Exploring 3 Undiscovered Gems in the United Kingdom Market

The United Kingdom market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, highlighting concerns over global economic recovery. In such a climate, investors might consider exploring small-cap stocks that demonstrate resilience and potential for growth despite broader market pressures.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| B.P. Marsh & Partners | NA | 42.17% | 45.70% | ★★★★★★ |

| Goodwin | 19.83% | 10.66% | 18.55% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.01% | 5.12% | ★★★★★★ |

| BioPharma Credit | NA | 7.73% | 7.94% | ★★★★★★ |

| Georgia Capital | NA | 2.23% | 16.34% | ★★★★★★ |

| MS INTERNATIONAL | NA | 15.73% | 53.22% | ★★★★★★ |

| Vectron Systems | NA | 2.48% | 28.82% | ★★★★★★ |

| Nationwide Building Society | 282.42% | 9.69% | 21.24% | ★★★★★☆ |

| Distribution Finance Capital Holdings | 9.37% | 48.09% | 66.49% | ★★★★★☆ |

| FW Thorpe | 2.12% | 10.94% | 13.25% | ★★★★★☆ |

Here's a peek at a few of the choices from the screener.

B.P. Marsh & Partners (AIM:BPM)

Simply Wall St Value Rating: ★★★★★★

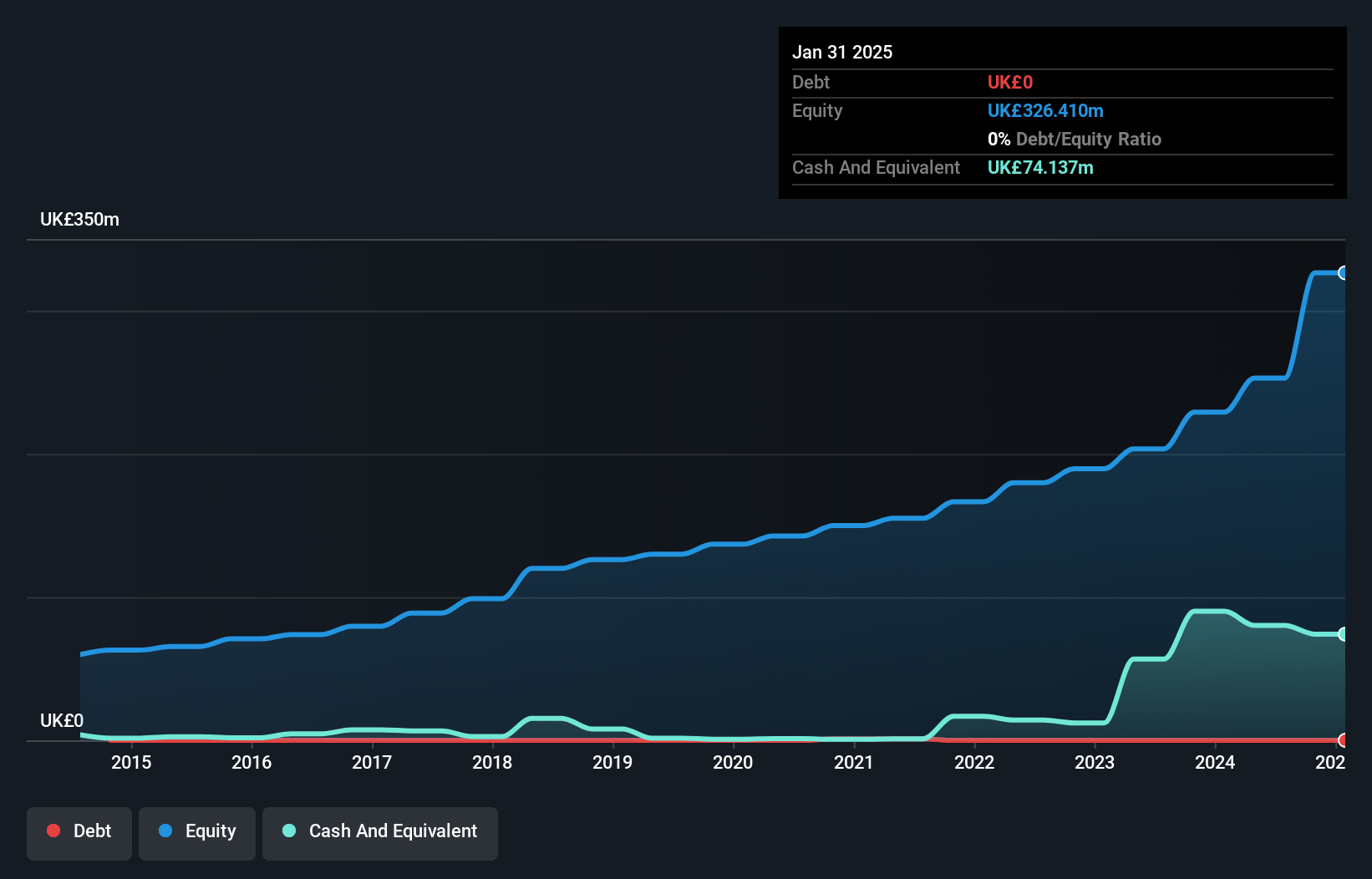

Overview: B.P. Marsh & Partners PLC focuses on investing in early-stage and SME financial services intermediary businesses both in the United Kingdom and internationally, with a market capitalization of £242.47 million.

Operations: Revenue primarily comes from consultancy services and trading investments in financial services, totaling £118.87 million.

B.P. Marsh & Partners stands out with a robust earnings growth of 94.8% over the past year, significantly surpassing the Capital Markets industry's 2.3%. The company operates without debt, eliminating concerns over interest payments and highlighting its financial prudence. Trading at 49.3% below estimated fair value, it presents an appealing valuation opportunity for investors seeking potential upside. Recent leadership changes see Dan Topping stepping up as CEO, bringing continuity to their strategic direction since joining in 2007. Despite not being free cash flow positive currently, the firm's high-quality non-cash earnings add depth to its financial profile.

- Delve into the full analysis health report here for a deeper understanding of B.P. Marsh & Partners.

Understand B.P. Marsh & Partners' track record by examining our Past report.

Georgia Capital (LSE:CGEO)

Simply Wall St Value Rating: ★★★★★★

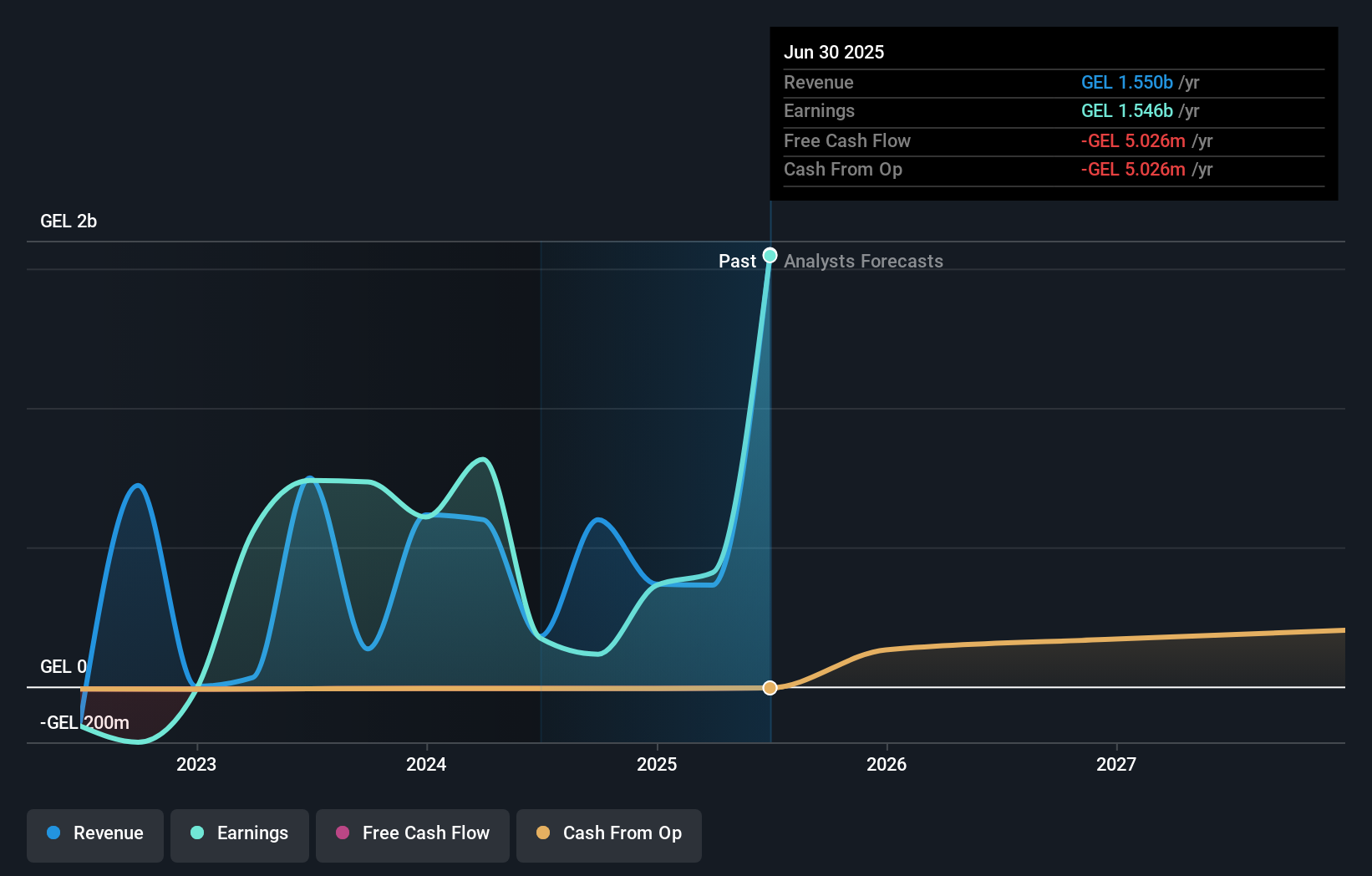

Overview: Georgia Capital PLC is a private equity and venture capital firm that focuses on early-stage investments, organic growth, and acquisitions, with a market capitalization of £915.06 million.

Operations: Georgia Capital PLC's revenue streams are primarily derived from its investments in early-stage companies and acquisitions. The firm focuses on organic growth strategies to enhance its portfolio value.

Georgia Capital, a dynamic player in the UK market, has recently made waves with its impressive earnings growth of 1381% over the past year. This surge was notably influenced by a significant one-off gain of GEL1.4 billion. Despite not being free cash flow positive, the company remains debt-free and has seen its stock trading at 18.6% below estimated fair value, suggesting potential undervaluation. Recent buybacks amounting to $44.6 million for 1,448,000 shares reflect strategic capital management efforts amid notable insider selling in recent months—a factor worth monitoring for future stability and investor confidence.

Law Debenture (LSE:LWDB)

Simply Wall St Value Rating: ★★★★★☆

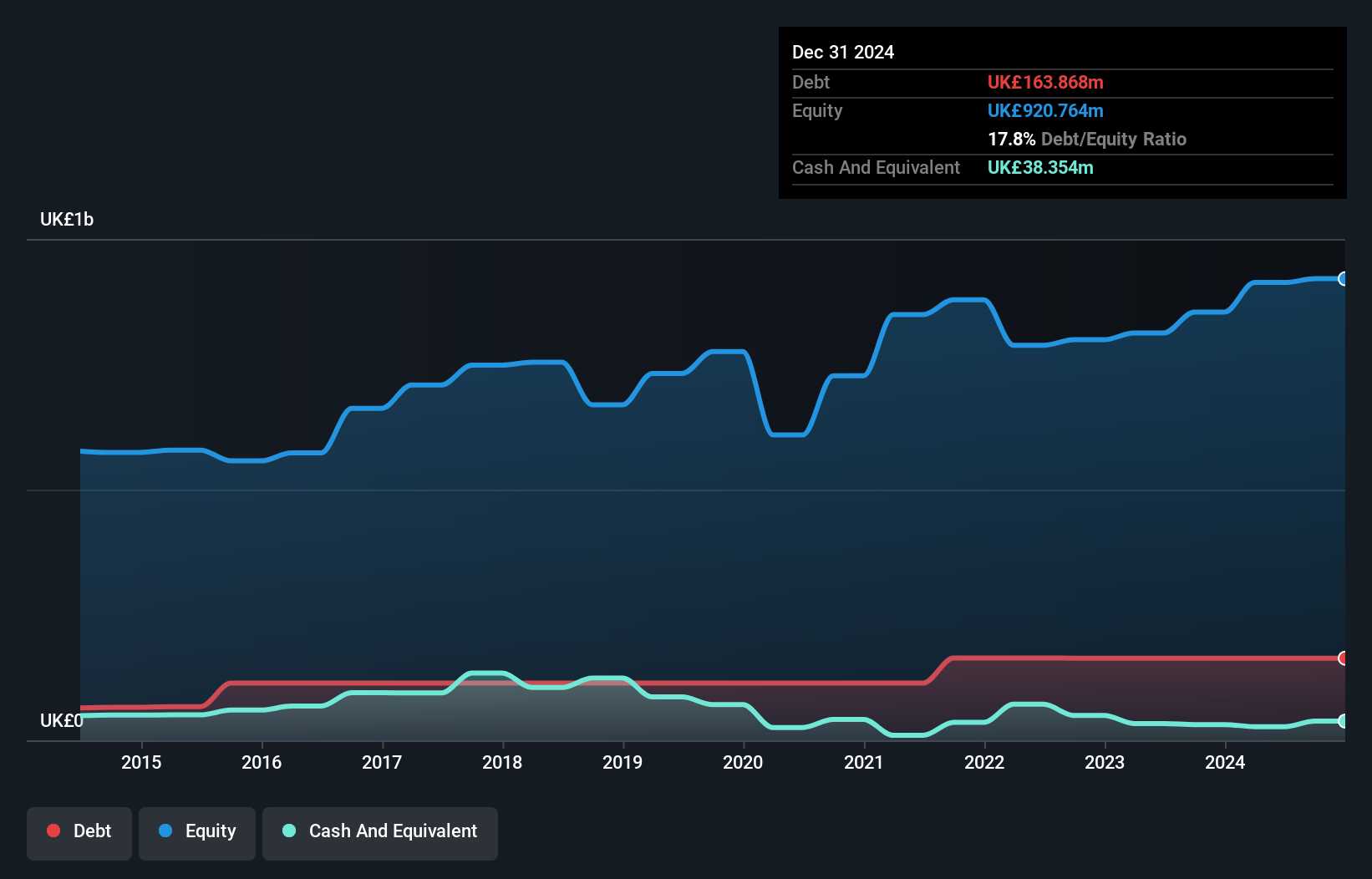

Overview: The Law Debenture Corporation p.l.c. is an investment trust that offers independent professional services globally, with a market capitalization of £1.38 billion.

Operations: Law Debenture generates revenue primarily from its investment portfolio (£38.42 million) and independent professional services (£63.99 million). The company's net profit margin is a key financial metric to consider when evaluating its profitability and operational efficiency.

Law Debenture, a notable player in the UK market, showcases robust financial health with a net debt to equity ratio of 15.2%, deemed satisfactory. Its earnings have surged by 20.9% over the last year, outpacing the industry average of 2.3%. This growth is supported by high-quality earnings and an attractive price-to-earnings ratio of 8.1x, well below the UK market's average of 16.1x. Additionally, interest payments are comfortably covered at 28.6 times EBIT, reflecting solid operational efficiency and financial stability amidst its dividend affirmations strategy for shareholder returns in recent months.

- Unlock comprehensive insights into our analysis of Law Debenture stock in this health report.

Examine Law Debenture's past performance report to understand how it has performed in the past.

Taking Advantage

- Take a closer look at our UK Undiscovered Gems With Strong Fundamentals list of 55 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com