Does Delta’s Recent 108% Three Year Rally Still Leave Room for Upside in 2025?

- If you are wondering whether Delta Air Lines at around $67 a share still looks attractive, or if most of the easy gains are already behind it, this breakdown will help you think through whether the current price makes sense.

- Delta's stock has climbed 3.5% over the last week, 14.5% over the last month, and 107.6% over three years. This suggests investors may be warming up to its recovery story or repricing the risk in airline stocks.

- Recent headlines have focused on sustained demand for both leisure and business travel and ongoing capacity expansion across major U.S. airlines. This supports a stronger revenue outlook for carriers like Delta. At the same time, investors are weighing higher fuel costs, labor agreements, and operational constraints, all of which can put a ceiling on margins even when planes are full.

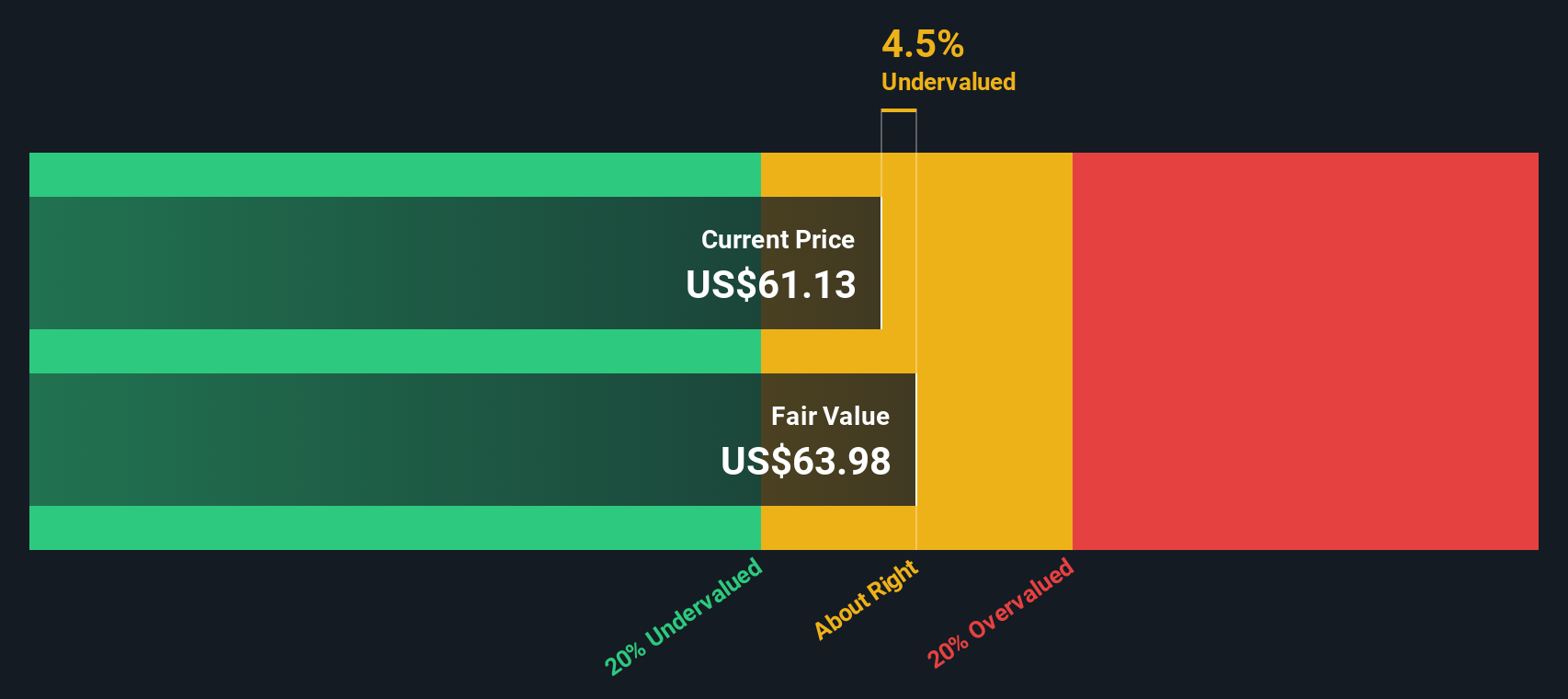

- On our checks, Delta scores a 4/6 valuation rating, which you can explore in more detail here. Next we will walk through what different valuation approaches are indicating about the stock, while keeping an eye out for a deeper and more insightful way to consider its worth by the end of the article.

Find out why Delta Air Lines's 8.7% return over the last year is lagging behind its peers.

Approach 1: Delta Air Lines Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting the cash it can generate in the future and discounting those cash flows back to today in dollar terms.

Delta Air Lines currently generates about $2.3 billion in free cash flow, and some analysts expect this to change over time as travel demand and efficiency evolve. Projections used in this 2 Stage Free Cash Flow to Equity model see free cash flow at roughly $5.5 billion by 2029, with further changes extrapolated for the following years based on more moderate assumptions once analyst estimates run out.

When all those projected cash flows are discounted back to today, the model arrives at an estimated intrinsic value of about $140.09 per share. Versus a current share price around $67, this particular DCF output implies the stock is roughly 51.9% below that modeled value, indicating that this framework views the market as still pricing Delta cautiously relative to its long-term cash generation potential.

Result: UNDERVALUED (per this DCF model)

Our Discounted Cash Flow (DCF) analysis suggests Delta Air Lines is undervalued by 51.9%. Track this in your watchlist or portfolio, or discover 899 more undervalued stocks based on cash flows.

Approach 2: Delta Air Lines Price vs Earnings

For profitable companies like Delta, the price to earnings ratio is a useful way to gauge how much investors are willing to pay today for each dollar of current profits. A higher PE generally reflects stronger growth expectations or lower perceived risk, while a lower PE suggests more modest growth or higher uncertainty, so what counts as a normal or fair PE depends on both the outlook and the risks around it.

Delta currently trades on a PE of about 9.4x, which is roughly in line with the broader Airlines industry average of around 9.2x but well below a wider peer group average of about 29.3x. Simply Wall St also calculates a Fair Ratio of 14.2x for Delta, a proprietary estimate of the PE investors might reasonably expect given its earnings growth profile, industry, profit margins, market cap, and company specific risks. This Fair Ratio is more tailored than a simple comparison to peers or the industry, because it adjusts for the fundamentals that actually drive sustainable earnings power rather than treating all airlines or transport stocks as identical. With the Fair Ratio above the current 9.4x multiple, this framework suggests Delta shares still trade at a discount to what its fundamentals would justify.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1450 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Delta Air Lines Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives, a simple way to connect your view of a company with the numbers behind it.

A Narrative is your story about Delta, where you spell out what you believe about its future revenue, earnings and margins, and then connect that story to a financial forecast and a fair value estimate.

On Simply Wall St's Community page, Narratives are an easy, accessible tool used by many investors to turn these stories into clear forecasts and fair values that you can compare directly with the current share price to decide whether Delta looks like a buy, hold or sell for you.

Narratives also stay live and relevant, because when new information like earnings results, news or guidance hits the market, the assumptions and fair values can be updated so your decision making reflects the latest data rather than a stale model.

For example, one Delta Narrative on the platform might lean cautious and arrive at a fair value near 49 dollars a share, while another, more optimistic Narrative might support a fair value above 71 dollars. Seeing that spread helps you quickly understand how different assumptions can justify very different views on whether the current price offers enough upside.

For Delta Air Lines however we will make it really easy for you with previews of two leading Delta Air Lines Narratives:

Fair value: $71.60 per share

Implied discount to fair value: 5.8% below this narrative's estimate

Revenue growth assumption: 3.37% per year

- Expects industry discipline on capacity and Delta's focus on margins and free cash flow to support steady earnings despite only modest top line growth.

- Sees premium cabins, loyalty programs, international routes and the UPS MRO agreement as durable revenue drivers that differentiate Delta and support pricing power.

- Assumes a re rating in the valuation multiple toward a mid teens PE by 2028, provided that Delta delivers on revenue, margin and balance sheet expectations despite macro and competitive risks.

Fair value: $59.84 per share

Implied downside to fair value: 11.3% over this narrative's estimate

Revenue growth assumption: 3.5% per year

- Recognises Delta as the operational leader among US legacy carriers but argues that thinner growth and lower justified PE multiples cap upside from current levels.

- Flags a stretched balance sheet, sensitivity to shocks and tariff related macro risks as key vulnerabilities that could quickly erode already slim airline margins.

- Views the stock as still attractive relative to peers but believes a fair entry point sits meaningfully below the present price, closer to the high 50 dollar range.

Do you think there's more to the story for Delta Air Lines? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com