MasTec (MTZ) Stock Surge: Is the Infrastructure Specialist Still Undervalued?

MasTec (MTZ) has quietly turned into one of the stronger infrastructure names this year, with the stock up roughly 57% year to date and about 60% over the past year.

See our latest analysis for MasTec.

That steady drumbeat of contract wins in clean energy and power delivery has helped MasTec’s share price grind higher, with a strong year to date share price return and hefty multi year total shareholder returns suggesting that momentum is still building rather than cooling.

If MasTec’s surge has you rethinking your watchlist, this is a good moment to explore fast growing stocks with high insider ownership for other fast moving names with skin in the game.

Yet with MasTec trading near all time highs but still sitting at a modest discount to analyst and intrinsic value estimates, investors now face a key question: is this a fresh buying opportunity, or is future growth already priced in?

Most Popular Narrative: 10.7% Undervalued

With MasTec’s fair value pegged well above the recent closing price of $220.38, the most followed narrative sees more upside still on the table.

Recent policy developments (including extended tax credits for renewables and regulatory clarity from new federal legislation) have strengthened MasTec's bookings pipeline and provide long-duration tailwinds. This reduces policy risk and supports visibility on new project awards, which improves future revenue predictability and supports higher valuation.

Want to see what is really powering that higher fair value? The narrative leans on accelerating revenues, fatter margins, and a future earnings multiple that might surprise you. Curious how those ingredients combine into one target number? Dive in to unpack the full playbook behind this valuation.

Result: Fair Value of $246.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, elevated growth investments and heavy reliance on a handful of major projects mean that delays, cancellations, or execution missteps could quickly challenge that bullish valuation case.

Find out about the key risks to this MasTec narrative.

Another Lens on Valuation

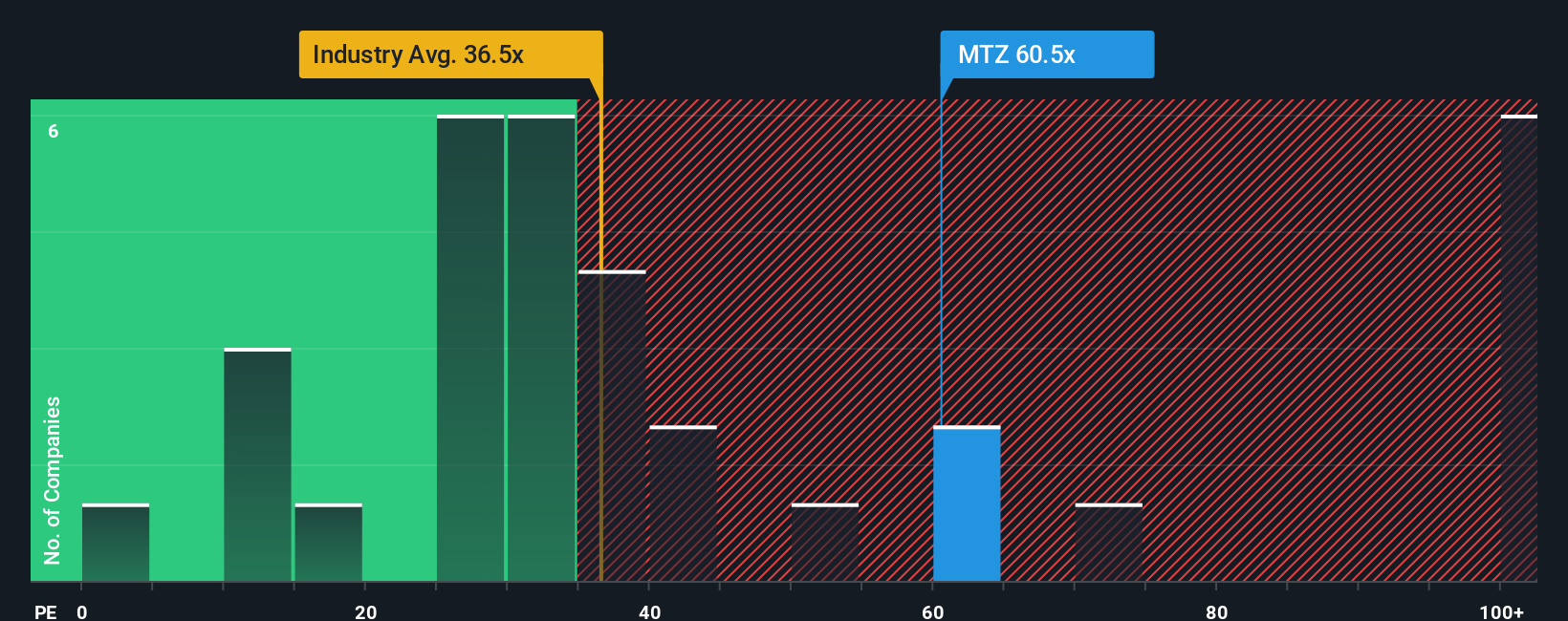

Step away from fair value models and MasTec suddenly looks pricey. At 51.7 times earnings, the stock trades above both the US Construction average of 34 times and a fair ratio of 39.7 times. This signals less margin of safety if growth expectations stumble.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MasTec Narrative

If you would rather follow your own data trail than rely on this view, you can build a personalized MasTec thesis in minutes: Do it your way.

A great starting point for your MasTec research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not leave your next big opportunity to chance, use the Simply Wall St Screener to uncover targeted ideas that match your strategy before the crowd notices.

- Capture upside potential in unloved names by scanning these 899 undervalued stocks based on cash flows that the market may be mispricing based on their future cash flows.

- Ride powerful thematic tailwinds by zeroing in on these 27 AI penny stocks positioned at the heart of the artificial intelligence build out.

- Strengthen your income stream by reviewing these 15 dividend stocks with yields > 3% offering attractive yields backed by solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com