Is There Still Upside in Travelers After Its Strong Multi Year Share Price Rally?

- If you are wondering whether Travelers Companies is still worth considering after such a strong run, or if most of the upside is already priced in, this breakdown can help you assess whether the current share price matches the underlying value.

- The stock has cooled slightly in the short term, slipping 1.8% over the last week and 1.1% over the past month. It is still up 15.9% year to date and 124.6% over five years, which reflects a business that has steadily rewarded patient shareholders.

- Recent market attention has centered on Travelers position as a high-quality property and casualty insurer with disciplined underwriting and a strong balance sheet. This has become more prominent as investors reassess which insurers can navigate higher catastrophe risks and evolving reinsurance costs. Broader sector commentary around insurance pricing cycles and resilience in commercial lines has also kept Travelers on the radar of investors who are looking for defensive, cash-generative names.

- On our framework, Travelers earns a valuation score of 4/6, which suggests it screens as undervalued on most, but not all, of our checks. Next we will walk through different valuation approaches to see what is driving that score and to introduce a more insightful way to think about its true worth by the end of the article.

Approach 1: Travelers Companies Excess Returns Analysis

The Excess Returns model looks at how effectively Travelers Companies turns shareholder capital into profits above its cost of equity, then capitalizes those surplus returns into an intrinsic value per share.

For Travelers, the starting point is a Book Value of $141.74 per share and a Stable EPS of $28.35 per share, based on weighted future Return on Equity estimates from 13 analysts. With an Average Return on Equity of 17.12% and a Cost of Equity of $11.52 per share, the company is expected to generate an Excess Return of $16.83 per share, a healthy spread that suggests it can keep compounding value for shareholders.

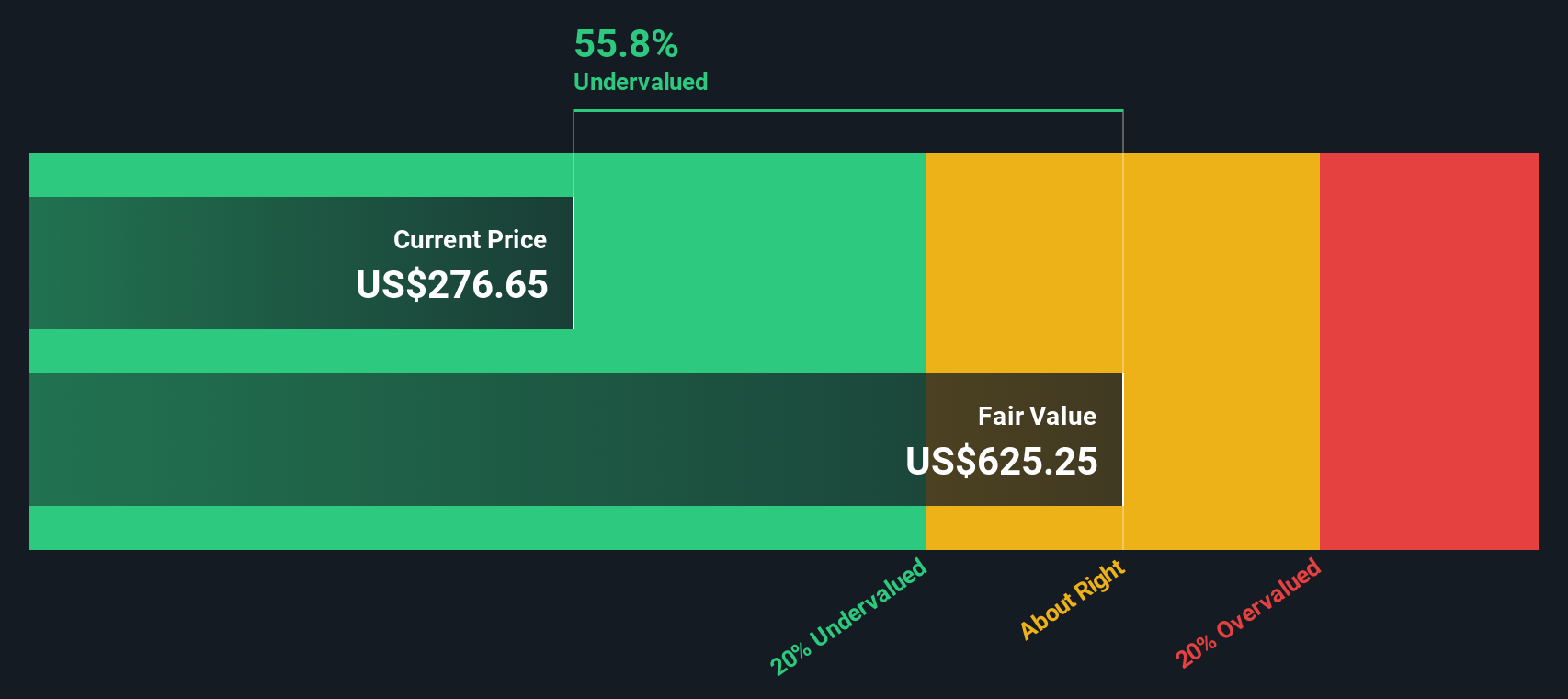

The model also uses a Stable Book Value of $165.63 per share, sourced from future book value estimates by 12 analysts, to gauge how this excess profitability scales over time. Combining these inputs, the Excess Returns valuation implies an intrinsic value that is roughly 55.0% above the current share price, indicating the shares are materially undervalued on this framework.

Result: UNDERVALUED

Our Excess Returns analysis suggests Travelers Companies is undervalued by 55.0%. Track this in your watchlist or portfolio, or discover 896 more undervalued stocks based on cash flows.

Approach 2: Travelers Companies Price vs Earnings

The price to earnings ratio is a useful way to value a profitable insurer like Travelers because it directly links what investors pay for the stock to the earnings the business generates each year. In general, companies with stronger and more reliable earnings growth, and lower perceived risk, are often associated with higher PE multiples, while slower growing or riskier names tend to trade on lower multiples.

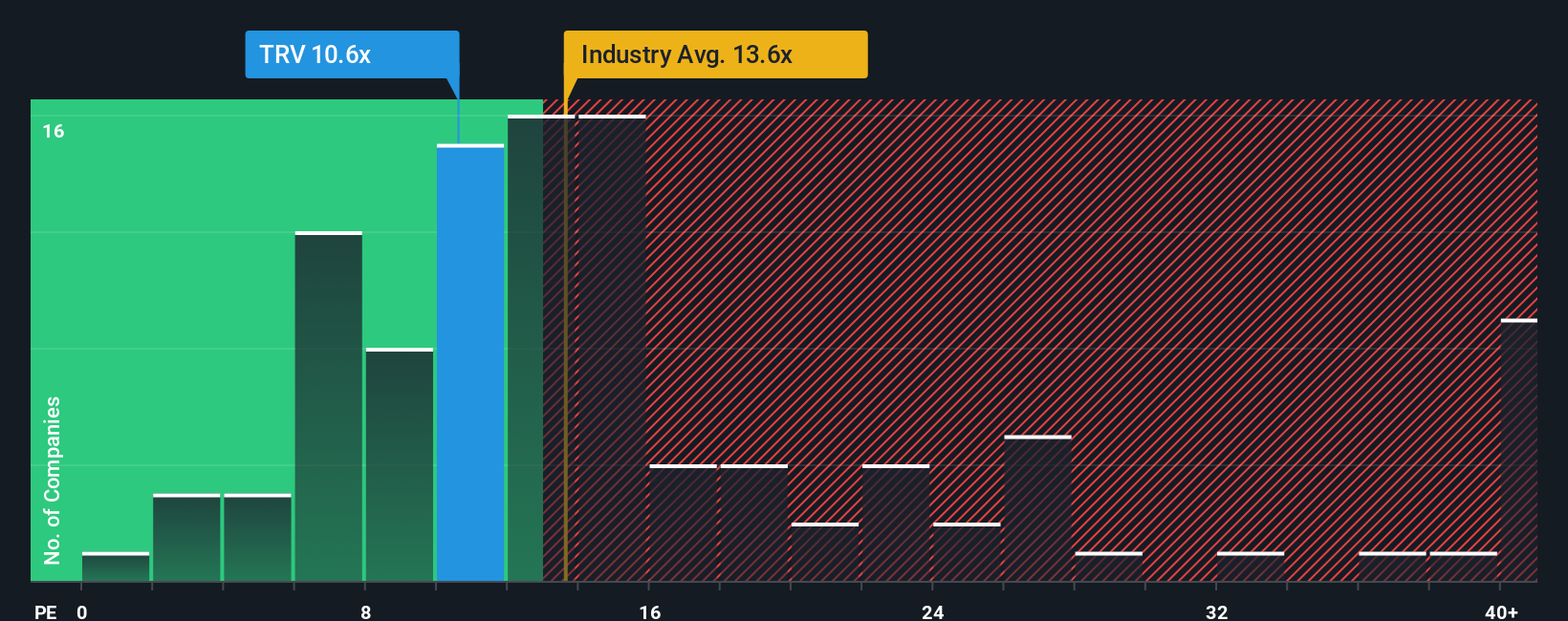

Travelers currently trades on a PE of 10.68x, which is broadly in line with its peer group at 10.55x, but below the wider Insurance industry average of 13.04x. This indicates that the market is valuing Travelers slightly more conservatively than the typical insurer, based on these ratios.

Simply Wall St’s Fair Ratio for Travelers is 12.23x, a proprietary estimate of what its PE could be once you factor in company specific drivers like earnings growth prospects, margins, risk profile, industry positioning and market cap. Because this metric adjusts for those fundamentals, it may provide more insight than a simple comparison with peers or industry averages. With the Fair Ratio sitting above the current 10.68x, the multiple based view points to the shares potentially being modestly undervalued.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1450 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Travelers Companies Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, which are simple, story driven forecasts you can build and explore on Simply Wall St’s Community page, used by millions of investors. Narratives connect your view of a company’s future revenue, earnings, and margins to a financial model, a fair value estimate, and ultimately to clear buy or sell signals, as that fair value is compared with the current share price. All of this updates dynamically as new news or earnings arrive. For Travelers Companies, one investor might create a bullish Narrative anchored on continued underwriting strength, resilient demand for specialty and cyber lines, and a fair value around the top analyst target of $320. Another investor might build a more cautious Narrative that assumes softer pricing, rising catastrophe losses, and a fair value closer to the low target of $233. This gives you an intuitive way to see how different stories, assumptions, and risk views translate directly into numbers and decisions.

Do you think there's more to the story for Travelers Companies? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com