Reassessing BKV’s Valuation as Analyst Upgrades and Earnings Momentum Drive Strong Outperformance

Recent analyst upgrades and rising full year earnings estimates have pushed BKV (BKV) into the spotlight, combining a strong Zacks ranking with sector beating returns that have investors reassessing the stock.

See our latest analysis for BKV.

That optimism is clearly showing up in the tape, with a 31.3% 3 month share price return and 32.5% 1 year total shareholder return at a recent share price of $29.07. This points to still building momentum after the follow on equity deal.

If BKV has you rethinking your energy exposure, it might be worth seeing what else is moving and exploring aerospace and defense stocks as another hunting ground for ideas.

With earnings estimates climbing, a fresh capital raise behind it and the share price hugging 52 week highs, is BKV still trading at a discount to its potential, or are investors already paying up for future growth?

Price to earnings of 63.2x: Is it justified?

On a headline basis, BKV’s last close of $29.07 embeds a rich price to earnings multiple of 63.2 times that screens as stretched versus peers.

The price to earnings ratio compares what investors pay today to each dollar of current earnings, a key lens for a recently profitable energy producer. With earnings only just turning positive and forecast to grow rapidly, the market appears to be front loading a lot of that optimism into today’s price.

However, that optimism carries a steep premium. BKV’s 63.2 times price to earnings ratio towers over the US Oil and Gas industry average of 13.5 times, and also stands well above an estimated fair price to earnings ratio of 27.5 times that the market could ultimately gravitate toward if expectations cool or fundamentals simply grow into a lower multiple.

Explore the SWS fair ratio for BKV

Result: Price to earnings of 63.2x (OVERVALUED)

However, any setback in aggressive earnings growth, or a reversal in gas pricing, could quickly challenge the premium multiple investors now accept.

Find out about the key risks to this BKV narrative.

Another way to look at value

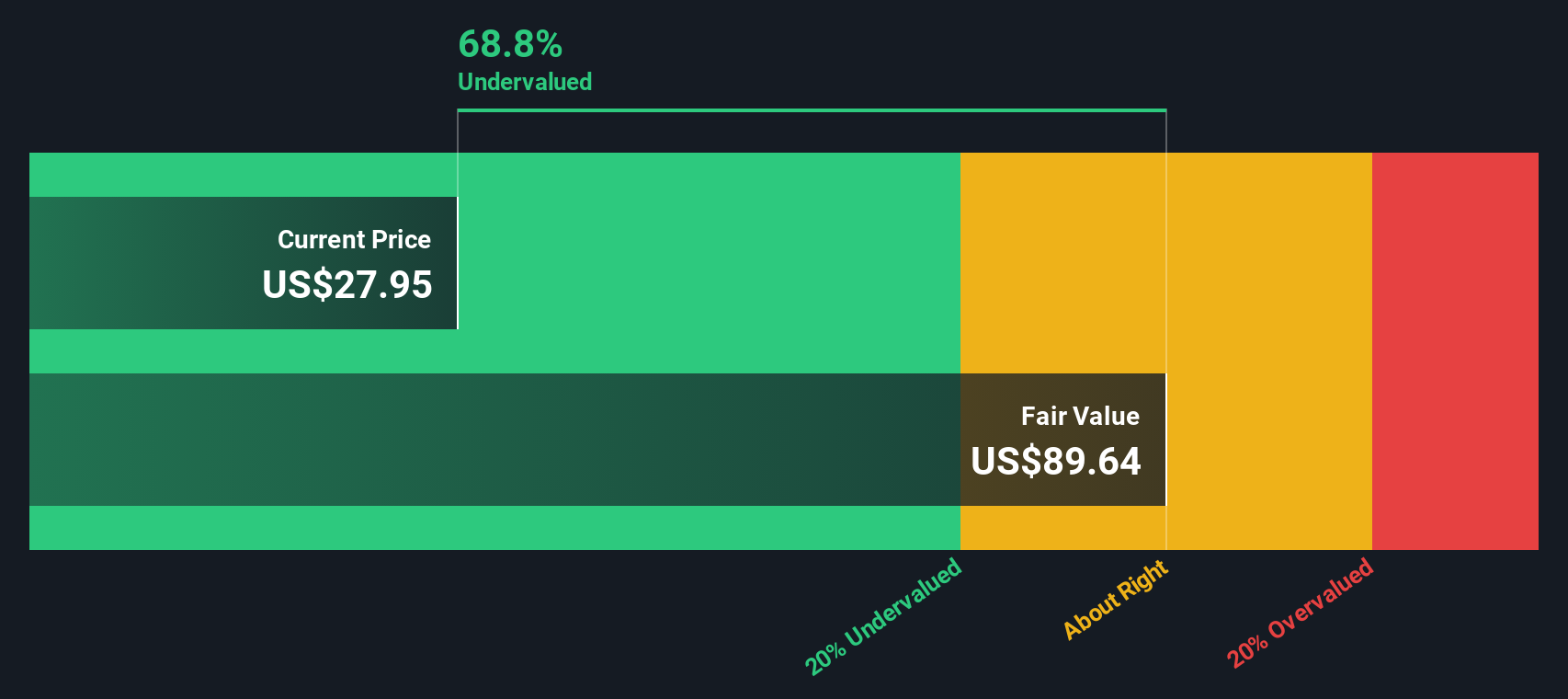

While the 63.2 times price to earnings ratio suggests an expensive valuation, our DCF model presents a very different picture and indicates fair value closer to $83.24 per share. If both are correct, investors may be underestimating how quickly cash flows could catch up.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out BKV for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 896 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own BKV Narrative

If you want to dig into the numbers yourself and challenge these conclusions, you can build a bespoke view of BKV in just minutes using Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding BKV.

Looking for more investment ideas?

Before you move on, explore your next potential move by scanning targeted stock ideas on Simply Wall St, where data and strategy work together.

- Explore potential opportunities with these 3591 penny stocks with strong financials that already show the financial characteristics many small caps lack.

- Position your portfolio within the AI theme by reviewing these 27 AI penny stocks that are involved in emerging technology trends.

- Review potential value opportunities by focusing on these 896 undervalued stocks based on cash flows where cash flows indicate the market may not fully reflect fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com