Does Hess Midstream’s Cash Flow Strength Signal More Upside After Recent Share Price Rebound?

- If you have been wondering whether Hess Midstream is quietly undervalued or already priced for perfection, you are not alone. This stock often flies under the radar despite some compelling numbers.

- After climbing 1.7% over the last week and 3.3% in the last month, the stock is still down 7.6% year to date, though it is up 4.2% over 1 year, 48.1% over 3 years, and 137.3% over 5 years. This profile points to both resilience and shifting risk perceptions.

- Recent headlines have focused on Hess Midstream's long term contracts, dropdown potential, and its role in supporting Bakken production growth. These themes help explain why investors have at times been willing to look past short term price dips. At the same time, the company has drawn attention for its relatively stable fee based model in a volatile energy landscape, which supports the view that its cash flows may be more durable than its share price sometimes suggests.

- Right now, Hess Midstream scores a 4/6 on our valuation checks, meaning it screens as undervalued on four key measures. We will start by walking through the usual valuation approaches, then finish with a more holistic way to judge whether the current price reflects the underlying story.

Find out why Hess Midstream's 4.2% return over the last year is lagging behind its peers.

Approach 1: Hess Midstream Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth by projecting the cash it can generate in the future and discounting those cash flows back to today. For Hess Midstream, the model used is a 2 stage Free Cash Flow to Equity approach, based on cash flows available to shareholders.

The company generated about $709.1 Million in free cash flow over the last twelve months, and analysts expect this to remain robust, with projections such as roughly $798.8 Million in 2026. Further out, Simply Wall St extrapolates these estimates, with free cash flow in 2035 projected at around $764.4 Million, still firmly in positive territory.

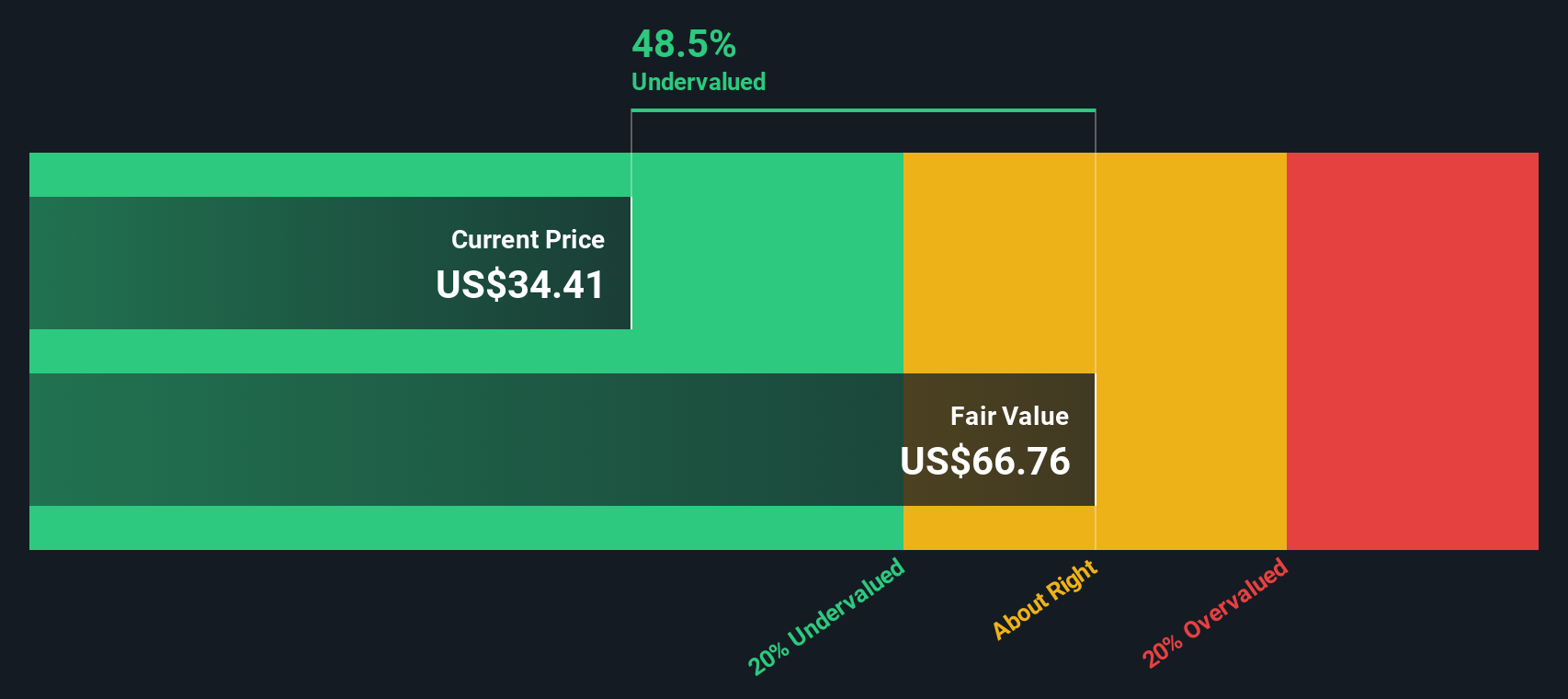

When these future cash flows are discounted back to today, the model arrives at an intrinsic value of about $74.22 per share. Compared with the current share price, this implies the stock trades at roughly a 53.2% discount, which suggests the market may be underestimating the durability of Hess Midstream's cash generation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Hess Midstream is undervalued by 53.2%. Track this in your watchlist or portfolio, or discover 896 more undervalued stocks based on cash flows.

Approach 2: Hess Midstream Price vs Earnings

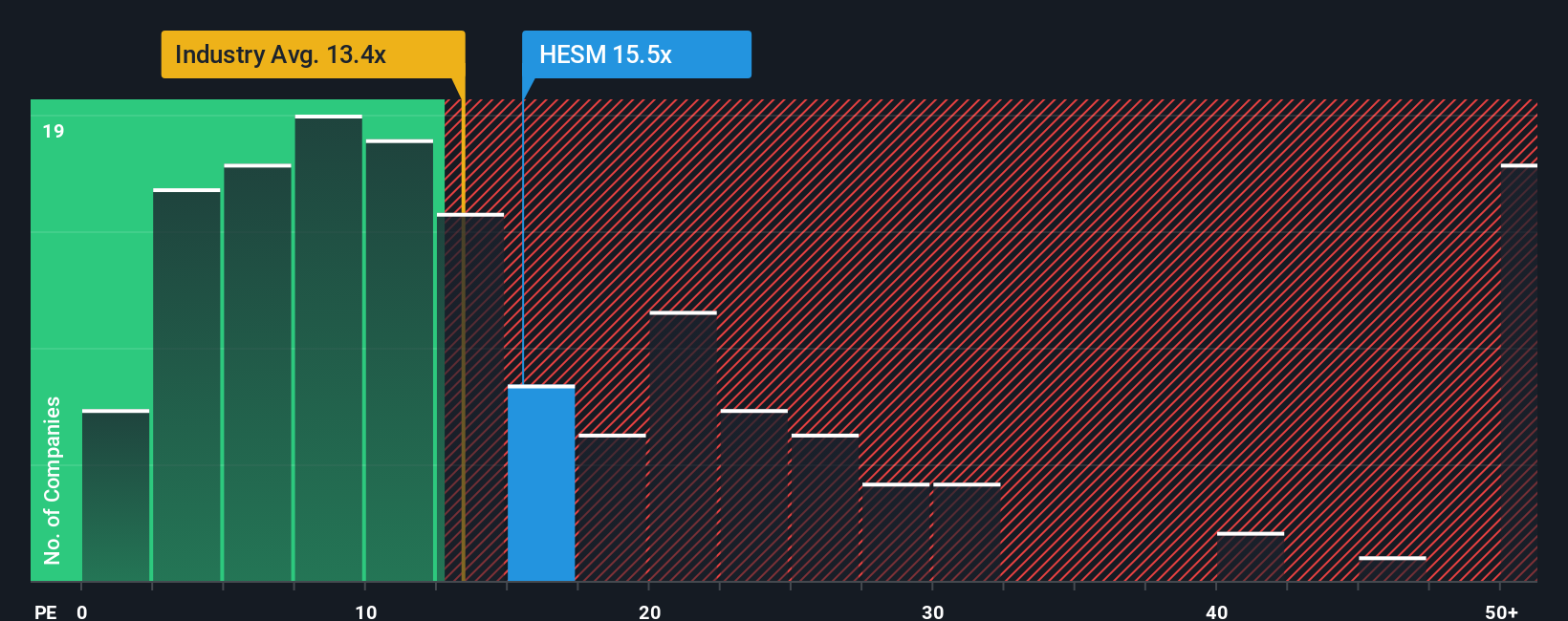

For profitable companies like Hess Midstream, the price to earnings ratio is a useful shortcut for gauging how much investors are willing to pay today for each dollar of current earnings. In simple terms, faster growing and less risky businesses usually deserve a higher PE, while slower or riskier ones typically trade on lower multiples.

Hess Midstream currently trades on a PE of about 13.6x, which is roughly in line with the broader Oil and Gas industry average of around 13.5x, but well below the 41.3x average of its peer group. On the surface, that could imply the market is assigning a discount despite similar near term fundamentals. However, peers and industries can be skewed by outliers, so these comparisons only tell part of the story.

Simply Wall St addresses this with its Fair Ratio, an estimate of what a stock’s PE ought to be after adjusting for factors such as earnings growth, risk profile, profit margins, size, and industry. For Hess Midstream, this Fair Ratio is about 19.6x, comfortably above its current 13.6x. That gap suggests the market is pricing the company more conservatively than its fundamentals might warrant. This points to potential upside if earnings and risk trends remain similar.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1450 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Hess Midstream Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple tool on Simply Wall St’s Community page that lets you attach a clear story, your assumptions for Hess Midstream’s future revenue, earnings and margins, and a resulting fair value estimate to the raw numbers, so you can see how the company’s story, your forecast, and today’s price all connect. Narratives can help you structure your thinking by comparing your Fair Value to the current market price, and they update dynamically as new news, guidance, or earnings arrive, so your view stays current without you rebuilding a model from scratch. For example, one Hess Midstream Narrative on the platform might see slower Bakken activity and ESG pressures limiting growth and arrive at a fair value close to about $36.86. Another more optimistic Narrative could focus on long term contracts, rising dividends and resilient fee based volumes to justify a meaningfully higher fair value. The difference between those two perspectives is made transparent, comparable, and easy to adjust in a few clicks.

Do you think there's more to the story for Hess Midstream? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com