Assessing Boston Properties (BXP) Valuation After a Recent Three-Month Share Price Slide

BXP (BXP) has been sliding over the past 3 months, and that drawdown is starting to raise more valuation questions than panic. With shares down roughly 7%, investors are reassessing long term expectations.

See our latest analysis for BXP.

Zooming out, that 3 month slide sits within a choppy year, with the share price now at $68.98 and a muted year to date share price return versus a still respectable 3 year total shareholder return of 21.08%, suggesting momentum in BXP has cooled even as longer term holders remain ahead.

If BXP’s recent pullback has you rethinking your options, this could be a good moment to explore fast growing stocks with high insider ownership for other compelling ideas on your radar.

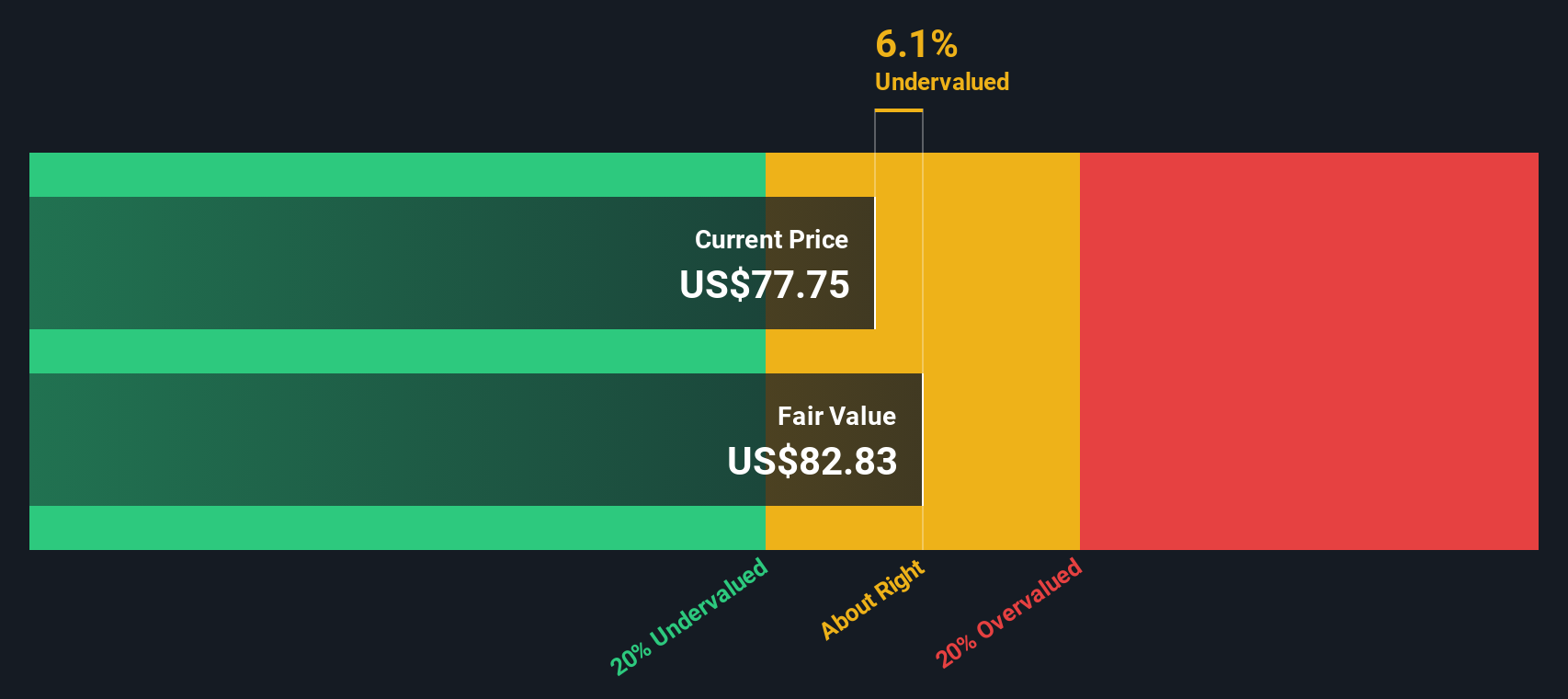

With the stock now trading at a notable discount to both analyst targets and intrinsic value estimates, despite solid multi year total returns, investors face a key question: is BXP undervalued here, or is the market already pricing in its future growth?

Most Popular Narrative: 13.6% Undervalued

With BXP closing at $68.98 against a most popular narrative fair value of $79.80, the gap reflects expectations for stronger future earnings power.

The company's investment in highly amenitized, sustainable, and green-certified developments (e.g., 343 Madison), supported by strong pre-leasing to blue-chip, investment-grade tenants, directly benefits from tenant ESG priorities, enabling BXP to achieve outsized rent growth and robust development yields, thereby enhancing long-term revenue and net margin profiles.

Want to see what kind of rent growth, margin lift, and earnings multiple are baked into that view? The narrative lays out bold, specific targets.

Result: Fair Value of $79.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside hinges on BXP overcoming softer leasing trends and managing capital allocation risks around large projects like 343 Madison, which could strain returns.

Find out about the key risks to this BXP narrative.

Another Lens on Value

Our SWS DCF model paints an even stronger upside than the narrative fair value, suggesting BXP is trading at a deeper discount to its long term cash flow potential. If both methods point to value, is the risk really in owning the stock or in staying on the sidelines?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own BXP Narrative

If this perspective does not quite match your own or you prefer digging into the numbers yourself, you can build a personalized narrative in just a few minutes, Do it your way.

A great starting point for your BXP research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you are serious about sharpening your portfolio, do not stop at BXP. Use the Simply Wall Street Screener to uncover your next edge before others react.

- Capture growth potential at the ground floor by reviewing these 3592 penny stocks with strong financials with strong balance sheets and business quality often overlooked by the broader market.

- Strengthen your future focused exposure through these 27 AI penny stocks that are building real products, real revenue, and durable advantages in artificial intelligence.

- Lock in resilient income streams by evaluating these 15 dividend stocks with yields > 3% that combine attractive yields with sustainable payout ratios and defensible cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com