China Automobile Dealers Association: The volume of transactions in the national used car market of 1,746,200 vehicles fell 2.21% year on year in November

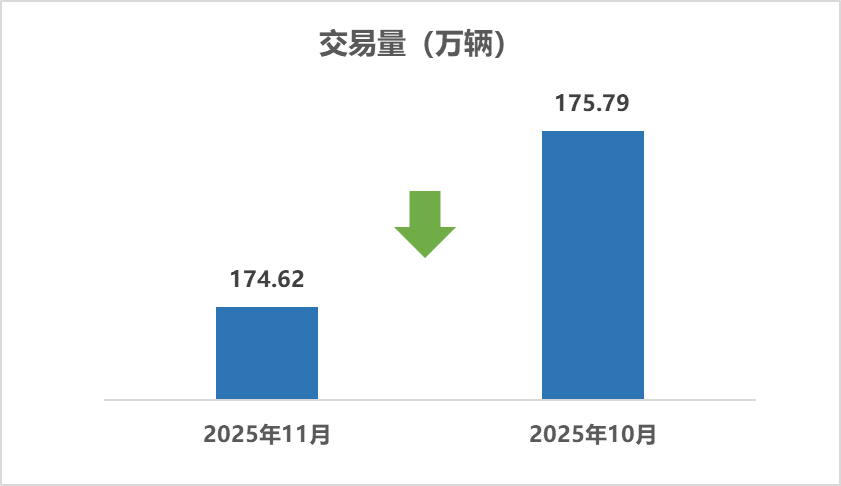

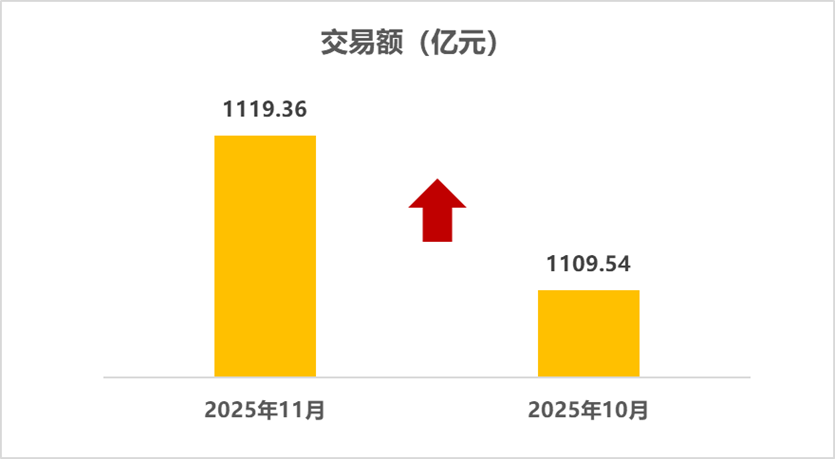

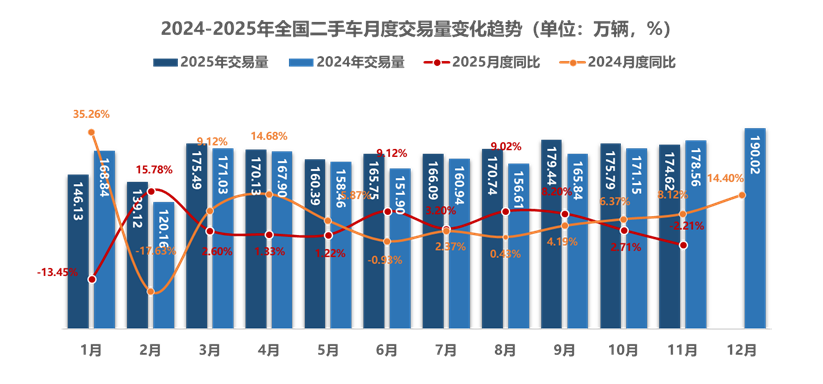

The Zhitong Finance App learned that on December 10, the China Automobile Dealers Association released a brief analysis of the used car market in November 2025. In November 2025, the volume of transactions in the national used car market was 1,746,200 vehicles, down 0.67% from the previous month and 2.21% from the previous year, with a transaction amount of 111,936 billion yuan. From January to November 2025, the cumulative transaction volume of used cars was 18.236,900 units, up 2.95% year on year. Compared with the same period, an increase of 522,900 units was added, and the cumulative transaction amount was 116.118 billion yuan.

This year, the used car market did not continue its strong sales inertia after the “Golden Nine and Silver Ten”; instead, it turned cold. Trade-in subsidy policies have come to an end in various regions. Consumers are uncertain about policy trends and price trends, have a strong wait-and-see mentality, and are slow to make car purchase decisions. At the same time, the new car market is sprinting to sales targets at the end of the year, and price reduction promotions are frequent, putting pressure on the used car market, and the pressure trend is obvious. The market entered a phased adjustment, and both monthly month-on-month and year-over-year data showed a downward trend. The used car managers' index for November was 46.3%, down 1.5 percentage points from the previous month, which also showed that market sentiment continued to be in a sluggish range.

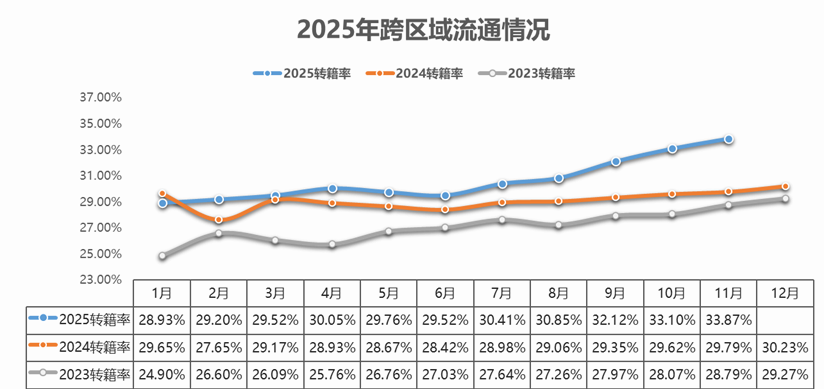

The characteristics of the used car market this month were remarkable: the cross-regional circulation ratio reached 33.87%, an increase of 4 percentage points over the previous year, relieving local dealer inventory pressure; in terms of price, the average price of used cars was 64,100 yuan in November, and the sales price increased slightly by 10,000 yuan over the previous month; the inventory cycle was 45 days shorter, one day shorter than the previous month, and circulation efficiency improved slightly. It also reflects subtle changes in market supply and demand and pricing strategies.

Looking ahead to December, as the end month of the year, the end effect of the policy will be compounded with the peak sales season at the end of the year. Some consumers may seize the policy dividend period to buy cars, and the peak spending season at the end of the year will also stimulate the release of potential demand. It is expected that the used car market will increase markedly in December and usher in a slight recovery from month to month. However, market recovery is not without challenges. Businesses need to pay close attention to market trends, adjust inventory structures reasonably according to market demand and competitive trends to avoid inventory backlogs or shortages; at the same time, optimize pricing strategies and accurately price according to factors such as vehicle conditions and market conditions, so as to seize opportunities in the recovering market and achieve steady operation.

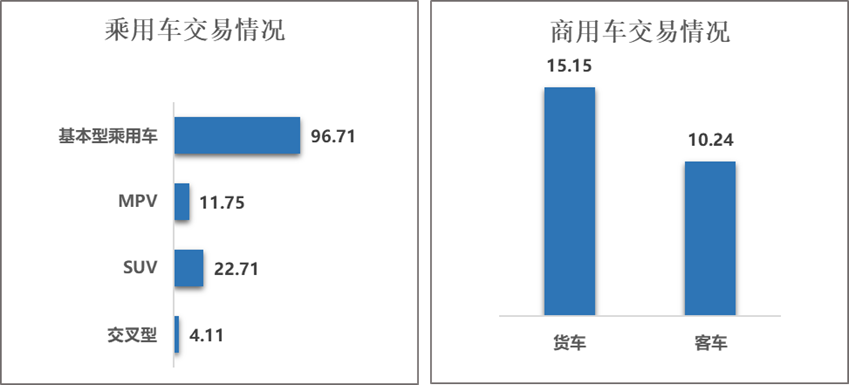

Passenger car situation: In November, 9671,000 basic passenger cars were traded, down 0.25% from the previous year, down 5.07%; the total number of SUVs traded, down 0.42% from the previous month, down 6.37% from the previous year; and 117,500 MPVs were traded, down 2.25% from the previous year, up 2.79% year on year.

Commercial vehicle situation: A total of 102,400 buses were traded, up 0.39% from the previous month, up 4.40% year on year; 151,500 trucks, down 1.18% from month to month, up 4.50% year on year.

In November, the used car market continued its pattern of differentiation by model structure, with significant differences in trends between passenger cars and commercial vehicles. Among them, the scale of basic passenger car transactions shrank slightly, showing a moderate decline month-on-month and year-on-year; sales volume of SUV models declined simultaneously, slightly expanding from the previous month but remained stable overall; demand in the MPV model market showed resilience, bucking the trend and achieving positive year-on-year growth under overall pressure; and cross-type passenger vehicle trading activity declined, showing a downward trend from month to month. In terms of the commercial vehicle market, the overall performance was superior to the same period last year. Both bus and truck transactions achieved positive year-on-year growth, and overall market activity further increased.

In January-November, a total of 14.294 million passenger cars were traded, an increase of 0.97% over the previous year. Among them: 10.232,200 basic passenger cars were traded, up 0.15% year on year; total SUV sales were 2.3976 million units, up 0.49% year on year; total MPV units were traded, up 7.55% year on year; total number of MPVs were traded, up 7.55% year on year; and 452,900 passenger cars were traded, up 6.05% year on year.

A total of 2.598,200 commercial vehicles were traded, an increase of 7.80% over the previous year. Among them: 1,558,200 trucks were traded, up 9.15% year on year; 1.04 million buses were traded, up 5.83% year on year.

From January to November, the overall used car market continued its steady development trend, and the performance differentiation between different model structures became more prominent. In the passenger car sector, the basic passenger car market has maintained moderate growth, showing stable market demand; the volume of transactions of SUV models has maintained a slight increase, and market vitality continues; MPV models have performed particularly well, and the growth rate is significantly ahead of other segments; and cross-type passenger cars have also shown a clear growth trend, and market acceptance has increased.

In the commercial vehicle sector, market growth is mainly led by strong trucks, and its growth rate is quite impressive, becoming the core force driving the overall upward trend of the commercial vehicle market; at the same time, the bus market has continued to grow at a steady pace.

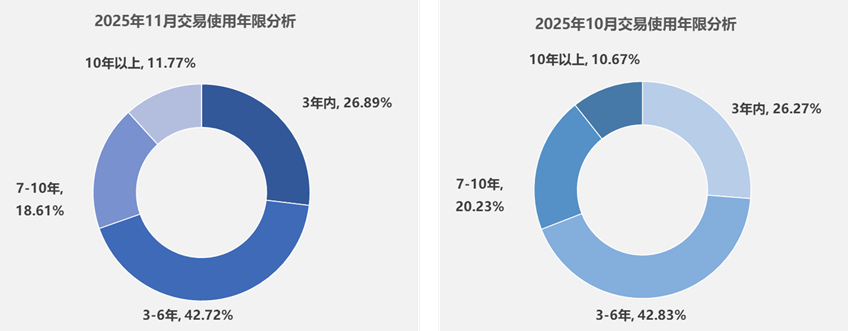

In November, used cars with a lifespan of 3-6 years accounted for the largest share of transactions, accounting for 42.72%, down 0.11% from the same period last year; models with a usage period of 3 years accounted for 26.89%, up 0.63% from the same period last year, up 0.28% from the same period last year; models with 7-10 years of age accounted for 18.61%, down 1.61% month-on-month, up 2.59% from the same period last year; the proportion of models over 10 years old was 11.77%, up 1.10% month-on-month, up 4.25% from the same period last year.

In the November used car trade, vehicles with a lifespan of 3-6 years still dominated the transaction, but both showed a downward trend; used cars with a lifespan of less than 3 years increased month-on-month, and there was also a slight increase compared to the same period last year; used cars aged 7-10 years showed a month-on-month decline, but continued to grow compared to the same period last year; used cars over 10 years old increased month-on-month, and the year-on-year data also showed an upward trend.

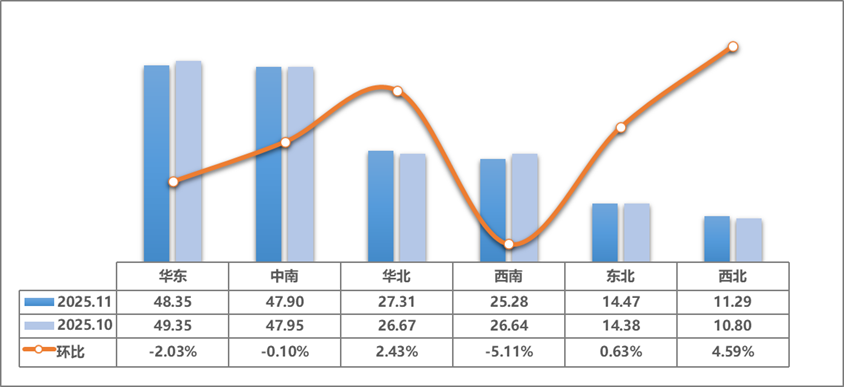

Used car transactions in the six major regions in November 2025

In November 2025, the overall transaction volume of the national used car market continued to decline slightly. Judging from the market performance in the six regions, the trading volume of East China, Central South China, and Southwest China all declined to varying degrees from month to month. However, trading volumes in North China, Northeast China, and Northwest China all achieved varying degrees of growth compared to the previous month.

Specifically, the volume of used car transactions in East China was 483,500 units, down 2.03% from the previous month, and the transaction volume decreased by 10,000 units compared to the previous month. In East China this month, used car transactions in Jiangxi and Shandong provinces showed a slight upward trend, while the rest of the provinces experienced varying degrees of decline in transaction volume. Among them, the decline in trading volume in Shanghai was particularly significant, with a month-on-month decline of 11.3%. The two provinces of Zhejiang and Anhui decreased by 7.3% and 6.4%, respectively, from the previous month. Both Jiangsu and Fujian provinces also showed a downward trend this month, with declines of 5.5% and 4.6%, respectively. However, it is worth noting that the markets in Shandong and Jiangxi provinces picked up slightly this month, with trading volume increasing by 7.2% and 1.6%, respectively.

The volume of used car transactions in the central and southern regions was 479 million units, down 0.1% from the previous month, and the transaction volume decreased by 0.05 million units compared to the previous month. Judging from the distribution of provinces, the three provinces of Guangdong, Guangxi and Hainan showed slightly sluggish performance in the used car market this month, with transaction volumes falling 2.7%, 3%, and 7.3%, respectively. In contrast, the three provinces of Henan, Hubei, and Hunan showed a recovery trend. In particular, in Hubei Province, the volume of used car transactions increased significantly from month to month, reaching 8.7%; the two provinces of Henan and Hunan achieved increases of 3.4% and 4.4%, respectively.

The volume of used car transactions in North China was 273,300 units, up 2.43% from the previous month, and the transaction volume increased by 0.65 million units compared to the previous month. Judging from the sub-regional market performance, there is a clear recovery trend in the used car market in Beijing and Inner Mongolia. Among them, Beijing's trading volume increased 9.1% month-on-month, while Inner Mongolia followed, with 8.8% growth; the Tianjin and Hebei markets maintained steady growth, with transaction volumes rising slightly by 1.9% and 2% month-on-month, respectively. In contrast, the Shanxi market continued to decline this month, with trading volume falling 6.6% month-on-month.

The volume of used car transactions in the southwest region was 252,800 units, down 5.11% from the previous month, and 13,600 units less than the previous month. Looking at each region, the Chongqing market performed well this month, with a slight increase in used car trading volume; while the four provinces of Sichuan, Guizhou, Yunnan, and Tibet all saw varying degrees of decline. The decline in the Yunnan market was the most prominent this month, with a drop of nearly 10%; trading volume in Sichuan and Guizhou fell 5.6% and 6.4% respectively; trading volume in the Tibet market also declined slightly, by 4.5%.

The Tohoku region traded a total of 144,700 vehicles this month, up 0.63% from the previous month, and the transaction volume increased by 0.09,000 vehicles compared to the previous month. This month, the market performance in Jilin Province was particularly impressive, with a significant increase of 8.5% compared to the previous month; while in Liaoning Province and Heilongjiang Province, there was a slight decline, with trading volume falling 2.1% and 3.4%, respectively.

A total of 112,900 vehicles were traded in the northwest region, up 4.59% from the previous month, and the transaction volume increased by 50,000 vehicles over the previous month. This month, the markets of Xinjiang and Ningxia rebounded. The Xinjiang market grew rapidly, with trading volume up 12.5% month-on-month; Ningxia market trading volume increased 1.6%; and the Shaanxi, Gansu and Qinghai markets continued to maintain a downward trend this month, with trading volumes falling 1.5%, 4.7%, and 5.2%, respectively.

In November, the used car transfer rate was 33.87%, up 0.8 percentage points from the previous month and 4.1 percentage points from the same period last year. The total number of used car transfers was 591,500, an increase of 1.65% over the previous year, and an increase of 11.19% over the same period last year.