European Stocks Estimated To Be Priced Below Intrinsic Value In December 2025

As European markets navigate a complex landscape marked by mixed economic signals and varying inflation rates, investors are keenly observing potential interest rate cuts in the U.S. and UK that could influence market dynamics across the continent. Amidst these conditions, identifying stocks priced below their intrinsic value can offer compelling opportunities for those seeking to capitalize on undervalued assets, particularly when macroeconomic factors suggest potential shifts in investment landscapes.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sanoma Oyj (HLSE:SANOMA) | €9.24 | €18.37 | 49.7% |

| PVA TePla (XTRA:TPE) | €22.40 | €44.05 | 49.1% |

| Nokian Panimo Oyj (HLSE:BEER) | €2.45 | €4.88 | 49.8% |

| Micro Systemation (OM:MSAB B) | SEK63.00 | SEK125.87 | 49.9% |

| Exel Composites Oyj (HLSE:EXL1V) | €0.389 | €0.77 | 49.8% |

| Esautomotion (BIT:ESAU) | €3.10 | €6.14 | 49.5% |

| E-Globe (BIT:EGB) | €0.62 | €1.23 | 49.6% |

| Dynavox Group (OM:DYVOX) | SEK101.40 | SEK202.29 | 49.9% |

| Digital Workforce Services Oyj (HLSE:DWF) | €2.58 | €5.10 | 49.4% |

| Circle (BIT:CIRC) | €8.08 | €15.79 | 48.8% |

Below we spotlight a couple of our favorites from our exclusive screener.

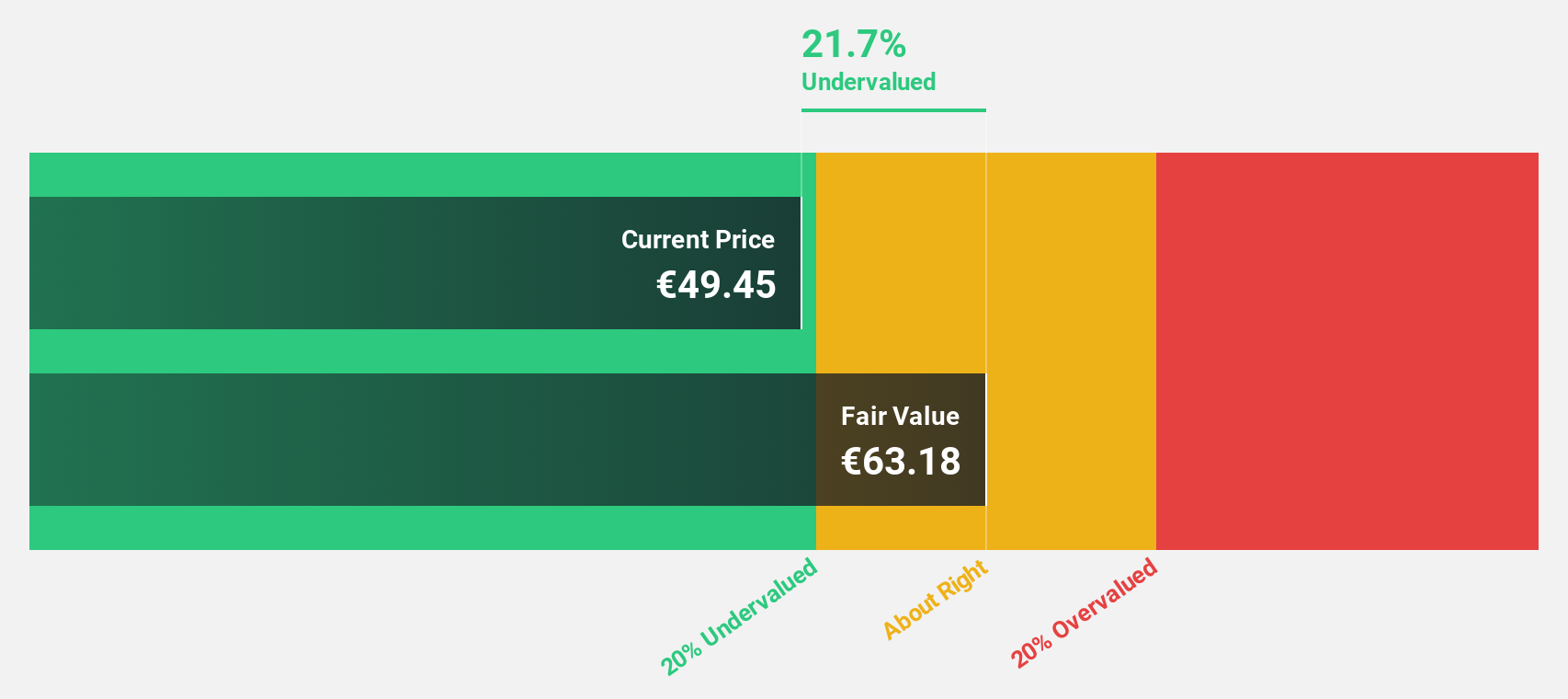

Harvia Oyj (HLSE:HARVIA)

Overview: Harvia Oyj operates in the sauna industry with a market capitalization of €771.92 million.

Operations: The company's revenue segment is primarily focused on Building Materials - HVAC Equipment, generating €196.19 million.

Estimated Discount To Fair Value: 34.4%

Harvia Oyj is trading at €41.3, significantly below its estimated fair value of €62.94, suggesting it may be undervalued based on cash flows. Despite high volatility in recent months and a high debt level, Harvia's earnings are forecast to grow 19.1% annually, outpacing the Finnish market's growth rate. Recent strategic moves include appointing Catharina Stackelberg-Hammarén as Chair and expanding in North America through a partnership with wellness expert Dr. Emilia Vuorisalmi.

- In light of our recent growth report, it seems possible that Harvia Oyj's financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of Harvia Oyj.

Mo-BRUK (WSE:MBR)

Overview: Mo-BRUK S.A. specializes in processing industrial, hazardous, and municipal waste across several European countries, with a market cap of PLN1.09 billion.

Operations: Revenue segments for Mo-BRUK S.A. include industrial waste processing generating PLN136.50 million, hazardous waste processing contributing PLN120.75 million, and municipal waste processing accounting for PLN95.20 million.

Estimated Discount To Fair Value: 48.5%

Mo-BRUK, trading at PLN310, is substantially undervalued based on cash flows, with a fair value estimate of PLN601.57. Despite recent net losses in the third quarter and nine months ending September 2025, earnings are forecast to grow significantly at 64.4% annually, outpacing the Polish market's 16.2%. However, profit margins have decreased from last year and its dividend yield of 4.25% is not well covered by earnings or free cash flows.

- Our growth report here indicates Mo-BRUK may be poised for an improving outlook.

- Get an in-depth perspective on Mo-BRUK's balance sheet by reading our health report here.

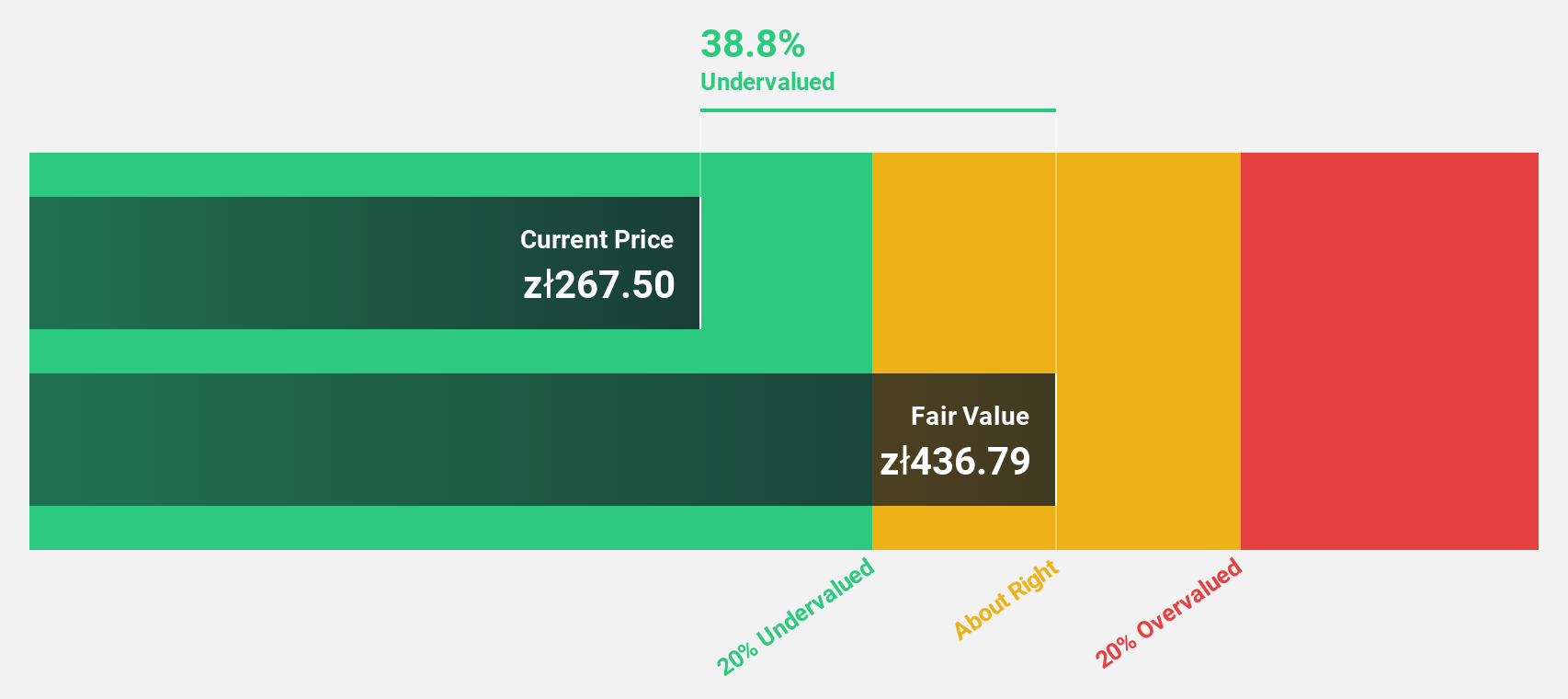

Wirtualna Polska Holding (WSE:WPL)

Overview: Wirtualna Polska Holding S.A., with a market cap of PLN1.78 billion, operates in Poland through its subsidiaries, focusing on media, advertising, and e-commerce businesses.

Operations: The company's revenue is primarily derived from its travel segment at PLN1.05 billion, followed by advertising and subscriptions at PLN714.68 million, and consumer finance at PLN226.62 million.

Estimated Discount To Fair Value: 44%

Wirtualna Polska Holding, trading at PLN59.7, is significantly undervalued with a fair value estimate of PLN106.55. Recent earnings reports show increased sales and net income for Q3 2025 compared to the previous year, though nine-month net income decreased slightly. Despite high debt levels and an unstable dividend track record, its earnings are forecasted to grow substantially at over 20% annually, outpacing the Polish market's growth rate of 16.2%.

- Our earnings growth report unveils the potential for significant increases in Wirtualna Polska Holding's future results.

- Dive into the specifics of Wirtualna Polska Holding here with our thorough financial health report.

Summing It All Up

- Navigate through the entire inventory of 191 Undervalued European Stocks Based On Cash Flows here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com