GF Securities: How do you view the recent weak trend in the Hong Kong stock market?

The Zhitong Finance App learned that GF Securities released a research report saying that Hong Kong stocks are more sensitive to peripheral risks, the future path of the Federal Reserve's interest rate cuts is unclear, and Hong Kong stocks faced a peak in December when the ban on restricted stocks was lifted, and molecular fundamentals are under pressure, so they are more likely to be impacted by liquidity. The bank expects a potential rebound in mid-late December and early January next year. On the technical side, in the case of a bull market, Hengke fell below the 120-day EMA, indicating that the release of downward momentum has been sufficient. There is a possibility of a rebound between the 120-250-day EMA at any time. As of December 9, it is only 2.7% away from the 250-day EMA.

The main views of GF Securities are as follows:

Comments on the decline in the Hong Kong stock market

1. Reasons for the recent sharp decline in Hong Kong stocks

Because Trump is dissatisfied with Powell's interest rate cut statement, the market expects the next Federal Reserve Chairman to be dovish. Hassett, who is currently the most likely chairman, stated on Monday evening that interest rate policies for the next six months cannot be announced in advance; we should keep an eye on economic data and cut interest rates moderately and prudently. This is too different from the dovish expectations of the market, so there is a net outflow of foreign capital from emerging markets. As a verification, it can be seen that Indonesia, India, and emerging markets have declined a lot, while the southbound net inflow into Hong Kong stocks.

2. Why did Hong Kong stocks fall the most and accelerate their decline since mid-November?

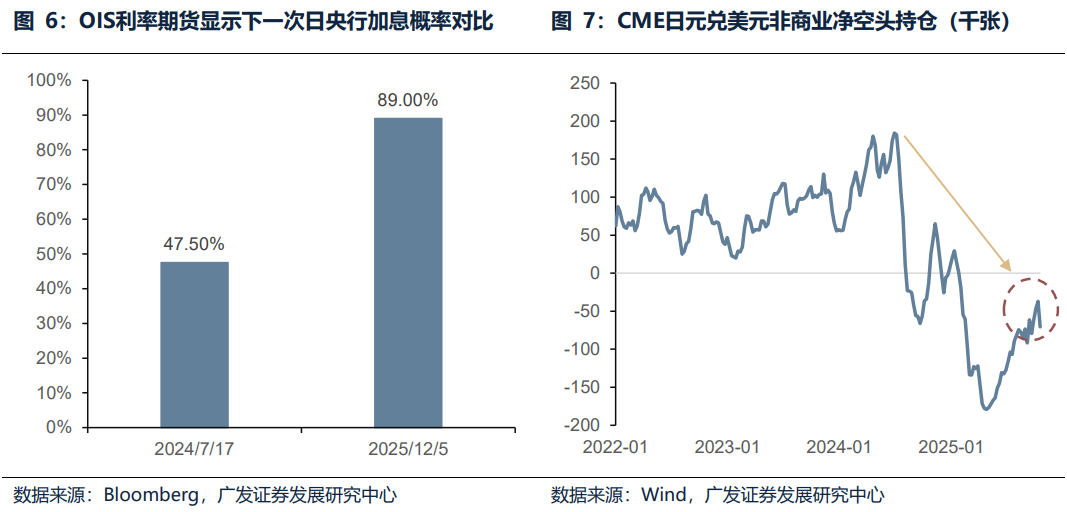

The fundamentals of Hong Kong stocks look at mainland China, and liquidity depends on overseas. The increase in A-shares is in valuation. The fundamentals are divided, and the pro-cyclical fundamentals are relatively poor; the rise in US stocks is fundamental, and liquidity is poor. Hong Kong stocks have taken up all of the two negative factors, and Hong Kong stocks are currently facing a peak in the lifting of the ban, which is easy to favor and weaken the weak point. Therefore, once there are turbulent events on the periphery (expectations of the Federal Reserve's interest rate cuts are repeated, and Japan may raise interest rates causing global interest rate hikes to close), there will also be more retractions.

The peak of the lifting of the ban on Hong Kong stocks: The peak of IPOs in the first half of the year was in response to the pressure to lift the ban in November-December (a total of HK$126 billion restricted shares were lifted in December, falling back below HK$50 billion in January). The accelerated decline in mid-November may be due to the drastic lifting of the ban by companies such as Ningde Times, which affected market sentiment.

3. Potential rebound timing

(1) Mid-late December: Pay attention to the fiscal policy of the year-end economic work conference & the Bank of Japan's interest rate hike statement (12.19). If the fiscal government exceeds expectations or Japan's interest rate hike statements are biased, there may be a positive numerator side or denominator side advantage. Furthermore, the economy is currently stable and improving, and it is unlikely that the fiscal balance will significantly exceed expectations; the risk of liquidation of Japanese yen arbitrage transactions is also less likely to cause a liquidity crisis, mainly because the current market expects sufficient interest rate hikes in Japan and interest rate cuts by the Federal Reserve, stock positions in arbitrage trading have shrunk markedly, and there is no sign of a shortage of short-term dollar liquidity, compounded by a high probability of a soft landing in the US economy.

(2) Early January: The peak of the lifting of the ban on Hong Kong stocks came to an end, and the minutes of the latest Federal Reserve meeting were released. If the path of interest rate cuts is dovish, it will benefit liquidity.

(3) Tracking indicators: Hengke fell below the 120-day EMA, indicating that the downward momentum has been released. As a support line for this round of Hengke's bull market, Hengke is likely to rebound between the 120-250 day EMA at any time. As of December 9, it will fall 2.7% to the 250-day support line. In the past, Hengke's bull market did not fall below the 250-day EMA in the 16-17 and 20-21 upward ranges.

Risk Alerts

The geopolitical conflict exceeded expectations, causing global inflation to once again experience significant upward pressure; repeated overseas inflation and the resilience of the US economy made the pace of global liquidity easing lower than expected (the pace of interest rate cuts by the Federal Reserve and the decline in US bond interest rates were lower than expected); the model was analyzed based on historical data, and there may be problems with insufficient effectiveness and applicability.