Assessing Alvopetro Energy’s (TSXV:ALV) Valuation After Strong November Sales and Above-Contract Gas Deliveries

Alvopetro Energy (TSXV:ALV) just posted November sales of 2,851 barrels of oil equivalent per day, with natural gas deliveries running above contracted volumes despite planned facility shutdowns. That mix of resilience and efficiency has investors taking notice.

See our latest analysis for Alvopetro Energy.

Even with the latest operational strength, Alvopetro’s share price has cooled off in recent months, with a softer 90 day share price return offset by a still solid year to date gain and a standout 1 year total shareholder return, suggesting longer term momentum remains intact.

If this kind of steady execution appeals to you, it might be worth comparing Alvopetro with other energy names and exploring fast growing stocks with high insider ownership for fresh ideas.

With earnings still growing, a history of strong long term returns, and the shares trading below analyst targets, the real question is whether Alvopetro is quietly undervalued or if the market is already pricing in future growth.

Most Popular Narrative: 22.9% Undervalued

Compared with the last close at CA$6.07, the most popular narrative points to a higher fair value, framing Alvopetro as a discounted growth story.

The Murucututu project offers a material long-term growth catalyst, with significant 2P reserves, multiple follow-up drilling locations, and new completions (183-D4 well) set to come online; this organic reserve and production growth underpins sustainable cash flow and earnings expansion potential for future years.

Curious how ambitious revenue growth, rising margins, and a lower future earnings multiple can still justify a higher valuation? See how these moving parts combine for Alvopetro’s projected upside.

Result: Fair Value of $7.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising capital intensity and heavy reliance on Brazilian assets mean that any project missteps or regulatory changes could quickly undermine the undervaluation case.

Find out about the key risks to this Alvopetro Energy narrative.

Another Angle on Valuation

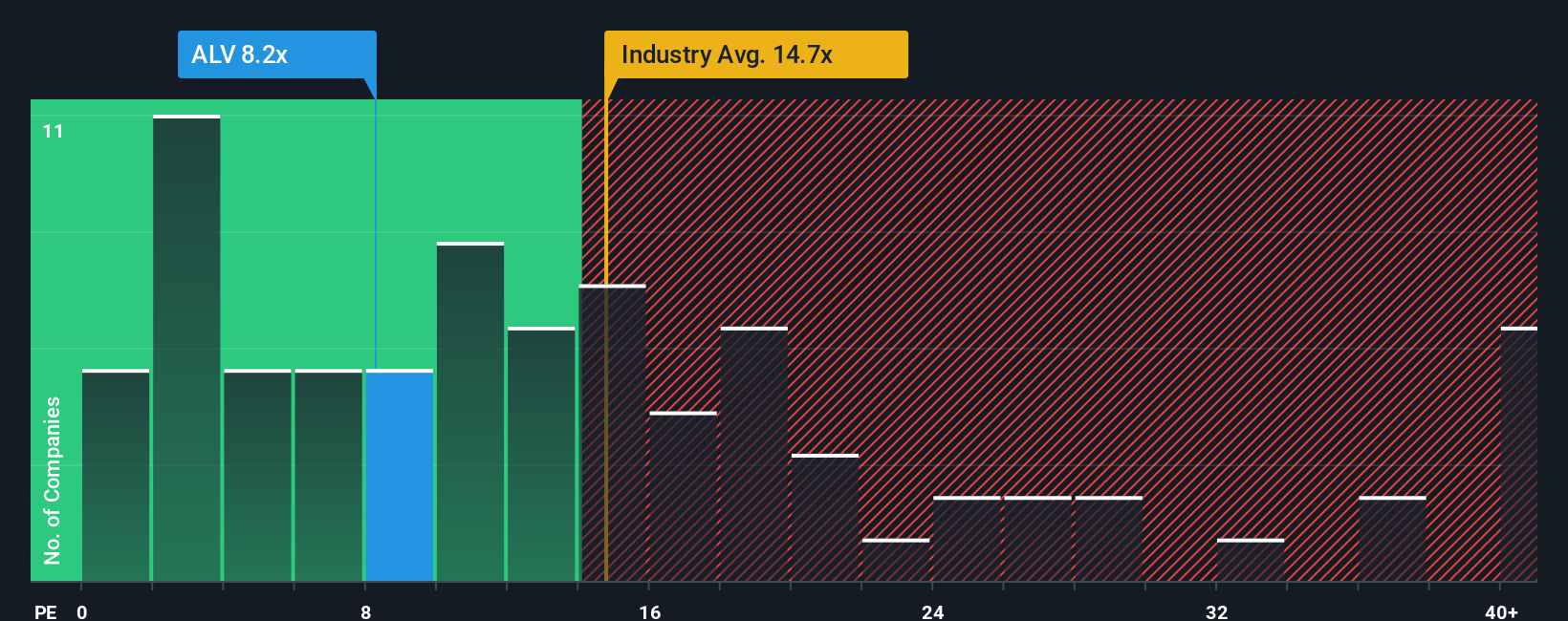

On earnings, the picture is more nuanced. Alvopetro trades on a P/E of about 8.1 times, slightly richer than close peers at 7.4 times but far below the Canadian oil and gas average of 14.9 times and an estimated fair ratio of 13.7 times. This raises the question of whether this is a value opportunity or a value trap in disguise.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Alvopetro Energy Narrative

If you see things differently or want to dig into the numbers yourself, you can craft a personalized view in just minutes. Do it your way.

A great starting point for your Alvopetro Energy research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in an edge by scanning fresh opportunities on Simply Wall Street’s Screener, where curated ideas can sharpen your next investing move.

- Seize potential high-upside movers by scanning these 3588 penny stocks with strong financials that already show stronger fundamentals than typical speculative names.

- Position ahead of the next tech wave with these 27 AI penny stocks riding powerful tailwinds in automation, data, and intelligent software.

- Strengthen your income strategy using these 15 dividend stocks with yields > 3% that aim to balance attractive yields with resilient business models.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com