Exploring Europe's Undiscovered Gems December 2025

As the European market navigates a landscape of mixed returns, with the STOXX Europe 600 Index inching higher amid hopes for interest rate cuts, investors are keenly observing economic indicators such as the uptick in eurozone inflation and Germany's robust factory orders. In this dynamic environment, identifying promising small-cap stocks involves looking beyond current headlines to uncover companies that demonstrate resilience and potential for growth despite broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| Evergent Investments | 3.63% | 11.51% | 22.05% | ★★★★★☆ |

| KABE Group AB (publ.) | 3.82% | 3.46% | 5.42% | ★★★★★☆ |

| Inmocemento | 28.68% | 4.15% | 33.84% | ★★★★★☆ |

| Inversiones Doalca SOCIMI | 13.10% | 6.72% | 3.11% | ★★★★★☆ |

| Dn Agrar Group | NA | 29.02% | 36.03% | ★★★★★☆ |

| ABG Sundal Collier Holding | 35.58% | -7.59% | -18.30% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| Alantra Partners | 11.36% | -6.39% | -33.69% | ★★★★☆☆ |

| MCH Group | 126.04% | 19.05% | 60.90% | ★★★★☆☆ |

We'll examine a selection from our screener results.

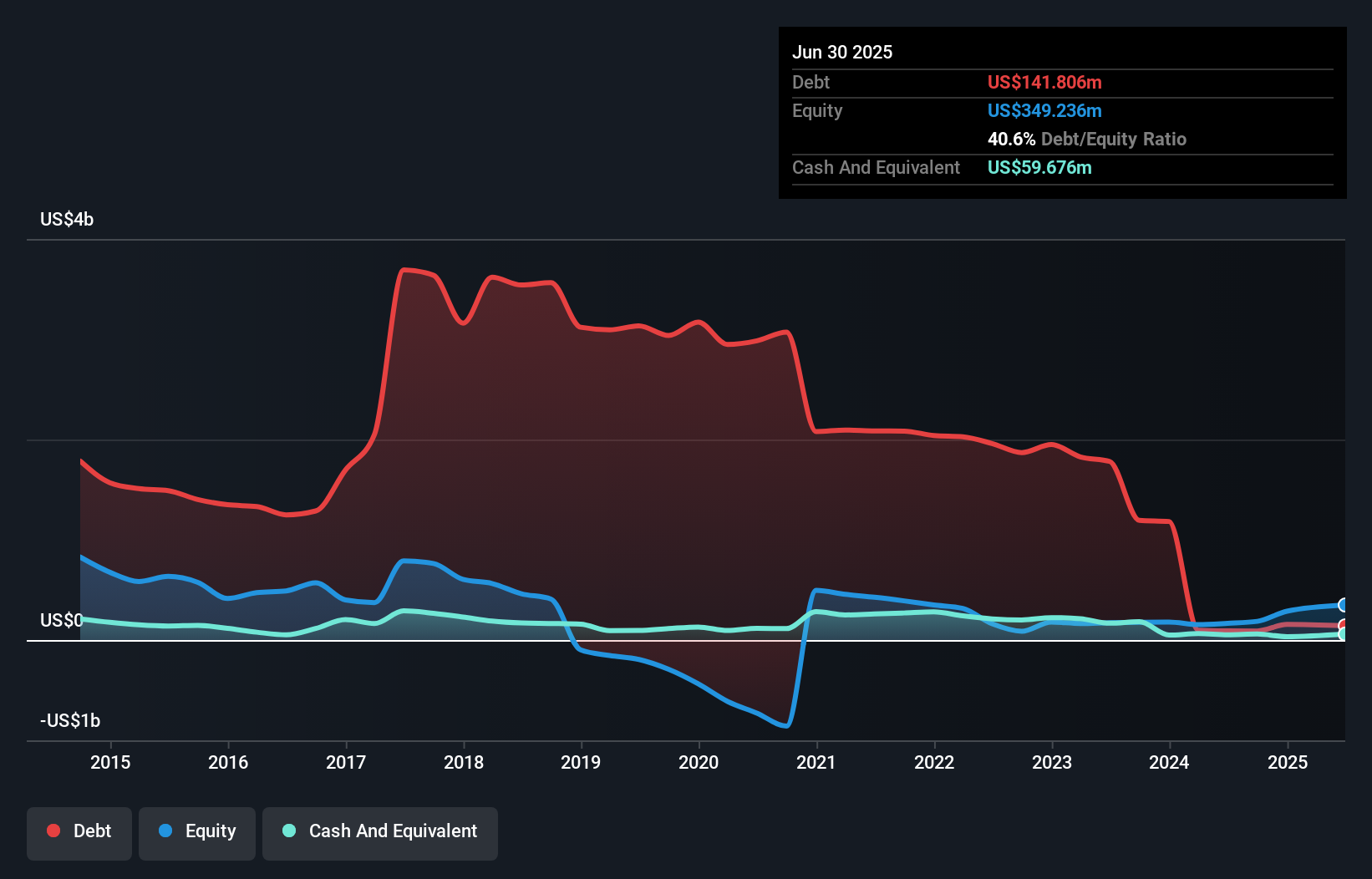

Solstad Offshore (OB:SOFF)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Solstad Offshore ASA is a company that owns and operates offshore service vessels, with a market capitalization of NOK3.47 billion.

Operations: Solstad Offshore generates revenue primarily through the operation of offshore service vessels. The company has a market capitalization of NOK3.47 billion.

Solstad Offshore, a small player in the energy services sector, recently reported a net income of US$26 million for Q3 2025, up from US$11 million the previous year. The company has turned profitable this year and boasts a satisfactory net debt to equity ratio of 15.2%. Despite its price-to-earnings ratio of 2.1x being well below the Norwegian market average of 13.9x, interest payments remain poorly covered by EBIT at just 2.1x coverage. A notable contract with Petrobras worth US$73 million is set to commence in early 2026, potentially bolstering future revenue streams.

Nyab (OM:NYAB)

Simply Wall St Value Rating: ★★★★★☆

Overview: Nyab AB (publ) operates in Finland and Sweden, offering engineering, construction, and maintenance services for energy, infrastructure, and industrial projects across both public and private sectors with a market cap of approximately SEK4.17 billion.

Operations: Nyab generates revenue primarily through its engineering, construction, and maintenance services in the energy, infrastructure, and industrial sectors. The company's financial performance is highlighted by a market cap of approximately SEK4.17 billion.

In the European construction sector, Nyab stands out with its impressive growth trajectory. Over the past year, earnings surged by 95%, significantly outpacing the industry's 18.6% increase. The company is trading at a notable 37% below its estimated fair value, presenting a potential opportunity for investors. Recent strategic moves include securing major projects such as a €35 million railway modernization in Sweden and a €136 million power line project in northern Sweden, both enhancing infrastructure resilience and capacity. With high-quality earnings and sufficient cash to cover debts, Nyab's financial health appears robust amidst ongoing expansion efforts.

- Navigate through the intricacies of Nyab with our comprehensive health report here.

Assess Nyab's past performance with our detailed historical performance reports.

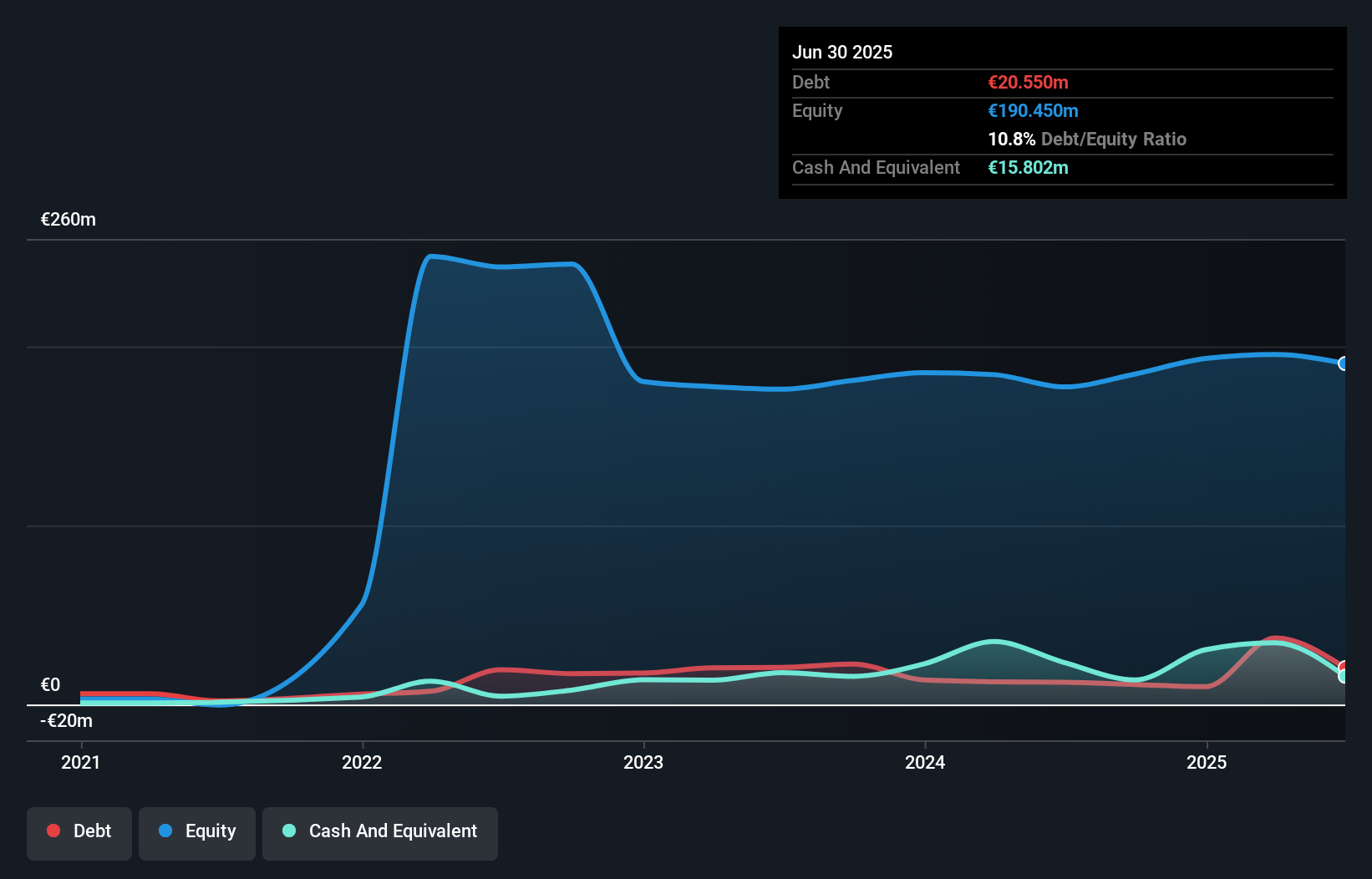

Grenevia (WSE:GEA)

Simply Wall St Value Rating: ★★★★★☆

Overview: Grenevia S.A. is a global manufacturer and seller of machinery and equipment for the mining, transport, and power industries with a market cap of PLN1.83 billion.

Operations: Grenevia's primary revenue stream is from the Famur segment, contributing PLN1.19 billion. The company experiences a segment adjustment of PLN86 million.

Grenevia, a notable player in the machinery sector, has shown impressive earnings growth of 35.2% over the past year, outpacing the industry average of 6.8%. Its price-to-earnings ratio stands at a favorable 4.8x compared to the Polish market's 11.9x, suggesting it trades at attractive value relative to peers. Despite an increased debt-to-equity ratio from 26.7% to 41.1% over five years, Grenevia maintains more cash than total debt and generates positive free cash flow. Recent results highlight robust sales growth with Q3 revenues reaching PLN 567 million and net income rising to PLN 74 million from PLN 63 million last year.

- Get an in-depth perspective on Grenevia's performance by reading our health report here.

Explore historical data to track Grenevia's performance over time in our Past section.

Taking Advantage

- Unlock our comprehensive list of 312 European Undiscovered Gems With Strong Fundamentals by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com