Kenon Holdings (TASE:KEN): Valuation Check After Mixed Q3 Results and Earnings Slowdown

Kenon Holdings (TASE:KEN) just posted mixed third quarter numbers, with revenue climbing but profit and earnings per share stepping down, a combination that tends to make investors reassess how they value the stock.

See our latest analysis for Kenon Holdings.

The latest earnings dip and upcoming board refresh seem to be giving investors pause in the near term, but the share price still shows strong positive momentum, with a year to date share price return above 60 percent and a one year total shareholder return in excess of 100 percent.

If Kenon’s run has you thinking about where capital might work hardest next, it could be worth exploring fast growing stocks with high insider ownership.

With fundamentals still showing a sizable intrinsic discount and momentum running hot, should investors treat Kenon’s recent pullback as a fresh entry point or assume the market is already pricing in its next leg of growth?

Price-to-Earnings of 6.7x: Is it justified?

On a simple earnings lens, Kenon’s last close at ₪197 screens as inexpensive, with the stock trading on a single digit price-to-earnings multiple that sits far below peers.

The price-to-earnings ratio compares what investors pay today for each unit of current earnings, and it is a common yardstick for established, profitable power producers like Kenon. With reported earnings up strongly over the last year and margins currently high, a compressed multiple can signal that the market is skeptical about how durable those profits will be.

Against both its direct peer group and the wider Asian renewable energy space, Kenon’s 6.7x price-to-earnings ratio looks striking. It sits well under the peer average of 37.4x and materially below the Asian renewable energy industry average of 16.6x, which implies that investors are assigning a sizeable discount despite recent earnings momentum and an estimated 38.2 percent gap to SWS DCF fair value of around ₪319.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 6.7x (UNDERVALUED)

However, investors still face risks, including potential earnings normalization from unusually high margins and policy or regulatory changes affecting long term power pricing.

Find out about the key risks to this Kenon Holdings narrative.

Another View: Cash Flows Point the Same Way

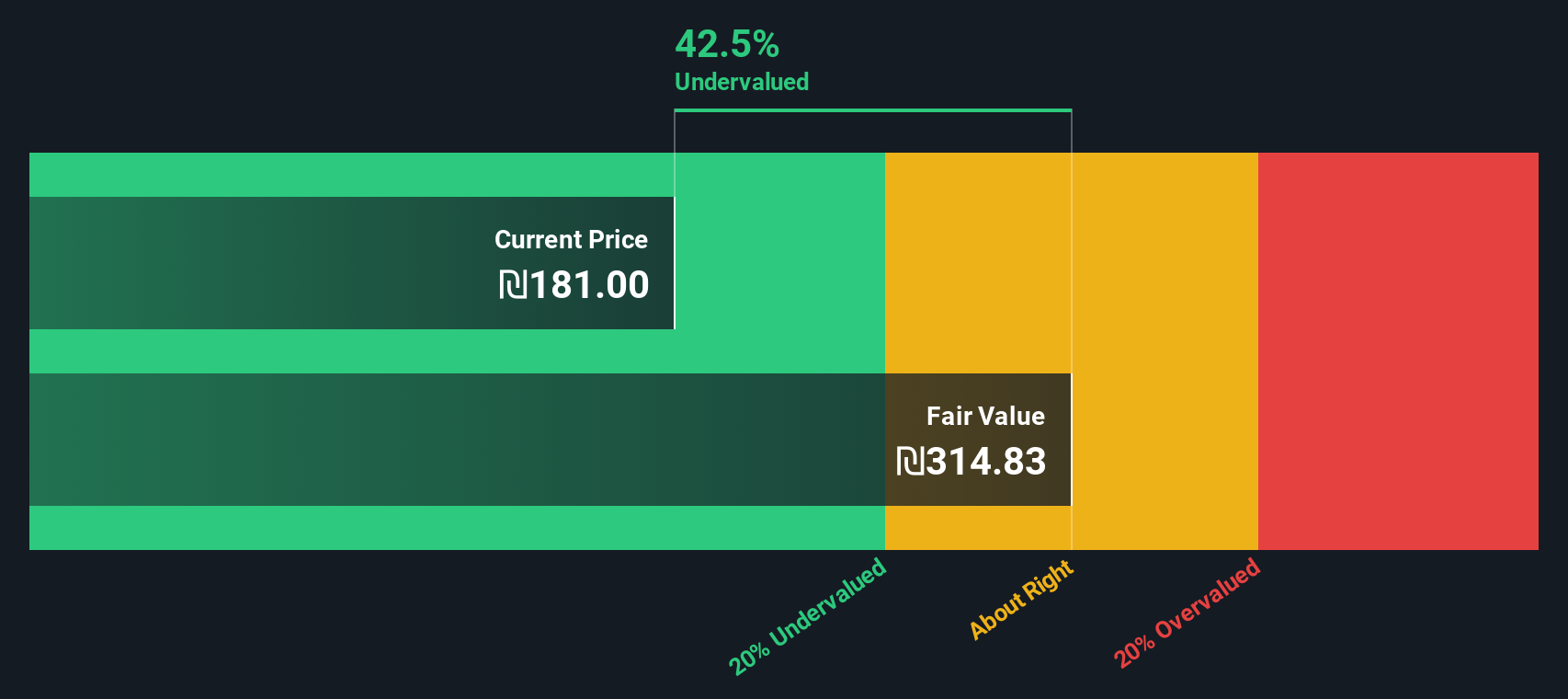

Our DCF model also flags Kenon as undervalued, with the current ₪197 price sitting well below an estimated fair value of about ₪319, a roughly 38 percent gap that suggests the market still discounts how durable today’s cash flows and margins might be.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kenon Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 899 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kenon Holdings Narrative

If you see the story differently or want to stress test these assumptions with your own numbers, you can build a personalized view in just a few minutes by using Do it your way.

A great starting point for your Kenon Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more high conviction opportunities?

Kenon might be compelling, but you risk leaving money on the table if you stop here. Let the Simply Wall Street Screener surface your next edge.

- Target income-focused returns by scanning these 15 dividend stocks with yields > 3% that aim to pay you reliably while you stay invested.

- Ride structural growth trends by checking out these 30 healthcare AI stocks, where innovation meets long term demand in one powerful theme.

- Capitalize on mispriced potential with these 899 undervalued stocks based on cash flows, built to spotlight quality companies trading at attractive cash flow discounts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com