Premium Brands Holdings (TSX:PBH) Valuation After Record Q3 Sales, Major Product Launch and Capacity Expansion

Premium Brands Holdings (TSX:PBH) just posted record Q3 sales, driven by organic growth and recent acquisitions, while rolling out its biggest ever product launch in grass fed beef sticks and increasing production capacity.

See our latest analysis for Premium Brands Holdings.

Investors seem to be warming back up to that story, with the share price at CA$102.76 after a roughly 16 percent 1 month share price return and a 35 percent 1 year total shareholder return. This suggests momentum is rebuilding rather than fading.

If this kind of steady consumer staples growth appeals to you, it could be worth exploring fast growing stocks with high insider ownership as a way to uncover other under the radar opportunities with aligned management.

Yet with earnings still playing catch up to sales and the stock trading below analyst targets, investors now face a key question: is this renewed optimism a genuine buying opportunity, or is the market already pricing in that future growth?

Most Popular Narrative: 11.4% Undervalued

With Premium Brands Holdings last closing at CA$102.76 versus a narrative fair value of CA$116, the story leans toward upside and hinges on aggressive earnings expansion.

The ramp-up of several new production facilities and the launch of significant new programs, particularly in the U.S. market, is expected to drive strong organic growth over the next few quarters and years. Leveraging rising demand for convenience and ready-to-eat foods will accelerate revenue growth and improve operating leverage, positively impacting both top-line and EBITDA.

Curious how this capacity build out turns modest revenue growth into a much richer earnings profile and lower future multiple expectations, all at a 6.1% discount rate? The narrative quietly stacks growth, margins, and valuation in a way that could reshape how you see this stock’s potential.

Result: Fair Value of $116 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent commodity price volatility and lumpy facility ramp ups could easily derail those optimistic margin gains and delay the expected earnings inflection.

Find out about the key risks to this Premium Brands Holdings narrative.

Another Lens On Valuation

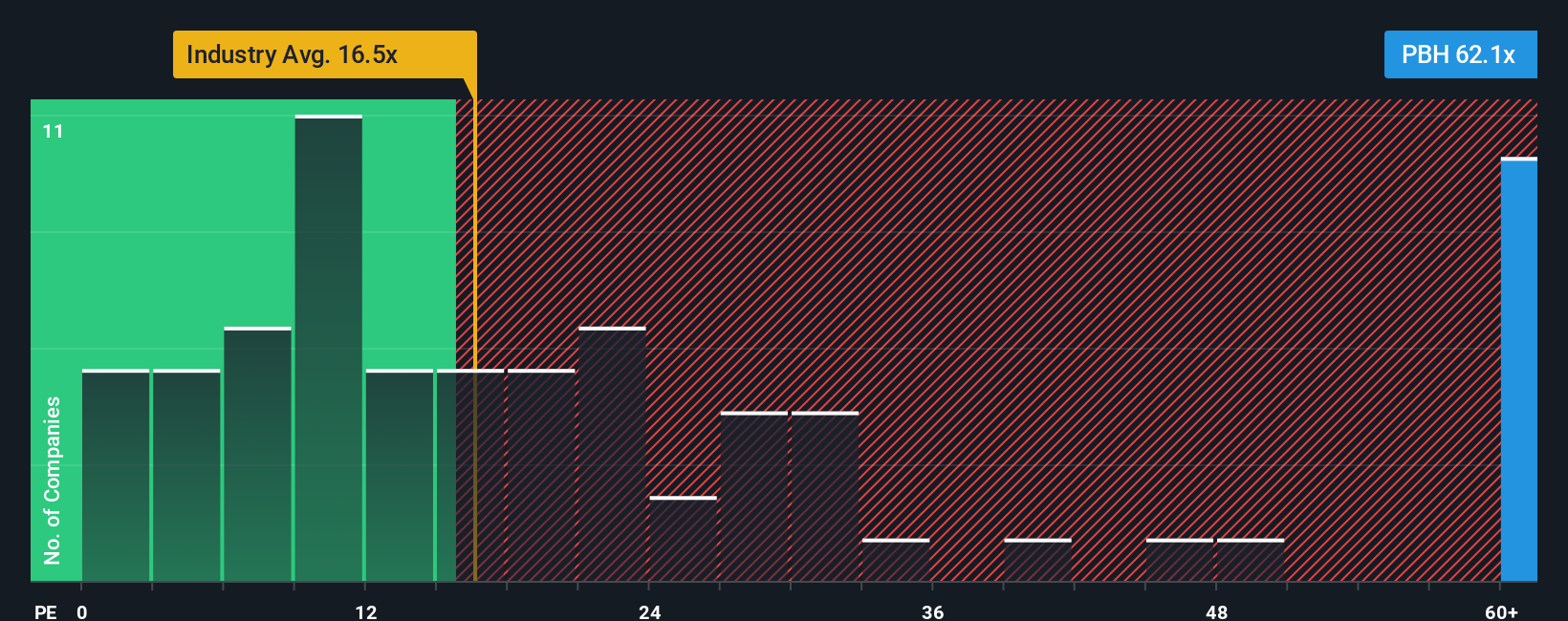

On simple earnings comparisons, Premium Brands looks rich rather than cheap. Its price to earnings ratio sits around 69.4 times, far above both the North American food industry at 18.1 times and peers at 11 times, and even above a 56.8 times fair ratio. Is the market paying too far in advance for the earnings catch up story?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Premium Brands Holdings Narrative

If this framing does not quite fit your view, or you would rather dive into the numbers yourself, you can build a full narrative in under three minutes, Do it your way.

A great starting point for your Premium Brands Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for your next investing edge?

Before you move on, lock in a few more smart ideas using the Simply Wall St screener so you are not leaving high potential returns on the table.

- Target reliable income by scanning these 15 dividend stocks with yields > 3% that balance solid yields with underlying business strength.

- Ride powerful innovation trends by focusing on these 27 AI penny stocks set to benefit from accelerating AI adoption.

- Position for long term upside by filtering for these 899 undervalued stocks based on cash flows that the market has not fully recognized yet.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com