European Growth Stocks With Strong Insider Backing For December 2025

As the European market navigates mixed returns with hopes for interest rate cuts in the U.S. and UK, investors are keenly observing opportunities within the region. In this environment, growth companies with substantial insider ownership often attract attention due to their potential alignment of interests between management and shareholders, offering a compelling angle for those seeking resilient investment options amidst economic fluctuations.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Warimpex Finanz- und Beteiligungs (WBAG:WXF) | 25.9% | 100.6% |

| Redelfi (BIT:RDF) | 12.4% | 39.1% |

| MilDef Group (OM:MILDEF) | 13.7% | 83% |

| MedinCell (ENXTPA:MEDCL) | 12.5% | 96.3% |

| Magnora (OB:MGN) | 10.4% | 75.1% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| DNO (OB:DNO) | 13.5% | 97.5% |

| CTT Systems (OM:CTT) | 17.5% | 52% |

| Circus (XTRA:CA1) | 24.1% | 65.8% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 49.6% |

Here we highlight a subset of our preferred stocks from the screener.

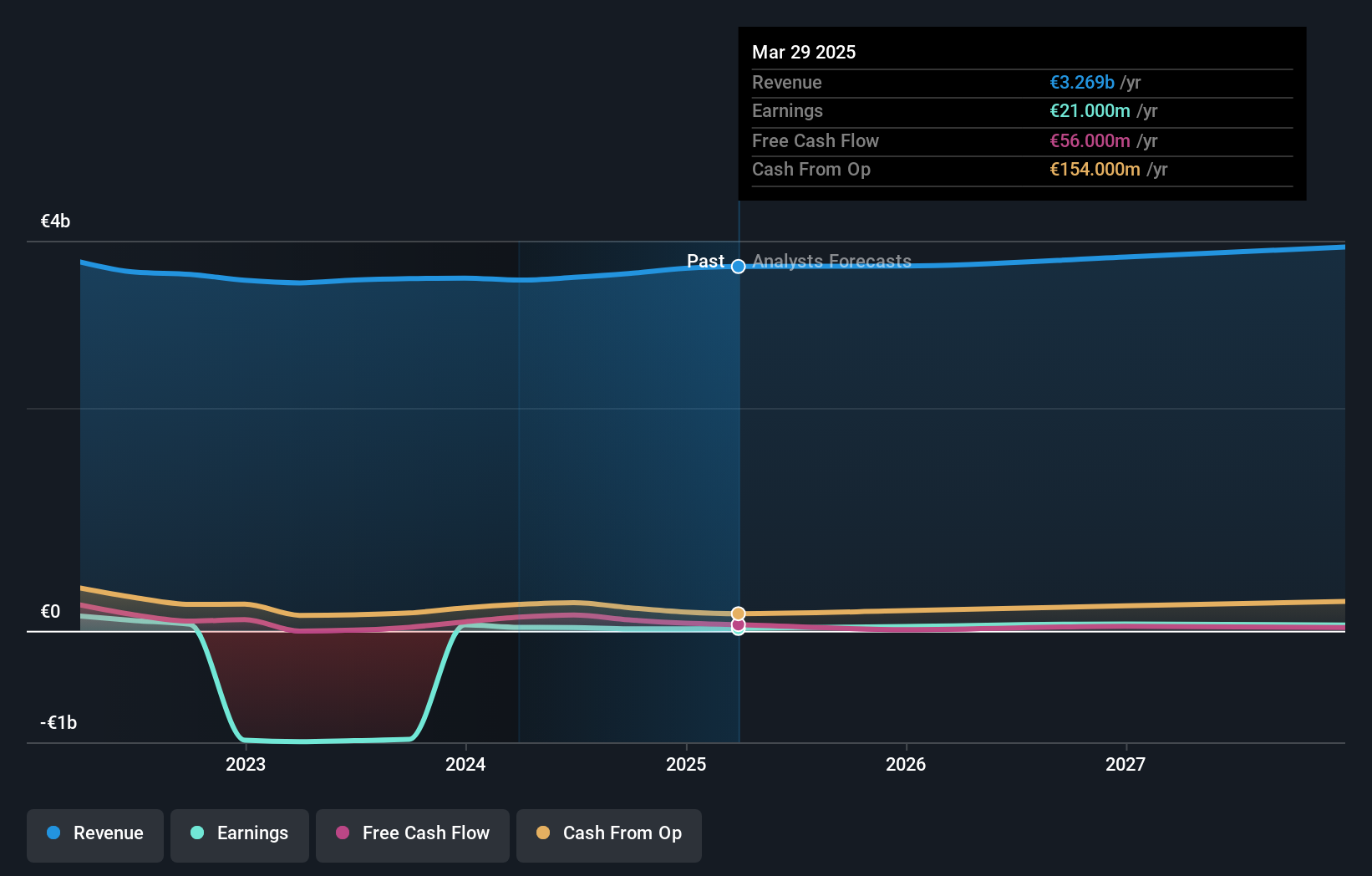

PostNL (ENXTAM:PNL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PostNL N.V. offers postal and logistics services to businesses and consumers across the Netherlands, Europe, and internationally, with a market cap of €504.87 million.

Operations: The company's revenue is primarily derived from its Parcels segment, generating €2.41 billion, and the Mail in The Netherlands segment, which contributes €1.32 billion.

Insider Ownership: 35.1%

PostNL's growth potential is tempered by slower revenue expansion, forecast at 2.7% annually, below the Dutch market's 8.2%. Despite trading at a good value relative to peers and industry, its financial position is strained with interest payments not well covered by earnings. Insider ownership remains stable without substantial recent trading activity. Earnings are projected to grow significantly by 75.32% annually, potentially achieving profitability within three years, outpacing average market growth expectations.

- Delve into the full analysis future growth report here for a deeper understanding of PostNL.

- The valuation report we've compiled suggests that PostNL's current price could be quite moderate.

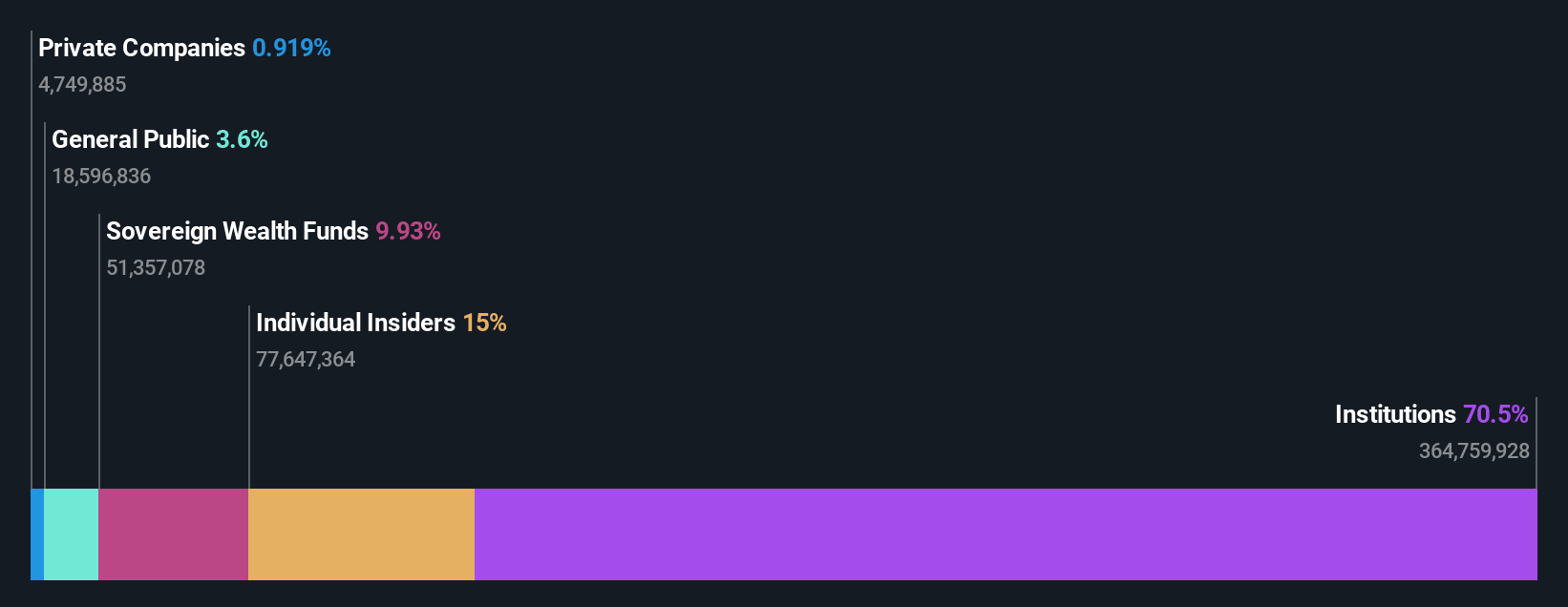

Mowi (OB:MOWI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Mowi ASA is a seafood company that produces and sells Atlantic salmon products globally, with a market capitalization of NOK124.65 billion.

Operations: Mowi's revenue is primarily derived from its Farming segment (€3.48 billion), Sales & Marketing - Markets (€4.05 billion), Sales and Marketing - Consumer Products (€3.74 billion), and Feed operations (€1.06 billion).

Insider Ownership: 15.3%

Mowi's earnings are forecast to grow significantly at 45.8% annually, outpacing the Norwegian market, while revenue growth is slower at 9.1%. Despite trading below its estimated fair value, Mowi carries high debt levels. Recent earnings show improved net income and EPS compared to last year despite slightly lower sales. The company increased harvest volume guidance for 2025 and expects further growth in 2026, although insider ownership changes have not been substantial recently.

- Click to explore a detailed breakdown of our findings in Mowi's earnings growth report.

- In light of our recent valuation report, it seems possible that Mowi is trading behind its estimated value.

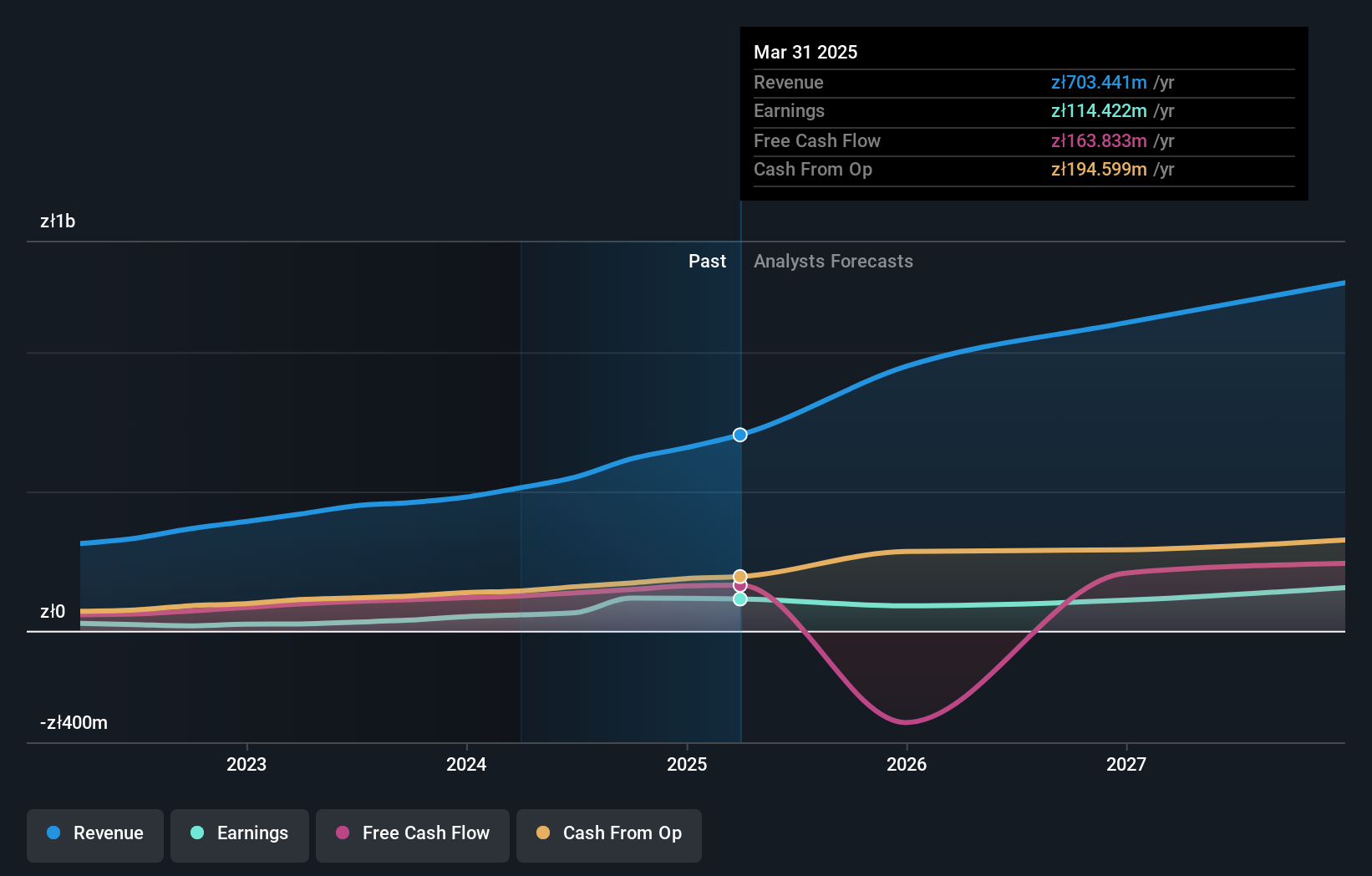

Cyber_Folks (WSE:CBF)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Cyber_Folks S.A. is a global technology company with a market capitalization of PLN2.72 billion.

Operations: The company's revenue segments include VERCOM at PLN472.00 million, Corporate at PLN1.83 million, E-Commerce at PLN144.09 million, and Cyber_Folks at PLN176.49 million.

Insider Ownership: 22.6%

Cyber_Folks is positioned for robust growth, with earnings forecast to rise 42.5% annually, surpassing the Polish market. Despite trading significantly below fair value, profit margins have declined due to large one-off items impacting results. The company faces high debt levels but anticipates revenue growth of 14.6% annually, outstripping the local market's pace. Recent earnings reveal increased sales yet decreased net income and EPS compared to last year; no substantial insider trading activity was reported recently.

- Unlock comprehensive insights into our analysis of Cyber_Folks stock in this growth report.

- Our expertly prepared valuation report Cyber_Folks implies its share price may be too high.

Key Takeaways

- Get an in-depth perspective on all 206 Fast Growing European Companies With High Insider Ownership by using our screener here.

- Searching for a Fresh Perspective? These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com