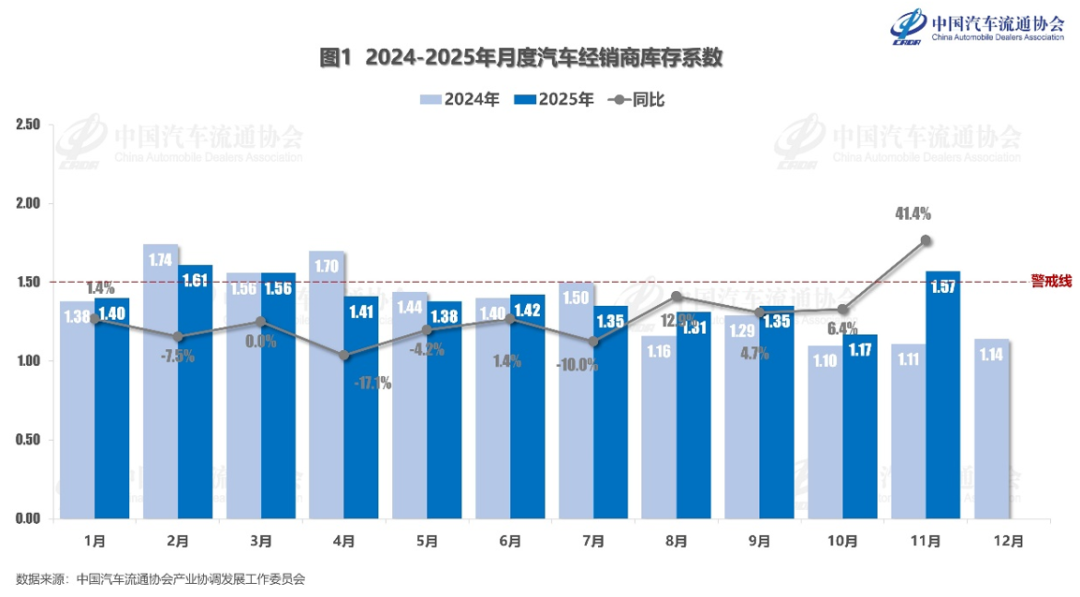

China Automobile Dealers Association: The comprehensive inventory coefficient of Chinese car dealers in November was 1.57, up 34.2% month-on-month

The Zhitong Finance App learned that on December 10, 2025, the China Automobile Dealers Association released the results of the November 2025 “Auto Dealer Inventory” survey: the comprehensive inventory coefficient for car dealers in November was 1.57, up 34.2% month-on-month and 41.4% year-on-year. The inventory level was above the warning line and higher than a reasonable range.

The inventory coefficient increased year-on-year and month-on-month in November

The passenger car market showed a backward trend in November, but the expected year-end “tipping effect” was not significant. The market started sluggishly at the beginning of the month, mainly affected by “gold nine silver ten” consumer demand pre-overdrafts, the tightening and suspension of subsidy policies in many places, and delays in consumption of new energy purchase tax underwriting plans. More than 80% of dealers were pessimistic about November. The second half of the month picked up due to the “Double 11" promotion, new car launches at the Guangzhou Auto Show, terminal price cuts, and a countdown discount on purchase tax exemptions. Combined with the end-of-life renewal policy, some demand was released at the end of December.

As of October 22, the number of applications for trade-in subsidies exceeded 10 million vehicles, with a cumulative total of 11.2 million vehicles in the first 11 months. With the large-scale suspension of subsidies in various regions, although dealers are making every effort to accelerate the absorption of inventory, inventory levels have risen rapidly and the pressure continues to increase due to end-of-year impulse replenishment and declining policies.

According to comprehensive estimates, according to statistics from the Passenger Federation Branch of the China Automobile Dealers Association, passenger car terminals sold 2,225,000 units in November. According to this estimate, the total inventory of car dealers at the end of November was roughly 3.5 million vehicles.

2. Inventory factors for high-end luxury, imported, joint ventures, and independent brands increased month-on-month

The inventory coefficient for high-end luxury & imported brands was 1.58, up 37.4% month-on-month; the inventory coefficient for joint venture brands was 1.70, up 41.7% month-on-month; and the inventory coefficient for independent brands was 1.51, up 30.2% month-on-month.

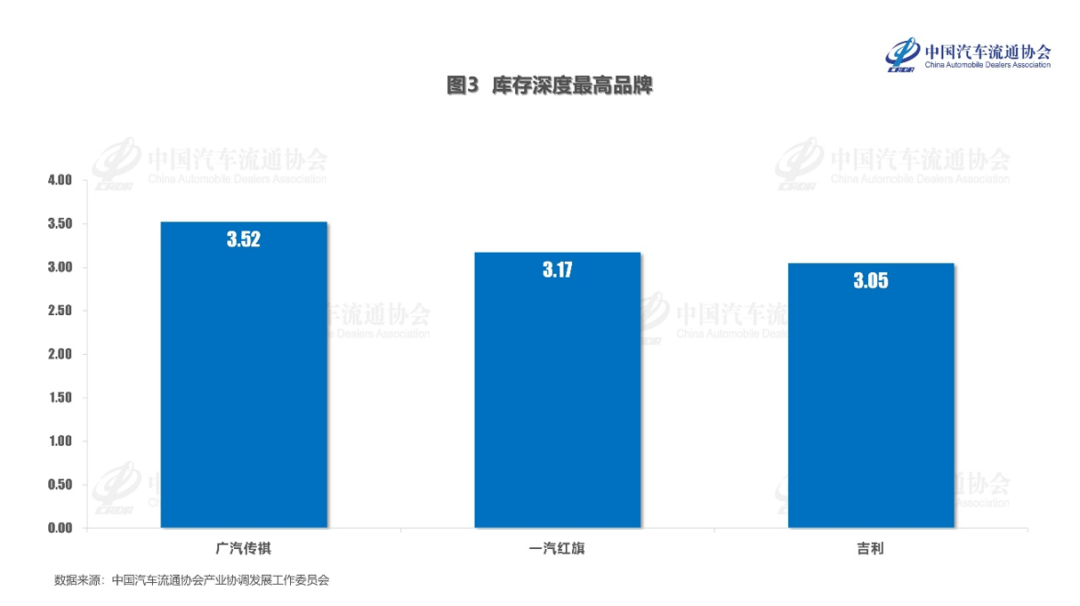

The brand with the highest inventory depth in March and November

According to the survey, there were 12 major brands with an inventory depth of more than 2 months in November. Among them, the brands with the highest inventory depth include GAC Trumpchi and FAW Hongqi.

4. Carefully anticipate market demand in December 2025 and reasonably control inventory

As December marks the end of the car market, terminal consumption is expected to pick up moderately. This is mainly due to increased terminal promotions from manufacturers and dealers in order to sprint to annual targets. At the same time, demand for car purchases before the Spring Festival is gradually being released. On the policy side, although the NEV purchase tax exemption policy expires at the end of the year (halved from 2026) and the end-of-life subsidy deadline should theoretically strengthen the “last train effect”, due to the fact that subsidy funds in many places have basically been exhausted, and demand for fuel vehicle replacement is clearly weak, there was no obvious decline in the car market as a whole at the end of the year.

The China Automobile Dealers Association suggests that in the future, uncertainty in the automobile market will increase, and dealers should rationally estimate actual market demand based on the actual situation. At the same time, it is necessary to increase publicity on “trade-in and end-of-life renewal policies”, boost consumer confidence by strengthening services, put cost reduction and efficiency first, and prevent business risks.