Piper Sandler (PIPR): Evaluating a Rich Valuation After Two Years of Strong Revenue and EPS Growth

Piper Sandler Companies (PIPR) is back on investors radar after two years of standout execution, with revenue climbing roughly 17% annually while earnings per share have been growing at about double that pace.

See our latest analysis for Piper Sandler Companies.

That strength is increasingly being reflected in the market, with the share price at $357.45 and a year to date share price return of 19.42% complementing a powerful five year total shareholder return of 295.57%. This suggests momentum is still firmly building rather than fading.

If Piper Sandler’s run has you thinking about where else strong execution might be hiding, now is a good moment to explore fast growing stocks with high insider ownership for more potential standouts.

With the shares sitting just below analyst targets after a powerful multi year run, the real question now is whether Piper Sandler is still trading below its true worth or if markets already reflect all that future growth.

Price-to-Earnings of 26.7x: Is it justified?

The current share price of $357.45 implies a rich valuation, with Piper Sandler trading on a 26.7x price-to-earnings multiple that sits well above peers.

The price-to-earnings ratio compares what investors are paying for each dollar of current earnings. It is a key yardstick for capital markets firms where profitability can be cyclical and highly sensitive to deal activity.

In Piper Sandler’s case, the market appears to be paying up for the company’s sharp recent earnings acceleration and solid execution, potentially baking in expectations that the current profitability step change can be sustained rather than mean revert.

However, that 26.7x multiple is markedly higher than both the peer group average of 8.1x and the broader US Capital Markets industry at 25x. This signals that investors are assigning a premium that goes beyond the sector’s already elevated pricing.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-earnings of 26.7x (OVERVALUED)

However, any setback in capital markets activity or a sharp slowdown in revenue growth could quickly challenge the premium multiple that Piper Sandler now commands.

Find out about the key risks to this Piper Sandler Companies narrative.

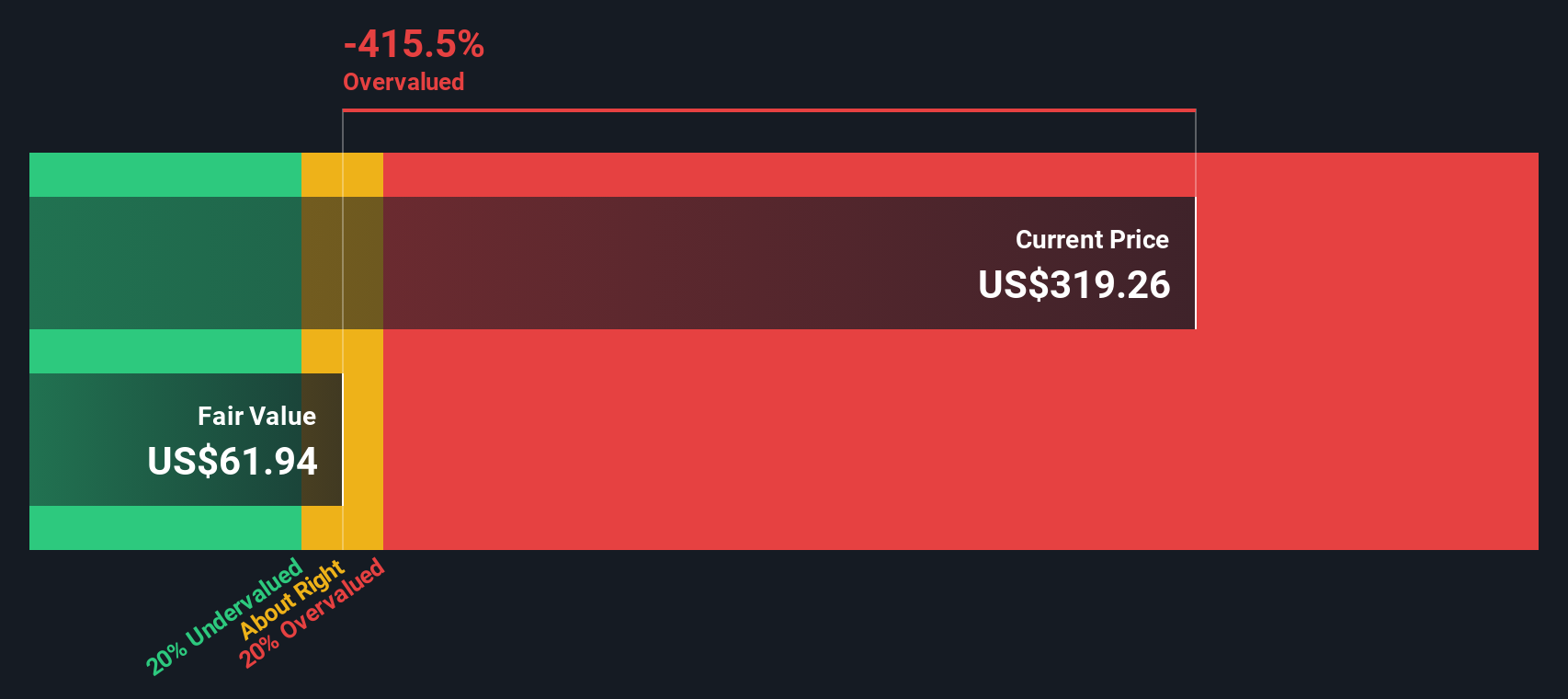

Another View: DCF Signals Even Less Value

While the 26.7x earnings multiple already looks stretched, our DCF model is even more cautious and suggests fair value closer to $60.85. That implies Piper Sandler could be trading at a hefty premium and raises the question of how long sentiment can stay this strong.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Piper Sandler Companies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 899 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Piper Sandler Companies Narrative

If you see things differently or want to dig into the numbers yourself, you can quickly craft a custom viewpoint in just a few minutes: Do it your way.

A great starting point for your Piper Sandler Companies research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider your next move with fresh, data backed ideas from the Simply Wall St screener so real opportunities do not slip past you.

- Capture potential mispricings by scanning these 899 undervalued stocks based on cash flows that appear inexpensive relative to their cash flow prospects and long term growth runway.

- Explore companies in innovation focused areas by targeting these 27 AI penny stocks involved in machine learning, automation, and intelligent software adoption.

- Refine your income strategy by focusing on these 15 dividend stocks with yields > 3% that combine dividend payouts with the potential for capital appreciation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com