Is Generac Stock Attractively Priced After Data Center and Grid Resiliency Tailwinds in 2025?

- If you are wondering whether Generac Holdings is quietly trading below what it is really worth, you are not alone. This article is going to unpack exactly that.

- The stock has been choppy, up 0.6% over the last week and 2.2% over the past month, but still down 6.8% over the last year and 27.4% over five years, even after a strong 58.3% gain over three years.

- Recent headlines have focused on Generac’s role in backing up power for data centers, growing grid instability, and the rising adoption of home backup systems as extreme weather events become more frequent. Those themes help explain why sentiment has swung between optimism about long term demand and caution about how quickly that demand converts into sustained growth.

- Right now, Generac scores a 5/6 valuation check, which suggests the market may still be underestimating the business. We will test that against multiple valuation approaches and, by the end, look at an even better way to think about what this stock is really worth.

Find out why Generac Holdings's -6.8% return over the last year is lagging behind its peers.

Approach 1: Generac Holdings Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth by projecting the cash it can generate in the future, then discounting those cash flows back to today in dollar terms.

For Generac Holdings, the latest twelve month Free Cash Flow is about $449.5 million. Analysts and extrapolated estimates point to Free Cash Flow rising to around $733.6 million by 2029, with a two stage Free Cash Flow to Equity model extending those projections out over the next decade. Early years are anchored to analyst forecasts, while later years are grown at gradually slowing rates to reflect a more mature business profile.

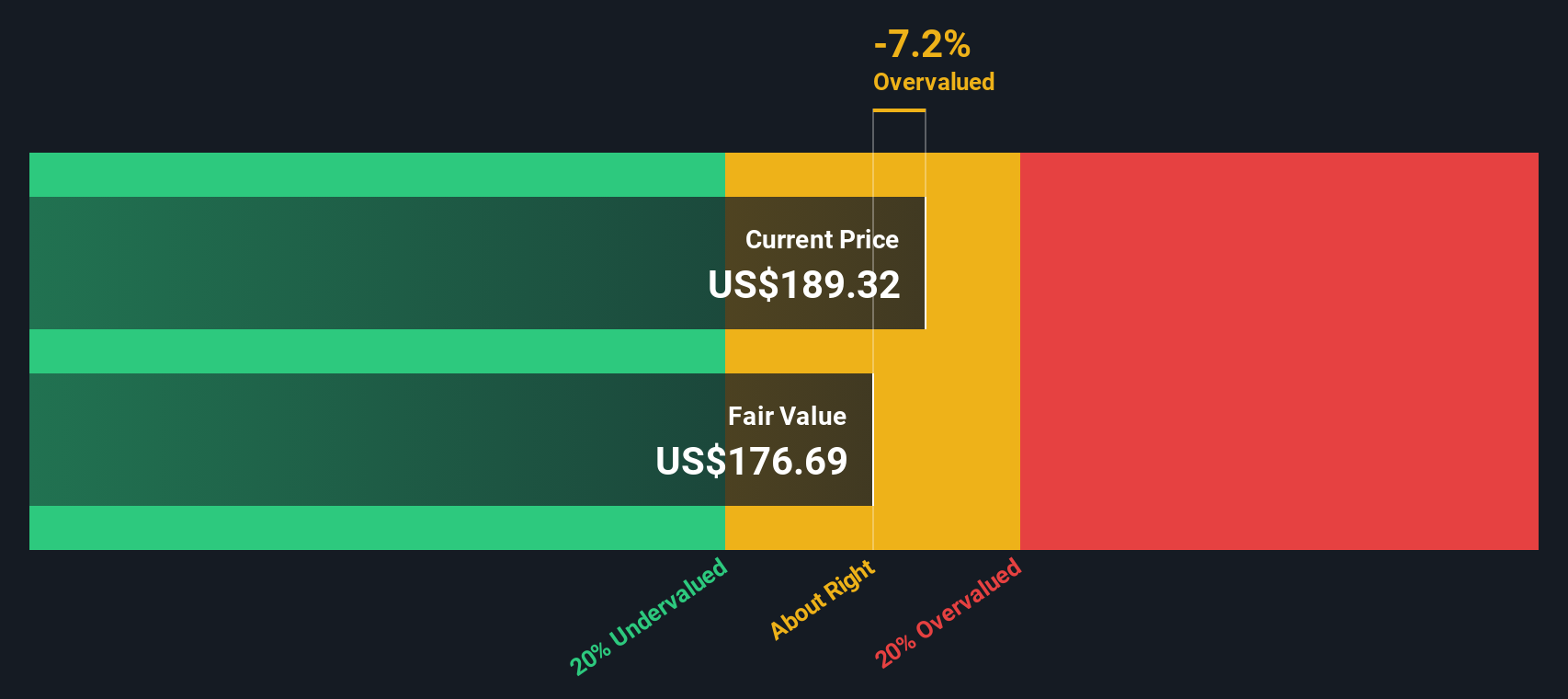

When those projected cash flows are discounted back to today, the model arrives at an intrinsic value of roughly $187.40 per share. That is about 14.6% above the current share price implied by this analysis, suggesting the market is pricing Generac below its modeled long term cash generation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Generac Holdings is undervalued by 14.6%. Track this in your watchlist or portfolio, or discover 895 more undervalued stocks based on cash flows.

Approach 2: Generac Holdings Price vs Earnings

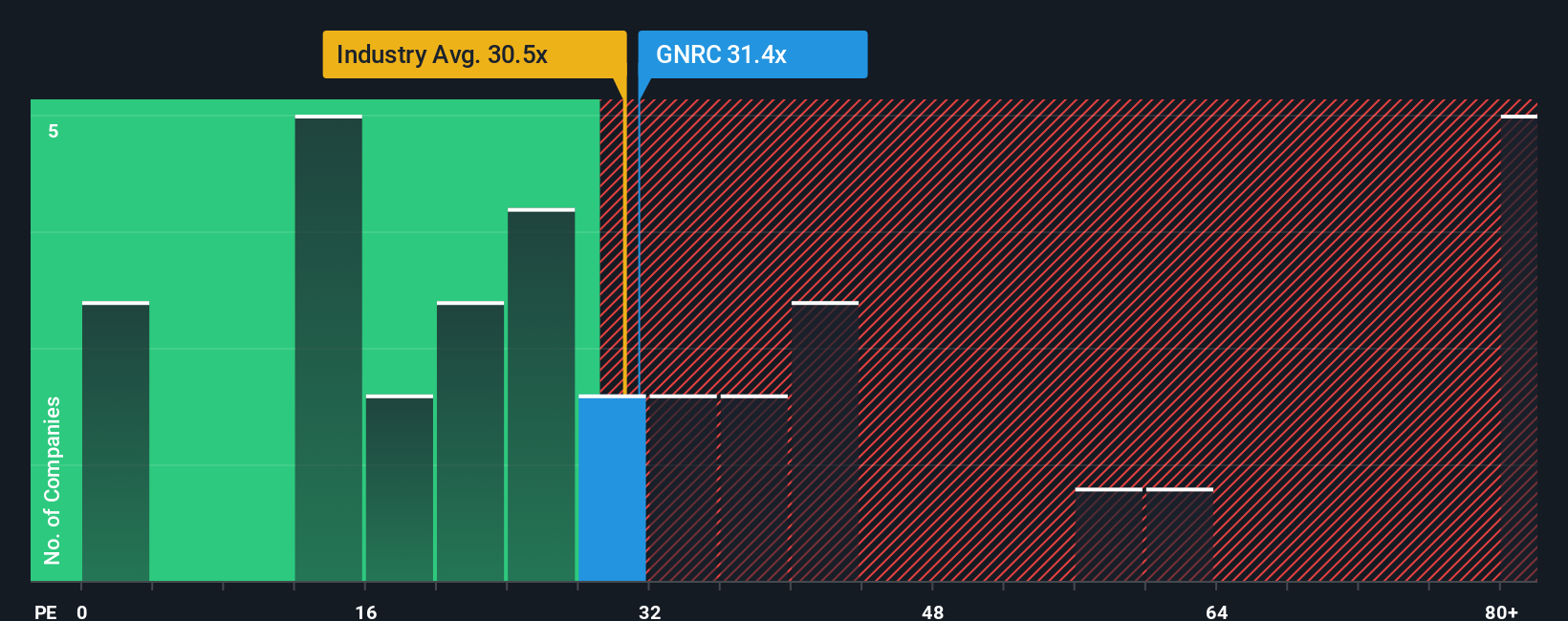

For profitable companies like Generac, the Price to Earnings, or PE, ratio is a straightforward way to judge valuation because it links what investors pay today to the profits the business is actually generating. A higher PE can be justified when a company is expected to grow earnings quickly and carries relatively low risk, while slower growth or higher uncertainty usually calls for a lower, more conservative PE.

Generac currently trades on a PE of about 30.0x. That is slightly below the broader Electrical industry average of roughly 30.7x, and also cheaper than the peer group average of around 35.4x, which suggests the market is not pricing Generac as aggressively as some comparable names. To go a step further, Simply Wall St calculates a Fair Ratio of 33.9x for Generac, a proprietary estimate of what its PE should be after factoring in its earnings growth outlook, profitability, industry positioning, market cap and specific risks.

Because this Fair Ratio is meaningfully above the current 30.0x PE, it points to Generac trading at a discount relative to what would typically be expected for a company with its profile.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1450 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Generac Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework on Simply Wall St’s Community page that lets you connect your view of a company’s story to a financial forecast and then to a fair value, so you can clearly see whether you think Generac’s future revenue, earnings and margins justify a fair value above or below today’s price and decide when to buy or sell, while the platform continuously updates that Narrative as new news or earnings arrive, meaning two investors can look at the same stock and see very different, but clearly quantified, perspectives such as one user believing Generac’s data center and grid resiliency opportunity supports a fair value near the bullish 250 dollar target, while a more cautious user builds in weaker residential demand, clean energy uncertainty and regulatory risk and arrives closer to the bearish 165 dollar view.

Do you think there's more to the story for Generac Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com