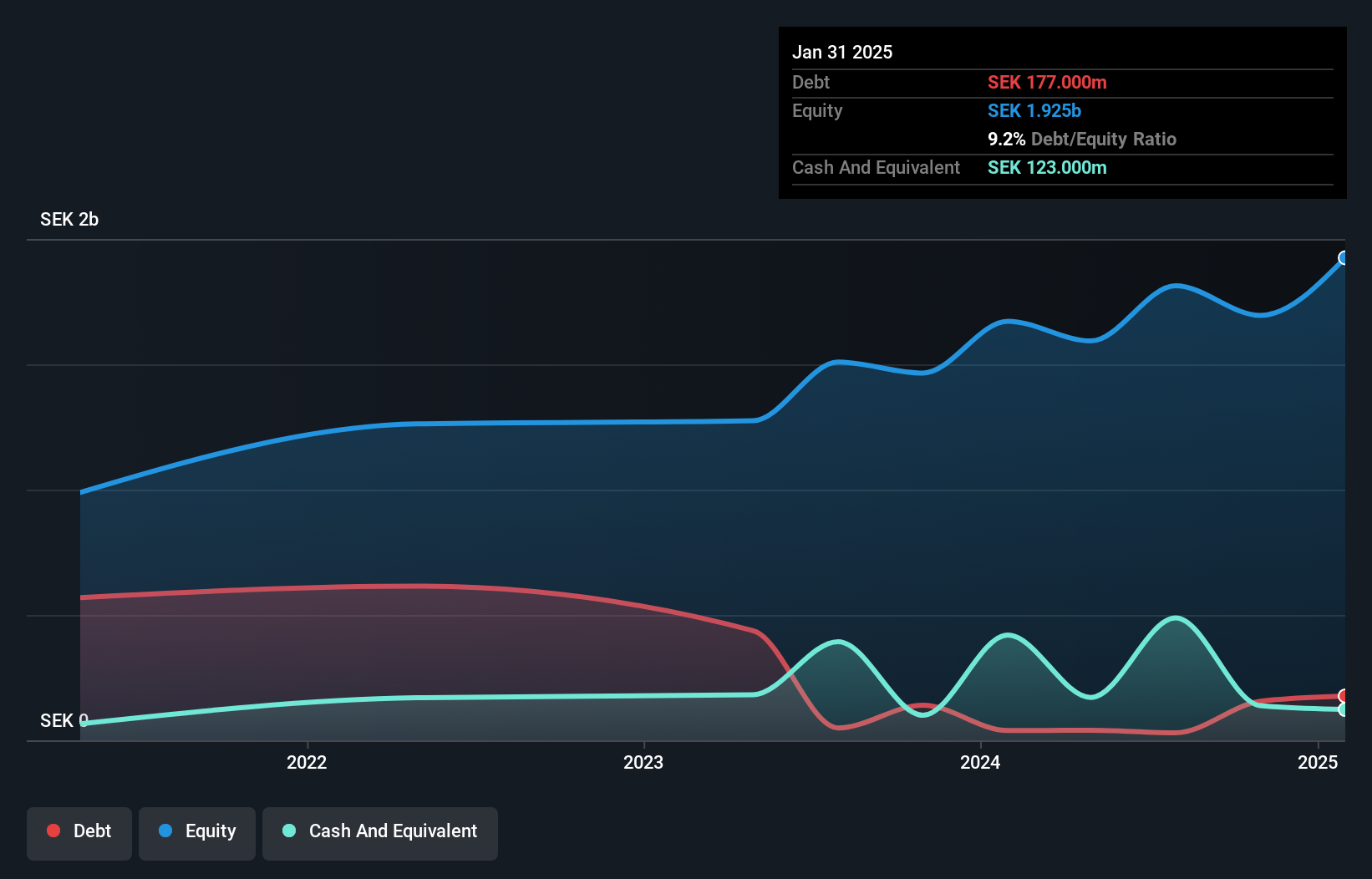

Rusta AB, a retailer in Sweden, Norway, Finland, and Germany, has been actively expanding with plans to open 50 to 80 new stores over the next three years. Recent earnings showed sales of SEK 2.95 billion for Q2 2025 compared to SEK 2.72 billion the previous year. Net income rose to SEK 106 million from SEK 58 million a year ago. With earnings per share at SEK 0.7 from continuing operations, Rusta's financial health is strong; its interest payments are well-covered by EBIT at a ratio of 3.3x and it trades significantly below estimated fair value by about half (51%).

Baader Bank (XTRA:BWB)

Simply Wall St Value Rating: ★★★★★☆

Overview: Baader Bank Aktiengesellschaft offers investment and banking services across Europe, with a market capitalization of €336.70 million.

Operations: Baader Bank generates revenue through its investment and banking services across Europe. The company has a market capitalization of €336.70 million, reflecting its valuation in the financial markets.

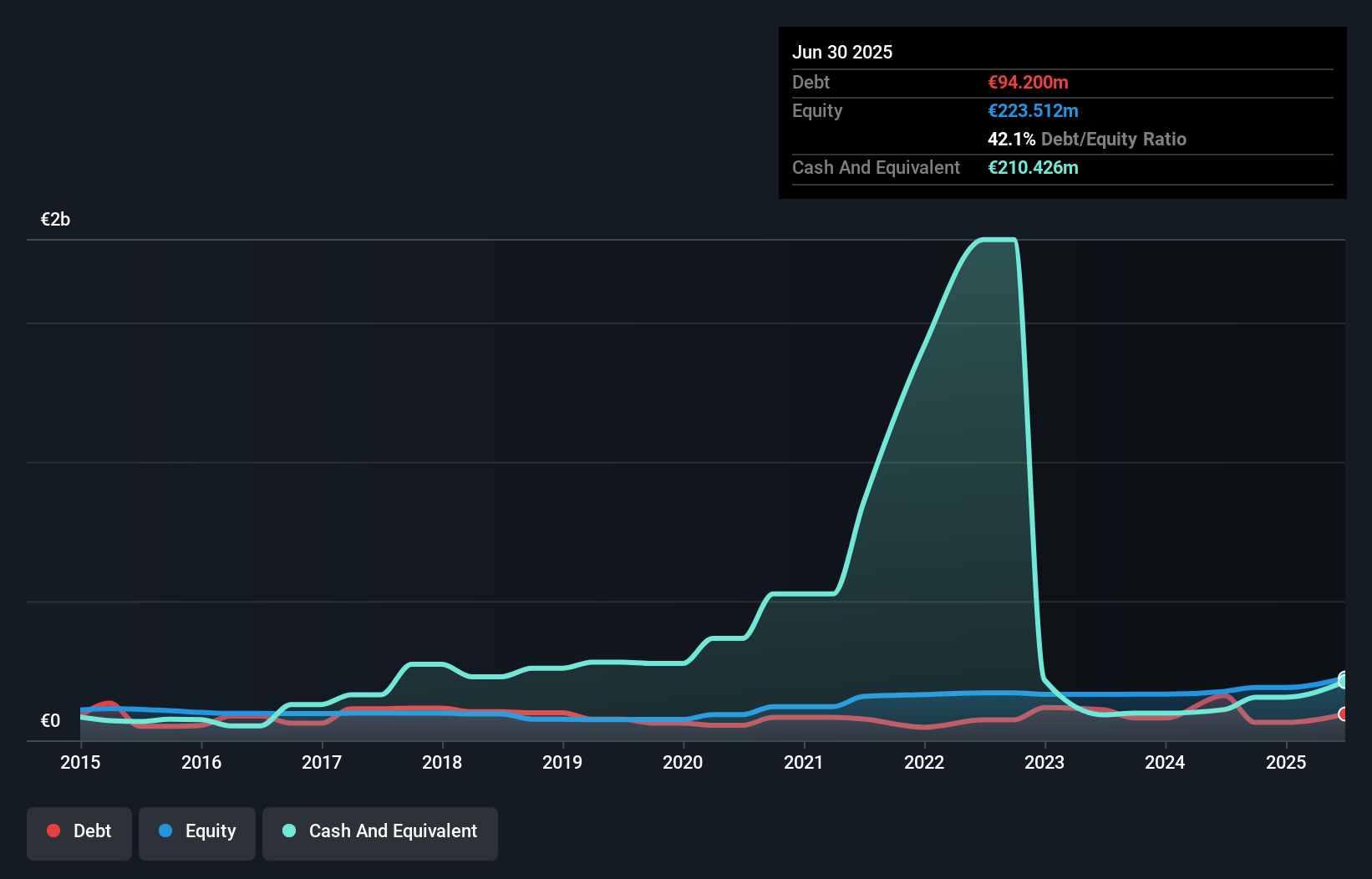

Baader Bank, a nimble player in the European financial scene, showcases a compelling story with its earnings surging by 268% over the past year, significantly outpacing the Capital Markets industry average of 27.5%. The bank's price-to-earnings ratio stands at 7x, well below Germany's market average of 17.9x, suggesting potential value for investors seeking opportunities outside mainstream picks. Over five years, Baader Bank has reduced its debt-to-equity ratio from 58.4% to 42.1%, indicating prudent financial management. Recent strategic alliances with AlphaValue and Erste Group aim to enhance research services and expand investor access across Europe and beyond, potentially boosting future growth prospects.

- Delve into the full analysis health report here for a deeper understanding of Baader Bank.

Explore historical data to track Baader Bank's performance over time in our Past section.

Seize The Opportunity

- Explore the 312 names from our European Undiscovered Gems With Strong Fundamentals screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com