iRhythm Technologies (IRTC): Evaluating Valuation After a Strong Year-to-Date Share Price Rally

iRhythm Technologies (IRTC) has quietly turned into one of the stronger performers in digital health this year, with the stock up sharply year to date even after some recent pullback.

See our latest analysis for iRhythm Technologies.

At around $173.63, the latest share price sits just below recent highs. While the 7 day and 90 day share price returns have cooled, the roughly 94 percent year to date share price return and near matching 1 year total shareholder return suggest positive momentum is still largely intact.

If iRhythm’s run has you rethinking where healthcare innovation could go next, it might be worth scanning other potential leaders using our healthcare stocks.

With shares hovering below record levels despite rapid revenue and earnings momentum, investors face a familiar dilemma: is iRhythm still trading at a discount to its growth runway, or has the market already priced in its next chapter?

Most Popular Narrative Narrative: 21.1% Undervalued

With the most widely followed narrative pointing to a fair value near $220 against a $173.63 last close, the implied upside leans heavily on future execution.

Investment in the Zio ecosystem, including next-generation patches, enhanced form factors, and AI-powered analytics (such as the Lucem Health partnership), is improving product differentiation, diagnostic yield, and workflow efficiency, likely leading to higher gross margins and operating leverage as software and data become a larger component of the business.

Curious what kind of revenue ramp, margin lift, and earnings power would need to materialize to justify that premium fair value signal? Read on. The narrative’s financial roadmap may surprise you.

Result: Fair Value of $219.93 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, mounting competition and ongoing regulatory scrutiny could pressure margins and slow adoption, which may challenge the upbeat growth and valuation assumptions embedded in this narrative.

Find out about the key risks to this iRhythm Technologies narrative.

Another Lens on Valuation

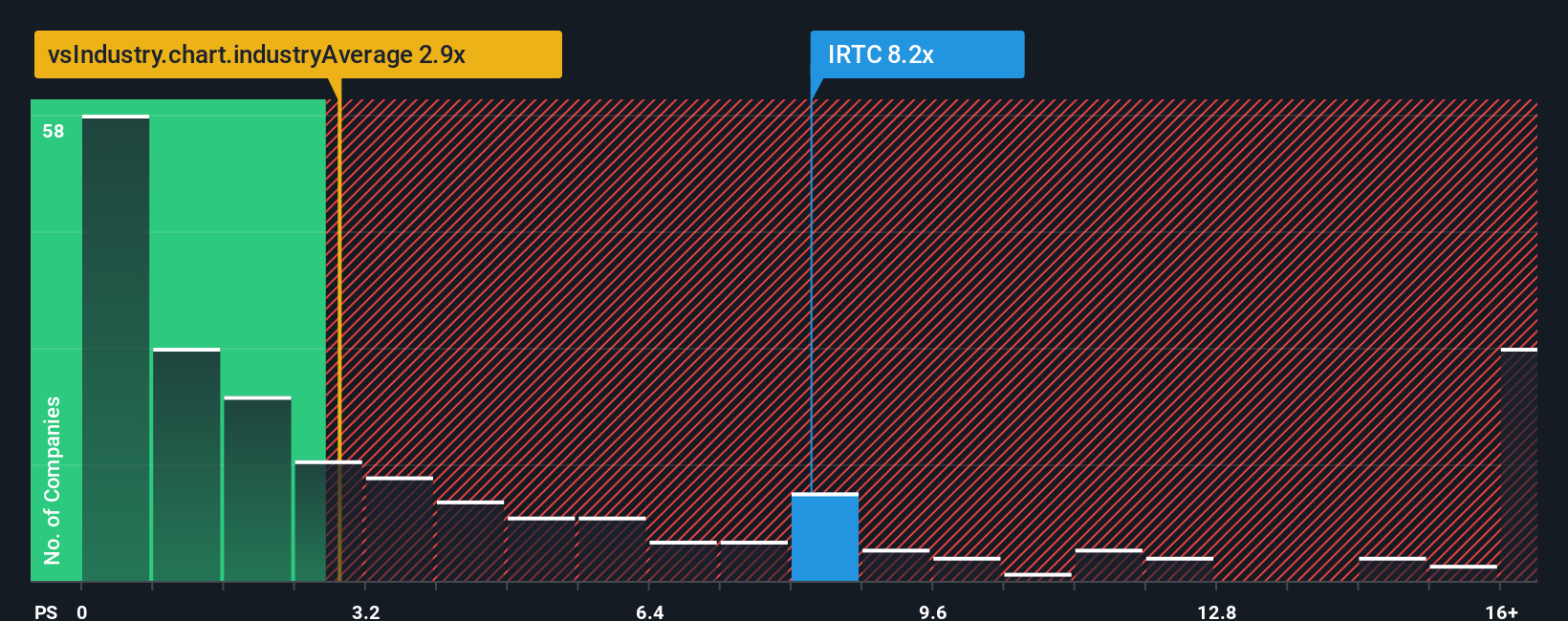

Those upbeat growth projections clash with a harsher reality on current pricing. On a price to sales basis, iRhythm trades around 8 times sales, far richer than the 3.4 times industry average, 5.7 times for peers, and even its 4.7 times fair ratio, which hints at meaningful downside if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own iRhythm Technologies Narrative

If you see iRhythm’s story differently or want to dive into the numbers yourself, you can build a personalized view in minutes using Do it your way.

A great starting point for your iRhythm Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next edge by using targeted screeners that surface opportunities most investors completely overlook while you act with clarity and speed.

- Capitalize on misunderstood value opportunities by scanning these 899 undervalued stocks based on cash flows that pair solid cash flows with attractive entry points.

- Ride the next wave of intelligent innovation by focusing on these 27 AI penny stocks positioned at the heart of real world AI adoption.

- Strengthen your income strategy by pinpointing these 15 dividend stocks with yields > 3% that balance yield with sustainability and long term growth potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com