SPIE (ENXTPA:SPIE) Valuation Check After Expanding Cybersecurity Reach With Cyqueo Acquisition

SPIE (ENXTPA:SPIE) is pushing deeper into cybersecurity with its acquisition of German specialist Cyqueo, a move that tightens its grip on complex IT security projects in a structurally growing market.

See our latest analysis for SPIE.

The Cyqueo deal lands as SPIE’s share price has climbed to about €47.24, with strong year to date share price returns and a robust multi year total shareholder return. This suggests momentum is building as investors increasingly price in growth and execution on recent leadership changes in Central Europe and board refreshment.

If this cybersecurity push has caught your attention, it could be a good moment to scan other infrastructure and tech driven plays via high growth tech and AI stocks and see what else matches your thesis.

Yet with SPIE trading around €47 and still sitting at a double digit discount to analyst targets and some valuation models, the key question is whether there is still upside for new investors or if the market is already pricing in the next leg of growth.

Most Popular Narrative: 10.6% Undervalued

With SPIE last closing at €47.24 against a narrative fair value near €52.83, the story frames current pricing as lagging future fundamentals.

The company's ongoing strategic acquisitions and successful integration in fragmented markets (notably in Germany, North-Western Europe, and Poland) are delivering operational synergies and margin accretion, driving up EBITDA and improving overall net margins.

Want to see what sits behind that margin upgrade story? The narrative leans on steadily rising revenues, fatter profits, and a future earnings multiple that assumes real execution. Curious which precise profit and valuation hurdles SPIE needs to clear to justify that upside? Explore the details to unpack the full roadmap behind this fair value call.

Result: Fair Value of €52.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained European economic softness and ongoing skilled labor shortages could squeeze SPIE’s margins and delay project execution, which would challenge the upside narrative.

Find out about the key risks to this SPIE narrative.

Another Angle on Valuation

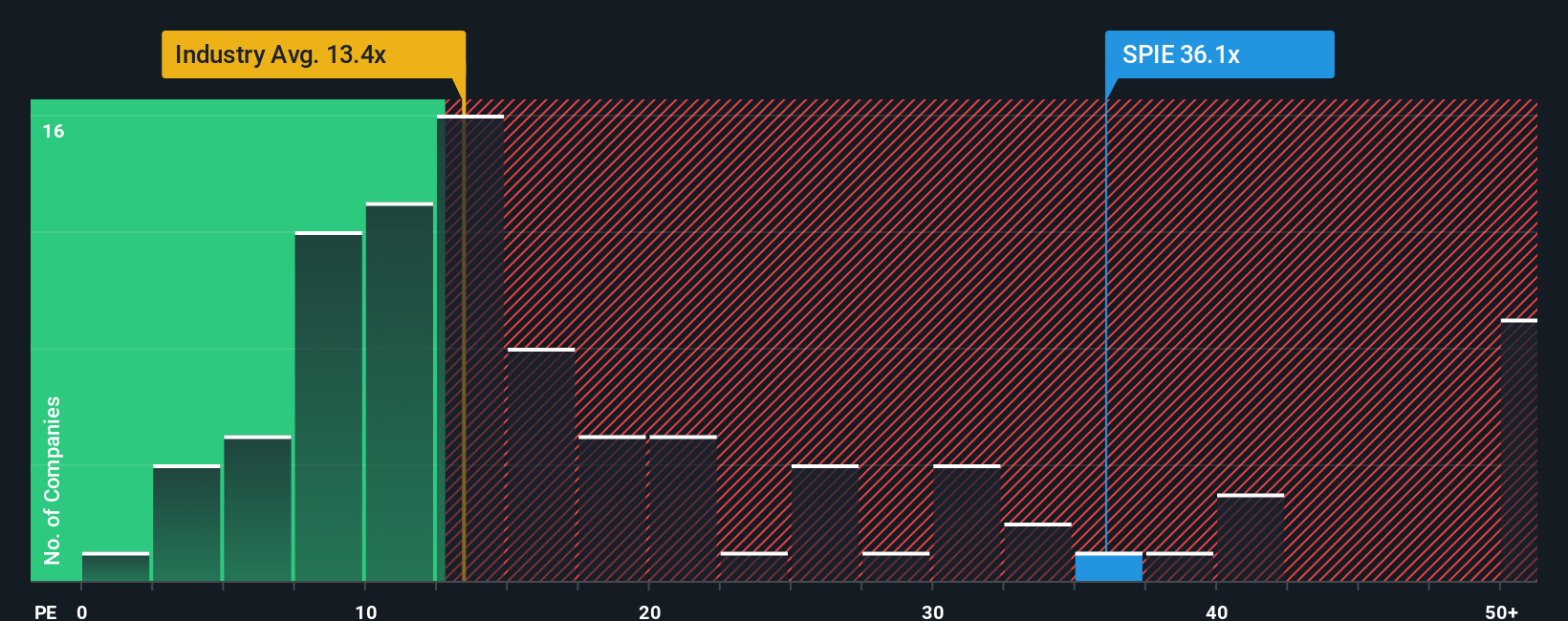

On earnings, the picture looks very different. SPIE trades on a P E ratio of 39.1 times, compared with about 13.7 times for both its European commercial services peers and a fair ratio of 20.1 times. That kind of premium can reflect quality, but it also raises the risk that any stumble hits the share price hard. Are you comfortable paying that much upfront for future growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own SPIE Narrative

If you would rather dig into the numbers yourself and challenge this view, you can build a personalised SPIE story in minutes. Do it your way.

A great starting point for your SPIE research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for your next investing edge?

Do not stop with one idea. Sharpen your portfolio by using the Simply Wall Street Screener to surface focused opportunities you may not want to miss.

- Capture potential mispricings by scanning these 899 undervalued stocks based on cash flows that look cheap relative to their cash flow strength and future prospects.

- Seek exposure to technology by targeting these 27 AI penny stocks positioned at the forefront of artificial intelligence adoption and monetisation.

- Explore dependable income streams by reviewing these 15 dividend stocks with yields > 3% that can help stabilise returns when markets turn volatile.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com