Is Mitsubishi Electric Still Attractive After a 73% Surge and Rising Growth Expectations?

- If you are wondering whether Mitsubishi Electric is still good value after such a strong run, you are not alone. This article is going to unpack what the current price might really be telling us.

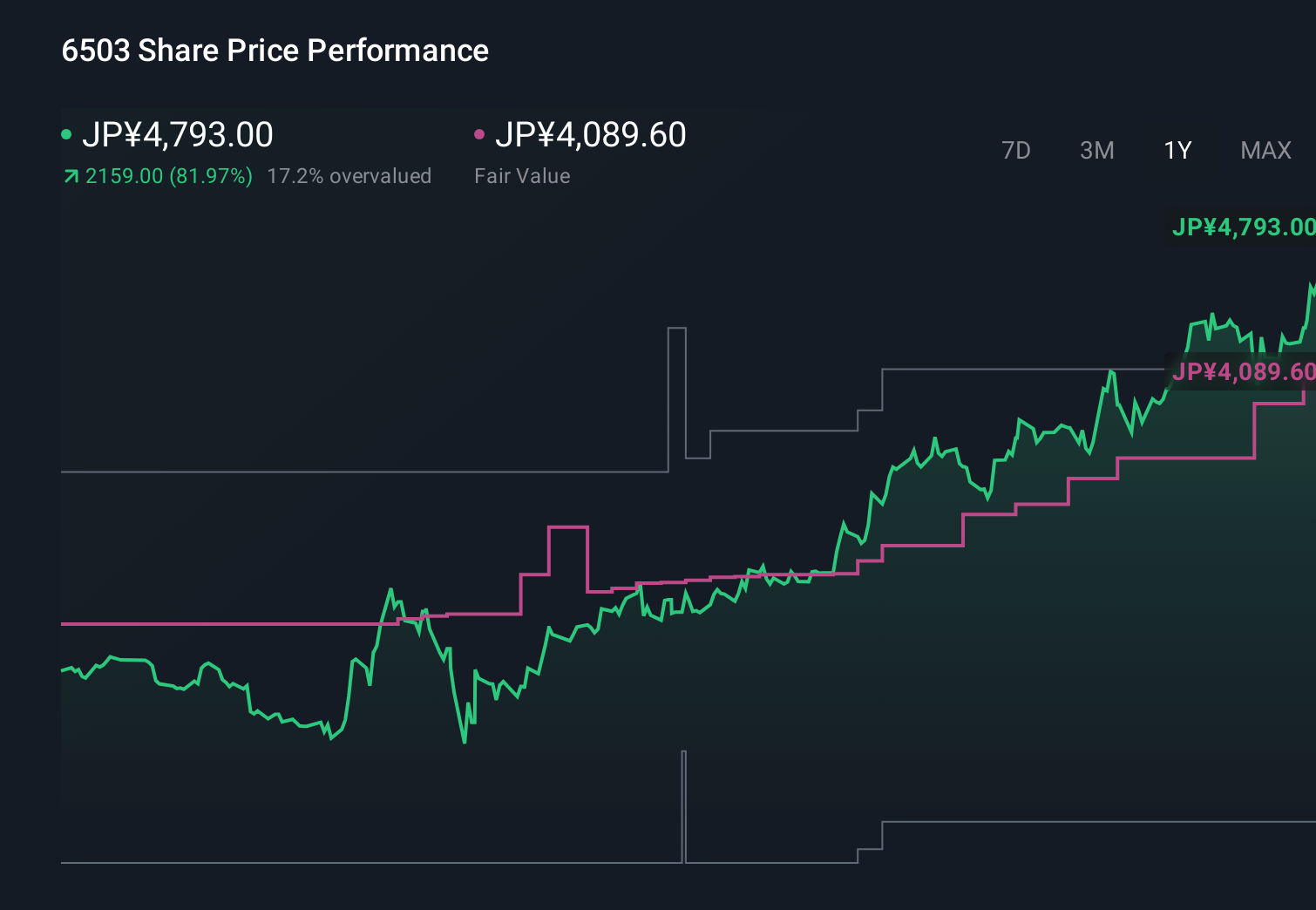

- The stock has climbed 6.9% over the last week, 7.6% over the past month, and an eye catching 72.7% year to date, building on gains of 78.3% over 1 year and 257.4% over 3 years.

- Investors have been reacting to Mitsubishi Electric's ongoing strategic push into factory automation and energy efficient infrastructure, areas that are central to Japan's industrial upgrade and global decarbonization trends. At the same time, the market is paying closer attention to its restructuring efforts and governance improvements, which have shifted sentiment toward a more growth oriented narrative rather than seeing it as just another cyclical industrial name.

- Despite that optimism, Mitsubishi Electric only scores 1/6 on our valuation checks, hinting that the market might be pricing in a lot of good news already. In the sections that follow we will walk through the main valuation approaches investors are using today, before finishing with a more holistic way to think about what the stock is truly worth.

Mitsubishi Electric scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Mitsubishi Electric Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth today by projecting the cash it can generate in the future and discounting those cash flows back to their present value. For Mitsubishi Electric, the model used is a 2 Stage Free Cash Flow to Equity approach, which captures a period of faster growth before tapering to more mature rates.

The company generated trailing twelve month free cash flow of roughly ¥304.1 billion, and analysts expect this to rise steadily, with Simply Wall St extrapolating out beyond the first few years of formal forecasts. By 2030, free cash flow is projected to reach about ¥517.0 billion, with ten year projections gradually flattening as growth normalizes.

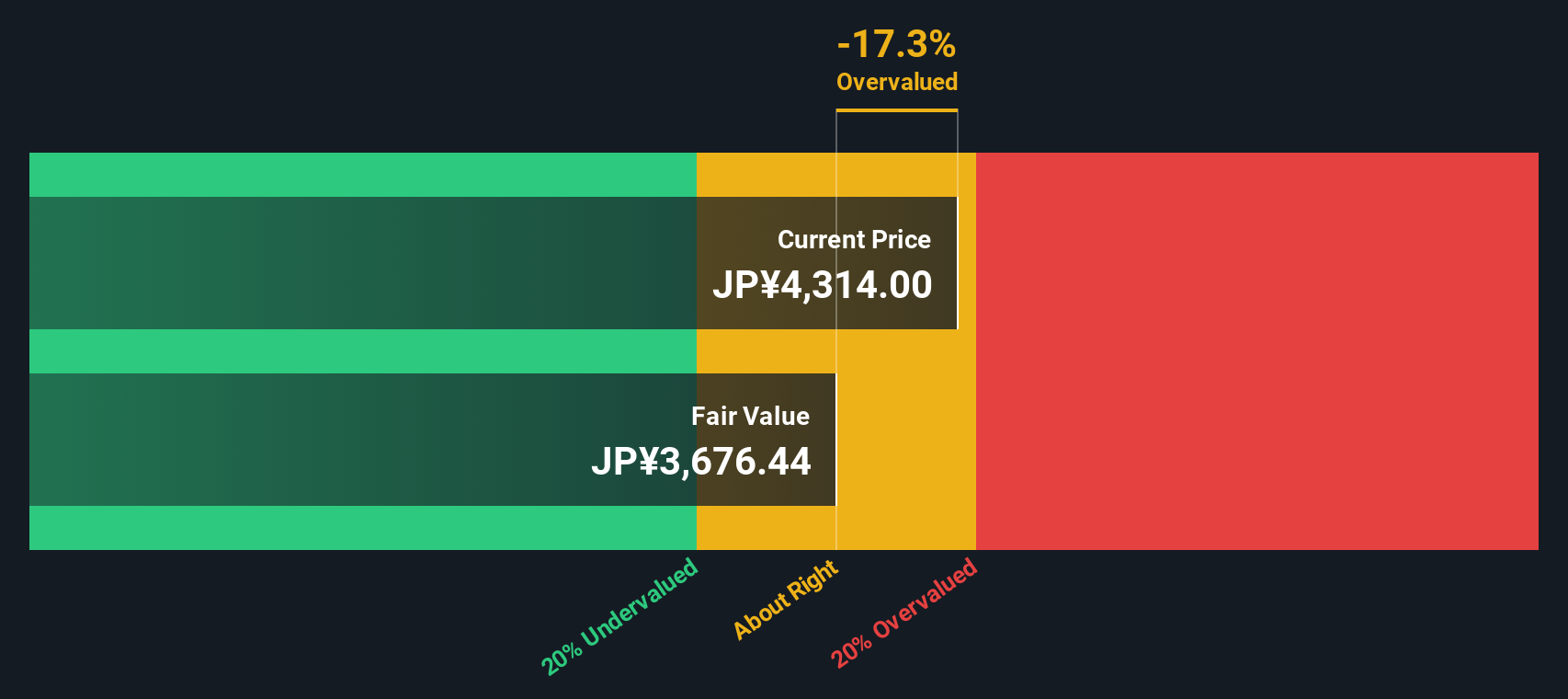

Aggregating and discounting these projected cash flows results in an estimated intrinsic value of around ¥3,735 per share. With the DCF implying that the stock is 24.1% above this fair value estimate, the model suggests that the market is paying a premium for Mitsubishi Electric's future growth and restructuring story.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Mitsubishi Electric may be overvalued by 24.1%. Discover 895 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Mitsubishi Electric Price vs Earnings

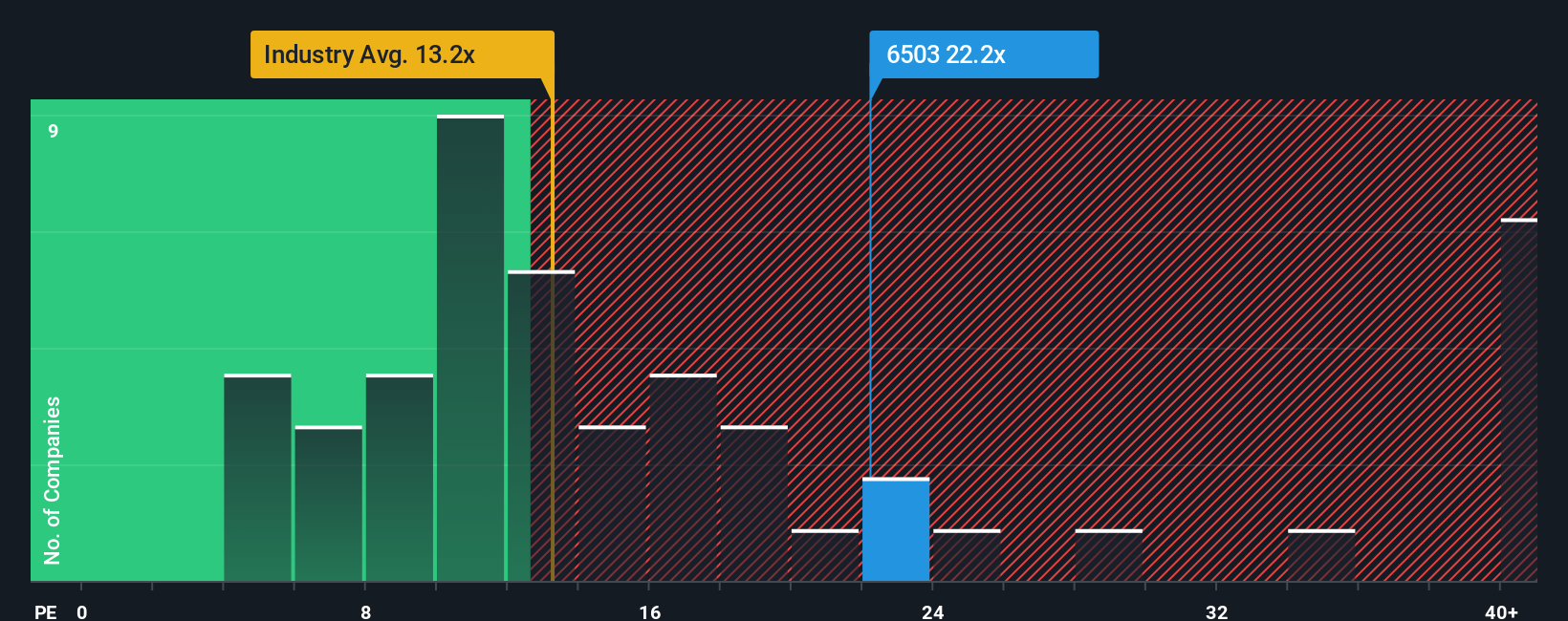

For profitable companies like Mitsubishi Electric, the price to earnings ratio is a useful shorthand for how much investors are willing to pay today for each unit of current earnings. It naturally connects to expectations for future growth and the level of risk, since faster growing, lower risk businesses usually deserve higher PE ratios than slower, more volatile ones.

Mitsubishi Electric currently trades on a PE of about 24.0x. That is well above the broader Electrical industry average of roughly 13.9x, but only slightly ahead of its direct peer group, which sits near 23.2x. To move beyond simple comparisons, Simply Wall St uses a proprietary Fair Ratio. This estimates what a reasonable PE should be given the company’s earnings growth outlook, profitability, industry dynamics, size, and risk profile. This tends to be more reliable than just looking at peers or the sector, which may themselves be mispriced or have very different business mixes.

For Mitsubishi Electric, the Fair Ratio is around 26.4x, modestly higher than the current 24.0x. This suggests that the market is not fully reflecting its fundamentals on this metric.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1450 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Mitsubishi Electric Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to link your view of Mitsubishi Electric’s story to a concrete forecast and a fair value estimate. A Narrative is your story behind the numbers, where you choose assumptions for future revenue, earnings and margins, then see the fair value that logically follows. On Simply Wall St, millions of investors can create and compare Narratives on the Community page, using them as an accessible tool to decide whether to buy or sell by comparing each Narrative’s Fair Value to the current share price. Because Narratives update dynamically when new information arrives, such as earnings, news or guidance changes, they help you keep your thesis current rather than static. For example, one Mitsubishi Electric Narrative might assume the more bullish outlook, closer to a ¥4,100 fair value, while another assigns more weight to downside risks and lands nearer ¥1,900. The gap between those views highlights exactly what you need to believe before investing.

Do you think there's more to the story for Mitsubishi Electric? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com