OR Royalties (TSX:OR) Valuation After Renewed Share Buyback and Strong Recent Share Price Gains

OR Royalties (TSX:OR) just renewed its normal course issuer bid, giving management the green light to buy back and cancel up to 5% of its shares, which can be interpreted as a signal of confidence in the business.

See our latest analysis for OR Royalties.

That buyback renewal comes after a powerful run, with the share price at $48.08 and a year to date share price return of 79.07%. The five year total shareholder return of 240.67% shows longer term momentum has been firmly building rather than fading.

If this kind of shareholder friendly story has your attention, it could be a good time to see what else is out there with fast growing stocks with high insider ownership.

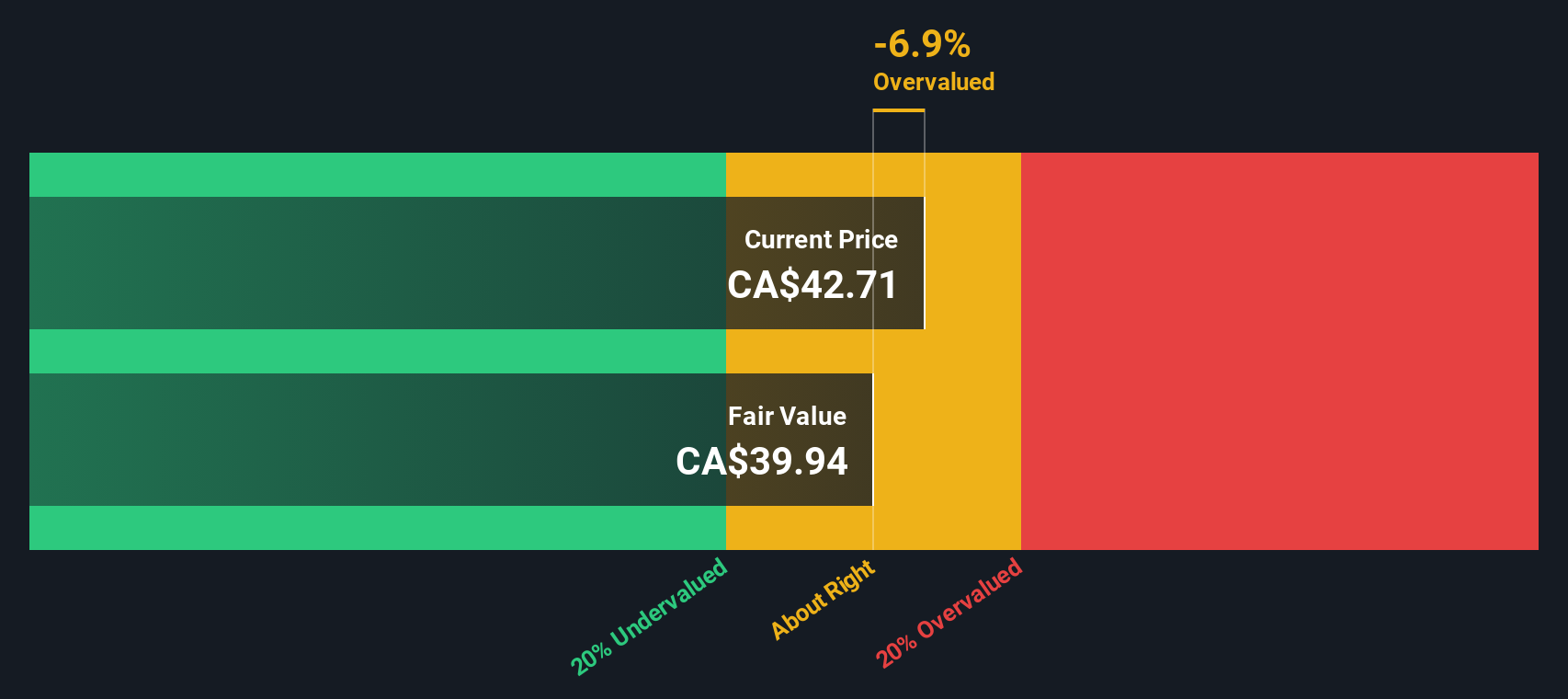

But with the shares already up sharply and trading at a discount to analyst targets yet a premium to some valuation models, is OR Royalties still attractive today or is the market already pricing in years of growth?

Price-to-Earnings of 44.2x: Is it justified?

On a price-to-earnings basis, OR Royalties looks richly valued at CA$48.08, suggesting investors are paying a steep premium versus peers and implied fair levels.

The price-to-earnings multiple compares the current share price to the company’s earnings per share, giving a snapshot of how much investors are willing to pay for each dollar of profit. For a royalty and streaming business like OR Royalties, which converts mine production into relatively high margin cash flows, this ratio is a common way to gauge how excited the market is about its earnings power.

At 44.2 times earnings, the stock trades at roughly double both its estimated fair price-to-earnings ratio of 22 times and the wider Canadian Metals and Mining industry average of 21.1 times. This signals the market is pricing in a much stronger earnings trajectory than either the fair ratio model or peer group suggests. If sentiment cools or growth expectations moderate, that gap gives plenty of room for the multiple to drift back toward those lower levels.

Compared with the peer average price-to-earnings of 22.3 times, OR Royalties’ 44.2 times stands out as aggressively priced. This underscores how much more investors are currently prepared to pay for its profit stream than for similar companies, and how far the valuation could compress if that enthusiasm fades.

Explore the SWS fair ratio for OR Royalties

Result: Price-to-Earnings of 44.2x (OVERVALUED)

However, investors should still weigh risks like commodity price volatility and project setbacks, which could pressure cash flows and challenge today’s optimistic valuation.

Find out about the key risks to this OR Royalties narrative.

Another View, What Does Our DCF Say?

Our DCF model paints a cooler picture, pointing to a fair value of about CA$38.46, meaning OR Royalties looks roughly 25% overvalued at today’s CA$48.08 price. If cash flows fall short of expectations, that premium could leave late buyers exposed.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out OR Royalties for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 899 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own OR Royalties Narrative

If you have a different view, or want to dig into the numbers yourself, you can build a complete narrative in minutes using Do it your way.

A great starting point for your OR Royalties research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before the next rally starts without you, put Simply Wall Street’s powerful screener to work and line up your next high conviction opportunities today.

- Target resilient growth by reviewing these 899 undervalued stocks based on cash flows that pair attractive prices with strong cash flow potential.

- Capture the next wave of innovation through these 27 AI penny stocks positioned at the forefront of intelligent automation and data driven disruption.

- Lock in reliable income streams with these 15 dividend stocks with yields > 3% that offer meaningful yields supported by solid business fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com