Assessing L'Oréal (ENXTPA:OR)'s Valuation After Its Recent Share Price Drift Higher

L'Oréal (ENXTPA:OR) has quietly pushed higher, with the share price drifting up over the past month despite some choppiness in the past 3 months, and that mix deserves a closer look.

See our latest analysis for L'Oréal.

Zooming out, L'Oréal's 30 day share price return of 3.9 percent and year to date share price gain near 9 percent suggest steady, if unspectacular, momentum as investors weigh its resilient growth against a demanding valuation.

If you are comparing L'Oréal with other consumer facing names, it might be worth widening the lens and exploring fast growing stocks with high insider ownership.

With the shares trading only modestly below analyst targets despite solid but not explosive growth, the key question now is whether L'Oréal is quietly undervalued or if the market is already pricing in years of premium expansion.

Most Popular Narrative Narrative: 5% Undervalued

With L'Oréal closing at €368.20 against a narrative fair value near €387.55, the storyline leans toward modest upside baked into measured growth.

Analysts expect earnings to reach €8.0 billion (and earnings per share of €15.09) by about September 2028, up from €6.1 billion today. The analysts are largely in agreement about this estimate.

Curious how moderate growth assumptions can still justify a premium earnings multiple for a beauty giant not classed as hyper growth? Want to see which revenue, margin, and valuation levers underpin that viewpoint? Dive into the full narrative to unpack the precise forecasts driving this fair value call.

Result: Fair Value of €387.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition from digital native and local brands, alongside shifting preferences toward clean, dermatological labels, could temper L'Oréal's premium growth story.

Find out about the key risks to this L'Oréal narrative.

Another Lens on Valuation

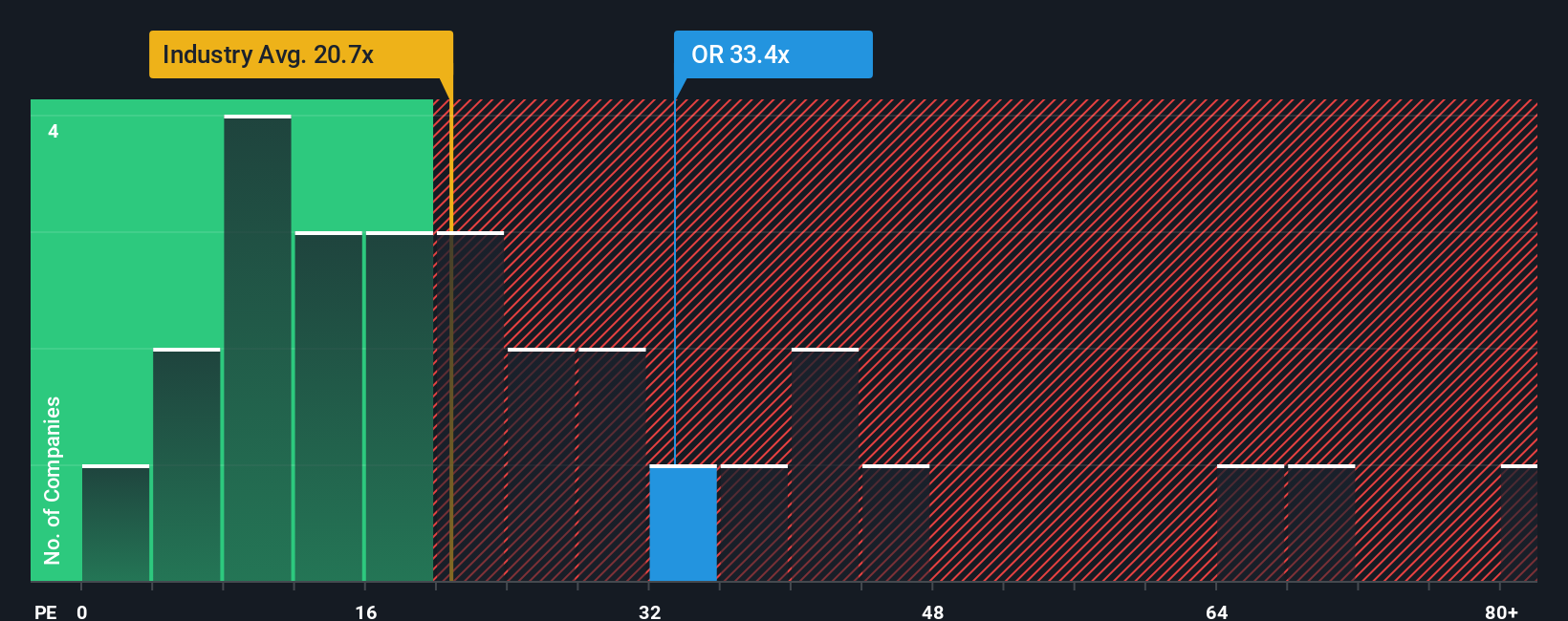

Step away from fair value models and L'Oréal starts to look fully priced. On a price to earnings basis it trades at 32.1 times, richer than the 31.5 times fair ratio, 27.5 times peers, and 18.9 times the wider industry, raising the risk of a sentiment swing.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own L'Oréal Narrative

If you want to stress test these assumptions or rely on your own due diligence instead, you can build a custom view in just minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding L'Oréal.

Ready for your next investing move?

Do not stop with one great business. Use the Simply Wall St Screener to spot fresh opportunities and stay one step ahead of other investors.

- Capture potential market mispricings early by scanning these 896 undervalued stocks based on cash flows that could be trading well below their intrinsic worth.

- Strengthen your portfolio income by targeting these 15 dividend stocks with yields > 3% that can help support reliable long term cash flow.

- Position yourself at the frontier of digital finance with these 80 cryptocurrency and blockchain stocks before the next wave of enthusiasm arrives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com