Assessing Wheaton Precious Metals (TSX:WPM) Valuation After Its New Hemlo Gold Stream Deal Completion

Wheaton Precious Metals (TSX:WPM) just closed a major gold stream linked to Carcetti Capital’s purchase of the Hemlo Mine from Barrick Gold, locking in immediate cash flow and a larger long term reserve base.

See our latest analysis for Wheaton Precious Metals.

The Hemlo gold stream lands against a backdrop of strong momentum, with Wheaton’s share price up 80.85% year to date and a hefty 68.00% one year total shareholder return, signaling growing confidence in its long term growth story.

If this kind of steady cash flow profile appeals to you, it might be worth exploring fast growing stocks with high insider ownership as a way to discover other compelling opportunities with aligned management incentives.

With the stock already up sharply and trading at a premium to some peers, yet still below analyst targets, the key question now is whether Wheaton remains undervalued or if the market has fully priced in future growth.

Most Popular Narrative: 17.2% Undervalued

Compared to Wheaton Precious Metals' last close of CA$151.30, the most followed narrative points to a higher fair value driven by stronger long term growth assumptions.

Industry wide constraints on new mine development and declining exploration success are expected to tighten future supply, structurally supporting higher prices for gold and silver and further enhancing Wheaton's leverage to precious metals pricing, boosting future cash flows and net margins.

Curious how moderate revenue growth, fatter margins, and a punchy future earnings multiple can still add up to upside from here? The narrative hinges on a specific path for sales, profits, and valuation that might surprise you. Want to see exactly how those moving parts combine into this fair value call?

Result: Fair Value of $182.74 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition for new streams and potential tax changes from 2026 could compress margins and challenge the growth path that underpins this valuation.

Find out about the key risks to this Wheaton Precious Metals narrative.

Another Angle on Valuation

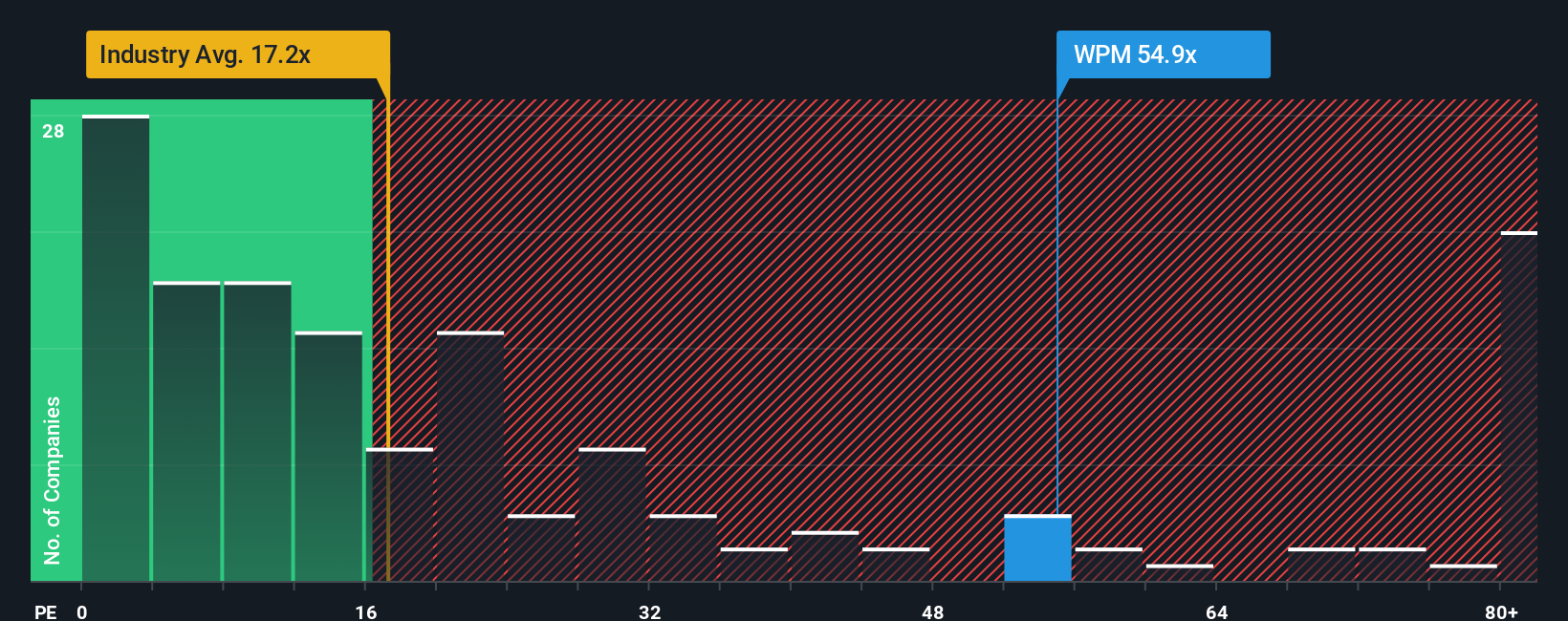

Analysts see upside, but simple earnings comparisons tell a different story. At 49.5 times earnings, Wheaton trades far richer than the Canadian metals and mining industry at 21.2 times, peers at 26.9 times, and even its own 22.9 times fair ratio. This raises the risk of multiple compression if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Wheaton Precious Metals Narrative

If you see the outlook differently or want to stress test the numbers with your own assumptions, you can build a custom view in under three minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Wheaton Precious Metals.

Ready for more investment ideas?

Do not stop with one great company when you can quickly line up your next opportunities using powerful, data driven tools built for serious investors.

- Capture potential bargains early by reviewing these 895 undervalued stocks based on cash flows that the market might be underpricing based on future cash flows and fundamentals.

- Ride structural trends in medicine by assessing these 30 healthcare AI stocks that could reshape diagnostics, treatment, and hospital efficiency over the next decade.

- Target income potential by scanning these 15 dividend stocks with yields > 3% that can strengthen your portfolio’s cash generation while rates and inflation keep shifting.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com