Bank of Hawaii (BOH): Revisiting Valuation After a Year of Slightly Negative Shareholder Returns

Bank of Hawaii (BOH) has been quietly grinding through a mixed stretch, with the stock roughly flat over the past 3 months but down about 6% over the past year.

See our latest analysis for Bank of Hawaii.

Those moves fit with a stock that is still digesting past volatility, with a slightly negative 1 year total shareholder return and a modestly positive 1 month share price return that may hint selling pressure is easing.

If BOH has you rethinking your bank exposure, it could be worth scanning fast growing stocks with high insider ownership to spot other names where conviction from insiders and growth potential are both on display.

With earnings still growing and the share price lagging its estimated intrinsic value, is Bank of Hawaii quietly setting up as an undervalued regional bank, or is the market already baking in all the growth that lies ahead?

Most Popular Narrative Narrative: 6.9% Undervalued

With Bank of Hawaii closing at $67.65 against a narrative fair value near the low $70s, the story leans toward mild upside rather than deep discount.

Analysts have raised their price target for Bank of Hawaii to $75 from $68, citing a favorable deposit environment and expectations that net interest margins may outperform because of asset repricing tailwinds in Hawaii.

Curious how steady loan demand, richer margins, and disciplined discounting combine into this valuation call? The narrative hides a surprisingly ambitious profit and revenue glide path. Want to see exactly how those moving parts stack up to justify today’s fair value target and the assumed future earnings multiple?

Result: Fair Value of $72.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside view still hinges on Hawaii's property market and deposits holding steady. Any slowdown or higher funding costs could quickly pressure earnings.

Find out about the key risks to this Bank of Hawaii narrative.

Another Lens On Value

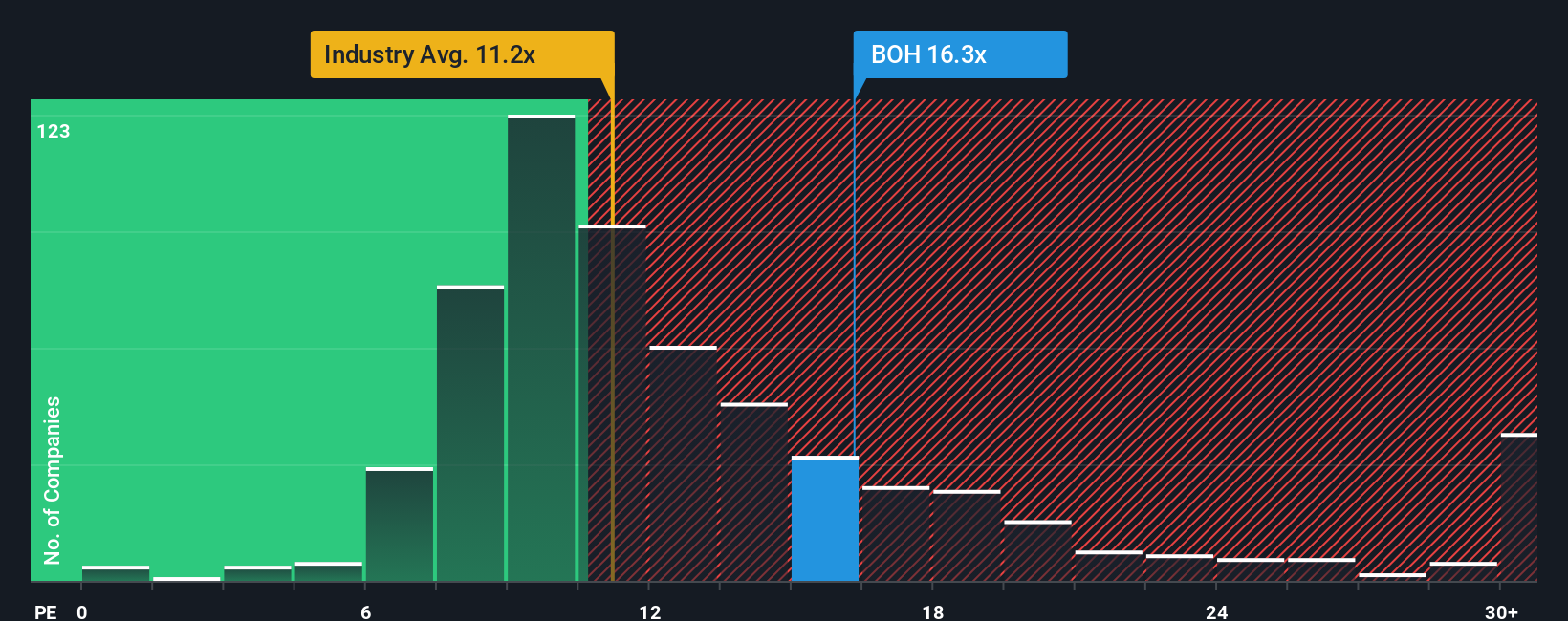

On earnings multiples, Bank of Hawaii looks anything but cheap. The shares trade around 16.5 times earnings, versus 12.8 times for peers and 11.7 times for the broader US banks, and above a fair ratio of 13.6. That premium narrows the margin of safety if growth disappoints.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Bank of Hawaii Narrative

If this perspective does not quite match your own view or you prefer hands on research, you can build a custom narrative yourself in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Bank of Hawaii.

Looking for more investment ideas?

Before you move on, lock in your next potential opportunity by using the Simply Wall St Screener to uncover fresh, data backed ideas beyond Bank of Hawaii.

- Capture potential mispricings by targeting companies that look attractive on a cash flow basis through these 899 undervalued stocks based on cash flows and position yourself before the market catches up.

- Ride structural growth trends in automation and machine learning by examining these 27 AI penny stocks and focus on businesses turning AI innovation into real revenue momentum.

- Strengthen your income stream by reviewing these 15 dividend stocks with yields > 3% and concentrate on companies offering yields above 3 percent with fundamentals to support those payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com