3 European Stocks That May Be Trading Below Their Estimated Value

As the pan-European STOXX Europe 600 Index recently edged higher on hopes of interest rate cuts in the U.S. and UK, mixed returns across major European stock indexes reflect a complex economic landscape marked by rising inflation and steady GDP growth. In this context, identifying stocks that may be trading below their estimated value requires a keen understanding of market dynamics and financial fundamentals, making it crucial for investors to focus on companies with strong potential for growth despite current market uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sanoma Oyj (HLSE:SANOMA) | €9.24 | €18.37 | 49.7% |

| PVA TePla (XTRA:TPE) | €22.40 | €44.05 | 49.1% |

| Nokian Panimo Oyj (HLSE:BEER) | €2.45 | €4.88 | 49.8% |

| Micro Systemation (OM:MSAB B) | SEK63.00 | SEK125.87 | 49.9% |

| Exel Composites Oyj (HLSE:EXL1V) | €0.389 | €0.77 | 49.8% |

| Esautomotion (BIT:ESAU) | €3.10 | €6.14 | 49.5% |

| E-Globe (BIT:EGB) | €0.62 | €1.23 | 49.6% |

| Dynavox Group (OM:DYVOX) | SEK101.40 | SEK202.29 | 49.9% |

| Digital Workforce Services Oyj (HLSE:DWF) | €2.58 | €5.10 | 49.4% |

| Circle (BIT:CIRC) | €8.08 | €15.79 | 48.8% |

Let's explore several standout options from the results in the screener.

Kempower Oyj (HLSE:KEMPOWR)

Overview: Kempower Oyj manufactures and sells electric vehicle charging equipment and solutions for various modes of transport across the Nordics, Europe, North America, and internationally, with a market cap of €793.16 million.

Operations: The company's revenue is primarily derived from its electric equipment segment, which generated €251.10 million.

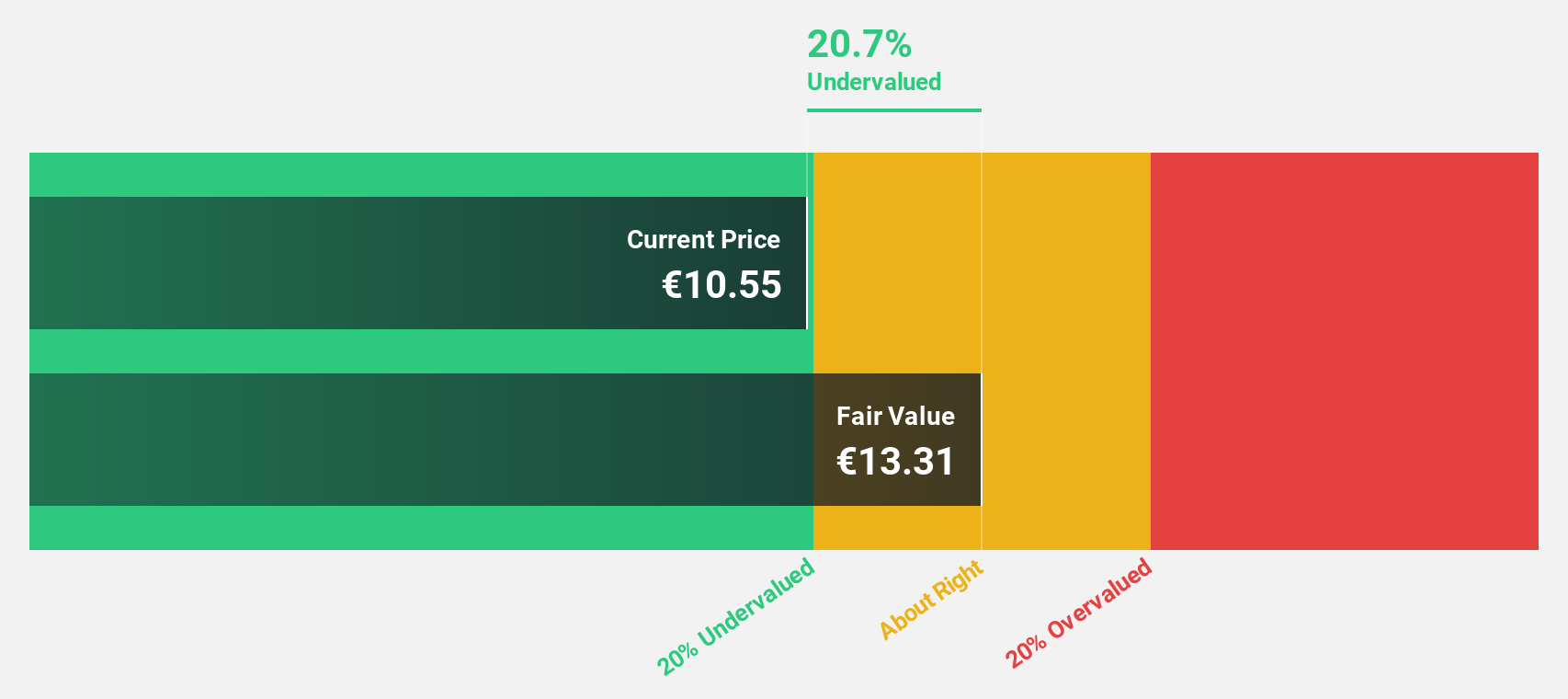

Estimated Discount To Fair Value: 20.7%

Kempower Oyj is trading at €14.32, below its estimated fair value of €18.05, indicating it is undervalued based on discounted cash flows. The company reported a reduced net loss for Q3 2025 and anticipates significant revenue growth between 10% to 15% for the year, with operative EBIT expected to improve substantially from 2024. Revenue growth forecasts exceed both market averages and Finnish industry standards, projecting annual increases above 20%.

- The analysis detailed in our Kempower Oyj growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of Kempower Oyj.

Dynavox Group (OM:DYVOX)

Overview: Dynavox Group AB (publ) develops and sells assistive technology products for individuals with impaired communication skills, with a market capitalization of approximately SEK10.55 billion.

Operations: The company generates revenue primarily from its Computer Hardware segment, amounting to SEK2.38 billion.

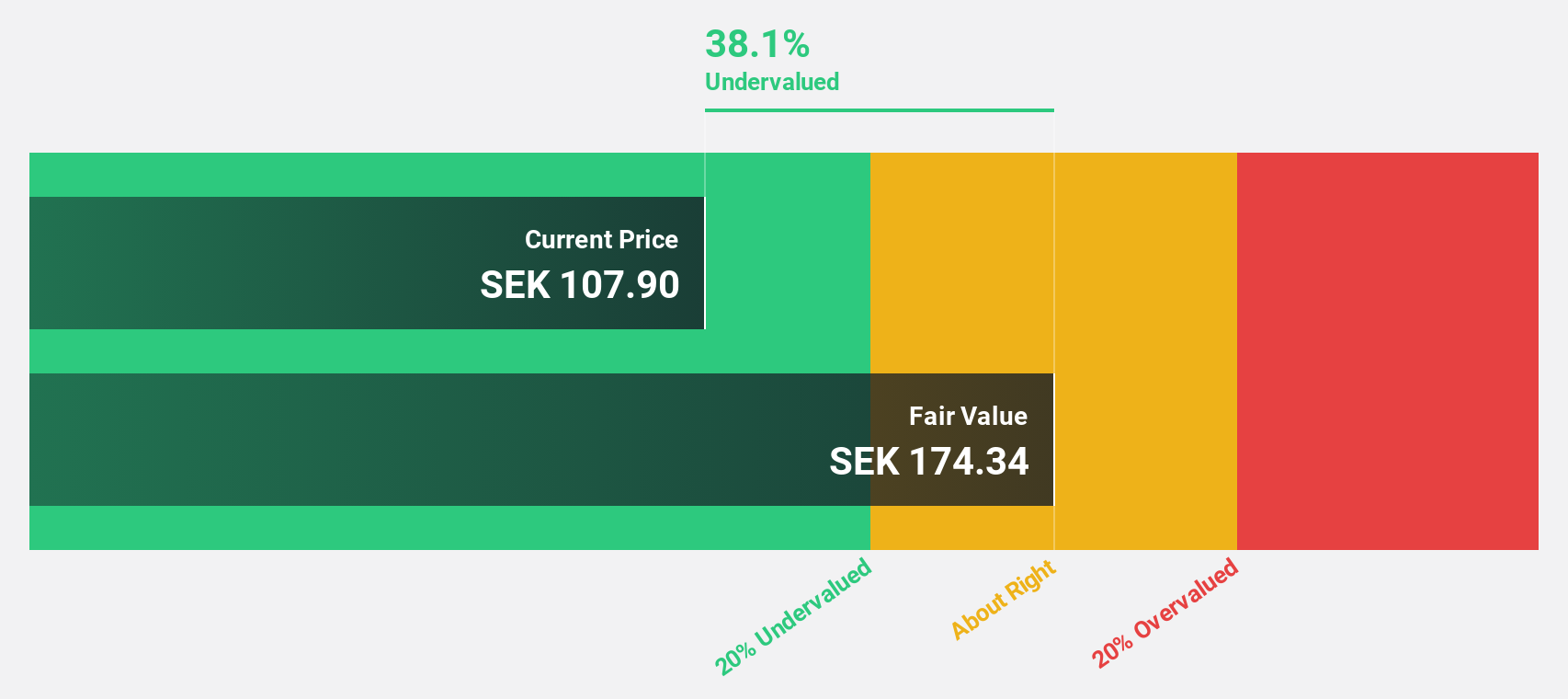

Estimated Discount To Fair Value: 49.9%

Dynavox Group is trading at SEK101.4, significantly below its estimated fair value of SEK202.29, highlighting its undervaluation based on discounted cash flows. Despite a high debt level, the company shows promising earnings growth potential, forecasted to rise 38.35% annually over the next three years—outpacing both market and industry averages in Sweden. Recent earnings reports reveal increased sales but slightly lower net income compared to last year, underscoring operational challenges amidst growth prospects.

- In light of our recent growth report, it seems possible that Dynavox Group's financial performance will exceed current levels.

- Navigate through the intricacies of Dynavox Group with our comprehensive financial health report here.

Hensoldt (XTRA:HAG)

Overview: Hensoldt AG, along with its subsidiaries, offers sensor solutions for defense and security applications globally and has a market cap of €8.59 billion.

Operations: The company generates revenue from its Sensors segment (€2.02 billion) and Optronics segment (€398 million).

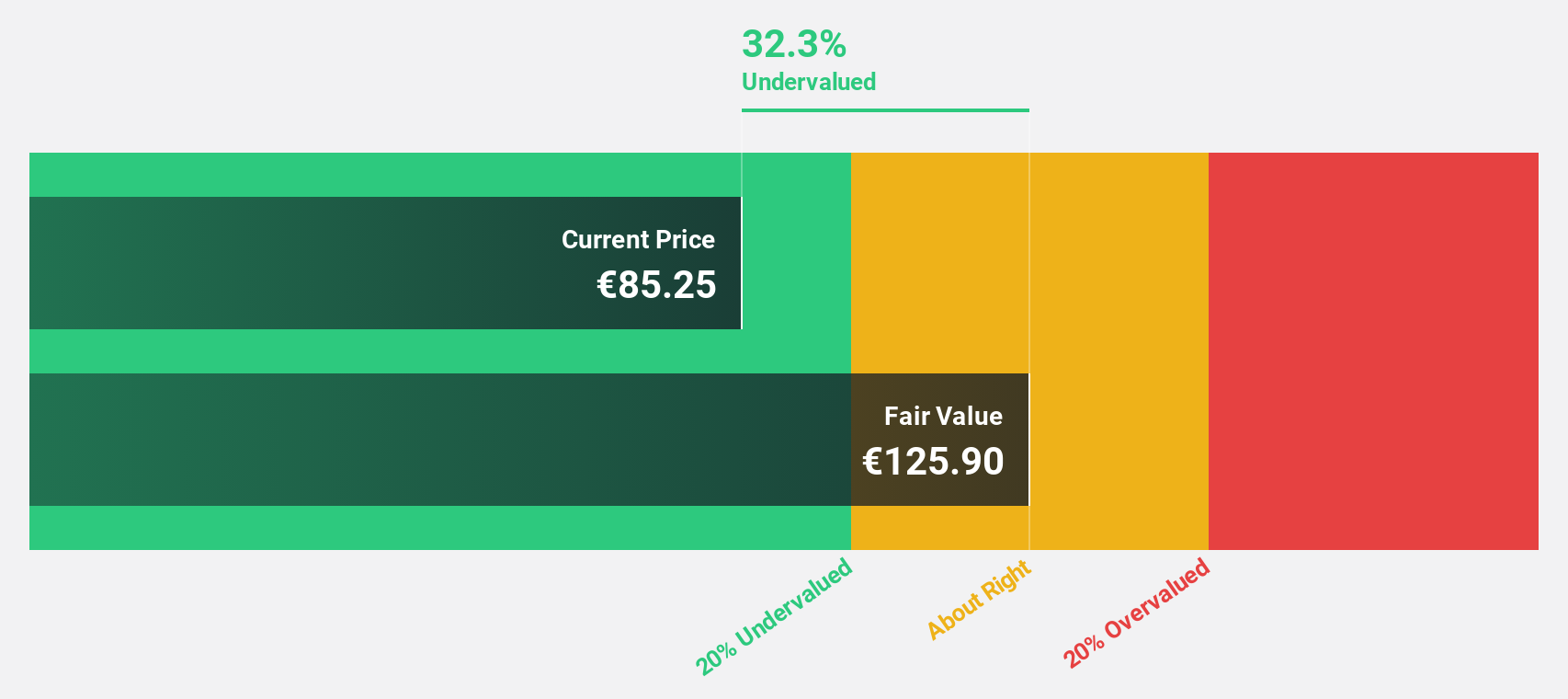

Estimated Discount To Fair Value: 43.4%

Hensoldt AG, trading at €74.05, is significantly undervalued with a fair value estimate of €130.73 based on discounted cash flows. Despite recent earnings showing a net loss reduction to €30 million for the first nine months of 2025, the company forecasts robust annual earnings growth of 27.1%, surpassing German market expectations. However, interest payments are not well covered by current earnings, and revenue guidance has been adjusted to approximately €2.5 billion for 2025.

- Our expertly prepared growth report on Hensoldt implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in Hensoldt's balance sheet health report.

Next Steps

- Investigate our full lineup of 191 Undervalued European Stocks Based On Cash Flows right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com