Undiscovered Gems in Global Markets for December 2025

As global markets navigate the anticipation of potential interest rate cuts and mixed economic signals, small-cap stocks have shown resilience with the Russell 2000 Index posting notable gains. In this dynamic environment, identifying undiscovered gems involves seeking companies that can thrive amid economic uncertainties and capitalize on emerging opportunities in their respective sectors.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Asian Terminals | 25.82% | 12.05% | 17.00% | ★★★★★★ |

| Cresco | 4.98% | 9.33% | 11.61% | ★★★★★★ |

| Allmed Medical ProductsLtd | 13.03% | -2.37% | -30.93% | ★★★★★★ |

| Maezawa Kasei Industries | 0.77% | 3.52% | 20.55% | ★★★★★★ |

| DoshishaLtd | NA | 3.17% | 3.20% | ★★★★★★ |

| Central Forest Group | NA | 5.20% | 24.71% | ★★★★★★ |

| Kyungbangco.Ltd | 26.40% | 3.35% | -9.29% | ★★★★☆☆ |

| Chinyang Holdings | 31.98% | 7.57% | -15.85% | ★★★★☆☆ |

| Marusan Securities | 3.64% | 0.57% | 3.44% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Hubei Sinophorus Electronic MaterialsLtd (SHSE:688545)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hubei Sinophorus Electronic Materials Ltd (SHSE:688545) operates in the electronic materials industry and has a market capitalization of CN¥11.83 billion.

Operations: Sinophorus generates revenue primarily from its electronic materials segment. The company's net profit margin has shown a notable trend, reflecting its financial efficiency in converting revenue into profit.

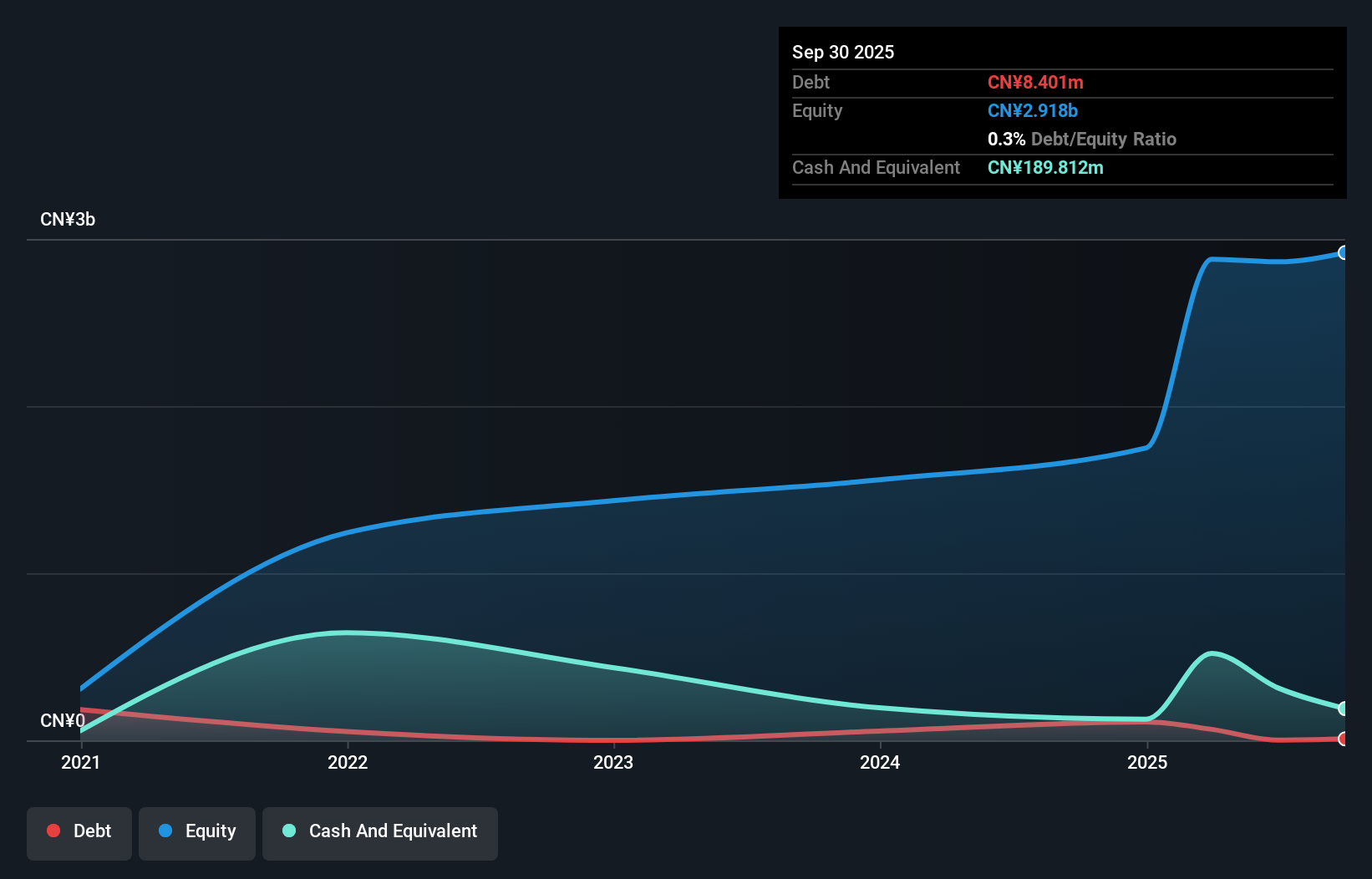

Hubei Sinophorus Electronic Materials, a smaller player in the electronics sector, showcases impressive growth with earnings increasing by 27.7% over the past year, outpacing the Chemicals industry average of 7.5%. Despite a volatile share price recently, their sales for the first nine months of 2025 reached CNY 1.06 billion compared to CNY 839 million last year. Net income also rose to CNY 165 million from CNY 133 million previously. However, basic and diluted earnings per share saw a slight dip to CNY 0.47 from CNY 0.51 last year, hinting at potential profitability challenges ahead despite robust revenue growth forecasts of nearly 41% annually.

Hunan Valin Wire & CableLtd (SZSE:001208)

Simply Wall St Value Rating: ★★★★★★

Overview: Hunan Valin Wire & Cable Co., Ltd. specializes in the research, development, production, and sale of wires and cables in China with a market capitalization of CN¥8.18 billion.

Operations: Valin Wire & Cable generates revenue primarily through the sale of wires and cables. The company has a market capitalization of CN¥8.18 billion.

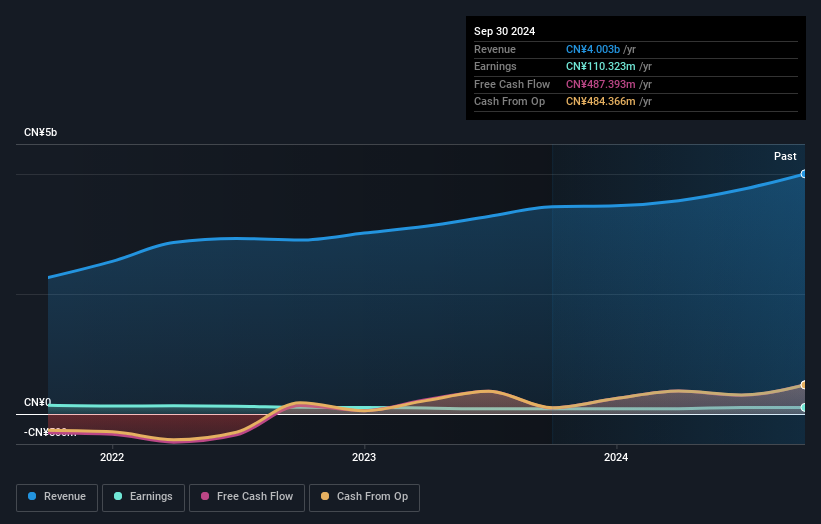

Hunan Valin Wire & Cable, a nimble player in the electrical industry, has shown resilience with earnings growth of 4.2% over the past year, surpassing the industry's 3.3%. The company boasts high-quality earnings and maintains a debt to equity ratio that has improved from 42% to 21.7% over five years. Recent amendments to its articles of association and significant private placements have marked strategic shifts, raising CNY 1.21 billion in net proceeds. Despite shareholder dilution last year, net income rose slightly to CNY 92 million for nine months ending September 2025 compared to CNY 86 million previously.

Changchun UP OptotechLtd (SZSE:002338)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Changchun UP Optotech Co., Ltd. specializes in the research, development, production, and sale of photoelectric measurement and control equipment products in China, with a market cap of CN¥12.67 billion.

Operations: The company generates revenue primarily from the sale of photoelectric measurement and control equipment products. It focuses on research, development, and production activities within China.

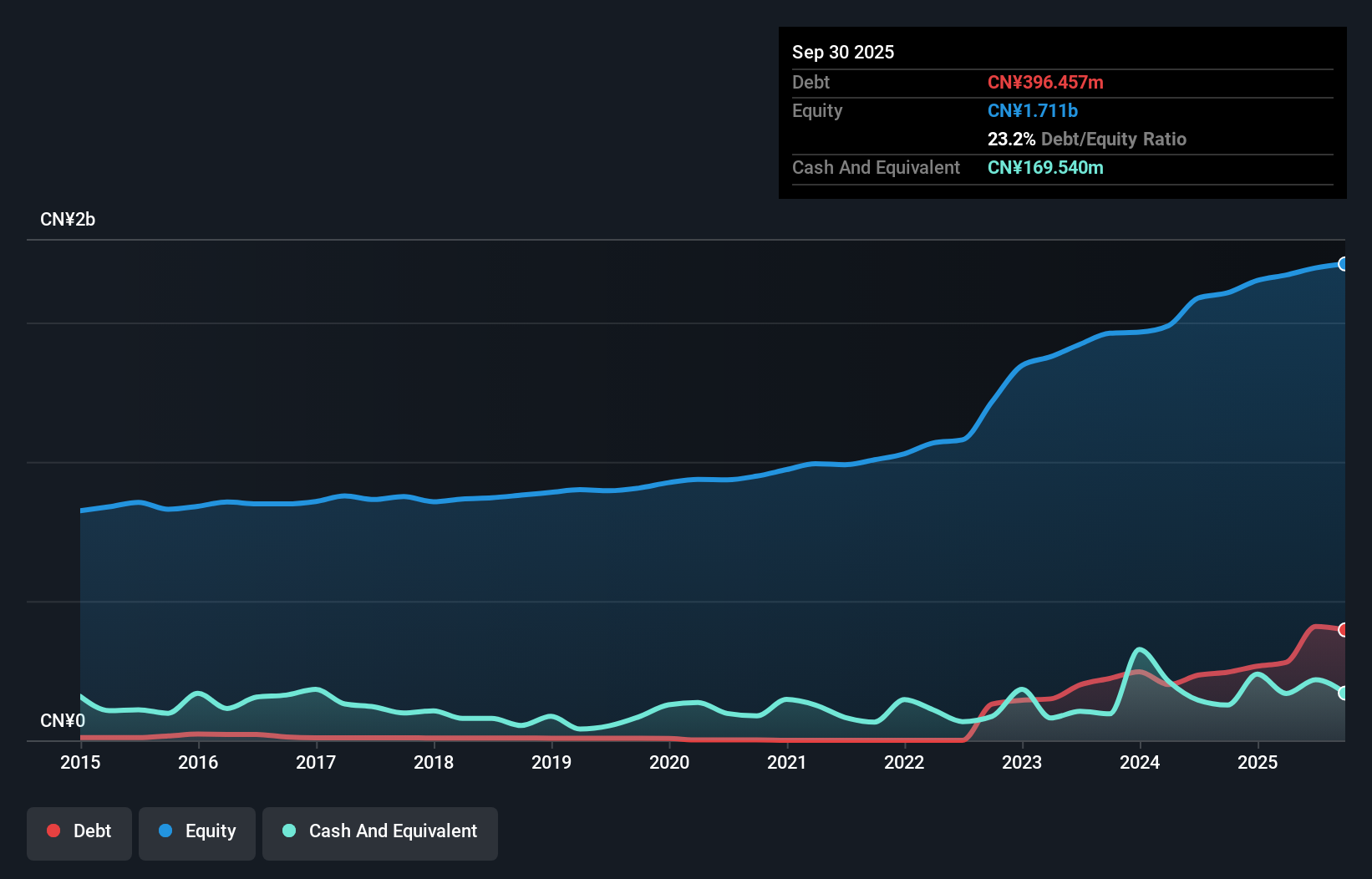

Changchun UP Optotech, a player in the Aerospace & Defense industry, has shown notable financial dynamics recently. Despite a CN¥34M one-off gain affecting its past year's results, its earnings growth of 10.9% outpaced the industry's -10.3%. The company's net debt to equity ratio stands at 13.3%, which is satisfactory given industry norms below 40%. However, over five years, this ratio increased from 0.1% to 23.2%, indicating rising leverage concerns. Recent changes in company bylaws suggest strategic shifts while sales for nine months ending September were CN¥510M with net income at CN¥38M compared to last year’s figures of CN¥522M and CN¥45M respectively.

Taking Advantage

- Discover the full array of 3000 Global Undiscovered Gems With Strong Fundamentals right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com