European Dividend Stocks To Consider: KBC Group And Two More

As European markets experience mixed returns amid hopes for interest rate cuts in the U.S. and UK, investors are closely watching economic indicators such as inflation and GDP growth to gauge future opportunities. In this environment, dividend stocks like KBC Group can offer a measure of stability and income potential, making them an attractive consideration for those looking to navigate current market conditions with a focus on reliable returns.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.28% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.61% | ★★★★★★ |

| Swiss Re (SWX:SREN) | 4.62% | ★★★★★☆ |

| Holcim (SWX:HOLN) | 4.11% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.84% | ★★★★★★ |

| Evolution (OM:EVO) | 4.78% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.22% | ★★★★★★ |

| Credito Emiliano (BIT:CE) | 5.11% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.46% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.42% | ★★★★★★ |

Click here to see the full list of 206 stocks from our Top European Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

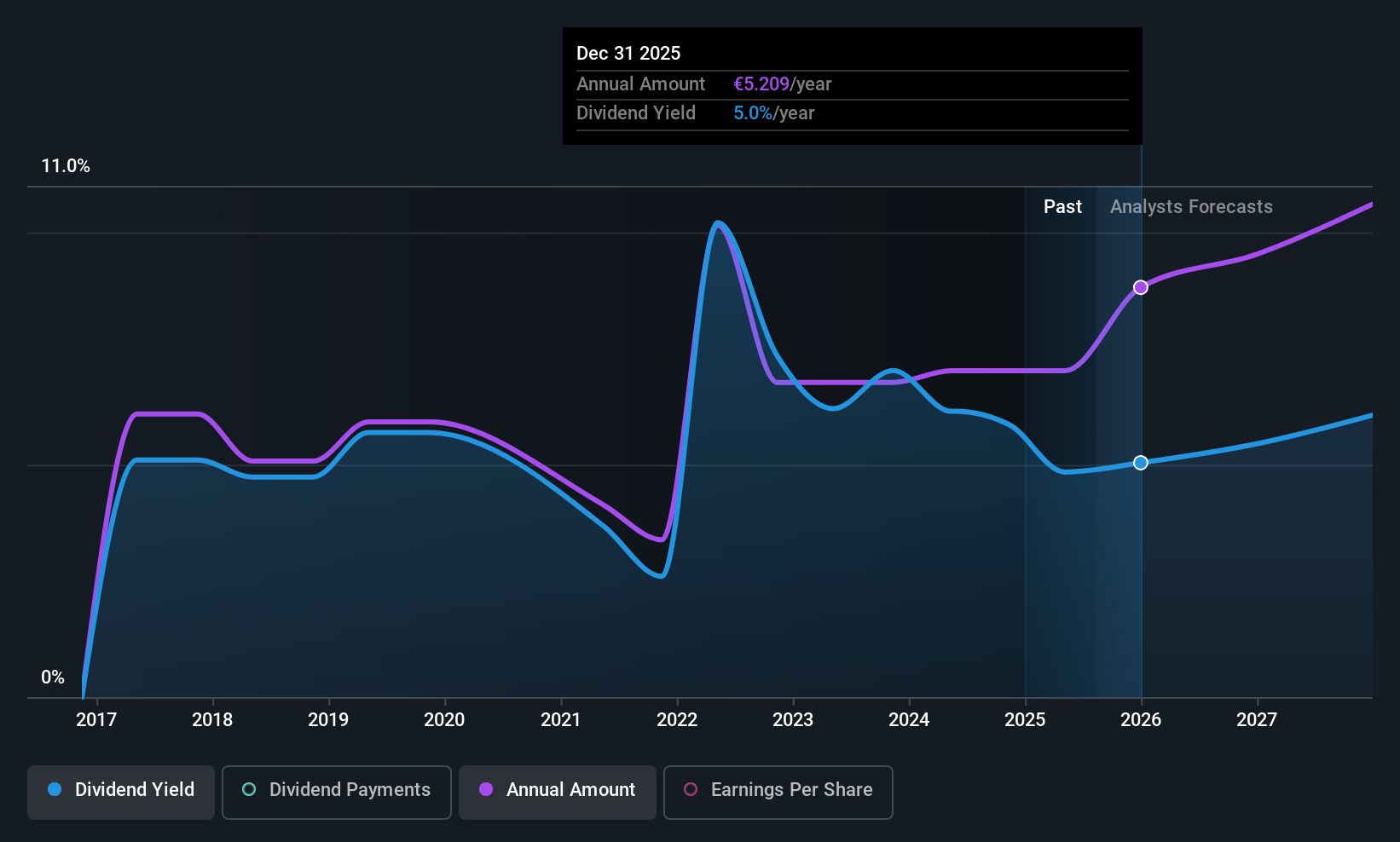

KBC Group (ENXTBR:KBC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: KBC Group NV offers banking, insurance, and asset management services to retail, private banking, small and medium-sized enterprises, and mid-cap clients across Belgium, Bulgaria, the Czech Republic, Hungary, and Slovakia with a market cap of €42.93 billion.

Operations: KBC Group's revenue is derived from several segments, including €6.87 billion from the Belgium Business, €2.49 billion from the Czech Republic Business, and contributions of €1.15 billion, €857 million, and €512 million from its operations in Hungary, Bulgaria, and Slovakia respectively.

Dividend Yield: 3.8%

KBC Group's dividend payments have been volatile and unreliable over the past decade, despite recent earnings growth of €1 billion in Q3 2025. The current payout ratio of 46.1% indicates dividends are covered by earnings, with future coverage expected at 63.7%. However, the dividend yield of 3.83% is low compared to top Belgian payers at 6.78%. KBC is exploring acquisitions like Ethias NV to bolster its strategic position in Europe.

- Unlock comprehensive insights into our analysis of KBC Group stock in this dividend report.

- Our expertly prepared valuation report KBC Group implies its share price may be lower than expected.

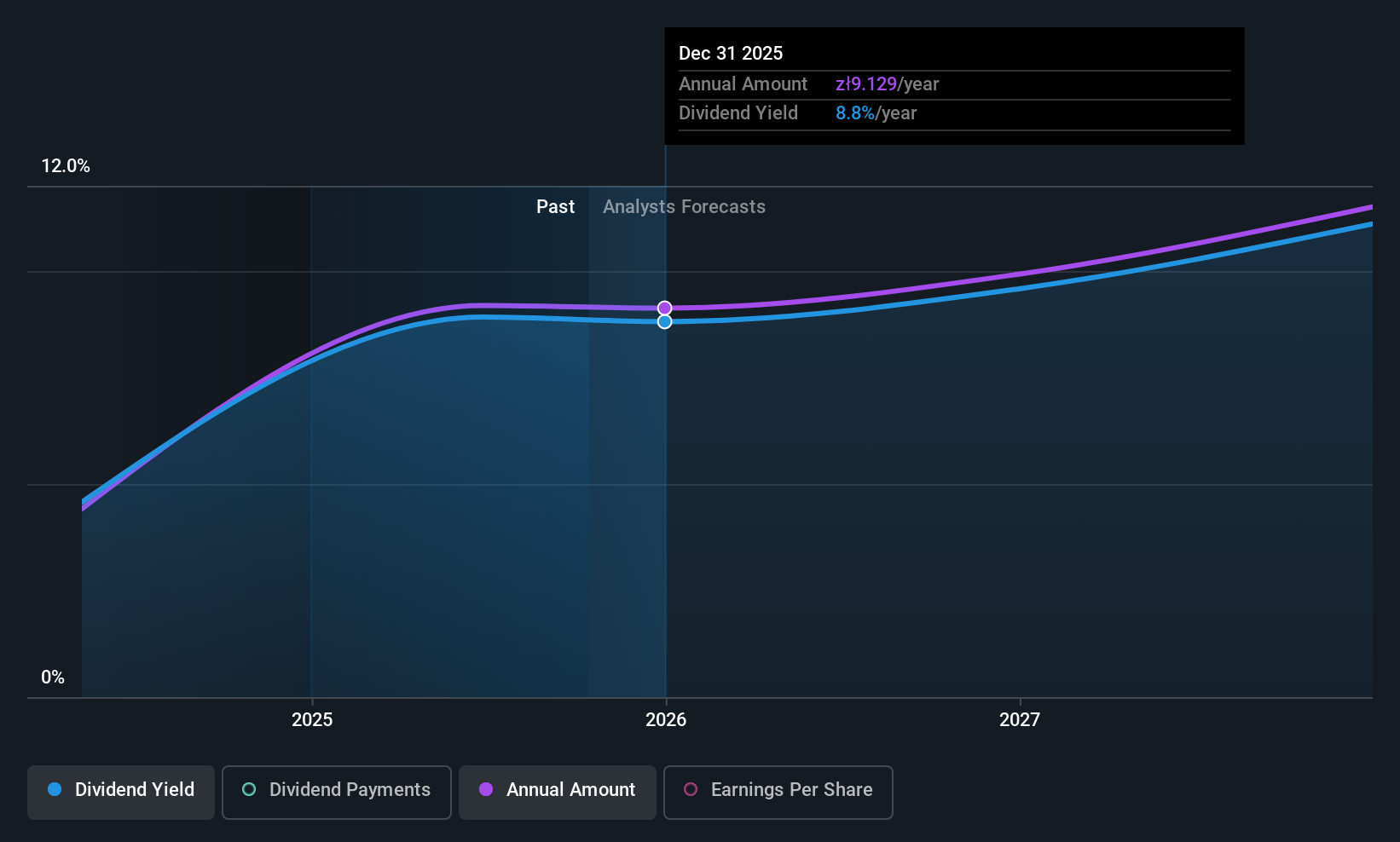

Alior Bank (WSE:ALR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Alior Bank S.A. is a Polish financial institution offering a range of banking products and services to individuals, businesses, and enterprises, with a market capitalization of PLN13.81 billion.

Operations: Alior Bank S.A. generates its revenue from segments including Treasury (PLN891.36 million), Retail Customers (PLN3.20 billion), and Business Customers (PLN1.60 billion).

Dividend Yield: 8.7%

Alior Bank's dividend yield is among the top 25% in Poland, supported by a reasonable payout ratio of 52.3%, though it has only paid dividends for two years. Despite its high level of bad loans at 5.9%, the bank trades at a significant discount to fair value, enhancing its attractiveness. Recent earnings showed a decline in net income and interest income compared to last year, which may impact future dividend sustainability despite current coverage forecasts.

- Click here to discover the nuances of Alior Bank with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Alior Bank's share price might be too pessimistic.

OVB Holding (XTRA:O4B)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: OVB Holding AG, with a market cap of €277.90 million, operates through its subsidiaries to offer advisory and brokerage services to private households across Europe.

Operations: OVB Holding AG generates revenue primarily from its insurance brokerage segment, which accounted for €439.65 million.

Dividend Yield: 5.1%

OVB Holding's dividend yield is in the top 25% of German payers, though its high payout ratio of 124.4% indicates dividends are not well covered by earnings. Despite stable and growing dividends over the past decade, recent earnings reports show a decrease in net income to €2.61 million for Q3 2025 from €4.09 million last year, raising concerns about sustainability. The stock trades at a discount to fair value but profit margins have declined year-over-year.

- Click to explore a detailed breakdown of our findings in OVB Holding's dividend report.

- Our valuation report unveils the possibility OVB Holding's shares may be trading at a premium.

Seize The Opportunity

- Unlock our comprehensive list of 206 Top European Dividend Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com