Is It Too Late To Consider Fabrinet After Its 126.2% Surge In 2025?

- If you are wondering whether Fabrinet is still worth buying after its massive run up, or if you have missed the boat, you are not alone. This stock is firmly on valuation watchers' radars.

- With the share price at about $498.45 after climbing 11.4% in the last week, 6.7% over the past month, and an eye catching 126.2% year to date, the market is clearly reassessing what this business is worth.

- Those gains have come alongside rising optimism around Fabrinet's role in optical communications and advanced manufacturing, especially as demand for high speed data and AI infrastructure continues to swell. Investors have also been responding to industry headlines about supply chain reshoring and long term secular growth in data traffic, which together help explain why the stock has been re rated so aggressively.

- Despite that excitement, Fabrinet currently scores just 0/6 on our undervaluation checks. In the next sections we will break down how different valuation methods look at this stock, and then finish with a more holistic way to think about what it might really be worth.

Fabrinet scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Fabrinet Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth by projecting the cash it could generate in the future and then discounting those cash flows back to today in dollar terms. For Fabrinet, the 2 Stage Free Cash Flow to Equity model starts from its last twelve month Free Cash Flow of about $244 million and then builds in both analyst forecasts and longer term estimates.

Analysts currently expect Fabrinet's Free Cash Flow to rise to roughly $506.5 million by 2028, with further growth extrapolated by Simply Wall St out to 2035. Each of those future cash flows is discounted back to present value, reflecting the risk and time value of money, and then summed to arrive at an estimated intrinsic value for the equity.

This approach produces a DCF fair value of about $310.18 per share, which is roughly 60.7% below the current share price of around $498.45, so the model suggests the stock is significantly overvalued on cash flow fundamentals.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Fabrinet may be overvalued by 60.7%. Discover 899 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Fabrinet Price vs Earnings

For profitable companies like Fabrinet, the Price to Earnings ratio is a useful yardstick because it directly links what investors are paying to the profits the business is generating today. In general, faster growth and lower perceived risk justify a higher PE multiple, while slower growth or higher risk argue for a lower, more conservative PE.

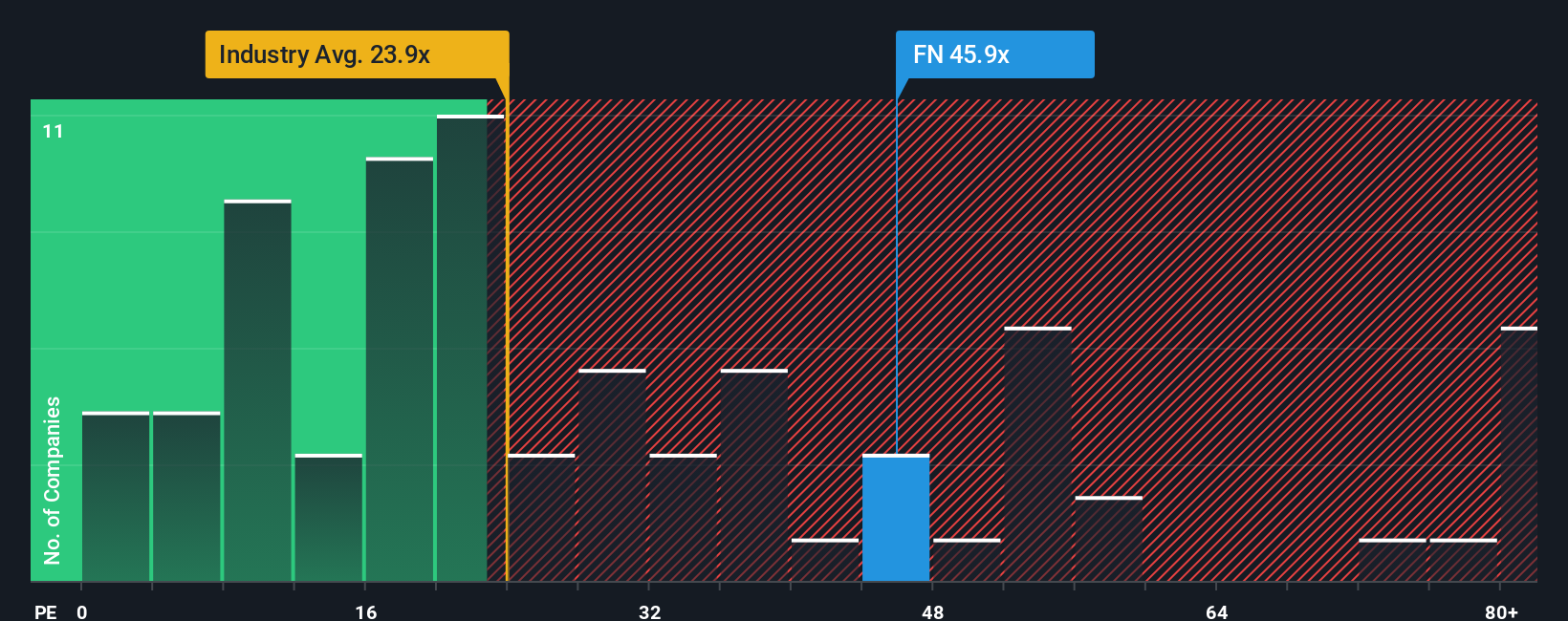

Fabrinet currently trades on about 50.87x earnings, which is rich compared to the broader Electronic industry average of roughly 24.55x and even above the peer group average of around 40.64x. Based on those simple comparisons alone, the stock appears expensive.

Simply Wall St’s Fair Ratio metric offers a more tailored view by estimating what PE multiple would be reasonable for Fabrinet given its earnings growth outlook, profitability, industry, market cap and specific risks. For Fabrinet, that Fair Ratio is about 34.33x, meaning the shares are trading well above what this more nuanced framework indicates is fair. Taken together, the preferred multiple analysis suggests that the market is pricing in a lot of optimism.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1450 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Fabrinet Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework where you write the story behind your numbers by linking your view of a company’s future revenue, earnings and margins to a clear forecast and a fair value estimate.

On Simply Wall St, Narratives live in the Community page and are used by millions of investors as an easy, guided tool that connects a company’s story to a financial model and then to an explicit Fair Value. This makes it straightforward to compare that Fair Value with today’s share price and decide whether it looks like a buy, hold or sell.

Because Narratives are updated dynamically as new information arrives, such as Fabrinet’s latest earnings, guidance or buyback activity, your fair value view can evolve with the facts instead of staying frozen in a static model.

For Fabrinet, for example, one investor might build a bullish Narrative around accelerating AI driven demand, margin expansion and a fair value closer to $479. Another could focus on customer concentration and supply chain risks to justify a far lower value nearer $220, and Narratives helps both of them see exactly how those differing stories translate into numbers and decisions.

Do you think there's more to the story for Fabrinet? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com