Legend Biotech (NasdaqGS:LEGN): Valuation Check After New CAR-T Clinical Data for CARVYKTI and LUCAR-G39D

Legend Biotech (NasdaqGS:LEGN) is back in the spotlight after releasing new clinical data on its multiple myeloma therapy CARVYKTI and early results for its allogeneic CAR T candidate LUCAR-G39D.

See our latest analysis for Legend Biotech.

Even with the latest CARVYKTI and LUCAR-G39D data strengthening its scientific story, Legend Biotech’s recent momentum has cooled, with the share price down sharply in the short term and the 1 year total shareholder return also firmly negative. This signals that investors are still weighing execution risk against long term growth potential.

If this kind of high risk, high reward biotech story interests you, it can be worth comparing Legend with other healthcare stocks that might offer different growth, risk and valuation trade offs.

With the share price down over 30% in the past year but analysts still seeing upside, the real question is whether Legend Biotech is now trading at a meaningful discount or if markets already reflect its future growth.

Most Popular Narrative Narrative: 68.1% Undervalued

Compared with Legend Biotech’s last close of $23.88, the most widely followed narrative sees fair value far higher, framing the stock as significantly mispriced today.

Significant expansion potential in both earlier lines of therapy and frontline settings for multiple myeloma, driven by strong survival data, ongoing clinical trials (CARTITUDE-5 and -6), and label updates that increase patient access, setting up long-term revenue acceleration as the patient pool widens.

Curious how bold growth assumptions, rising margins and a richer future earnings multiple all combine into that lofty fair value estimate? Unpack the full narrative to see which specific revenue, profitability and valuation projections are doing the heavy lifting behind this upside case.

Result: Fair Value of $74.91 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside rests on CARVYKTI, with any safety setbacks or faster competing therapies potentially eroding its lead and undermining those growth assumptions.

Find out about the key risks to this Legend Biotech narrative.

Another Angle on Valuation

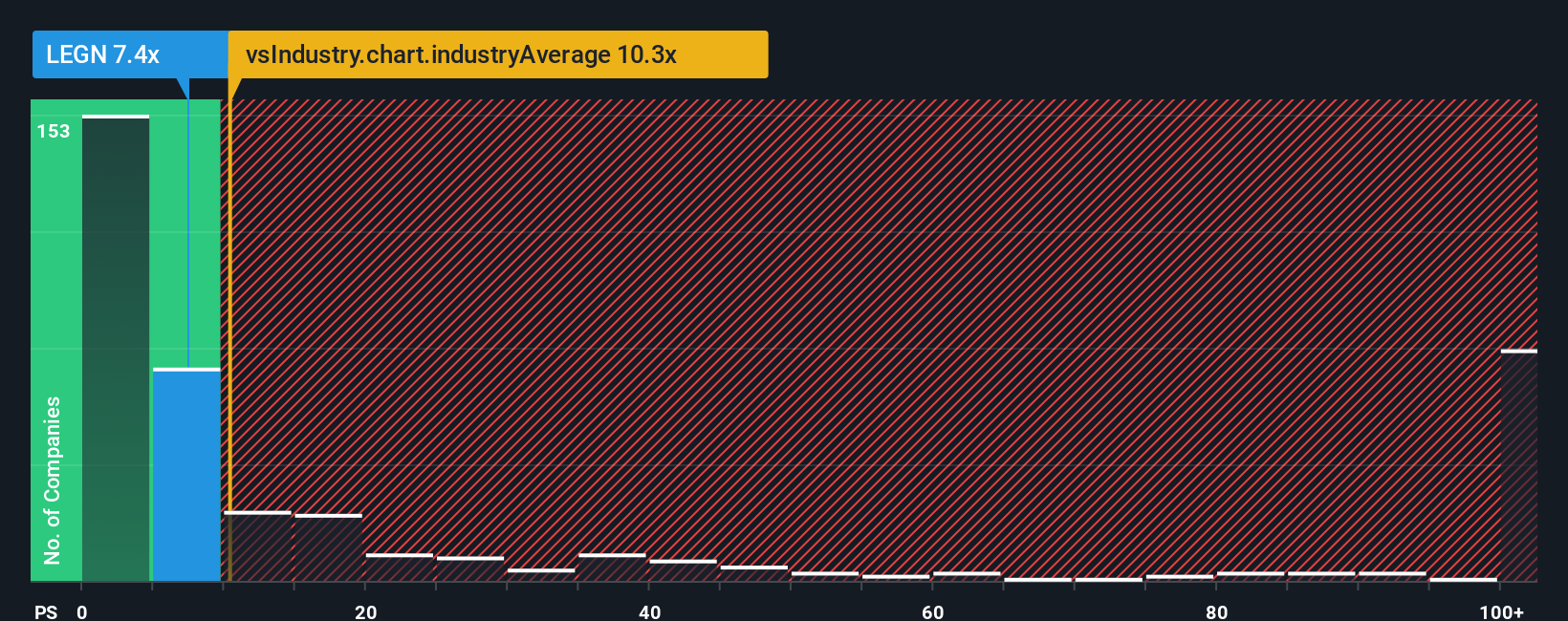

While the narrative and analyst targets argue Legend Biotech is deeply undervalued, its current price to sales ratio of 4.9x sits above a 4.6x fair ratio, hinting at less obvious upside. Yet it still trades far below the US Biotechs average of 12.1x and peer average of 20.1x, complicating the picture. Is this a value trap or a mispriced opportunity?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Legend Biotech Narrative

If you see things differently or want to dig into the numbers yourself, you can craft a personalized view in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Legend Biotech.

Ready for more high conviction ideas?

Before prices move without you, put Simply Wall Street’s Screener to work and line up your next set of high potential, research ready opportunities today.

- Capture powerful trend shifts early by tracking these 27 AI penny stocks, which are turning artificial intelligence into real revenue growth and long runway opportunities.

- Strengthen your portfolio’s income engine with these 15 dividend stocks with yields > 3% that can potentially support long term cash flows and help smooth market volatility.

- Lean into valuation upside by assessing these 899 undervalued stocks based on cash flows, where cash flow potential and current prices may be misaligned in your favor.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com