3 Global Growth Companies With Up To 38% Insider Ownership

As global markets navigate the complexities of economic shifts, with hopes for interest rate cuts and mixed performance across major indices, investors are keenly observing growth companies that exhibit strong insider ownership. In this environment, stocks that combine robust growth potential with significant insider stakes can offer a compelling proposition, as they often reflect confidence from those closest to the company's operations and strategic direction.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| UTI (KOSDAQ:A179900) | 25.2% | 120.7% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Rasan Information Technology (SASE:8313) | 31.1% | 21% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Fulin Precision (SZSE:300432) | 11.6% | 55.2% |

Let's uncover some gems from our specialized screener.

Chongqing Zaisheng Technology (SHSE:603601)

Simply Wall St Growth Rating: ★★★★★☆

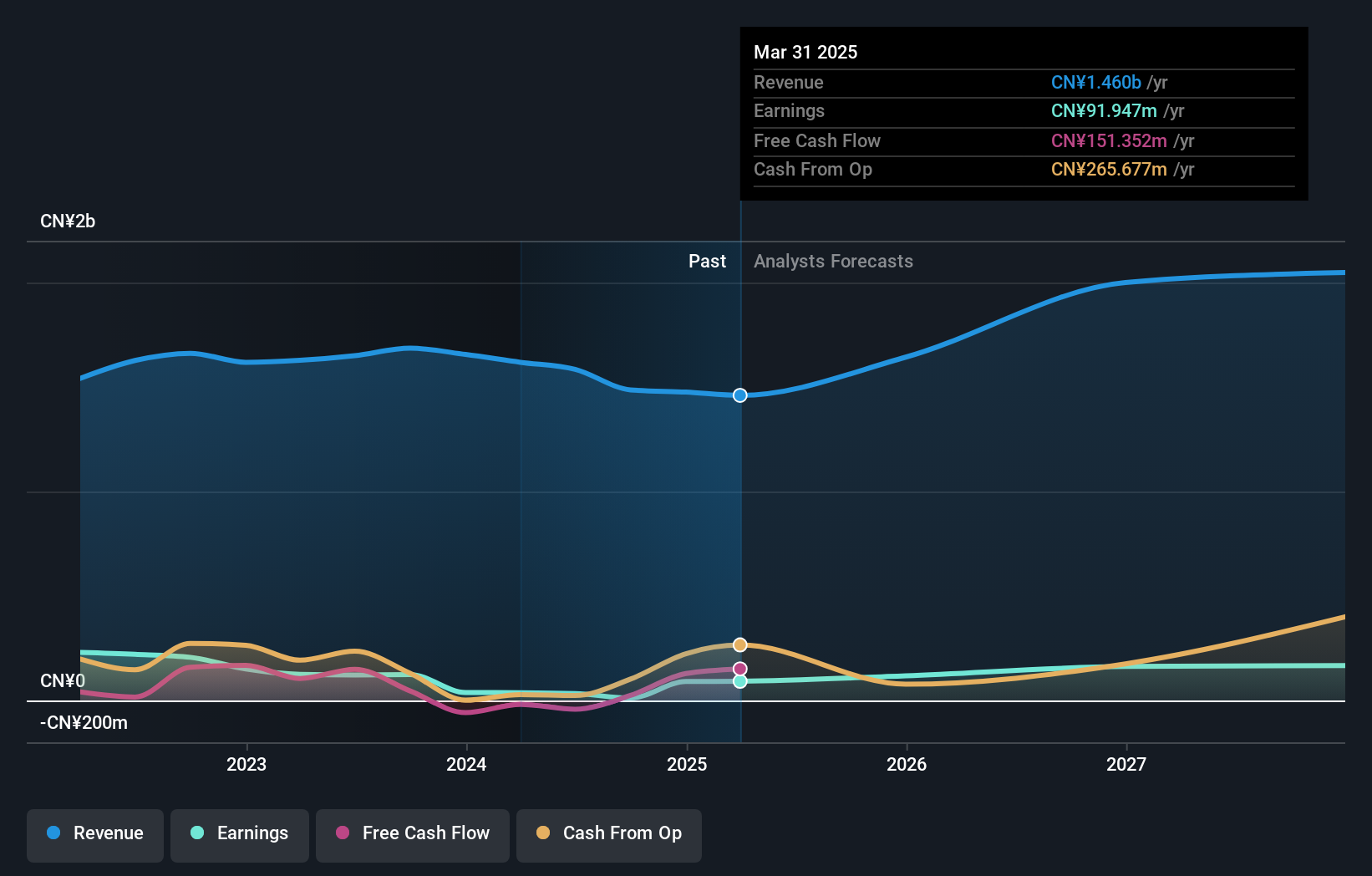

Overview: Chongqing Zaisheng Technology Co., Ltd. is engaged in the research, manufacturing, and marketing of fiber cotton in China with a market capitalization of approximately CN¥6.52 billion.

Operations: Chongqing Zaisheng Technology Co., Ltd. generates its revenue primarily through the research, production, and sale of fiber cotton in China.

Insider Ownership: 33.6%

Chongqing Zaisheng Technology showcases significant growth potential with expected earnings and revenue increases of 41% and 27.3% per year, respectively, outpacing the Chinese market. While insider ownership remains high, a recent transaction saw Guo Mao reduce their stake from 33.13% to 27.09%. Despite trading significantly below its fair value estimate, the company faces challenges from large one-off items impacting financial results and a low forecasted return on equity of 8.7%.

- Click to explore a detailed breakdown of our findings in Chongqing Zaisheng Technology's earnings growth report.

- Our valuation report here indicates Chongqing Zaisheng Technology may be overvalued.

Hangzhou Lion ElectronicsLtd (SHSE:605358)

Simply Wall St Growth Rating: ★★★★★☆

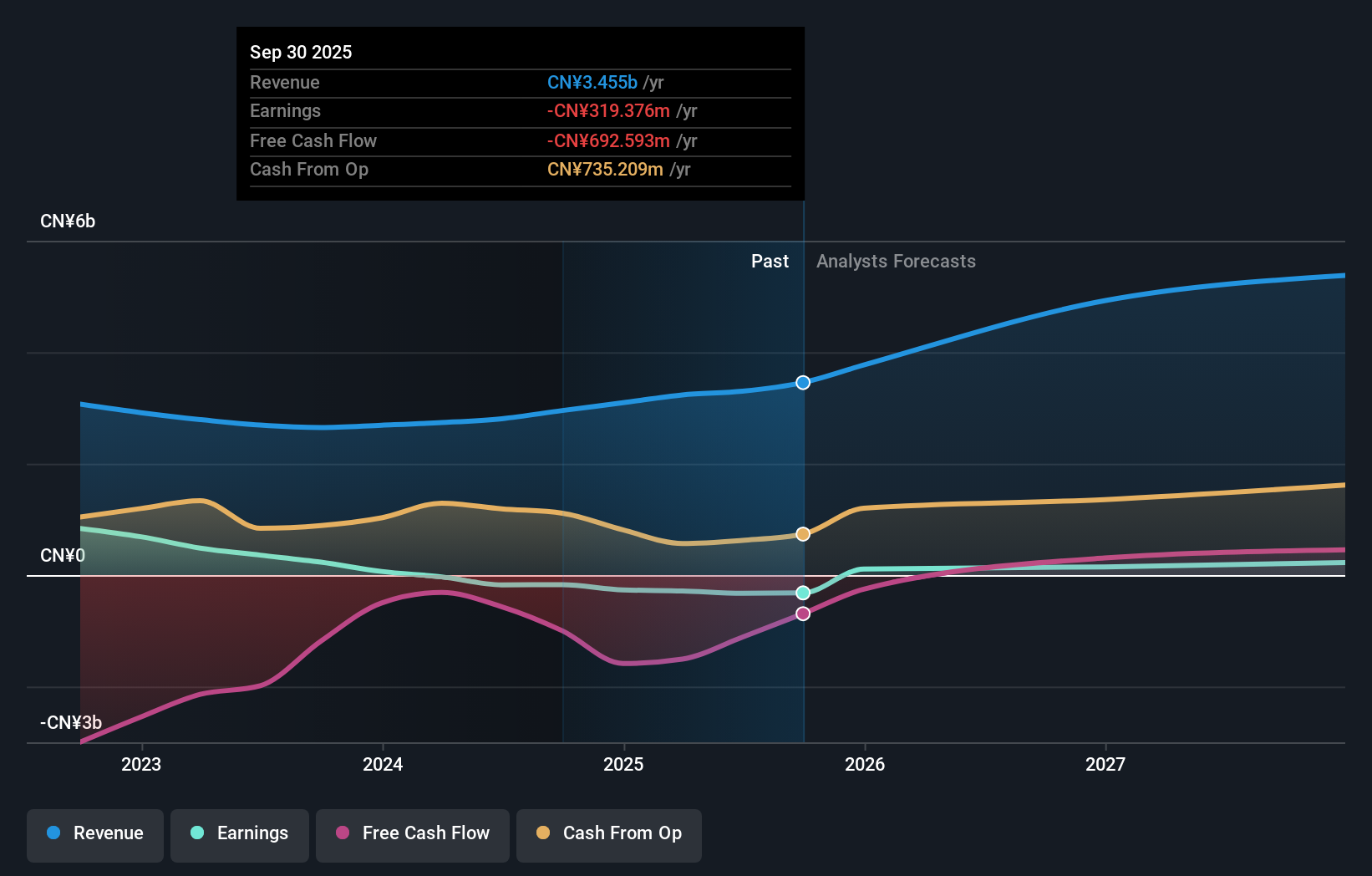

Overview: Hangzhou Lion Electronics Co., Ltd specializes in the research, development, production, and sale of semiconductor silicon wafers, power devices, and compound semiconductor radio frequency chips both in China and internationally, with a market cap of CN¥20.17 billion.

Operations: The company's revenue is derived from the production and sale of semiconductor silicon wafers, power devices, and compound semiconductor radio frequency chips in both domestic and international markets.

Insider Ownership: 17.8%

Hangzhou Lion Electronics is positioned for substantial growth, with revenue expected to increase by 20.3% annually, surpassing the Chinese market's average. Despite this, the company faces challenges with a low forecasted return on equity of 2.7% and inadequate debt coverage by operating cash flow. Recent earnings revealed sales of CNY 2.64 billion but a net loss of CNY 107.96 million for the first nine months of 2025, highlighting ongoing profitability issues despite anticipated future gains.

- Unlock comprehensive insights into our analysis of Hangzhou Lion ElectronicsLtd stock in this growth report.

- Insights from our recent valuation report point to the potential overvaluation of Hangzhou Lion ElectronicsLtd shares in the market.

Ningbo Zhenyu Technology (SZSE:300953)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ningbo Zhenyu Technology Co., Ltd. specializes in the R&D, design, production, and sale of precision progressive stamping dies and downstream precision structural parts both in China and internationally, with a market cap of CN¥25.59 billion.

Operations: The company's revenue primarily comes from its Machinery & Industrial Equipment segment, totaling CN¥8.71 billion.

Insider Ownership: 38%

Ningbo Zhenyu Technology is experiencing robust growth, with earnings rising to CNY 411.94 million from CNY 172.41 million year-over-year for the first nine months of 2025. Revenue reached CNY 6.59 billion, a significant increase from the previous year's figures, and future earnings are forecasted to grow by over 30% annually, outpacing the Chinese market average. However, recent shareholder dilution and inadequate debt coverage by operating cash flow present challenges despite high insider ownership stability.

- Take a closer look at Ningbo Zhenyu Technology's potential here in our earnings growth report.

- Our expertly prepared valuation report Ningbo Zhenyu Technology implies its share price may be too high.

Make It Happen

- Click through to start exploring the rest of the 856 Fast Growing Global Companies With High Insider Ownership now.

- Seeking Other Investments? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com