Nankai Electric Railway (TSE:9044): Evaluating Valuation After the Expanded Share Buyback Program

Nankai Electric Railway (TSE:9044) just stepped up its ongoing share repurchase, buying 136,600 shares as part of a broader 6 million share plan. This move may be interpreted as a clear signal about management’s confidence in the business.

See our latest analysis for Nankai Electric Railway.

The buyback comes after a strong run, with Nankai Electric Railway’s year to date share price return of roughly 15% and a one year total shareholder return of about 17%, suggesting momentum is still broadly constructive despite recent softness.

If this kind of steady, fundamentals backed story appeals to you, it might be worth exploring fast growing stocks with high insider ownership for more ideas with serious upside potential.

With a roughly 20% gap to analyst targets but only modest profit growth, investors now face a key question: is Nankai Electric Railway undervalued after the buyback news, or is the market already pricing in its future expansion?

Price-to-Earnings of 12.9x: Is it justified?

At the last close of ¥2831.5, Nankai Electric Railway trades on a 12.9x price to earnings multiple, suggesting only a slight premium to some benchmarks but a clear premium to others.

The price to earnings ratio compares what investors pay today with the company’s current earnings, making it a core yardstick for mature, profit generating transport operators like Nankai Electric Railway.

Relative to the broader Japanese market, Nankai Electric Railway looks modestly priced, with its 12.9x multiple sitting below the 14.1x market average. This implies investors are not paying an aggressive headline premium for its earnings despite its long operating history and diversified business lines. The estimated fair price to earnings ratio of 12.7x points to the market paying just above what our regression based fair ratio model might move toward over time.

However, when stacked against the domestic transportation industry at 11.8x, the stock clearly trades rich to sector peers. This indicates investors are still willing to ascribe a higher multiple to its earnings than the typical Japanese transport operator even though its earnings growth is expected to be relatively muted.

Explore the SWS fair ratio for Nankai Electric Railway

Result: Price-to-Earnings of 12.9x (ABOUT RIGHT)

However, lingering concerns around slower net income growth and a premium to transport peers mean sentiment could reverse quickly if earnings disappoint.

Find out about the key risks to this Nankai Electric Railway narrative.

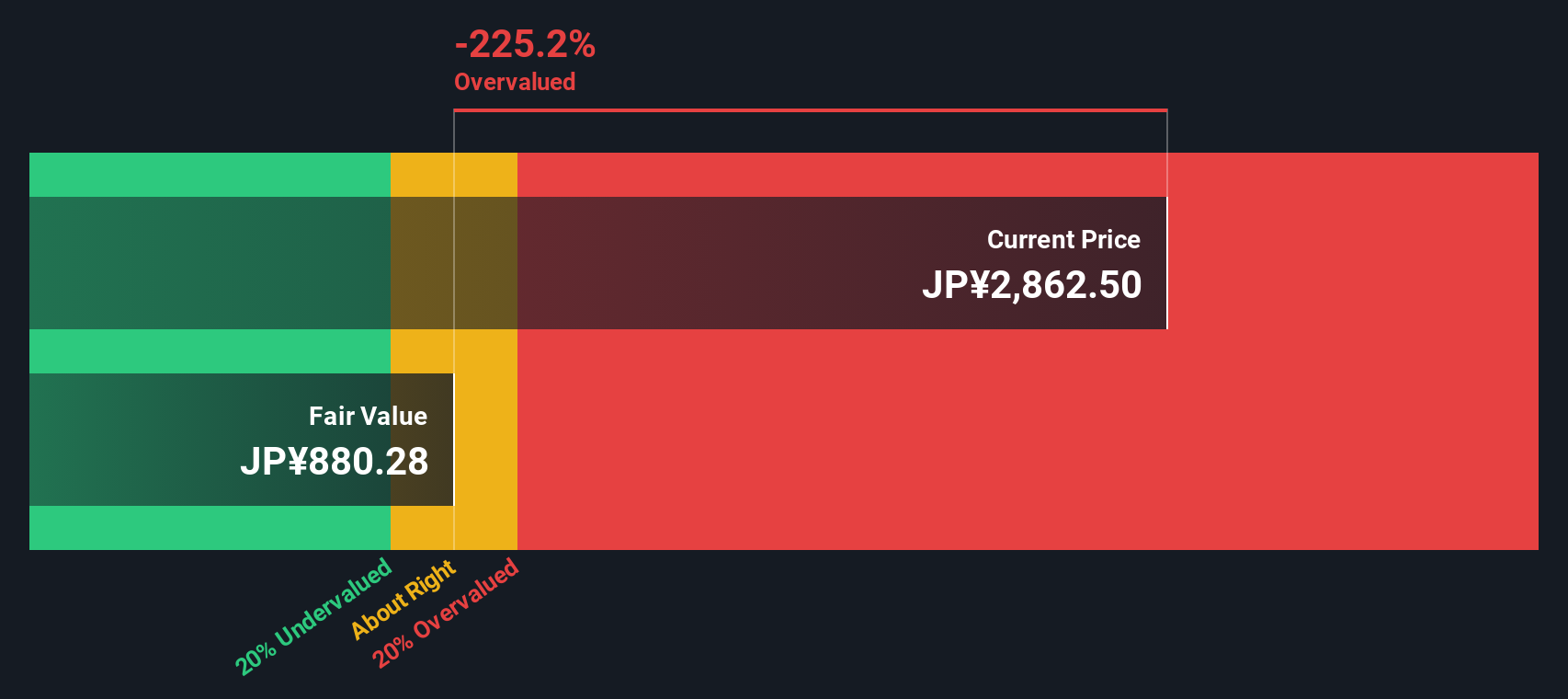

Another View: DCF Flags a Very Different Story

Our DCF model paints a far less forgiving picture, putting fair value near ¥919 versus the current ¥2831.5 share price. That implies Nankai Electric Railway could be trading at more than three times its estimated worth. Are buybacks amplifying downside risk instead of upside?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nankai Electric Railway for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 899 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nankai Electric Railway Narrative

If you see the story differently or simply prefer to dive into the numbers yourself, you can craft a personalized view in just minutes: Do it your way.

A great starting point for your Nankai Electric Railway research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Ready for your next move in the market? Use the Simply Wall St Screener to uncover fresh, data driven opportunities before other investors catch on.

- Target reliable income by reviewing these 15 dividend stocks with yields > 3% that can potentially strengthen your portfolio’s cash flow while others overlook steady payers.

- Capture the next wave of innovation by studying these 27 AI penny stocks positioned to benefit from the rapid adoption of artificial intelligence across industries.

- Strengthen your long term return potential by focusing on these 899 undervalued stocks based on cash flows that may still trade below their intrinsic worth based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com