Evaluating Diversified Healthcare Trust (DHC) After Its Latest Investor Presentation and Operational Updates

On December 8, Diversified Healthcare Trust (DHC) walked investors through an updated game plan, spotlighting 8% year over year SHOP NOI growth and richer medical office leasing spreads that hint at improving portfolio economics.

See our latest analysis for Diversified Healthcare Trust.

Those operational gains seem to be resonating, with a roughly 8% 1 month share price return helping push Diversified Healthcare Trust to a 114.98% year to date share price gain and a powerful 585.76% 3 year total shareholder return. This points to momentum that is still very much alive.

If this kind of recovery story has your attention, it could be a good time to explore other healthcare real estate and services names via healthcare stocks for fresh ideas.

But after such a dramatic rebound and only a modest discount to analyst targets, is Diversified Healthcare Trust still trading below its true recovery potential, or are investors already pricing in the next leg of growth?

Most Popular Narrative Narrative: 7% Undervalued

With a fair value estimate of $5.25 against a last close of $4.88, the most followed narrative sees more recovery room in DHC's story.

Active portfolio repositioning, executing non-core asset sales and focusing on higher growth senior housing and medical office/life science properties, enables the company to concentrate capital on assets with sector tailwinds (strong demand for outpatient care settings) and embedded rent growth, supporting long-term revenue and FFO growth.

Curious how modest revenue growth, a sharp margin swing, and a surprisingly low future earnings multiple combine into that fair value? The full narrative spells it out.

Result: Fair Value of $5.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising interest costs on DHC's elevated leverage, along with any slowdown in healthcare real estate demand, could quickly challenge the recovery embedded in this narrative.

Find out about the key risks to this Diversified Healthcare Trust narrative.

Another Angle on Valuation

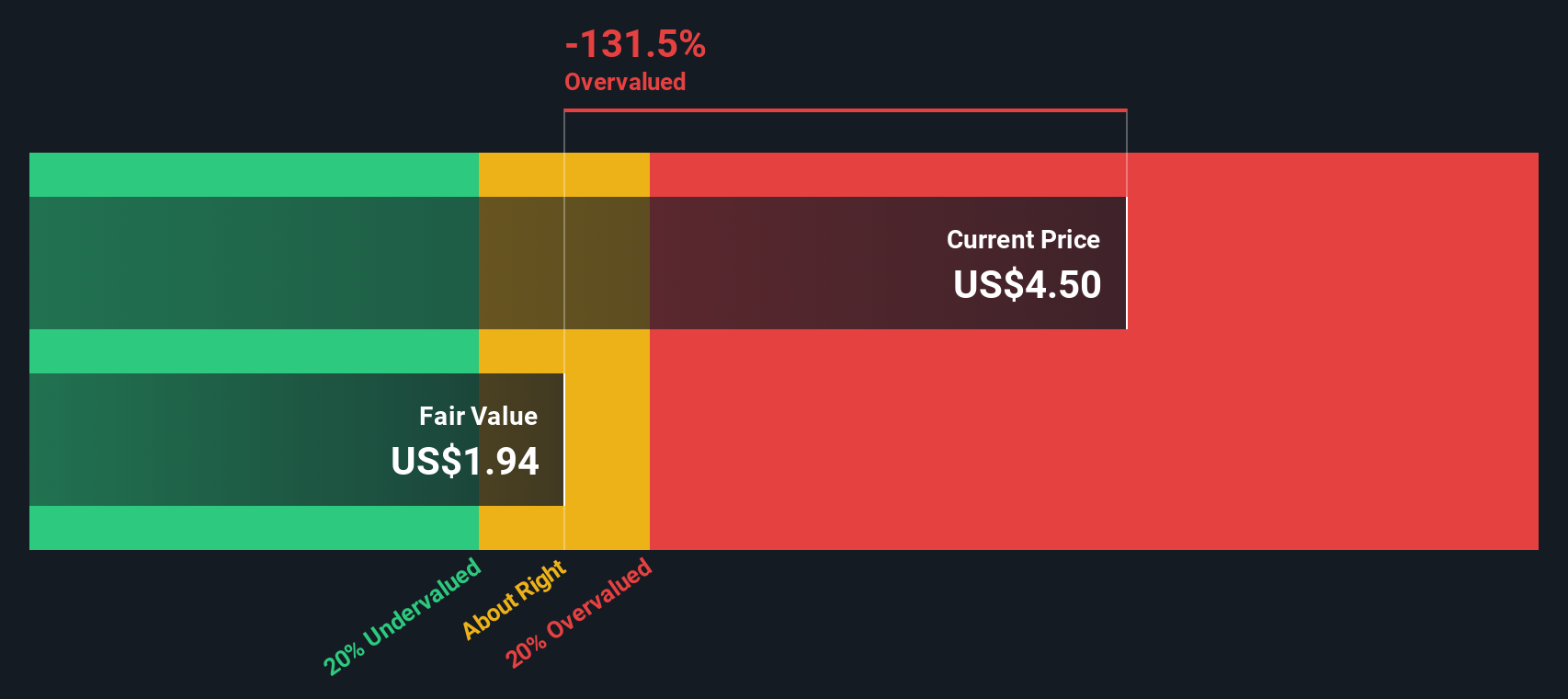

Our SWS DCF model paints a less generous picture, with DHC trading above its DCF fair value of $4.18, which implies the stock may already be pricing in much of the recovery upside. Is this just a pause in a longer re-rating, or a signal to be cautious?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Diversified Healthcare Trust for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 895 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Diversified Healthcare Trust Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in just a few minutes: Do it your way.

A great starting point for your Diversified Healthcare Trust research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next potential opportunity by scanning targeted stock ideas tailored to different strategies using the Simply Wall Street Screener.

- Capture growth potential early by reviewing these 3591 penny stocks with strong financials that already show solid fundamentals instead of just speculative hype.

- Ride powerful secular trends by focusing on these 27 AI penny stocks positioned at the intersection of innovation, productivity gains, and long-term demand.

- Strengthen your income strategy with these 15 dividend stocks with yields > 3% that can help support returns even when markets turn choppy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com