Ferrari (BIT:RACE): Reassessing Valuation After F1 Struggles and Morgan Stanley Downgrade

Ferrari (BIT:RACE) has been under pressure lately, caught between a tough first F1 season with Lewis Hamilton and a downgrade that questioned its slower growth path. Yet, the long term story has barely changed.

See our latest analysis for Ferrari.

The share price tells that story too, with a roughly 7.7% one-month share price return and about a 20% share price pullback year to date, cooling momentum even as the three-year total shareholder return of around 56% remains robust.

If you are reassessing Ferrari after this reset in expectations, it can also be worth scanning other premium car makers and discovering auto manufacturers as potential alternatives or complements in your portfolio.

With sentiment bruised by track setbacks and a cautious growth roadmap, Ferrari’s valuation now sits well below analyst targets. However, resilient margins and brand power muddy the picture. Is this pullback a buying opportunity, or is future growth already priced in?

Most Popular Narrative: 19.7% Undervalued

With Ferrari last closing at €324.8 against a narrative fair value near €404, the most widely followed view frames this pullback as opportunity rather than warning.

The ramp up of high margin, recurring revenue streams from brand sponsorships, lifestyle, and personalization fueled by lifestyle activities, racing events, and growing global brand desirability will further enhance margin accretion, drive resilient long term earnings, and reduce reliance on car sales volume alone. Ongoing investments in innovation (for example, electrification, new manufacturing/paint facilities, and cross sector technology transfers like the Hypersail project) both future proof the business and leverage secular trends towards luxury experiential goods, likely resulting in higher capital efficiency and supporting sustainable earnings growth over the next cycle.

Want to see the financial engine behind that upbeat view? The narrative leans on steady growth, rising margins, and a future earnings multiple usually reserved for elite compounders. Curious which specific revenue, profit, and valuation assumptions push its fair value so far above today’s price?

Result: Fair Value of €404.24 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower-than-expected EV adoption or softer demand for new launches could undermine Ferrari’s pricing power and derail those upbeat earnings assumptions.

Find out about the key risks to this Ferrari narrative.

Another View: Market Multiples Flash a Warning

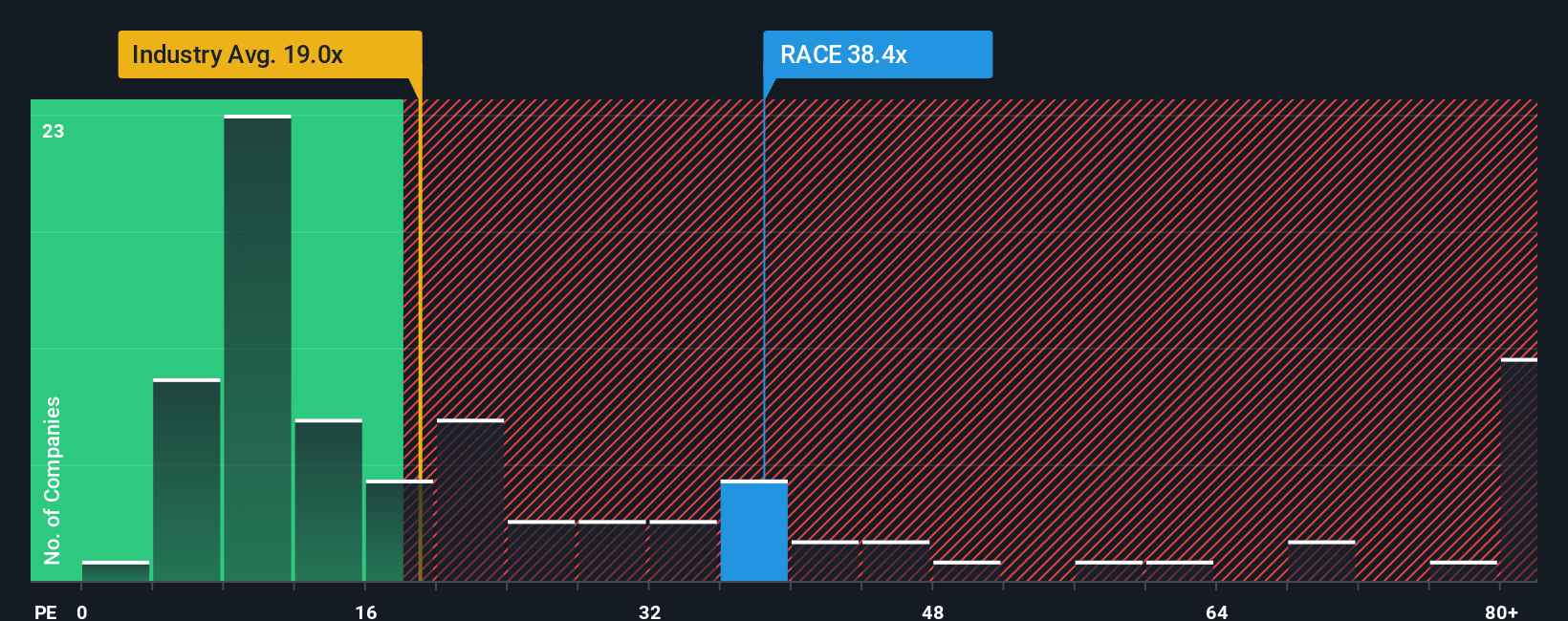

Set against that upbeat fair value, Ferrari’s current valuation looks stretched on earnings. The shares trade on a price to earnings ratio of about 36 times, versus roughly 18.8 times for the global auto sector and a fair ratio closer to 19.7 times, implying meaningful downside if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ferrari Narrative

If you see the story differently, or prefer to dig into the numbers yourself, you can build a personalized thesis in minutes with Do it your way.

A great starting point for your Ferrari research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Do not stop with a single stock. Expand your opportunity set now with targeted screeners that surface quality ideas before the crowd even notices.

- Capitalize on mispriced quality by using these 899 undervalued stocks based on cash flows to uncover companies where strong cash flows are not yet fully reflected in the share price.

- Ride structural growth trends by scanning these 27 AI penny stocks for businesses positioned at the forefront of artificial intelligence innovation.

- Boost your income potential with these 15 dividend stocks with yields > 3% and pinpoint reliable companies offering attractive yields backed by solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com