Has the Recent Surge in DICK'S Stock Already Priced In Its Growth Story?

- Wondering if DICK'S Sporting Goods is still a smart buy after its big run over the last few years, or if the easy money has already been made? This article will help you make sense of where the value really lies.

- The stock now trades around $217.99, and while it is down 0.5% over the last month and 3.9% year to date, it is still up 4.3% over the past year and an impressive 103.2% over three years and 374.7% over five years, hinting at a business that has already created serious long term wealth.

- Recent headlines have focused on DICK'S Sporting Goods expanding its in store experiences and premium brands mix, as well as steadily returning capital to shareholders through buybacks and dividends. At the same time, analysts and investors are debating how sustainable the post pandemic demand trends are for sporting goods and outdoor categories. This is an important backdrop when you think about what the stock should be worth today.

- Right now, DICK'S Sporting Goods scores a 4/6 valuation check score, suggesting it screens as undervalued on most, but not all, of our metrics. Next, we will unpack those different valuation approaches before finishing with a more holistic way to judge whether the current price truly reflects the long term story.

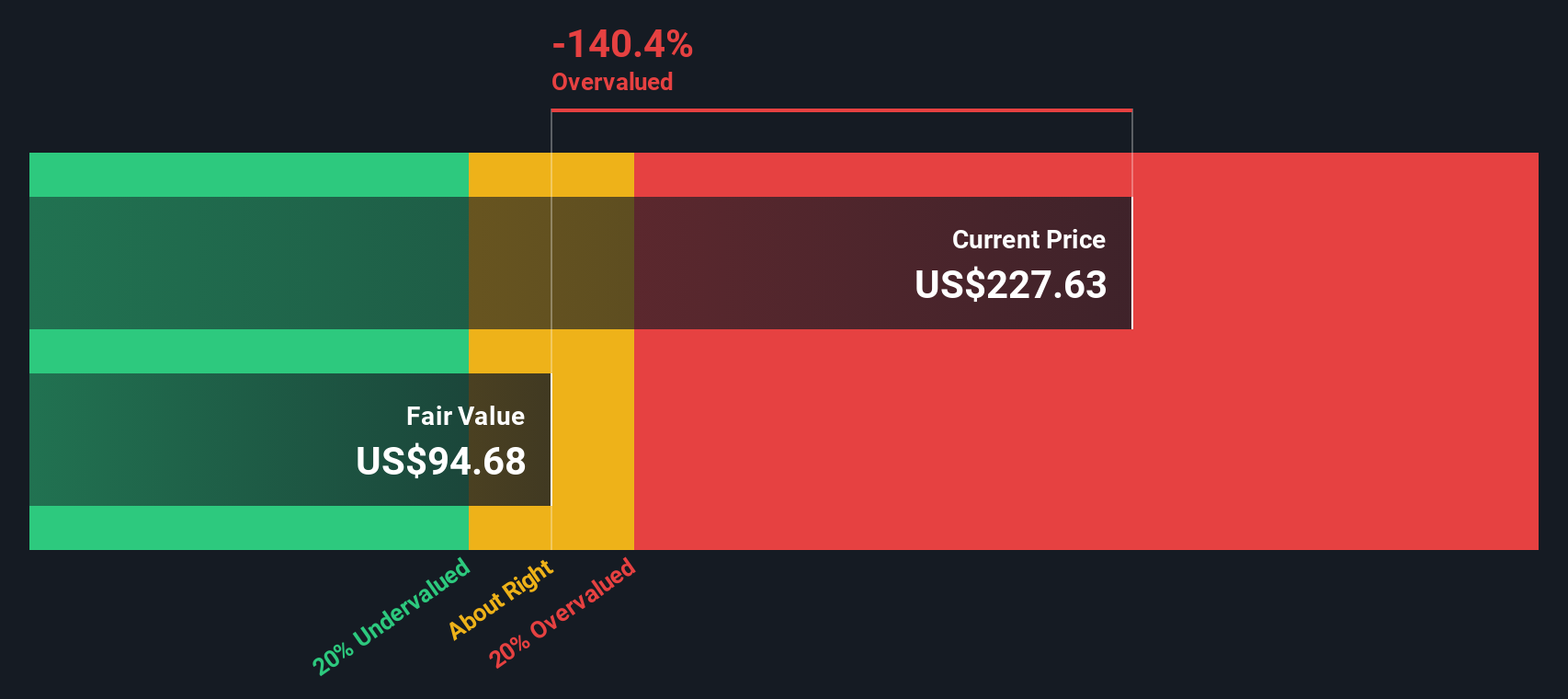

Approach 1: DICK'S Sporting Goods Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a business is worth by projecting the cash it can generate in the future and then discounting those cash flows back to today.

For DICK'S Sporting Goods, the latest twelve month free cash flow is about $293.0 Million. Analysts provide detailed forecasts for the next few years. Beyond that, Simply Wall St extrapolates the trend, leading to an estimated free cash flow of roughly $1.71 Billion by 2030 as the business scales.

Adding up all those projected cash flows and discounting them back to today gives an estimated intrinsic value of about $311.34 per share using a 2 Stage Free Cash Flow to Equity model. Compared with the current share price around $217.99, the model suggests the stock is roughly 30.0% undervalued. This implies investors are not paying full price for the expected future cash generation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests DICK'S Sporting Goods is undervalued by 30.0%. Track this in your watchlist or portfolio, or discover 899 more undervalued stocks based on cash flows.

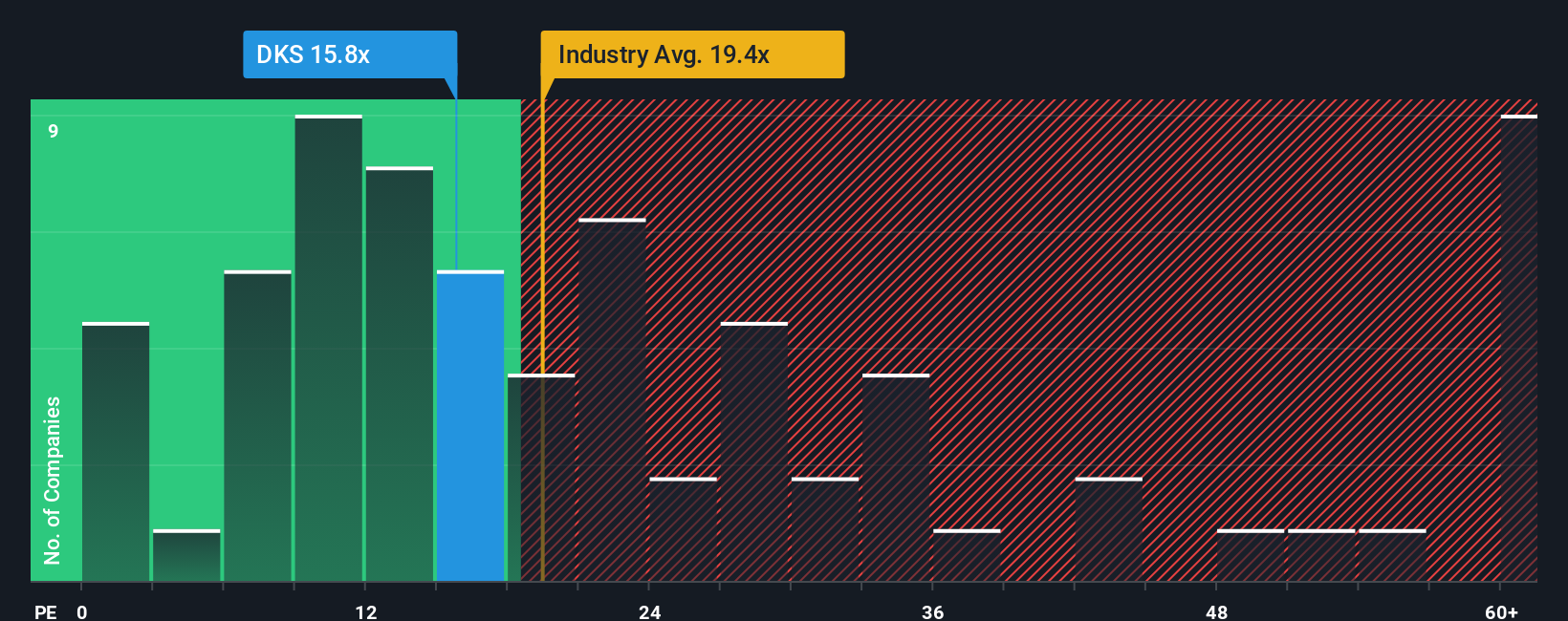

Approach 2: DICK'S Sporting Goods Price vs Earnings

For profitable businesses like DICK'S Sporting Goods, the price to earnings, or PE, ratio is a practical way to judge valuation because it links what investors pay today to the company’s current earnings power. In general, faster growth and lower perceived risk justify a higher PE, while slower growth or higher uncertainty should translate into a lower, more conservative multiple.

DICK'S Sporting Goods currently trades on a PE of about 19.2x. That is broadly in line with the Specialty Retail industry average of roughly 19.4x, but well below the wider peer group average of around 43.6x. This suggests the market is not awarding DKS a premium despite its strong track record. To refine this view, Simply Wall St calculates a proprietary Fair Ratio for each stock. This metric estimates what the PE should be after accounting for factors such as earnings growth, profit margins, risk profile, industry classification and market cap.

For DICK'S Sporting Goods, the Fair Ratio is about 20.9x, modestly above the current 19.2x. That gap implies the shares still trade at a discount to where they arguably deserve to be on fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1450 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your DICK'S Sporting Goods Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, an easy framework on Simply Wall St’s Community page that lets you write the story behind your numbers by tying your assumptions about future revenue, earnings and margins to a forecast and then to a Fair Value. You can then compare that Fair Value to today’s price to decide whether to buy or sell. The Narrative itself automatically updates when new information like earnings or major news hits the market.

For DICK'S Sporting Goods, for example, one optimistic Narrative might lean into long term health and sports participation trends, successful integration of Foot Locker and expanding high margin private label brands to justify a higher Fair Value. A more cautious Narrative might focus on execution risks, heavier exposure to footwear, integration costs and potential margin pressure from slower store traffic to arrive at a lower Fair Value. Seeing these contrasting stories side by side helps you quickly decide which view feels more realistic for your own investment decision.

Do you think there's more to the story for DICK'S Sporting Goods? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com