Uncovering Three Promising Small Caps In The Middle East Market

As most Gulf markets experience gains ahead of a crucial Federal Reserve meeting, investor sentiment in the Middle East is buoyed by expectations of a potential U.S. interest rate cut and solid economic fundamentals, particularly in the non-oil sector. In this environment, identifying promising small-cap stocks requires a keen focus on companies with robust growth prospects and resilience to broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mendelson Infrastructures & Industries | 17.65% | 4.48% | 4.46% | ★★★★★★ |

| Qassim Cement | NA | 4.02% | -11.40% | ★★★★★★ |

| Y.D. More Investments | 51.67% | 27.49% | 36.12% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.26% | 17.17% | 23.30% | ★★★★★★ |

| Najran Cement | 14.49% | -4.20% | -30.16% | ★★★★★★ |

| Etihad GO Telecom | 0.85% | 38.36% | 57.78% | ★★★★★☆ |

| Birikim Varlik Yonetim Anonim Sirketi | 59.38% | 42.42% | 36.01% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

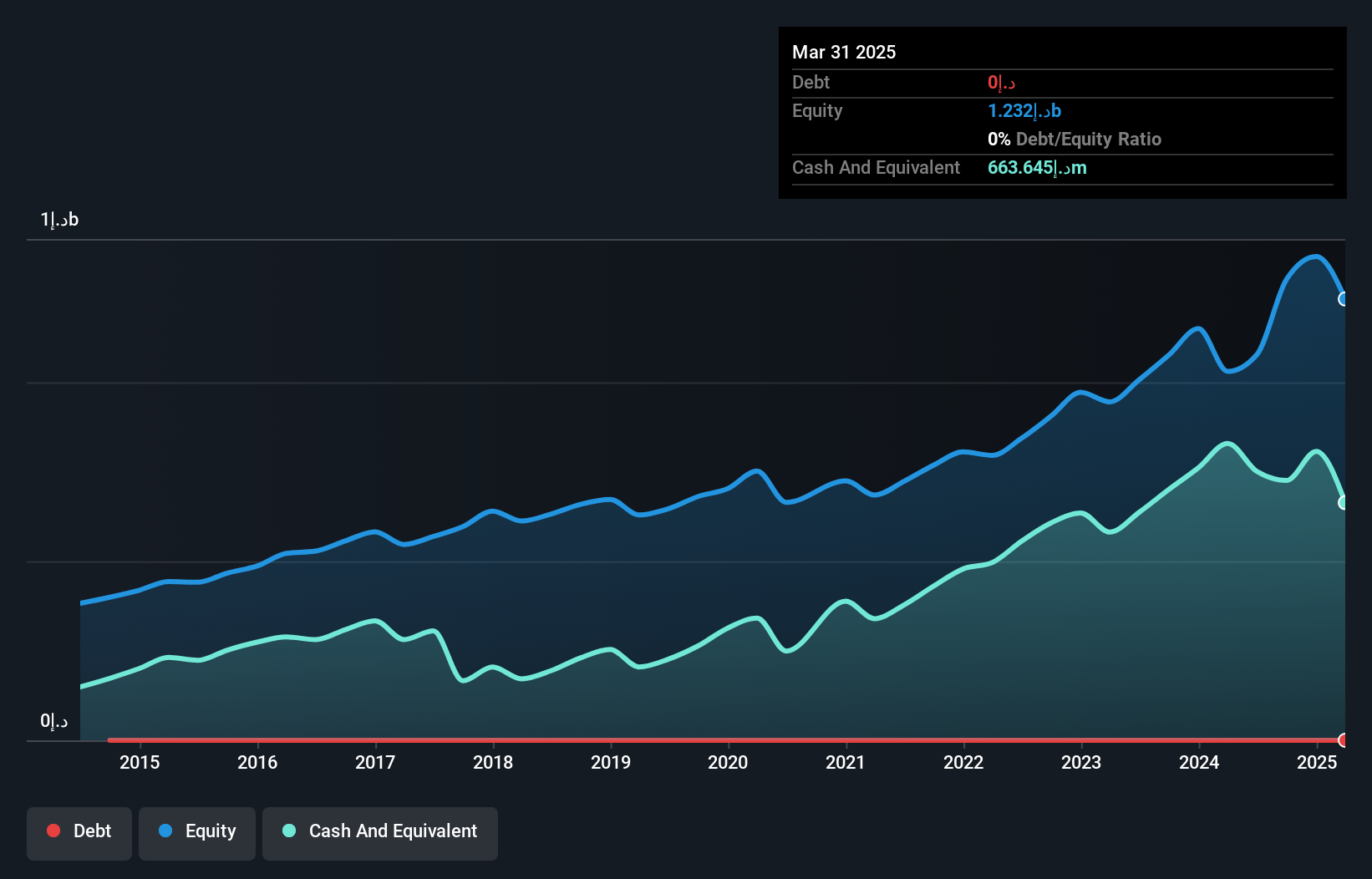

Emirates Driving Company P.J.S.C (ADX:DRIVE)

Simply Wall St Value Rating: ★★★★★★

Overview: Emirates Driving Company P.J.S.C., along with its subsidiaries, specializes in managing and developing motor vehicle driving training in the United Arab Emirates and has a market capitalization of AED3.34 billion.

Operations: Emirates Driving generates revenue primarily from its car and related services segment, amounting to AED738.10 million. The company's financial performance is highlighted by a net profit margin that reflects its operational efficiency in the driving training sector.

Emirates Driving Company P.J.S.C. showcases a compelling profile with impressive financial growth and strategic positioning. Over the past year, earnings surged by 20.5%, outpacing the Consumer Services industry at 13.7%. The company trades at a notable 34.7% below its estimated fair value, highlighting potential for investors seeking undervalued opportunities in this region. Recent results reveal significant gains, with Q3 sales reaching AED 209 million from AED 162 million last year and net income climbing to AED 109 million from AED 85 million previously. This debt-free entity has consistently delivered high-quality earnings, reinforcing its robust market stance amidst peers.

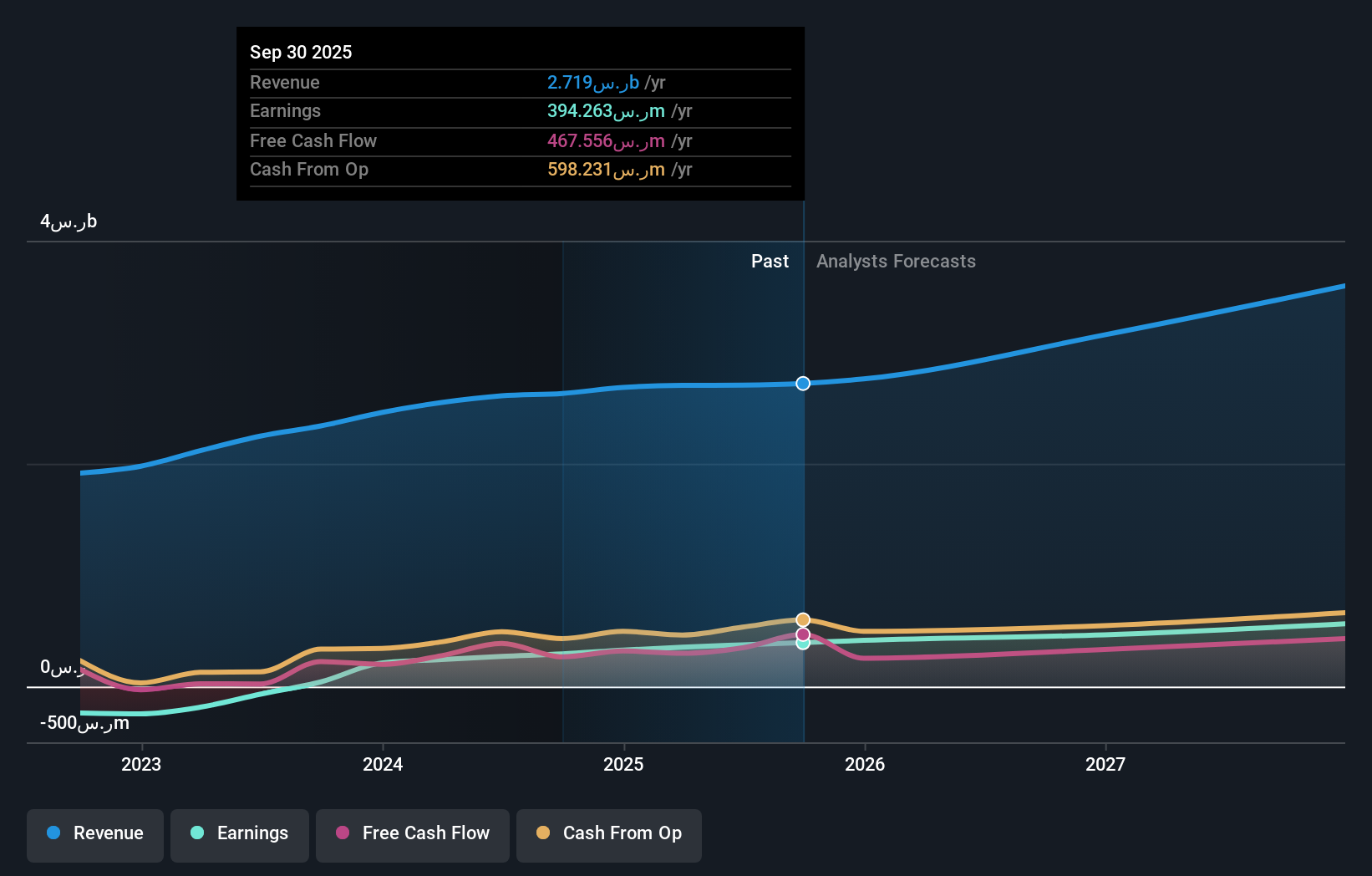

Saudi Ground Services (SASE:4031)

Simply Wall St Value Rating: ★★★★★★

Overview: Saudi Ground Services Company offers ground handling and support services across Saudi Arabia, with a market capitalization of SAR7.43 billion.

Operations: The primary revenue stream for Saudi Ground Services is derived from its transportation infrastructure segment, generating SAR2.72 billion.

Saudi Ground Services, a notable player in the Middle East's infrastructure sector, has shown promising financial health. With no debt on its books currently compared to a 18.9% debt-to-equity ratio five years ago, the company is well-positioned financially. Recent earnings for Q3 2025 revealed sales of SAR 683 million and net income of SAR 101 million, up from SAR 81 million last year. Earnings per share rose to SAR 0.54 from SAR 0.43 previously. The board's decision to distribute interim dividends of SAR 1 per share further underscores its robust cash flow and shareholder-friendly approach.

- Click here and access our complete health analysis report to understand the dynamics of Saudi Ground Services.

Understand Saudi Ground Services' track record by examining our Past report.

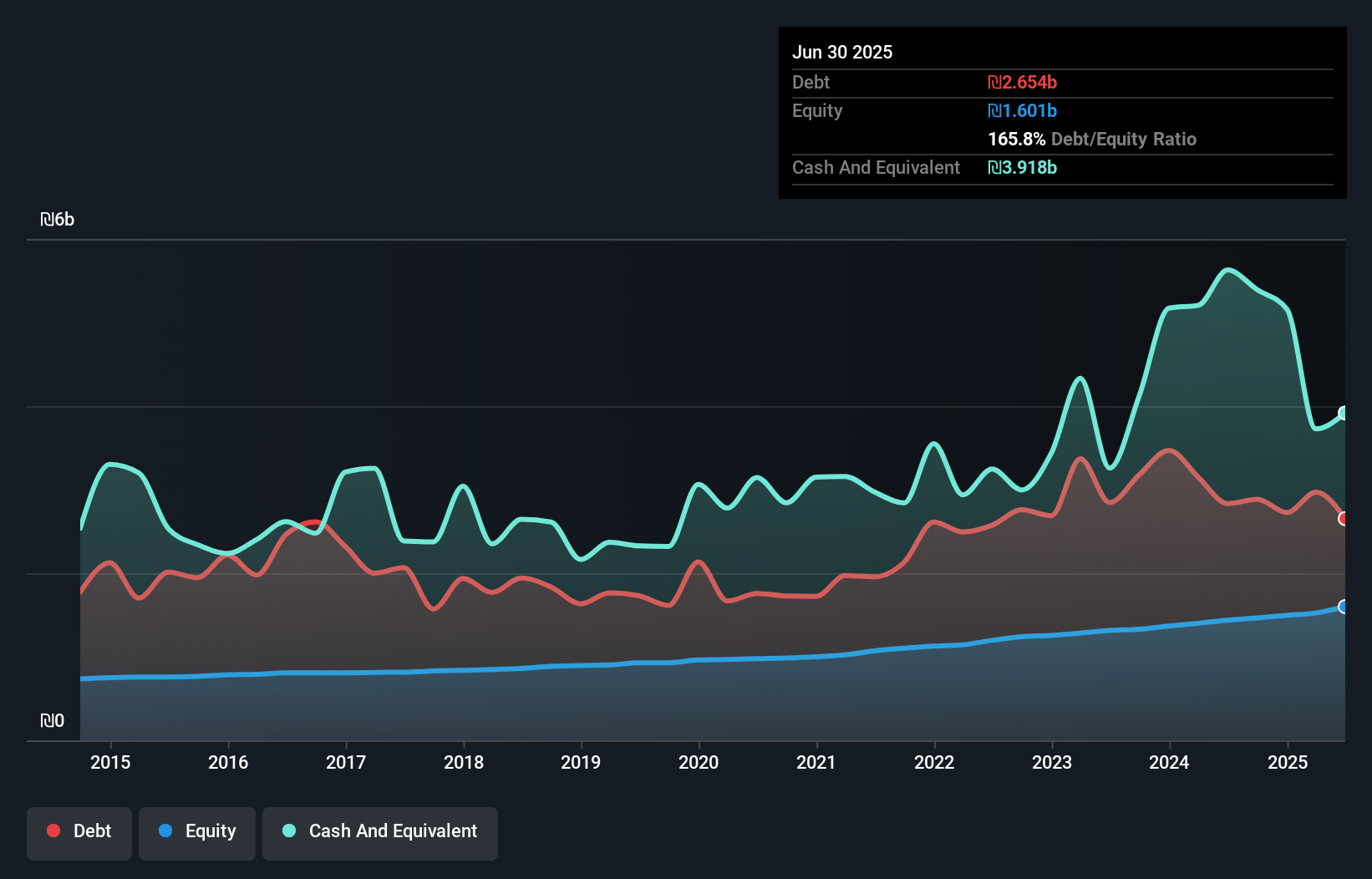

Bank of Jerusalem (TASE:JBNK)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Bank of Jerusalem Ltd. offers commercial banking services in Israel with a market capitalization of ₪1.66 billion.

Operations: The bank generates revenue primarily through interest income from loans and advances, as well as fees for various banking services. Its cost structure includes interest expenses on deposits and other borrowings, along with operational costs. The net profit margin has shown variability across different periods without a consistent trend.

With total assets of ₪22.3 billion and equity at ₪1.6 billion, Bank of Jerusalem stands out with a robust balance sheet. Total deposits reach ₪17.7 billion, while loans amount to ₪16 billion, supported by 86% low-risk funding from customer deposits. The bank's earnings growth of 23.3% last year surpassed the industry average of 10.8%, showcasing high-quality past earnings and a price-to-earnings ratio of 8.6x below the IL market average at 15.1x, indicating potential value for investors seeking opportunities in smaller financial institutions within the region's dynamic landscape.

- Click here to discover the nuances of Bank of Jerusalem with our detailed analytical health report.

Evaluate Bank of Jerusalem's historical performance by accessing our past performance report.

Summing It All Up

- Delve into our full catalog of 179 Middle Eastern Undiscovered Gems With Strong Fundamentals here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com