Kering (ENXTPA:KER): Assessing Valuation After a 3-Month Rally and Recent Share Price Pullback

Kering (ENXTPA:KER) has quietly outperformed over the past 3 months, even as the share price has slipped about 4% this month, prompting investors to reassess what is already priced into the stock.

See our latest analysis for Kering.

Zooming out, Kering’s recent pullback sits against a much stronger backdrop, with a roughly 23% 3 month share price return and a 1 year total shareholder return of about 23%. This suggests that sentiment has improved but is now pausing to reassess growth and brand execution risks.

If Kering’s rebound has you thinking more broadly about consumer and brand led momentum, it could be a good time to explore fast growing stocks with high insider ownership.

With Kering now trading only slightly below analyst targets despite a strong rebound, investors face a key question: is this still a mispriced luxury turnaround story, or are markets already baking in the next leg of growth?

Most Popular Narrative Narrative: 3.4% Undervalued

With Kering last closing at €286.50 against a most popular narrative fair value near €296, the valuation hinges on a delicate balance of slower growth assumptions but higher profitability and multiples.

The analysts have a consensus price target of €200.652 for Kering based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €360.0, and the most bearish reporting a price target of just €135.0.

Want to see how modest revenue growth, rising margins and a punchy future earnings multiple still add up to a higher fair value than today? The full narrative breaks down the exact profit path, valuation bridge and discount rate assumptions driving that conclusion. Curious which forecasts really move the dial on that target?

Result: Fair Value of €296.45 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on a fragile backdrop, with muted luxury demand and execution risk around Gucci and Balenciaga’s turnarounds still capable of derailing the recovery.

Find out about the key risks to this Kering narrative.

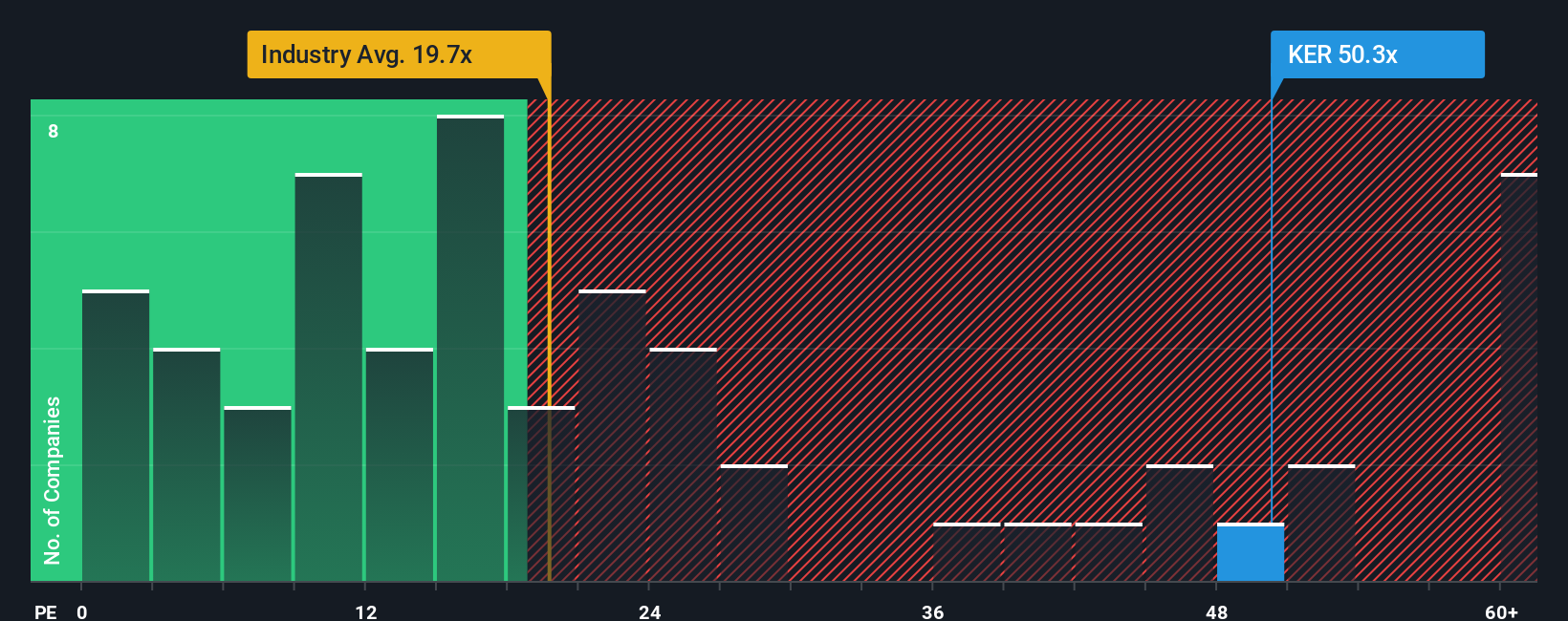

Another Lens On Value: Earnings Multiple Sends A Different Signal

While the most popular narrative suggests Kering is modestly undervalued, its current price to earnings ratio of 48.2x paints a richer picture. It is trading well above the European luxury average of 20.5x and a fair ratio of 32.7x. That gap implies meaningful downside risk if sentiment cools, rather than hidden upside.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kering Narrative

If this perspective does not fully align with your own, or you would rather dig into the numbers yourself, you can build a personalised view in just a few minutes, Do it your way.

A great starting point for your Kering research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop with a single stock when the market is full of mispriced potential; use the Simply Wall Street Screener to uncover opportunities others are still missing.

- Capture recovery stories by targeting companies trading below intrinsic value using these 899 undervalued stocks based on cash flows before the crowd catches on.

- Look for structural growth trends in automation and data by filtering for innovators at the heart of the AI boom through these 27 AI penny stocks.

- Explore potential income streams while rates and volatility shift by focusing on consistently paying businesses via these 15 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com