Evaluating Pilgrim's Pride (PPC) Valuation After Recent Share Price Pullback

Pilgrim's Pride (PPC) has quietly lagged the broader market this year, with the stock down about 19% year to date, even as its multi year total returns still look surprisingly strong.

See our latest analysis for Pilgrim's Pride.

The latest pullback, including a 13.57% 3 month share price return and a 19.37% year to date share price decline to about $38, contrasts with an 86.60% three year total shareholder return. This suggests momentum has cooled even if the long term story remains intact.

If Pilgrim's Pride has you rethinking where growth and resilience might show up next, it could be worth exploring fast growing stocks with high insider ownership as potential candidates for your watchlist.

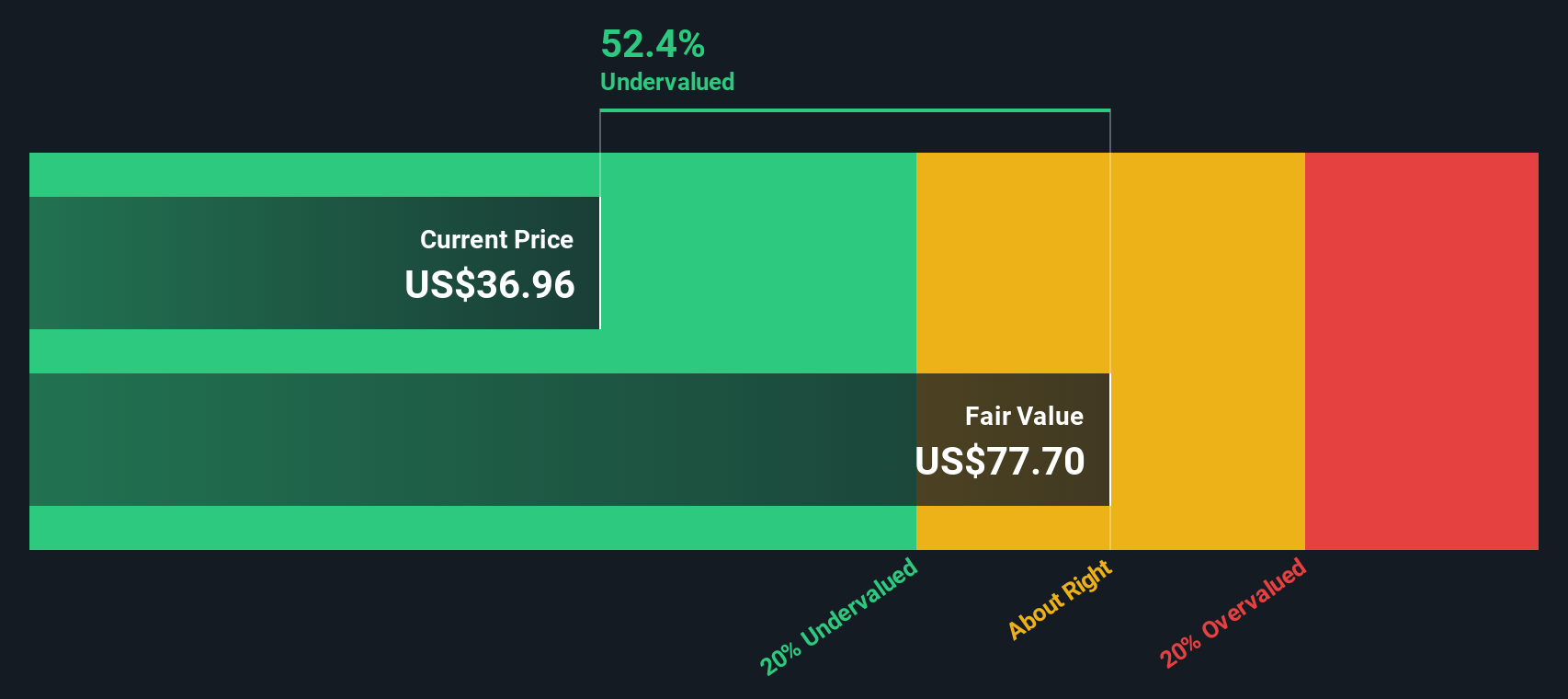

With earnings growth slowing and the share price sitting below analyst targets, investors now face a key question: is Pilgrim's Pride undervalued after this pullback, or is the market already pricing in its future growth?

Most Popular Narrative: 14% Undervalued

With Pilgrim's Pride last closing at $38.08 and the most followed fair value near $44.29, the narrative leans toward meaningful upside from here.

Strategic investments in brands, prepared foods, and global capacity, paired with operational efficiencies and strong financial discipline, position Pilgrim's Pride for resilient, diversified growth. Catalysts About Pilgrim's Pride: Produces, processes, markets, and distributes fresh, frozen, and value-added chicken and pork products to retailers, distributors, and foodservice operators in the United States, Europe, and Mexico.

Curious how modest top line growth, thinner future margins, and a richer earnings multiple can still add up to upside potential? See the full playbook behind that outcome.

Result: Fair Value of $44.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside case could falter if commodity input costs spike again or if regulatory and labor pressures erode profitability faster than analysts expect.

Find out about the key risks to this Pilgrim's Pride narrative.

Another View: Cash Flow Says Something Different

While analyst-based fair value suggests Pilgrim's Pride is about 14% undervalued, our DCF model paints a starkly different picture, with fair value near $0.57 versus a $38.08 share price, implying extreme overvaluation. Are long term cash flow assumptions simply too harsh, or are earnings based views too generous?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Pilgrim's Pride for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 899 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Pilgrim's Pride Narrative

If you see the numbers differently or prefer to dig into the details yourself, you can build a tailored view in minutes: Do it your way.

A great starting point for your Pilgrim's Pride research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before you move on, you can explore hand picked opportunities from our powerful screener, so you are not stuck watching others capitalize.

- Explore potential pricing gaps by targeting companies flagged as undervalued based on future cash flows through these 899 undervalued stocks based on cash flows tailored to value driven investors.

- Focus on structural trends in healthcare by looking at innovators using artificial intelligence in medicine with these 30 healthcare AI stocks and see how they are shaping tomorrow's patient outcomes.

- Explore income opportunities with these 15 dividend stocks with yields > 3% featuring companies that currently offer yields above 3% from established payers.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com