Aya Gold & Silver (TSX:AYA): Valuation Check After High-Grade Zgounder and Record Boumadine Drill Results

Aya Gold & Silver (TSX:AYA) just delivered another batch of high grade drill results from Zgounder and a record mineralized intercept at Boumadine, extending mineralization and sharpening the growth story around both Moroccan assets.

See our latest analysis for Aya Gold & Silver.

The market seems to be catching on to that story, with Aya Gold & Silver’s roughly 67.9% year to date share price return and 5 year total shareholder return above 500% pointing to building momentum around its Moroccan growth pipeline rather than fading enthusiasm.

If these drilling results have you thinking bigger about future winners, it is worth exploring fast growing stocks with high insider ownership for more fast moving names backed by committed insiders.

With Aya’s shares already up sharply and analysts still seeing upside, the key question now is whether markets are underestimating the scale of Zgounder and Boumadine, or whether they are already pricing in years of growth and leaving limited upside.

Most Popular Narrative: 18.3% Undervalued

With Aya Gold & Silver closing at CA$18.85 versus a narrative fair value around CA$23.08, the most popular view points to meaningful upside from here.

The upcoming Boumadine PEA (scheduled for Q4 2025) is expected to establish Boumadine as a Tier 1 asset and set the stage for transformational growth, expanding Aya's production profile and potentially attracting a higher valuation relative to peers with less project visibility, ultimately improving future cash flow and profitability.

Want to understand why a pure silver producer is getting growth stock treatment? The narrative leans on aggressive revenue expansion, surging margins, and a rich future earnings multiple that might surprise you.

Result: Fair Value of $23.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upbeat narrative could unravel if ore grades disappoint or Moroccan political and permitting risks escalate, which could derail the growth and valuation case.

Find out about the key risks to this Aya Gold & Silver narrative.

Another View: Rich Multiples Signal Caution

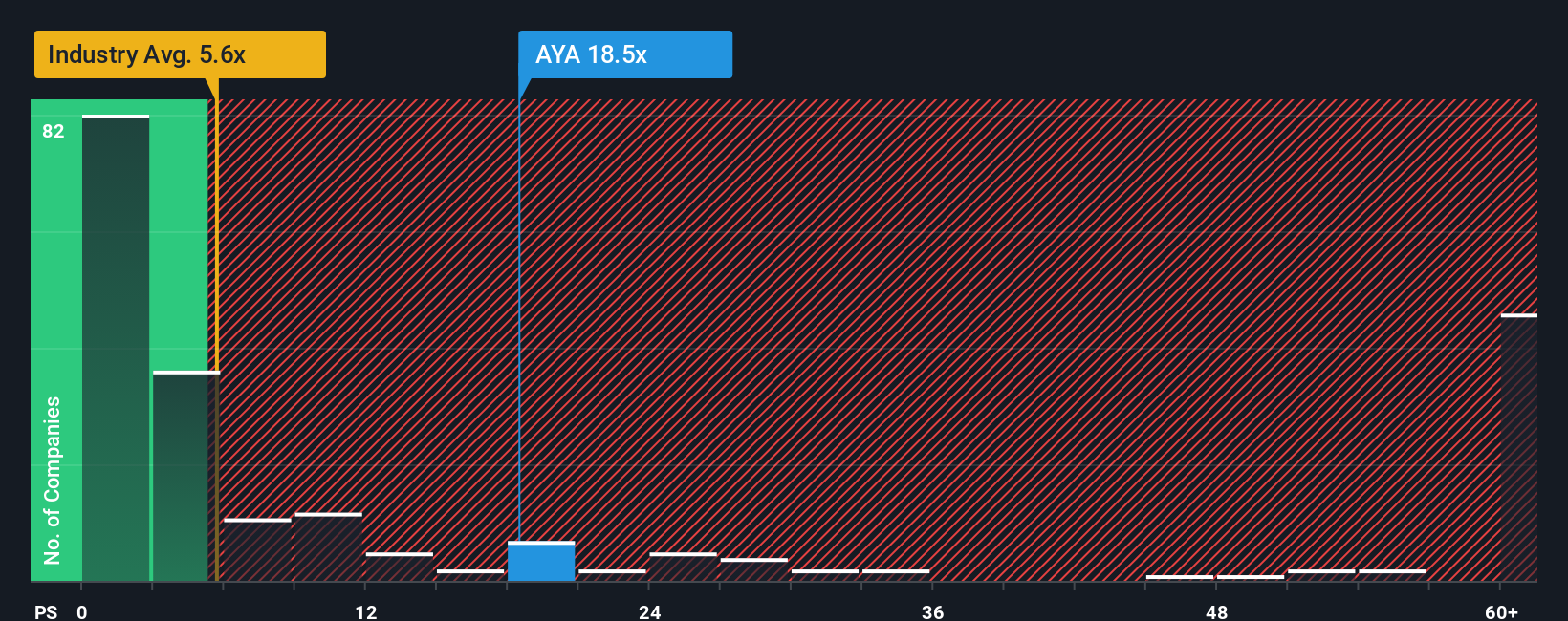

Step away from narratives and the numbers look punchy. Aya trades on a 14.2x price to sales ratio versus a fair ratio of 3.6x, well above the Canadian metals and mining average of 6.5x and peer average of 7.4x, raising the risk that expectations outrun delivery.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Aya Gold & Silver Narrative

If this view does not quite fit your outlook, dive into the numbers yourself and craft a personalized thesis in minutes, Do it your way.

A great starting point for your Aya Gold & Silver research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before you move on, lock in your edge by scanning fresh opportunities on the Simply Wall St Screener, where data backed ideas can sharpen your portfolio.

- Target resilient cash generators as you assess these 15 dividend stocks with yields > 3% that can potentially steady your returns when markets turn choppy.

- Review these 27 AI penny stocks that are positioned to benefit from advances in artificial intelligence across multiple industries.

- Consider these 80 cryptocurrency and blockchain stocks that could gain as digital asset adoption expands beyond early adopters.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com